How the Coronavirus

Is Affecting Retirement Saving

Our latest research looks at where the largest retirement savings gaps exist...

What will be the effects on retirement saving?

Key findings:

- The coronavirus pandemic is exacerbating an already troubling societal retirement saving shortfall as workers look to long-term retirement savings to solve short-term financial problems.

- While the percentage of participants taking advantage of CARES Act provisions such as increased loan and distribution limits is low, doing so can undo years of retirement savings.

- Solutions like financial wellness can help shape future financial behaviors when balancing and reconciling short-term needs and long-term financial goals.

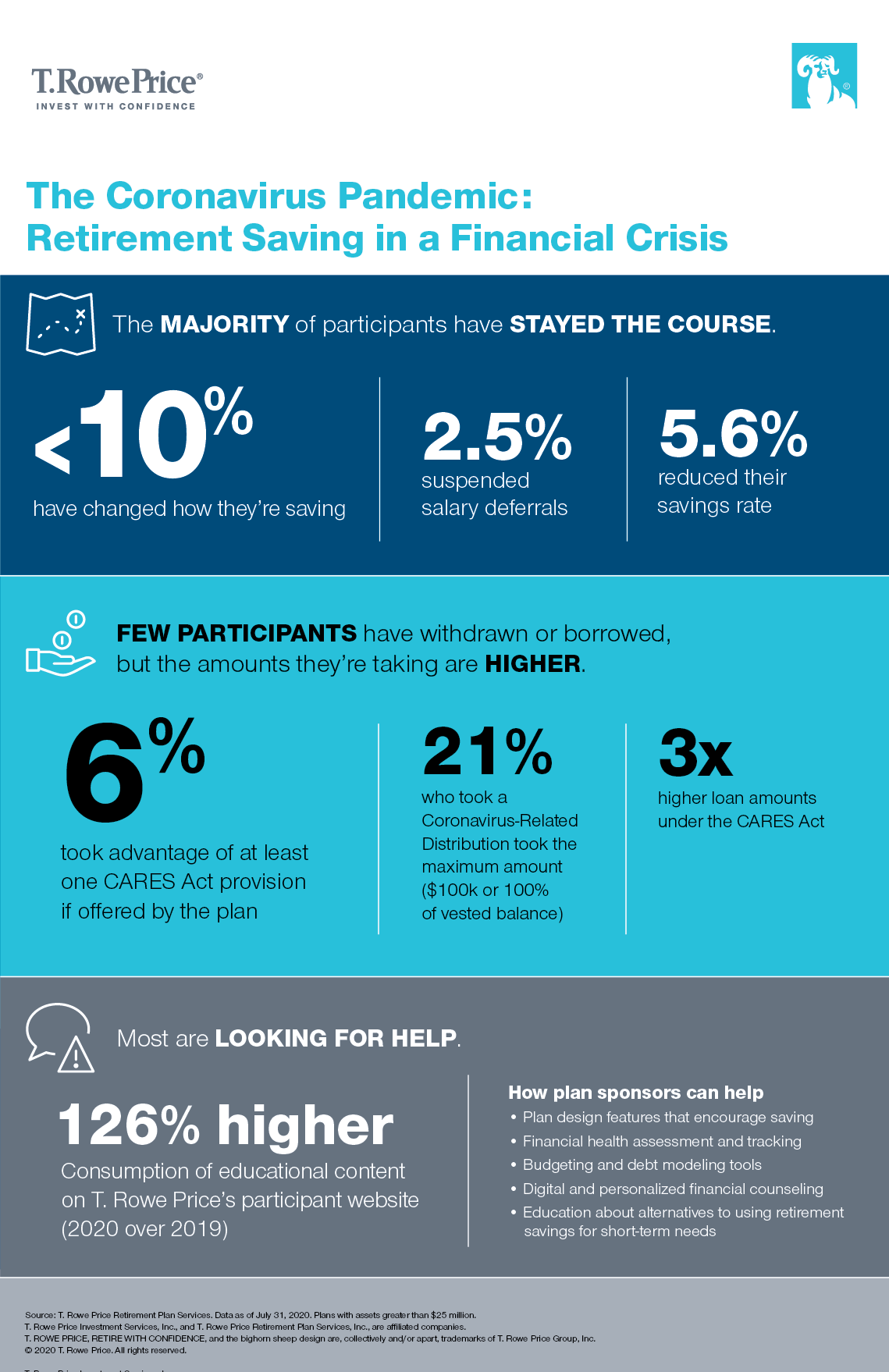

Global Disruption—But Few Changes to Saving

Despite the broad disruption the coronavirus has caused, 401(k) plan participants generally are staying the course. Less than 10% of participants in plans at T. Rowe Price have stopped contributing or reduced their savings rates.1

