retirement planning | may 28, 2025

Beyond savings: Why retirement lifestyle planning is important

Steps to help you connect the nonfinancial aspects of retirement to your financial planning.

1:45

Retirement planning goes far beyond finances.

While 74% of people plan financially for retirement, only 35% make a similar effort to plan emotionally for this major life change.

To complete your plan, you need to create your vision for retirement.

What kind of lifestyle do you picture?

Ask yourself, "How and when will I retire? Do I want to retire all at once or ease into it by working part-time?

Where will I live in retirement? Should I downsize? Do I want to move for better weather, a lower cost of living, or to be near friends and family?

How will I spend my time? What activities will bring fulfillment and meaning to my life: traveling, volunteering, pursuing hobbies, connecting with family, or something else?”

Make your retirement vision a reality.

You can take steps now to bring the future you envision to life.

Contact a T. Rowe Price financial consultant to talk about the retirement you imagine.

Key Insights

Planning for the nonfinancial aspects of retirement can help to strengthen your financial preparation.

Start by visualizing the Who, What, When, Where, and Why of your retirement.

A thoughtful retirement lifestyle vision can help to reduce anxiety and increase excitement about the transition to retirement.

Lindsay Theodore, CFP®

Thought Leadership Senior Manager

When it comes to retirement planning, we often focus on the financial side. And while financial preparation is key, there is a lot more to retirement planning than savings rates or investment vehicles. Close consideration of nonfinancial factors, like the lifestyle you want to live, should play a critical role in the planning process. After all, it’s hard to figure out how much you need to have saved for retirement when you don’t know what you’re saving for.

Surveys show that although 77% of retirees report having enough money to retire comfortably1, only 43% have given thought to their emotional health in retirement.2 This could indicate that financially prepared individuals are still setting themselves up to fail in retirement. Building the nonfinancial aspects of your retirement lifestyle into your plan can help you fine-tune the financial components—as well as prepare you emotionally and mentally for the exciting (but potentially anxiety-inducing) transition to retirement.

What is retirement lifestyle, and why is it important?

Retirement lifestyle is essentially the way you choose to spend your time, energy, and yes, money in your nonworking or partially working years. Your retirement lifestyle vision should incorporate the activities, interests, social connections, and personal growth opportunities you wish to pursue when you’ll no longer be defined or constrained by a full-time career. Since retirees are generally happier when they view retirement not only as freedom from work, but as freedom to move toward something else, defining and then fine-tuning your retirement lifestyle vision is key.

How to create a retirement lifestyle vision

The core of creating your retirement vision focuses on the five W’s of retirement—Who, What, When, Where and Why. The answers to each of these questions can serve as building blocks for the lifestyle you’ll aim to enjoy. It’s important to recognize that this vision may change, but adapting is easier when you have a strong foundation to begin with. Here are some tips for how to think through and analyze each of these components based on who you are today, what’s going to change, and what might stay the same.

Who are the people you will spend your time with?

There are mind and body benefits to growing and maintaining strong social connections, especially in retirement. People who are socially engaged have a lower risk of cognitive decline, dementia, and other adverse health effects. By design, retirement will likely provide more time and opportunity to cultivate relationships with friends and loved ones. But those relationships are not a given. They require proactive effort and active, ongoing engagement.

Think about the people you spend time with today (spouse, children, grandchildren, parents, siblings, friends, neighbors, colleagues, etc.). List them numerically from the people you currently spend the most time with (1) to the least time with. Then list them based on your preferences—and in light of how those dynamics may change—in retirement. Consider the actions you can take to nurture and grow the relationships that matter most: biweekly coffee dates, monthly visits, family dinners, annual weeklong vacations, book club meetings, scheduled workouts, etc.

It’s also important to think about caregiving support roles: the people you may need to care for and the people who will care for you. If you care for a spouse, an aging parent, or a special needs child, these responsibilities are likely to continue into retirement and could even take up more time. If you expect a friend or loved one to be part of your care team, it’s crucial for you to let them know that and ensure they’re on board.

