Championship Thinking Starts with Curiosity

Capabilities to meet a full range of investor needs

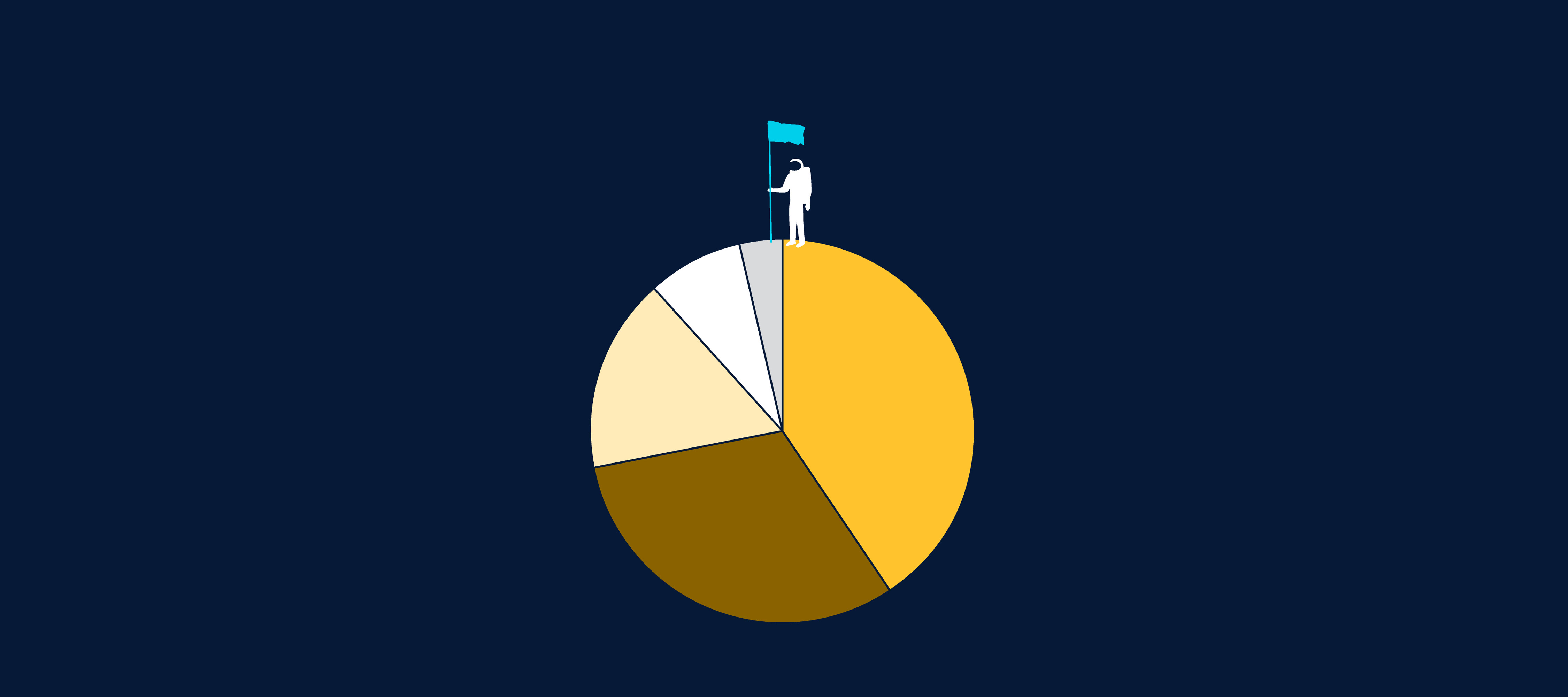

Asset class figures and retirement percentage shown represent total assets under management of $1.80 trillion as of January 31, 2026. All amounts shown in U.S. dollars and subject to adjustment.

Equity

$879B

Fixed Income

$213B

Multi-Asset

$646B

Alternatives

$59B

Retirement assets are 67% of AUM

An experienced partner with global reach

Figures as of September 30, 2025.

1937

60

7,773

We instill investor confidence.

Learn more about our firm and the benefits of partnering with us to meet your financial goals.

We put our clients at the center of our best thinking.

Better questions. Better Insights. T. Rowe Price helps you see what’s ahead, what’s most important, and how our investment teams are responding now.

Collections

items

The Angle

The Angle podcast brings you sharp insights on the forces shaping financial markets.

Market Volatility Insights

Discover how our active management approach has guided clients through market volatility. Stay up to date on the latest insights and come out ahead.

Active Management Insights

Stay current on active portfolio management tactics to help achieve financial goals.

Equity Insights

Insights to help you navigate global stock markets

Fixed Income Insights

Navigate global bond markets with expert fixed income insights

Healthcare Insights

Comprehensive healthcare investment insights to keep you informed.

Markets and Economy Insights

Navigate changing global markets with expert insights

Multi-Asset Insights

Insights to help you position your portfolio for success

Personal Finance Insights

Explore financial essentials, education on a variety of investment products, and strategies to help craft your personalized financial plan

Retirement Insights

Resources to help you plan for retirement

CONFIDENT CONVERSATIONS® on Retirement

This retirement-focused podcast features experts who provide actionable strategies for your future on a range of financial topics.

Latest insights

Feb 2026

From the Field

Article

Feb 2026

From the Field

Article

What’s behind gold’s surge—and what could end it

Feb 2026

From the Field

Article

Feb 2026

From the Field

Article

Smarter alpha: Get more from a portfolio’s core

Nov 2025

On the Horizon

Nov 2025

On the Horizon

2026 Global Market Outlook

AI will continue to drive growth in 2026, but investors will need to be clear-eyed about the risks while exploring growing opportunities in non-tech sectors.

A destination for all our clients

4811610