Market Setbacks Don’t Need to Set Back Retirement Plans

Workers not nearing retirement can—and mostly do—stay the course.

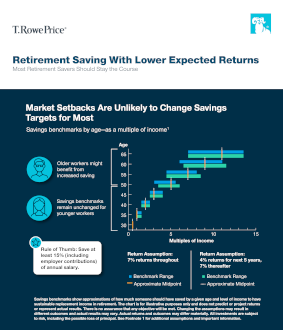

Our research shows that, generally, only workers nearing retirement should consider modest changes to their retirement savings plan given the recent pullback in the markets.

Pulling money out of the market or making other major changes in reaction to short-term market setbacks can pose long-term risks to retirement goals.

Retirement Savers Are Staying the Course1

Over 95%

of 401(k) participants have not changed their investments

8.4%

Deferral rates have remained steady around 8.4%

1 in 5

401(k) participants have increased their deferral rate

1 Data as of January 1, 2022, through June 30, 2022, source: T. Rowe Price.

Some Areas of Concern:

A small number of 401(k) participants appear to be trying to time the market

Deferral rates have trended slightly lower as inflation has picked up

Source: T. Rowe Price.

What Can Plan Sponsors Do to Help?

Higher adoption of target date solutions in their plan lineup

Provide sustainable retirement planning tools

Provide emergency savings vehicles

Messaging to discourage market timing

See What Else Our Research Revealed:

There's so much we can do together to help you build your business—connect with us and let's discuss the possibilities.