What do you plan to do with your time?

Without the time commitment or stress of a nine-to-five job, retirement can be a time for personal growth and exploration. It can also be somewhat boring if you don’t plan ahead. Think carefully about how you spend your time today and how that might change when you retire. If there are classes, hobbies, vacations, or skills that have always interested you, start listing and prioritizing them. Just as you periodically reallocate your investment portfolio, it’s a great exercise to consider how you’d want to reallocate your time in retirement. (See Figure 1.)

Also, work has become a larger part of people’s retirement lifestyles, both for financial reasons and for the nonfinancial benefits (including social engagement and purpose). So, for many, work is a part of their retirement vision, but it may just carry lower priority in retirement. If you intend to work part time, start thinking about how that might look and feel. Just keep in mind that even in retirement, there are only 24 hours in a day.

Determining your What: How do you spend your time today and how might that change when you retire?

(Fig. 1) For each of the activities below, assign a rating between 1 and 10, where 1 equals the activity that takes up the most time, and 10, the least. Then consider how those ratings will change (ideally) in retirement. Some activities may have equal ratings, but try your best to prioritize them.

| Today | In Retirement | |

|---|---|---|

| Working | ||

| Commuting | ||

| Household management (chores, dishes, laundry, managing schedules, etc.) | ||

| Traveling | ||

| Relaxing/watching TV/flipping through a magazine or scrolling social media | ||

| Exercising (running, swimming, playing golf, taking classes at the gym, etc.) | ||

| Enjoying the outdoors (gardening, hiking, biking, camping, skiing, etc.) | ||

| Spending time with family | ||

| Helping out with children or grandchildren | ||

| Caring for parents or grandparents | ||

| Caring for pets | ||

| Engaging in fun social activities (hosting parties, dining out, going to shows, etc.) | ||

| Pursuing education (learning a new language, picking up a musical instrument, etc.) | ||

| Pursuing hobbies (art, cooking, sewing, building, renovating, playing music, etc.) | ||

| Participating in religious/spiritual activities | ||

| Volunteering |

When do you plan to retire based on your personal definition of retirement?

Although it can be difficult to anticipate the right time to retire, it’s helpful to set a goal of when you would like to retire fully or begin transitioning into retirement. Our research has found that instead of retiring cold turkey, many retirees are opting to transition gradually into retirement by moving to part time or getting another job. Essentially, to some retirees, retiring just means doing work that is less stressful or demanding on their time.

That said, there are still several key financial indicators and age milestones to which investors often choose to anchor their retirement date. For some, it’s attaining a certain savings figure or coming into a cash windfall such as an inheritance. For others, it’s reaching a certain age. For instance, you become eligible for penalty-free access to your retirement accounts at age 59½, for Medicare coverage at age 65, and for your maximum Social Security benefits at age 70.

Of course, there may be other factors that can influence the timing of your retirement. Some are within your control and some are not. Common nonfinancial factors that could influence when you may retire are health issues for yourself or a loved one, personal dissatisfaction with your nine-to-five job, the desire to move on to a new chapter and do something else, and the retirement of an older spouse, among others. See Figure 2.

Write down your target retirement age along with the reason you chose it. Then list other factors that could impact that choice (from highest to lowest likelihood) and whether each would require you to retire earlier or later.