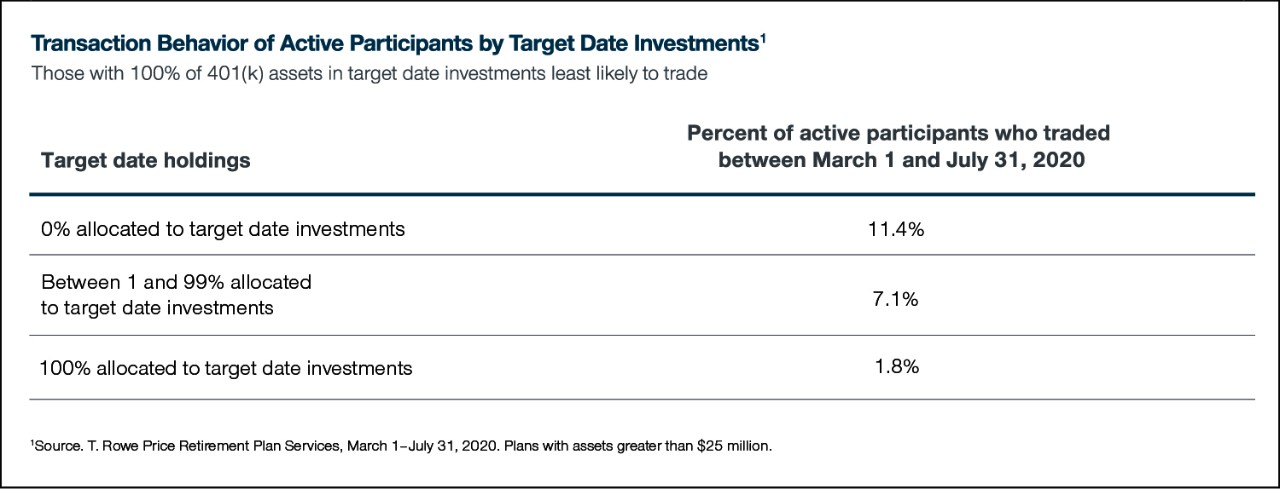

In addition, participants are not panic trading due to market volatility, especially those who invested in target date investments.

Participants who were 100% allocated to target date investments (i.e., many who were auto-enrolled) were less likely to trade than the general plan population. In contrast, those who did not invest were more likely to transact. These latter investors are most likely to be harmed by trying to time the market, particularly since the market has recovered from the lows reached in March 2020. Though plan design has proven useful to many, some investors still succumbed to the often counterproductive instinct to seek safety in times of uncertainty.

Only 2.5% suspended their contributions, and only 5.6% reduced their contributions.1

Warning Signs Ahead

Despite the apparent good news for saving and investment allocation, there are some concerning trends to be mindful of as the crisis plays out over the longer term.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law in March 2020, included optional provisions to give participants greater access to their plan savings in order to address a coronavirus-related financial need. The optional provisions include:

- Penalty-free coronavirus-related distributions, up to a maximum of $100,000 or 100% of the participant’s vested account balance.

- Increased loan limits, up to a maximum of $100,000 or 100% of the participant’s vested account balance.

Participant usage of the CARES Act provisions has been relatively low for plans at T. Rowe Price as of July 31, 2020. However, among those participants who took advantage of one or more of the provisions, the amounts they are taking is trending upward.

Help Wanted: Participants Seek Guidance

Consumption of T. Rowe Price’s educational content on the participant website has increased during the market event, with financial wellness a key topic of interest.

Plan sponsors can support participants during the pandemic.

- Plan design features that encourage saving

- Financial health assessment and tracking

- Budgeting and debt modeling tools

- Digital and personalized financial counseling

- Education about alternatives to using retirement savings for short-term needs

62% of 401(k) plan participants said they rely on the company that manages the 401(k) plan to help them achieve their lifetime financial goals.

Source: T. Rowe Price Retirement Saving and Spending Study, 2019.

Contact your T. Rowe Price representative to find out how we can take your plan to the next level.