April 2024 / RETIREMENT INSIGHTS

Mixed Benefits: Identifying a Single Glide Path for All

Closed and frozen defined benefit plans shape glide path design.

Key Insights

- Plan sponsors increasingly maintain mixed benefit structures because of changing defined benefit (DB) plan offerings and merger and acquisition activity.

- Differences in DB plan coverage should be considered when selecting a glide path for all participants in a defined contribution plan’s target date offering.

- We believe it is possible to identify a glide path appropriate for all participants by closely considering those without DB plan access within the workforce.

Many employers have made changes to their defined benefit plans in recent years. While some sponsors have closed plans to new hires and/or frozen benefit accruals for current employees, others have brought together plans with differing status and/or levels of employee coverage as a result of merger and acquisition activity. These actions can result in a workforce that has varying degrees of access to different sources of retirement income, typically based on tenure with the company.

When a sponsor decides to close a DB plan to new participants, most of the workforce continues to accrue DB benefits in the first few years after closure. However, the plan’s characteristics will slowly shift as more participants terminate or retire and are replaced by employees not eligible for plan coverage. These new hires typically are only enrolled in the sponsor’s defined contribution (DC) plan.

Sponsors may face a potentially difficult administrative challenge when both employee cohorts—DB plan participants and nonparticipants—are covered by the same DC plan, typically with a single target date offering.

Sponsors often ask us how DB plan benefit structures should be reflected in their glide path evaluation process.

The previous installment in our Making the Benefit Connection series1 argued that, under a set of preferences we believe applicable to a broad participant population, it may be appropriate to reduce equity exposure in the glide path when DB plan coverage is available because participants may not need to absorb additional market volatility when their defined benefits provide a base level of retirement income. 2However, we believe the answer is more nuanced for most plan sponsors—particularly if their DB plan is either closed to new entrants or frozen for all participants.

In fact, our analysis shows that if any participants in the DC plan do not have access to the DB plan (i.e., if the DB plan was closed before a portion of the current workforce joined the company), then the glide path that potentially provides the highest overall utility for the entire DC plan population in our simulations often has a similar level of equity exposure as one suitable for a sponsor who offers no DB plan at all.

Optimal glide paths based on DB plan eligibility

T. Rowe Price’s glide path assessment framework focuses on outcomes. Our primary objective is to seek to maximize investor utility derived from consumption and wealth, rather than focusing on conventional investment metrics—such as risk‑adjusted rates of return—that are more typically used in the target date industry. Using our framework, we can investigate how the existence of a closed or frozen DB plan potentially can impact the optimal shape of a target date glide path.

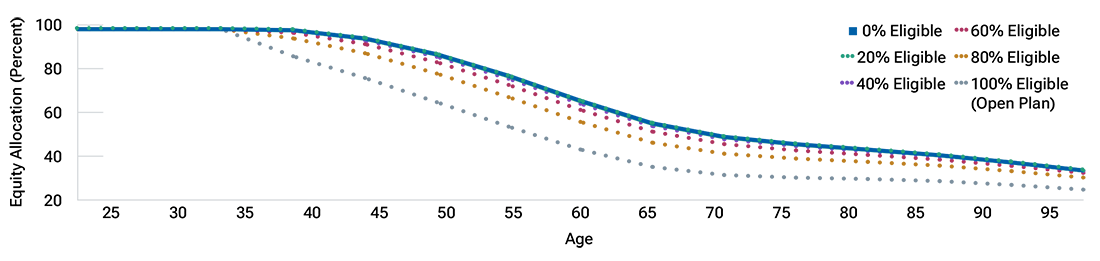

The optimal equity allocation declines as defined benefit eligibility increases

(Fig. 1) Hypothetical glide paths based on percent of participants eligible for a DB plan

For illustrative purposes only. Not representative of an actual investment or T. Rowe Price product. This analysis contains information derived from a Monte Carlo simulation. See Appendix for important information.

Source: T. Rowe Price.