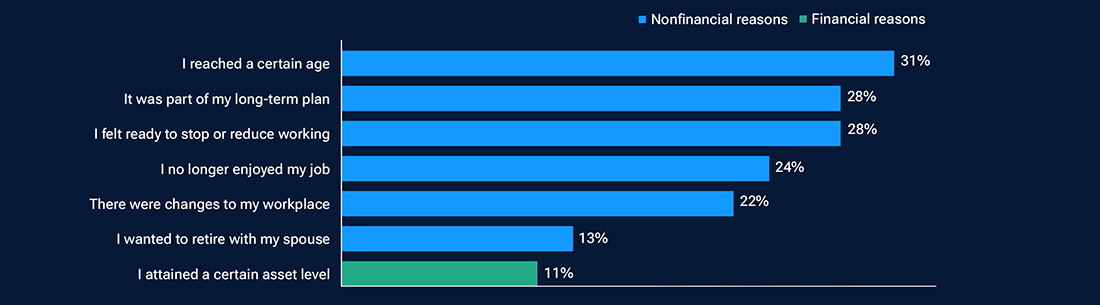

Nonfinancial considerations influence retirement planning decisions

(Fig. 2) Preretirees tend to base their decision about when to retire on personal or quality of life factors rather than financial benchmarks such as attaining a certain asset level.

Source: 2023 T. Rowe Price Retirement Savings and Spending Study Question: What prompted you to retire?

Where will you live in retirement, and what are the main factors influencing that decision?

Among the roughly 40% of retirees who opt to move in retirement, frequently cited reasons include moving closer to family and friends, reducing expenses (on taxes and overall cost of living), downsizing or moving to an aging-friendly home, moving to a better climate, and seeking to start a new chapter in life.3

When you made the decision about where to live in your working years, there were likely a number of factors that you took into consideration: proximity to the office, clients, transportation, good schools, convenience (stores, gyms, etc.), and of course, family and friends. When you take “proximity to work” out of the consideration set, you can reprioritize your criteria. If you could live anywhere, consider where you would live and why. Then consider how that choice could complement or compete with your preferences for the other W’s.

Why are you going to get out of bed every day in retirement? What provides you with the most fulfillment and meaning in your life today, and how might that change when you retire?

A day-to-day life filled with purpose and fulfillment tends to be happier and less stressful. Before retirement, the Why for many people often revolves around work and family. But our relationships with both of those areas will change when we retire. So, thinking through the new Why ahead of time will help the transition go much more smoothly. Keep in mind that the Why is different than the What. The What is how you spend your time. The Why is meant to help you identify and nurture the sense of fulfillment you may get from how you spend that time in retirement.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Determining your Why: What gives you the most fulfilment now and, potentially, in the future?

(Fig. 3) Exercise: Think about the things that give you the most meaning in your life today and how that may change when you retire. Rank the list below by entering a number between 1 and 9 in each column, where 1 equals the most fulfillment.

| Today | In Retirement | |

|---|---|---|

| Success in my job | ||

| Family time | ||

| Staying healthy and energized | ||

| Continuous learning/education | ||

| Traveling to new locations | ||

| Non-work-related hobbies | ||

| Religious/spiritual activities | ||

| Neighborhood/community involvement | ||

| Other: |

Build a personalized action plan

Now that you’ve thought through the five W’s, you can begin to lay the groundwork for making your vision a reality. This involves communication, learning, and practice.

Communicate

Coordinate your vision with your spouse, partner, and other loved ones. Don’t assume you and your spouse have the same plan in mind if you haven’t explicitly discussed it. You may also want to involve your children and other family members since your plans can have an impact on their futures.

Learn

Once you’ve identified your priorities—who you want to spend time with, where you want to live, what you want to do—you can begin to conduct research on the logistics, costs, and preparation steps. For example, if you’d like to travel, start exploring and prioritizing trip options. If you’re planning on volunteering or working part time, start looking for opportunities that align with your interests and skills.

Practice

After conducting your research, you can build in some practice. For example, consider spending long weekends or vacations in your top-ranked relocation destinations. If you’re planning to volunteer or take classes, spend some time on the weekends trying it out. Practicing your retirement lifestyle now will help you confirm or reassess key components of your vision.

Now connect these items to your financial plan

Communication, learning, and practice can help you fine-tune your plan and build excitement for retirement. Here are some of the ways you can bolster your financial plan based on your lifestyle vision.

