On the Horizon

On the Horizon

2026 U.S. Retirement Market Outlook

January 2026, Retirement Market Outlook

Sudipto Banerjee, Ph.D., Aliya Robinson, Jessica Sclafani, CAIA®, Brandon Shea, Rachel Weker

Key Insights

- The retirement industry is witnessing a shift toward more diversified investment options as demand grows for enhanced risk-adjusted returns.

- Automation and artificial intelligence adoption across the retirement ecosystem are expected to streamline operations and improve participant experiences significantly.

- Growing demand for personalized financial advice reflects participants’ need for holistic guidance that addresses their complete financial picture, not just retirement savings.

- Retirement snapshot

- Policy overview

- Diversification reimagined

- Technology & AI

- Personalized guidance

Foreword

The U.S. retirement system is at a pivotal moment—shaped by evolving regulation, rapid technological change, and a renewed focus on meeting the diverse needs of plan participants. This year, we spotlight three transformative themes: enhanced diversification in defined contribution (DC) plans to address modern market complexities, the accelerating impact of artificial intelligence (AI) across the retirement ecosystem, and the growing demand for personalized advice solutions.

The regulatory landscape continues to progress, with new legislation and guidance designed to close coverage gaps, particularly for gig workers and independent contractors who typically lack traditional benefits and access to employer-sponsored retirement plans. Efforts to broaden plan adoption through pooled employer plans and automatic IRA provisions reflect a commitment to inclusivity and expanded retirement security. At the same time, emerging frameworks for integrating private markets into DC plans are reshaping diversification and risk management, as shifts in the investment landscape are compelling asset allocators to build more robust and diversified portfolio solutions.

Technology, especially AI and automation, is redefining retirement services, delivering measurable efficiencies, and transforming participant engagement. Advisors, consultants, plan sponsors, and the providers that serve them are exploring practical applications ranging from virtual assistants and automated workflows to advanced data-driven insights—helping improve service delivery while maintaining the trust and responsibility that underpin our industry.

The need for advice has become a central pillar of retirement planning as participants face mounting financial stress across savings, debt, and daily expenses. Our research confirms that one-on-one guidance—whether human or digital—remains key to addressing complex retirement decisions and driving confident outcomes. Data show that as some participants approach retirement, they become more active in tailoring their savings levels and asset allocation, presenting an opportunity for personalized strategies that evolve with increasing financial complexity. Plan sponsors, consultants, and advisors increasingly leverage technology and behavioral insights to deliver the right message at the right moment. For many, their focus has expanded beyond exclusively addressing the savings phase to also supporting the spending phase, which is likely to include an advice component.

The convergence of regulatory change, technology adoption, and product innovation presents both challenges and opportunities. T. Rowe Price is committed to helping our clients navigate this evolving landscape by providing forward-looking insights and actionable solutions that help improve retirement outcomes for all.

Retirement by the numbers

1 ici.org/statistical‑report/ret_24_q2

2 Bureau of Labor Statistics (BLS) bls.gov/news.release/ebs2.t01.htm#ncs_nb_table1.f.3

3 Numbers for January 2024. Social Security Administration faq.ssa.gov/en‑us/Topic/article/KA‑01903.html

4 Federal Reserve Survey of Consumer Finances, Table 6. November 2023. federalreserve.gov/econres/scfindex.htm

5 Includes both mutual funds and collective investment trusts as of June 30, 2024 (Morningstar).

A road map for implementation priorities

The U.S. retirement plan landscape is at an inflection point as momentum builds around expanding access to private assets in DC plans, enhancing retirement income solutions, and addressing retirement plan coverage gaps for a modern workforce. These developments signal an opportunity to expand the options, outcomes, and number of participants in the private retirement system.

Coverage Expansion

- Legislation—Several bills targeting gig workers and independent contractors, including the Independent Retirement Fairness Act6—which aims to enhance access to pooled employer plans (PEPs)—and the Unlocking Benefits for Independent Workers Act7—which proposes benefit safe harbors—highlight efforts to address coverage gaps.

- In addition, the Automatic IRA Act8, which has been introduced in multiple Congresses, would require employers with 10+ employees to either maintain a 401(k) plan or facilitate auto‑enrollment into an IRA.