Figure 1 shows a range of glide paths for a hypothetical target date offering when differing percentages of the DC plan population also are eligible for defined benefits.3

If 100% of the employees in our hypothetical example were DB plan eligible (i.e., if the plan was still open), then the lowest equity glide path shown in Figure 1 (the bottom line) potentially would produce the best aggregate retirement outcomes across the entire sample population, given our utility preference settings.

Alternatively, if 0% of all employees were DB eligible (i.e., if the employer had no DB plan at all), then the glide path with the highest equity allocation (the top line in Figure 1) potentially would be the utility‑maximizing solution. Between these two extremes are glide paths optimized for sponsors that have closed DB plans with varying proportions of eligible participants.

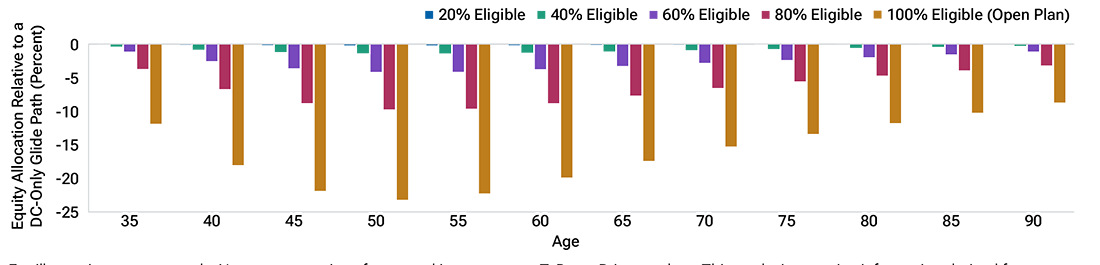

Changes in optimal equity exposure are minimal when defined benefit eligibility is reduced

(Fig. 2) Differences in hypothetical equity allocations at various ages based on DB plan eligibility

For illustrative purposes only. Not representative of an actual investment or T. Rowe Price product. This analysis contains information derived from a Monte Carlo simulation. See Appendix for important information.

Note that the different glide paths are not evenly spaced, indicating that the proportion of employees who are eligible for the DB plan can have a nonlinear effect on glide path suitability. Figure 2 shows this more explicitly:

The allocation shifts were negligible until 80%+ of the employee base was covered by the DB plan.

If 60% or less of the employees had access to the DB plan, the change in the optimal equity allocation was less than five percentage points at each age level.

Even if 80% of employees were DB eligible, the change in the optimal equity allocation was less than 10 percentage points at all ages. However, the shift was much more significant if 100% of the employee population were DB eligible.

Thus, we believe that sponsors who decide to close their DB plan to new participants would do well to also reassess their investment glide paths, because those without DB benefit coverage likely will have a material impact on overall glide path suitability.

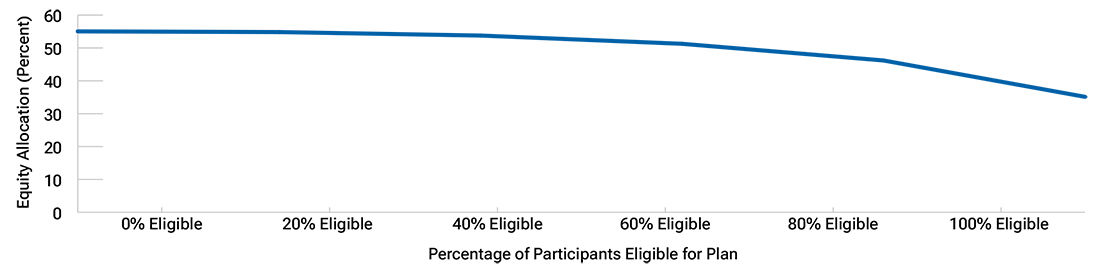

Figure 3 highlights the changes in equity allocation based on the DB eligibility of the participant population at age 65—the most frequent retirement age. Here again we see that the indicated drop off in equity exposure is largest when a significant portion of all employees are eligible for the DB plan.