Assess your potential spending (income replacement) needs in retirement. To maintain your current lifestyle in retirement, you will likely need to replace around 75% of your preretirement income. This goal typically can be achieved (assuming your savings are already on track), by saving 15% of your income and retiring at age 65.

If, however, your retirement vision would require replacing more than 75% of your income, you may need to boost your savings rate or work longer.

If your retirement vision is simple and will likely result in a lower income replacement rate, you may be able to retire earlier.

Whether your vision includes buying a second home, relocating, traveling, pursuing a passion project, or just reading, walking, and spending time with grandkids—a financial professional can help you determine whether your current savings strategy is sufficient. Just be sure to give yourself time to make adjustments before you retire.

Work with a financial professional to develop a Social Security claiming strategy. Once you’ve outlined your vision and obtained a clearer understanding of your income replacement needs, you can make better, more informed decisions when it comes to Social Security claiming.

If you’re married, it’s important to coordinate your claiming strategy with your spouse. For example, if you were the higher income earner, regardless of when you retire, you may want to wait until age 70 to claim your benefits. This way, you maximize your own benefit as well as your spouse’s eventual survivor benefit.

In addition, make sure you consider what role work may play in your retirement vision. If you claim Social Security when you’re still working and before your full retirement age, you may incur a reduction in benefits that negatively affects you in the long run.

Based on your When (target retirement age) explore your options for health care. Medicare eligibility begins at age 65. If your plan is to retire at or after that age, be sure to understand enrollment rules and coverage options. If your goal is to retire before age 65, you may want to explore continuing coverage through your employer (if possible) or through private health care plans offered through your state’s health care exchange. Be sure to consider any underlying health conditions and the potential need for a separate long-term care policy (PDF). Learn more at Medicare.gov and HealthCare.gov.

Make your retirement vision a reality

It can feel daunting to envision a phase of life that feels so far in the future, but by closely reflecting on what you value today—then considering how that might change or stay the same in the future—you can create a retirement vision you’ll greatly look forward to. This vision can help you build a stronger financial plan and greater conviction to take the steps necessary to fully realize it.

Personalize your retirement journey

Preparing for and living in retirement is a dynamic journey unique to you. The T. Rowe Price Retirement Advisory Service™ expert advisors are dedicated to helping you achieve clarity and providing sound strategies personalized to your unique financial situation. They work with you to go beyond just the numbers to help ensure your savings today are aligned with your future goals and that living your retirement dreams is close at hand.

For select enrolled retirees and those about to retire, your advisor will leverage our innovative Income Solver™ tool, designed to provide personalized, holistic retirement income strategies, including coordinating Social Security and Medicare.

Explore the newest enhancements to Retirement Advisory Service.™

1Brenan, M. (May 25, 2023), “Americans’ Outlook for Their Retirement Has Worsened,” Gallup.

2AARP Research October 2022, “Planning for a Successful Retirement, For People of All Ages" (PDF).

3Retiree Life in the Post-Pandemic Economy, 24th Annual Transamerica Retirement Survey, Nonprofit Transamerica Center for Retirement Studies®, November 2024.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the author as of May 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

The T. Rowe Price Retirement Advisory Service™ is a nondiscretionary financial planning service and retirement income planning service and a discretionary managed account program provided by T. Rowe Price Advisory Services, Inc., a registered investment adviser, under the Investment Advisers Act of 1940. Brokerage accounts for the Retirement Advisory Service are provided by T. Rowe Price Investment Services, Inc., member FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon company, member NYSE/FINRA/SIPC, which acts as a clearing broker for T. Rowe Price Investment Services, Inc. T. Rowe Price Advisory Services, Inc. and T. Rowe Price Investment Services, Inc. are affiliated companies.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is no guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

View investment professional background on FINRA's BrokerCheck.

202505-4534014

Next Steps

Explore all the ways we can help you reach your retirement goals.

Contact a Financial Consultant at 1-800-401-1819.