- Regulation/guidance—In July 2025, the Department of Labor (DOL) issued limited guidance and a request for information on PEPs as the agency continues to develop frameworks for small business retirement solutions.9

Product evolution

- Parity for 403(b) plans—Congress is working on legislation that would allow 403(b) plans to invest in collective investment trusts.10 Such legislation would provide 403(b) participants with full investment parity to 401(k) plan participants.

- Retirement income strategy advancement and integration—The opportunities around retirement income options continue to grow. For example, DOL Advisory Opinion 2025‑04A, which confirms that target date products with embedded annuities qualify as qualified default investment alternatives (QDIAs), sets the stage for expanded integration of guaranteed income features within default investment options.11

- Private assets regulatory framework—Following the August 2025 Executive Order “Democratizing Access to Alternative Assets for 401(k) Investors,”12 we expect multiagency coordination between the DOL, the Department of the Treasury, and the Securities and Exchange Commission (SEC) to produce comprehensive frameworks for including private equity, private credit, and other alternative investments in DC plans, with potential safe harbors to reduce implementation barriers.

Regulatory activity

- Deregulation—Through executive orders, the Trump administration has demonstrated a desire to move toward a deregulatory environment. “Unleashing Prosperity Through Deregulation” mandates that federal agencies identify at least 10 existing rules, regulations, or guidance documents to repeal whenever they seek to introduce a new rule or regulation.13 “Ensuring Lawful Governance and Implementing the President’s ‘Department of Government Efficiency’ Deregulatory Initiative” instructed the agencies to prepare a list of rules that are not consistent with the law, are beyond the agency‘s authority, or are unjustifiably burdensome.14 We expect deregulatory activity to continue in the upcoming year.

- Fiduciary and environmental, social, and governance (ESG) rule revisions—We anticipate revisions to fiduciary and ESG rules that align with rules issued during the first Trump administration.

- SECURE 2.0 implementation—We expect additional guidance and/or final rules on automatic enrollment requirements, required minimum distribution rule modifications, and long‑term part-time employee provisions, alongside anticipated guidance on pension-linked emergency savings accounts (PLESA) and the Saver’s Match, among others.

Litigation reform

- The recent proliferation of ERISA class action litigation has curbed innovation and drained resources from plans and participants. We anticipate legislative and regulatory activity aimed at reducing baseless lawsuits and encouraging prudent innovation.

The convergence of executive action, legislative proposals, and regulatory guidance creates unprecedented opportunities to address retirement security challenges. Employers and firms that proactively interpret and respond to these retirement policy shifts will be well positioned to capitalize on emerging opportunities and help improve participant outcomes.

Building more resilient defined contribution investments

Shifts in the investment landscape—including fiscal expansion in the U.S., stubborn inflation, and uncertain monetary policy—are compelling asset allocators to reimagine diversification and build more robust total portfolio solutions that can meet the varied needs of retirement investors across a range of market environments.

Since they were designated as QDIAs by the DOL nearly two decades ago, target date strategies have evolved well beyond their foundational diversification frameworks. These solutions began as dynamic portfolios that adjust stock and bond allocations based on participants’ evolving risk tolerances as they save for retirement. Today, many target date solutions have matured to employ a more sophisticated approach to diversification that incorporates sub‑asset classes and alternative investment strategies, such as exposure to nontraditional bonds and

private assets.

Rethinking diversification in fixed income

After a decade of near-zero interest rates, bond yields now sit at elevated levels relative to much of the post-global financial crisis period, prompting DC plan sponsors and their consultants and advisors to sharpen their focus on participants’ fixed income exposure (Figure 1).

(Fig. 1) Fixed income yields are attractive relative to equities

Past performance is not a guarantee or a reliable indicator of future results.

Sources: Bloomberg Finance L.P., Bloomberg Index Services Limited, and Standard & Poor’s. Please see vendor indices disclaimers for more informationabout the sourcing information: www.troweprice.com/marketdata

The “Magnificent 7” is Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA, and Tesla. The specific securities identified and described are for informational purposes only and do not represent recommendations.

Fixed income yields (Bloomberg U.S. High Yield, Cash, Bloomberg U.S. Aggregate) are yield to worst. Equity yields (S&P 500, S&P 500 ex. Magnificent 7) are earnings yield.

