Why global high yield?

Discover income opportunities with global high yield - combining attractive yields and diversification

Hi, I’m Jennifer Poon from the T. Rowe Price Fixed Income team.

I think global high yield deserves a place in portfolios because it’s offering something quite rare in today’s markets – attractive yields, higher than government bonds and has historically been less volatile than equities. The global high yield market is large and well established. It’s around three trillion Australian dollars in size today, with over 1500 issuers and more than 3000 individual bonds.

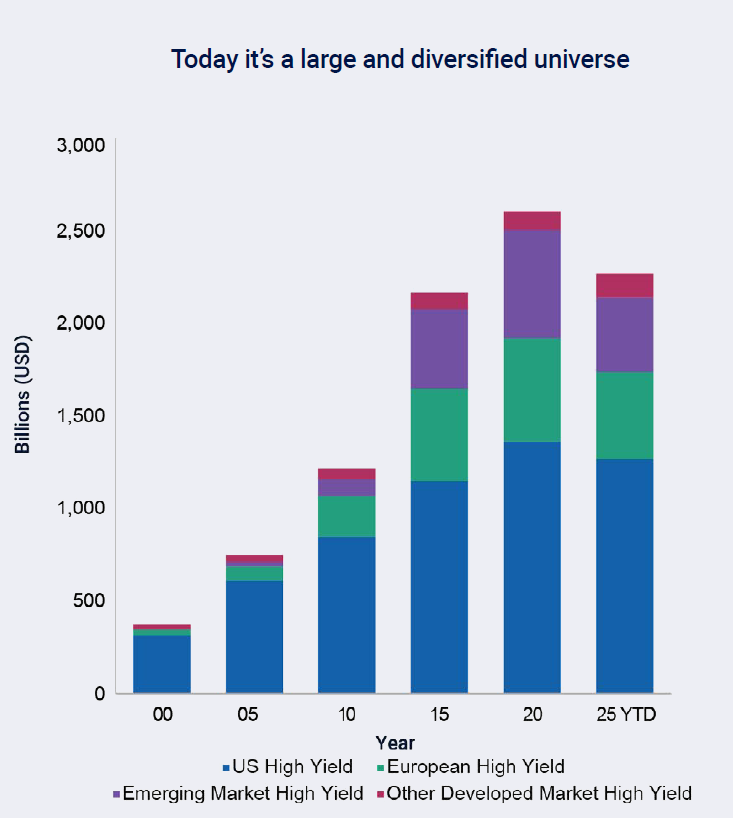

The high yield market originated in the U.S. during the 1970s and has since evolved into a large and global asset class. It’s actually one of the fastest growing asset classes, expanding nearly 6 times since 2000. Not only has it grown in size, but it has expanded its global reach, with opportunities across Europe and emerging markets.

Around 60% of the global high yield market is rated BB, which is just one notch below investment grade. So a large part of the market is actually closer to the higher-quality end of the spectrum within high yield.

The global high yield market gives investors a lot of choice. You’re not just limited to one country or one industry – you can build a portfolio that’s well diversified across the U.S.,Europe and emerging markets, as well as sectors ranging from healthcare, and technology to energy and consumer goods. This diversity creates more opportunities to find value.

High yield is supported by a very stable investor base – roughly 79% is held by dedicated investors, like mutual funds, retirement funds, and insurance companies. Because these investors tend to take a long-term view and focus on income, rather than trading in and out and that helps provide more stability to the asset class over time.

So, hopefully this helps you understand a little bit more about global high yield. For more information on this exciting asset class, speak to your financial adviser.

1. It's big and broad

The high yield market is approximately $3 trillion AUD with over 3,200 bonds and 1,500 issuers, having grown 6x since 2000, covering US, Europe and emerging markets1.

Credit ratings do not remove market risk and are subject to change.

Source: High Yield Market represented by the ICE BofA Global High Yield Index.

2025 YTD is as of 31 March 2025.

2. It's better quality than the past

The market spans US, Europe, and emerging markets, offering investors broad geographic and sector diversification.

3. Stable dedicated investor base

Around 79%1 is held by long-term focused investors like retirement funds and insurance companies, providing market stability.

1 Source ICE BofA. High Yield Market represented by the ICE BofA Global High Yield Index, as of 31 March 2025.

Read the complete story

Complete the learning and short quiz to earn CPD points.

New to high yield terms?

Get quick definitions of key concepts to help you navigate the high yield education hub with confidence.

Continue your learning

items

High yield is all around us...

You could be surprised by some familiar names

Understanding high yield bond returns

The power of the compounding coupon

It's all in the name... High yield

Breaking down a high yield bond

Comparing high yield to other asset classes

See how high yield stacks up from a risk and return, and volatility perspective

Correlations

It behaves more like equities than traditional bonds

More ups than downs

See how it's performed during times of market stress

Portfolio construction

Where does global high yield fit in your portfolio?

The importance of avoiding defaults

How active management can make a big difference

Risks of high yield

Things to consider before investing

Exciting companies.

Compelling incomes.

Current yield

7.08%*

*As of 30 September 2025. Past performance is not a guarantee or a reliable indicator of future results. The current yield of the fund reflects the market-weighted average of coupon divided by price per security.

Risks

Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities.

Additional Disclosures

ICE BofA do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit https://www.troweprice.com/en/au/market-datadisclosures for additional legal notices & disclaimers.

202508-4771180