Retaining Retirees:

What does it mean for retirement plans?

Key insights

- According to T. Rowe Price research, only 17.8% of defined contribution (DC) plan sponsors prefer to have participants leave their plans at retirement. So the question becomes: Should we consider the implications of keeping participants in the plan for a long period after they retire?

- The question isn't just academic. On average, retired participants made up 14.3% of plan populations within our survey pool.

- Plan sponsors strongly agree that there are benefits to taking a longerterm view before and through retirement--even sponsors who prefer that participants leave their plans at retirement.

- Taking a longer view of participants' retirement journeys will have a significant impact on plan decisions, including communications strategies; the availability of plan distribution options; and the selection of qualified default investment alternatives (QDIA).

Plan sponsor preferences are changing.

A 2018 study by T. Rowe Price found that nearly 40% of plan sponsors preferred to keep participants in their defined contribution plans even after retirement.1

That's contrary to conventional wisdom that a plan's responsibility extends only to the day a participant retires. Today, a growing number of plans actively encourage participants to stay in plan after retirement.

More than 39% of plan sponsors are encouraging retirees to stay in their defined contribution (DC) plans. That's more than twice as many as those who require them to leave through lump-sum distributions or rollovers to an IRA (17.8%). (See Figure 1.)

(Fig. 1) All Respondents

Q: When your employees retire, what would your organization prefer that they do with their DC plan balances?2

A: A Significant number of plan sponsors (37.2%) expressed no preference either way. That doesn't necessarily mean they're indifferent. Instead, they seem open to both options: supporting participants who want to leave, and accepting retirees who wish to remain.

Larger plans are more likely to prefer retaining retirees.

There's a clear dividing line: Sponsors of larger plans (assets of $500 million or more) are more likely to encourage retirees to remain in plan.

(Fig. 2) Responses Base on Reported Plan Assets, >$500M and <$500M

Q: When your employees retire, what would your organization prefer that they do with their DC plan balances?2

Plan size, however, may not be the only determining factor. Smaller employers might worry that they don't have the administrative resources to support a large pool of retirees for a long period.

Interestingly, the willingness of larger plans to keep retirees may eventually benefit smaller plans. As demand for more features, solutions, and resources grows, it's likely that more of those options will become available to smaller plans.

Retirees already make up a significant percentage of plan populations.

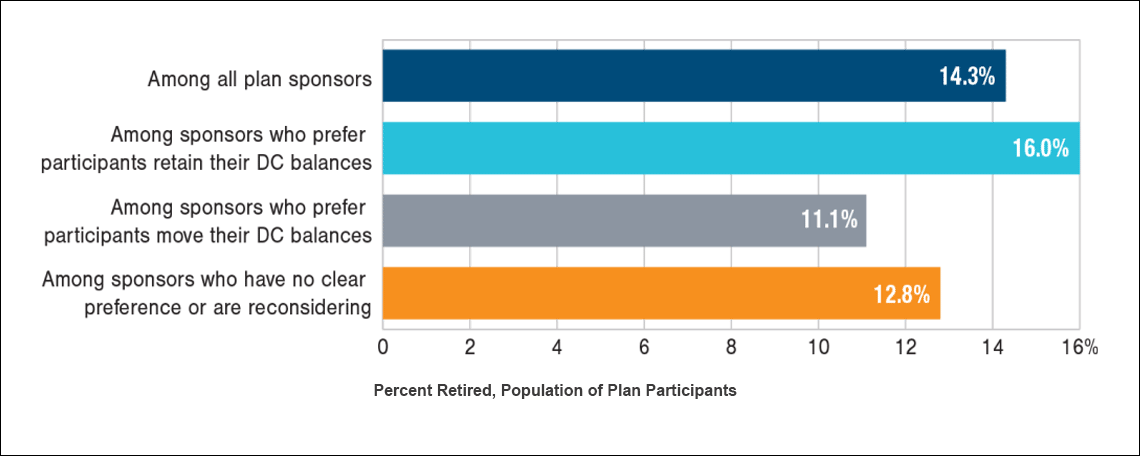

Our research revealed that, on average, about 14.3% of participants in DC plans are already retired, regardless of the plan sponsor's preference.

(Fig. 3) Portion of Participants Who Are Already Retired5 Average Values by Plan Sponsor Retention Preference

It also seems that many of them want to stay in well beyond retirement. Separate research by T. Rowe Price provides broader context:6

- Nearly half (45%) of participants who left their employers (retired or otherwise) kept balances in a prior employer's plan, or consolidated it with a new employer.

- Only 38% chose to roll over their plan balances to an IRA.

Survey Methodology

T. Rowe Price's survey was sponsored by Pensions & Investments and conducted during September and October 2018 by Signet Research, a marketing research firm. The survey universe is a list of plan sponsors and consultants selected from the P&I database. Responses were received from 210 plan sponsor officials. Not all survey respondents completed all survey questions. Respondents participated via online surveys and were offered a chance to win prize awards as incentives for their participation. T. Rowe Price designed the survey questions and is solely responsible for the interpretation of the results.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide fiduciary recommendations concerning investments; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it intended to serve as the primary basis for investment decision-making.

The views contained herein are those of the authors as of February 2019 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

All investments involve risk. All charts and tables are shown for illustrative purposes only.

1. See Advancing the Way We Think About Perceptions of Risk and Achieving Outcomes.

2. Results from 191 respondents.

3. Results from 88 respondents.

4. Results from 102 respondents.

5. For "Among all plan sponsors," results from 165 respondents. For "Among sponsors who prefer participants retain their DC balances," results from 65 respondents. For "Among sponsors who prefer participants move their DC balances," results from 29 respondents. For "Among sponsors who have no clear preference or are reconsidering," results from 63 respondents.

6. RSS4 © 2018 NMG Consulting. All rights reserved. T. Rowe Price engaged NMG Consulting to conduct a national study of 3,005 adults age 21 and older who have never retired and are currently contributing to a 401(k) plan or are eligible to contribute and have a balance of at least $1,000. We also included an oversample of 1,005 adults who have retired with a rollover IRA or left-in-plan 401(k) balance.

Contact your T. Rowe Price representative to find out how we can take your plan to the next level.