This heightened attention was evident in our T. Rowe Price 2025 Defined Contribution Consultant Study where:

- Nearly three-quarters (73%) of the largest DC-focused consultant and advisor firms identified “a greater focus on fixed income diversification opportunities” as a primary driver influencing their evaluation of fixed income investments across target date strategies, managed accounts, and multi‑manager custom fixed income options. This was a 25-percentage-point increase from 48% in 2021.15

- Among plan sponsors, 60% asserted that fixed income oversight requires more time and attention than in prior years,16 compared to less than half (48%) in 2021—before the simultaneous downturn in both equity and fixed income markets in 2022.17

Openness to private markets

The potential for private assets to be included in DC plans, primarily through custom or off-the-shelf target date solutions, was a key theme throughout 2025. We expect the discussion to continue, with new solutions coming to market in 2026 and beyond. Private assets include a range of investment strategies such as private credit, private equity, and private infrastructure.

Notably, DC consultants appear increasingly open to the inclusion of private credit as a building block in target date solutions. This is another example of the industry’s increased focus on building fixed income allocations that are more durable across varying interest rate environments. Our research shows that this evolution reflects both consultant sentiment and participant concerns.

- Results from our 2025 DC Consultant Study show growing interest in private credit for DC plans. Expectations for incorporating private credit into DC plan solutions rose from an average rating of 1.7 in 2024 to 2.1 in 2025, based on a four-point scale where four represents highest likelihood for incorporation into DC plans over the next 12–24 months. While still relatively neutral, this increase indicates greater openness among consultants to include private credit as a building block in professionally managed, multi-asset portfolios.18

- Meanwhile, 49% of U.S. retirement savers express significant worry about inflation, and 33% cite interest rates as very concerning, outweighing concerns about unemployment and stock market performance.19 Building more durable and diversified fixed income allocations can support participants by providing a less volatile investment experience that is more aligned with participant expectations for fixed income investments.

Emerging innovation in capital preservation

Today’s unique investment environment is also creating significant opportunities for innovation within fixed income, particularly in capital preservation activity. The 2025 DC Consultant Study reveals that consultants and advisors anticipate increased interest in reviewing and revisiting existing capital preservation strategies relative to prior years, with 94% of respondent firms citing the current interest rate environment as a catalyst for change.20

Most notably, consultants and advisors are increasingly exploring ways to transition stable value general account/insurance company products to pooled funds for higher crediting rates or to facilitate smoother recordkeeper transitions.21 Some plans with separate account stable value funds are also seeking creative ways to boost crediting rates and compete with money market yields, such as adding allocations to equities, high yield, or private credit. We are having more discussions with consultants and advisors on ways they could incorporate stable value into custom target date funds and retirement income offerings.

Not necessarily active, but not passive either

A shifting interest rate environment and heightened equity market volatility are also catalysts to reconsider the value of active management. The traditional paradigm of “active versus passive” is increasingly outdated as plan sponsors and their consultants and advisors look for opportunities to offer participants some of the benefits of active management at fee levels that reflect the DC industry’s fee sensitivities.

An in-between category, featuring strategies that seek a market-plus return with market‑like risk, could be an emerging DC plan investment trend. These strategies aim to deliver net returns above the index at lower cost than traditional active management—both characteristics that align with plan sponsors’ goals to improve participant retirement outcomes while focusing on value for cost.

Our 2025 plan sponsor research found:

- About 8 in 10 (82%) U.S. DC plan sponsors support the use of active management to hedge against downside [risk] due to heightened market volatility, and three‑quarters (76%) express a “belief that active management adds value.”22

- Conversely, in terms of support for passive management, 84% of U.S. DC plan sponsors say, “limiting cost is the most important consideration,” and 78% point to passive to mitigate against benchmark deviation.

Investment strategies that limit tracking error while offering opportunities for excess returns can be appealing for DC plans. These solutions can bridge the gap between active and passive approaches by delivering the sophisticated balance of performance potential and cost efficiency that modern retirement plans demand.

Combining the benefits of active and passive management is also reflected in the growing category of blend target date solutions, which allocate to both active and passive building blocks. In the 2025 DC Consultant Study, we asked consultants and advisors to rate various statements on a four-point scale, where 1 = do not support and 4 = strongly support. The statement “target date solutions constructed with both active and passive strategies” received an average rating of 3.8 in 2025, up from 3.5 in 2021, highlighting growing demand for blend target date solutions.