The optimal equity allocation at retirement remained relatively high unless DB plan eligibility was above 80%

(Fig. 3) Hypothetical equity allocations at age 65 based on DB plan eligibility

For illustrative purposes only. Not representative of an actual investment or T. Rowe Price product. This analysis contains information derived from a Monte Carlo simulation. See Appendix for important information.

Source: T. Rowe Price.

While DB benefit eligibility is often binary, particularly for closed plans, the reality can be a little more complex for frozen DB plans because the financial situation of each employee with access to the plan will differ based on the length and trajectory of their career prior to the plan freeze. However, at any given freeze date there are likely to be DB participants with minimal accrued benefits, while everyone subsequently hired will not have access to the plan at all.

Considerations for plan sponsors

So, should sponsors simply pick the glide path that reflects the percentage of their workforce eligible for their DB plan? No, not necessarily.

Basing the glide path directly on DB eligibility could prove challenging administratively, given that the share of the total workforce eligible for DB plan benefits would continue to drop as employees with defined benefits left the company and were replaced by employees who did not have access to the plan.

In our view, seeking to maximize utility for participants who do not have access to the DB plan should be the goal that drives glide path selection. Why? Because the retirement income profile of participants with DB benefits is relatively more secure. Therefore, the glide path that potentially provides the greatest utility for the entire participant base should closely resemble the utility‑maximizing glide path in cases where there is no DB plan at all.

Our analysis of closed plans shows that unless there is a DB plan open to all participants, sponsors should consider solving for the “lowest common denominator,” which is to assume that there is no DB plan at all. As time progresses, those without DB benefits will become the dominant population within the workforce (if they are not already), and there will be no need to switch glide paths at that point. Our analysis for frozen plans follows the same logic, meaning that the frozen DB benefit should have minimal impact on a utility‑maximized glide path across the overall employee population.

The logical next question, though, is: To what extent could participants with DB benefits be disadvantaged by a glide path that doesn’t reflect their own level of retirement preparedness? The answer is: minimally.

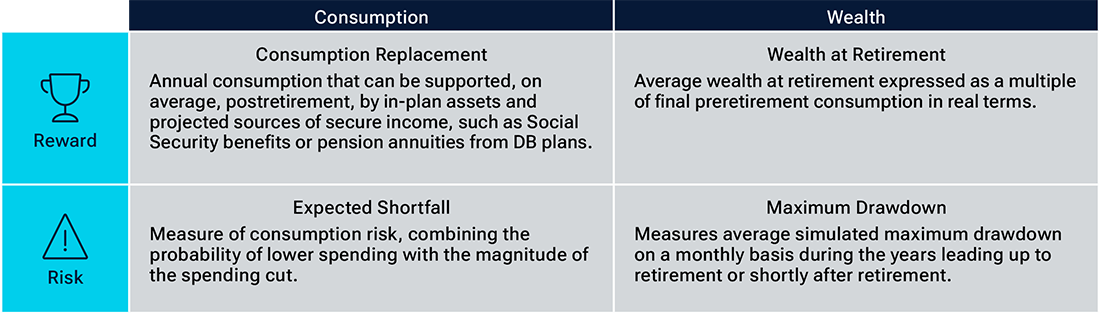

We define glide path risk and reward in terms of specific retirement outcomes

(Fig. 4) Metrics conveying utility under assumed preferences

Source: T. Rowe Price.

Figure 4 defines the key retirement outcome metrics in our glide path utility model. Figure 5 shows potential outcomes for those same metrics for two hypothetical DC plan participants, Participant One and Participant Two. Participant One has access to a DB plan in addition to the DC plan, while Participant Two has DC plan coverage only. Using Monte Carlo simulation, we compared potential outcomes for each participant from two assumed glide paths: one designed to reflect their own specific situation, and the other one optimized based on the DB status of the other participant.