Key considerations for plan sponsors, consultants, and advisors

- As more multi-asset retirement solutions that include private assets become available, DC plan sponsors, with the support of advisors and consultants, can explore the risk, liquidity, and operational implications of offering private asset exposure to participants. This process should align with participant needs, evolving regulatory requirements, and the plan’s overall objectives and governance framework.

- Amid unpredictable market conditions, plan sponsors who have embraced fully passive investment solutions may wish to revisit the important role active management can play in terms of diversification and volatility management to support participants in staying invested and working toward their retirement goals.

Rapidly evolving technology landscape driving retirement industry modernization

As we mark 50+ years since the passing of ERISA, retirement platforms have continually adapted to new policies and evolving investor needs. Advances in generative AI and rapid innovation in technology are expected to streamline operations, elevate participant engagement, and unlock measurable cost savings for advisory firms, recordkeepers, and plan sponsors. The potential impact is substantial: Consulting firm Everest Group estimates that AI could save the U.S. retirement and pension industry $16 billion–$20 billion in operational costs.23

Our 2026 Global Market Outlook discusses how the narrative around AI is beginning to shift from possibility to profitability.24 Within the retirement ecosystem, we are still in the early stages of product implementation, though sentiment is trending positive (Figure 2). As use cases prove AI’s value, the industry is increasingly focused on scalable opportunities (particularly in service, personalized advice, and plan operations) that can drive outcomes and improve efficiencies for plan sponsors, advisors, and participants.

Adoption momentum is building

Advisors and consultants report that they are evaluating and exploring AI governance as they prioritize potential high-impact applications. More than two-thirds of plan sponsors (66%) see potential in AI-powered virtual assistants that answer common 401(k) questions.25 With growing demand, innovative solutions that can standardize secure, auditable AI workflows that improve accuracy and speed while maintaining trust will be transformative.

Participants, especially younger generations, express demand for digital experiences. Nearly three-quarters (74%) of Gen X, Gen Z, and millennial app users value the ability to execute transactions through virtual assistants. Additionally, 63% of millennial and Gen Z participants rate virtual assistants as very or extremely important to their digital retirement experience.26

These preferences create meaningful opportunities. AI capabilities that enable personalized participant communications, guide transactions, and simplify complex decisions can encourage action and improve long‑term outcomes.

(Fig. 2) How advisors/consultants are using AI

Source: T. Rowe Price 2025 Defined Contribution Consultant and Advisor Study. Question: How are you using AI? (Select all that apply).

Efficiency remains the top strategic priority

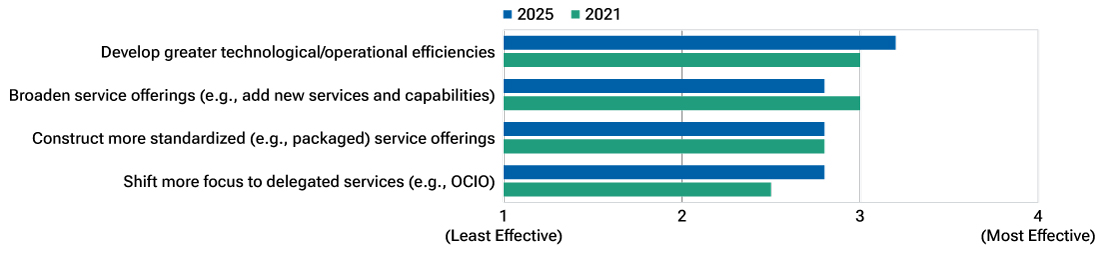

In our annual DC Consultant Study, advisors and consultants have consistently cited developing technological and operational efficiency as their number one focus for five consecutive years (Figure 3). AI and automation will extend these gains—reducing manual workflows, enhancing plan operations, and tailoring participant communications at scale. The payoff is twofold: increased efficiencies and better experiences that encourage healthier saving behaviors and more confident decision-making.

For advisors and consultants to realize AI’s promise in retirement services, they and the providers they work with will need to:

- Modernize their technology and not simply bolt AI on top of legacy systems. This means upgrading to API-first (Application Programming Interface), cloud-capable platforms that consolidate today’s fragmented systems and enable true ecosystem integration.

- Treat data as an enterprise asset: AI outcomes depend entirely on clean, unified data and strong data stewardship.

- Implement robust controls and data governance, which are required to overcome the two biggest adoption barriers: limited legacy integration and persistent data quality issues.

The question is no longer whether AI will transform retirement services, but rather how quickly. Among retirement advisory firms, AI adoption is most visible in large, acquisition‑driven organizations that are leveraging AI to boost advisor productivity and participant engagement. As organizations demonstrate cost savings, governance maturity, and positive participant outcomes, adoption is likely to accelerate across the industry.

(Fig. 3) Strategies that consultants and advisors believe will be most effective for profitability or growth

Source: T. Rowe Price 2025 Defined Contribution Consultant and Advisor Study. Question: Please rate the strategies you think will be the most effective for improving profitability or supporting overall business growth.

Key considerations for plan sponsors, consultants, and advisors

- Plan sponsors, advisors, and consultants can modernize their operations through virtual assistants, proactive outreach, and automated workflows that drive efficiency and improve participant satisfaction. Strong data foundations that focus on quality, security, governance, and interoperability can ensure that AI insights remain reliable and transferable across recordkeepers and payroll systems. Equally important is robust AI governance with human oversight to maintain transparency, fairness, and accountability.

- A practical road map starts with targeted productivity wins, using AI to streamline repeatable and/or time-intensive tasks. Organizations can then formalize use cases into compliant, standardized workflows and governance frameworks. Over time, these frameworks can support more strategic integration of AI into plan design, participant experience, and vendor oversight.

Smarter tech, more personalized solutions, less financial stress

As more participants approach retirement, many are looking for personalized financial help. Advances in technology that include secure platform integration, data analytics, and automation are making it possible to deliver tailored products and services more efficiently and cost‑effectively to those participants who would benefit from additional support.

We expect tech-enabled, scalable advice to become a reality for broad participant populations. This shift will expand access to quality financial guidance for all participants, including populations that have typically been underserved due to cost barriers.

The challenge: Competing financial priorities

In today’s uncertain environment, employees navigate complex financial lives as they juggle priorities that directly impact their ability to save effectively for retirement.

According to our recent annual survey of plan participants, retirement savings remains the top priority, but it’s not the only one. Individual circumstances and goals also vary significantly, and participants are also highly focused on nonretirement financial objectives (Figure 4).

These competing priorities are not trivial, and they can create significant barriers to effective retirement saving. External factors like inflation, rising education costs, and delayed major life decisions (e.g., homeownership and starting families) further complicate the picture.

The result is widespread financial stress. In our 2025 Global Retirement Savers Study, a majority of participants reported high to moderate stress levels across all financial planning categories:

- 63.1% stressed by budgeting

- 62.1% stressed by retirement savings

- 58.7% stressed by nonretirement savings

- 57.7% stressed by health care planning

(Fig. 4) Major financial objectives

| Saving for retirement in current 401(k) | 58% |

| Managing day-to-day expenses | 56% |

| Saving for emergencies | 53% |

| Converting retirement assets into income stream | 40% |

| Paying existing debt | 34% |

| Saving to purchase a primary residence | 29% |

| Saving for college expenses | 25% |

| Saving to start a business | 18% |

Source: 2025 T. Rowe Price Global Retirement Savers Study. Question: Please indicate how important each financial objective is to your household.

As employers increasingly provide access to benefits that can help to address these varied challenges, individuals can benefit from holistic financial guidance that considers unique personal scenarios and goals to maximize value. With such complexity, financial advice is not a nice‑to-have, it is essential.

Meeting rising demand for guidance

With a workforce that spans six generations, we are witnessing changes in relationships between employers and employees. In particular, young employees entering the workforce today have different expectations of their employers and the benefits offered than previous generations did. Demand for guidance is rising, and employers who address this need can improve employee satisfaction by helping to reduce employee financial stress and enhancing their overall financial wellness.

Our research shows that the workplace remains the primary source for accessing educational tools and financial guidance across the board. One-on-one consultations with a financial advisor ranks as the most helpful learning format for retirement planning, with 43% across age groups rating them “very helpful.” Notably, several studies have found that people who work with financial advisors typically report higher retirement confidence than those who do not.

Online courses and videos rank second at 30%, but with a clear generational split: 36% of workers under age 34 favor these digital resources compared with 21% of those age 50 and older. These results underscore the critical importance of offering a flexible spectrum of solutions, both in person and digital, that can adapt to both changing participant needs and generational preferences.