Outcomes for participants who are not defined benefit eligible should drive glide path selection

(Fig. 5) Hypothetical outcomes for participants based on DB plan status and assumed glide path

Participant One (Has Access to DB Plan) |

|||||

Hypothetical Outcomes |

|||||

Assumed Glide Path |

Consumption Replacement |

Expected Shortfall |

Multiple of Preretirement Consumption Saved at Retirement |

Maximum Drawdown |

Overall Utility Score |

Optimal Glide Path for Participant One |

113.9% |

6.1% |

11.0 |

34.9% |

0.72 |

Optimal Glide Path for Participant Two |

127.2 |

5.4 |

12.6 |

37.1 |

0.71 |

Impact on Participant One of Following the Optimal Glide Path for Participant Two |

Consumption Increased by 11.7% |

Shortfall Risk Decreased by 11.5% |

14.5% More Wealth at Retirement |

Maximum Drawdown Increased by 6.3% |

|

Participant Two (Does Not Have Access to DB Plan) |

|||||

Hypothetical Outcomes |

|||||

Assumed Glide Path |

Consumption Replacement |

Expected Shortfall |

Multiple of Preretirement Consumption Saved at Retirement |

Maximum Drawdown |

Overall Utility Score |

Optimal Glide Path for Participant Two |

95.8% |

19.3% |

12.2 |

37.1% |

0.71 |

Optimal Glide Path for Participant One |

83.1 |

22.2 |

10.5 |

34.9 |

0.65 |

Impact on Participant Two of Following the Optimal Glide Path for Participant One |

Consumption Decreased by 13.3% |

Shortfall Risk Increased by 15.0% |

13.9% |

Maximum Drawdown Reduced by 5.9% |

|

Results shown are hypothetical and for illustrative purposes only. This does not represent the results of an actual investment or T. Rowe Price product.

This analysis contains information derived from a Monte Carlo simulation. See Appendix for important information.

Source: T. Rowe Price.

Our analysis suggests that while a DC‑only glide path may give participants who have DB benefits higher equity exposure than they need, there are offsetting potential benefits. In our example, the DC‑only glide path produced a somewhat larger maximum drawdown and a lower utility score for Participant One (the employee with DB coverage), but they were compensated with improved outcomes on several other fronts: higher consumption replacement, a lower expected shortfall, and a higher balance at retirement.

The opposite is true for Participant Two (the DC‑only participant). Following a glide path designed for participants that also have access to the DB plan increases Participant Two’s expected shortfall risk by 15.0%, a substantial rise. In addition, moving from 95.8% to only 83.1% of preretirement consumption replacement likely would require Participant Two to make some very challenging spending decisions.

For Participant One, the nearly 12% increase in preretirement consumption replacement provided by the DC‑only glide path no doubt would be an easier adjustment to make. However, that increase does come with more risk—and, thus, given the preferences we used, would not maximize overall utility.

Conclusions

All else being equal, participants who have legacy DB benefits should be better prepared for retirement than participants who do not. This means that a glide path not specifically calibrated for the presence of DB benefits should have less overall impact on key retirement metrics for employees with DB plan coverage than a glide path design that does account for DB plan benefits would have for employees who will need to rely more heavily on their DC plans for retirement income.

We believe sponsors should carefully consider the needs of participants who do not have access to the DB plan when evaluating glide paths for their target date offerings. These are the employees who will rely most on their DC plans to meet retirement goals, and, most likely, are also the ones who will have a significant portion of their total wealth invested in their DC plan account.

The fourth installment of our Making the Benefit Connection series further explores the wealth and substitution effects—i.e., do the additional wealth and better retirement preparedness made possible by DB plan benefits typically imply the appropriateness of a lower‑equity glide path for the companion DC plan? What if we control retirement programs for wealth and consider the possibility that freezing a DB plan might create the opportunity to offer a more generous DC plan?

This material was prepared for use in the United States for U.S.-based plan sponsors, consultants, and advisors, and the material reflects the current

retirement environment in the U.S. It is also available to Canadian-based plan sponsors, consultants and advisors for reference. There are many

differences between the two nations’ retirement plan offerings and structures. Therefore, this material is offered to accredited investors in Canada for

educational purposes only and does not constitute a solicitation or offer of any product or service

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.