Opportunity for personalization as participants age

Defaults like auto-enrollment and target date QDIAs have meaningfully improved retirement outcomes. Given technology advances, we now have the opportunity, particularly for participants approaching or in retirement who are more likely to have complex financial lives, to introduce personalization.

Our research indicates that more plans are offering managed accounts as an opt-in investment option alongside a target‑date strategy as the default, providing personalization for participants who may benefit from additional guidance. For example, major life events—marriage, divorce, parenthood, job transitions, health issues, etc—can significantly impact long‑term savings.

Data from our recordkeeping system show that as participants age, they become more actively involved with their retirement savings. Participants are more likely to increase their contributions and adjust asset allocations as they get older. This uptick in savings activity likely reflects higher discretionary income during peak earning years or reduced financial obligations, while portfolio adjustments may indicate increased risk tolerance gained through experience or greater awareness of potential retirement gaps.

To better understand these allocation adjustments, our research examined how participants modify their portfolios as they age. Between 2019 and 2024, we tracked how participants across three age groups actively changed their equity allocations. We found that older participants are more likely to adjust their allocations compared with younger cohorts (Figure 5). Specifically, among participants aged 50+, about one‑quarter (26%) did not make any investment changes, while half (50%) increased their exposure to equities, and the remainder reduced their equity allocation (24%).

(Fig. 5) Older participants more likely to make investment changes

| Age | No Change (%) | Higher Equity Share (%) | Lower Equity Share (%) |

|---|---|---|---|

| 20–34 | 46 | 34 | 20 |

| 35–49 | 30 | 44 | 26 |

| 50+ | 26 | 50 | 24 |

Source: T. Rowe Price’s recordkeeping platform from 2019 to 2024. We analyzed fixed panels of active retirement plan participants across the three age groups: ages 20–34 (94,933 investors), 35–49 (133,974 investors), and 50+ (84,083 investors).

As retirement approaches, complexity increases. Decisions become more nuanced as savers navigate how to draw income; when to claim Social Security; how to sequence withdrawals; and how to balance longevity, market risk, and health care costs. These participants are typically more receptive to guidance that addresses their specific circumstances.

Our research suggests that for younger participants in their early to mid-careers, the benefits of personalized investment strategies may be less compelling as the optimal portfolio for most during this period will emphasize growth. However, as participants approach retirement and their financial situations become more complex, some may want to personalize their investments. Advances in technology provide an opportunity to introduce tailored solutions to these participants more efficiently and cost effectively than ever before. We expect more plan sponsors to consider offering these options in the coming years.

Key considerations for plan sponsors, consultants, and advisors

- Advances in technology can help plan sponsors implement tailored solutions at scale to address the needs of participants who want to personalize their savings experience.

- Consultants and advisors can help clients build integrated advice journeys that connect digital tools, personalized communications, and access to human financial advisors. As participants’ financial needs evolve throughout their careers, this comprehensive support framework helps ensure they receive appropriate guidance for their complete financial picture, which should lead to better retirement outcomes.

Appendix

2021 Defined Contribution Consultant Study: The study included 51 questions and was conducted from September 20, 2021, through November 2021. Responses are from 32 consulting and advisory firms with more than $7.2 trillion in assets under administration.

2023 Future of Fixed Income in Defined Contribution Plans Study: The survey was fielded October 12, 2022, through November 15, 2022. Data reflect responses from 158 plan sponsors.

2025 DC Plan Sponsor Retirement Trends Study: The survey was fielded November 6, 2024, to December 12, 2024. Data reflect responses from 116 plan sponsors.

2025 Defined Contribution Consultant and Advisor Study: This study included 45 questions and was conducted from January 13, 2025, to March 10, 2025. Responses are from 36 consulting and advisor firms with over 136,000 DC plan sponsor clients and nearly $9 trillion in assets under administration.

2025 T. Rowe Price Global Retirement Savers Study: The study was conducted between June 24, 2025, and July 31, 2025. It included 7,010 retirement savers in Australia (1,000), Canada (1,000), Japan (1,006), the UK (1,003), and the U.S. (3,001). (Weighted to reflect equal representation across the 5 countries). The sample was constructed to reflect the demographic composition of each country’s workforce, ensuring representation across age, gender, and regional distributions. All survey respondents were adults age 18 and older who are currently employed (full time or part time) and have never retired. The respondents either actively contribute to or are eligible to contribute to a defined contribution or similar account‑based workplace retirement plan.

6 S.2217—Independent Retirement Fairness Act (introduced June, 9 2025). congress.gov/bill/119th-congress/senate-bill/2217

7 S.2210—Unlocking Benefits for Independent Workers Act (introduced June 8, 2025). congress.gov/bill/119th-congress/senate-bill/2210

8 H.R.7293—Automatic IRA Act of 2024 (introduced February 7, 2024). congress.gov/bill/118th-congress/house-bill/7293

9 U.S. Department of Labor. Department of Labor solicits public input on ways to help smaller employers improve retirement plan outcomes for workers. July 28, 2025. dol.gov/newsroom/releases/ebsa/ebsa20250728

10 H.R.3383—Incentivizing New Ventures and Economic Strength Through Capital Formation (INVEST) Act of 2025 (introduced May 14, 2025). congress.gov/bill/119th-congress/house-bill/3383

H.R.1013—The Retirement Fairness for Charities and Educational Institutions Act (Introduced February 5, 2025). congress.gov/bill/119th-congress/house-bill/1013

11 U.S. Department of Labor. Advisory Opinion 2025-04A, September 23, 2025. dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/advisory-opinions/2025-04a

12 The White House. Democratizing Access to Alternative Assets for 401(k) Investors, August 7, 2025. whitehouse.gov/presidential-actions/2025/08/democratizing-access-to-alternative-assets-for-401k-investors/

13 The White House. Unleashing Prosperity Through Deregulation, January 31, 2025. whitehouse.gov/presidential-actions/2025/01/unleashing- prosperity-through-deregulation/

14 The White House. Ensuring Lawful Governance and Implementing the President’s “Department of Government Efficiency” Deregulatory Initiative, February 19, 2025. whitehouse.gov/presidential-actions/2025/02/ensuring-lawful-governance-and-implementing-the-presidents-department-of- government-efficiency-regulatory-initiative/

15 T. Rowe Price, 2025 Defined Contribution Consultant Study. Question: To what extent have the following trends influenced your evaluation of capital preservation and/or fixed income investment options? Respondents were offered 10 statements and asked to select the top 5.

16 T. Rowe Price, 2025 DC Plan Sponsor Survey.

17 T. Rowe Price, 2023 Future of Fixed Income in DC Plans Survey.

18 T. Rowe Price, 2025 Defined Contribution Consultant Study. Question: What alternative investment strategies are most likely to be incorporated into DC plans over the next 12–24 months? Respondents were offered a scale of 1 to 4, where 1 = least likely and 4 = most likely.

19 T. Rowe Price, 2025 Global Retirement Savers Study. Question: Thinking about the next 12 months, how concerned are you about the following? (very concerned, somewhat concerned, not very concerned, not concerned at all). Percentages refer to very concerned.

20 T. Rowe Price, 2025 Defined Contribution Consultant Study. Question: What capital preservation do you expect from clients in the next 12–18 months? Respondents were asked to rate each statement on a scale of 1 (strongly disagree) to 4 (strongly agree). The statement “increased interest in reviewing/revisiting the capital preservation option” received an average rating of 2.8 in 2025, up from 2.4 in 2021. Question: To what extent have the following trends influenced your evaluation of capital preservation and/or fixed income investment options. Respondents were offered 10 statements and asked to select the top 5.

21 T. Rowe Price, 2025 Defined Contribution Consultant Study. Question: What capital preservation do you expect from clients in the next 12–18 months? Respondents were asked to rate each statement on a scale of 1 (strongly disagree) to 4 (strongly agree).

22 T. Rowe Price, 2025 DC Plan Sponsor Retirement Trends Study. Question: Please indicate your level of agreement with each of following statements related to reasons for using active management or passive management on a scale of 1 (strongly disagree) to 4 (strongly agree).

23 Vigitesh Tewary and Pawar A., “From Data to Decisions: The Future of Retirement Planning in the Age of AI.” Everest Group, April 7, 2025.

24 T. Rowe Price, “2026 Global Market Outlook: Minds, machines, and market shifts.” November 2025. troweprice.com/en/us/insights/global-market-outlook

25 “Cost Concerns Ease as AI Moves Up the Agenda for DC Plan Sponsors.” Escalent. July 8, 2025. Plan sponsors managed DC plans with at least $100 million in plan assets.

26 Corporate Insight, 2024 Participant Survey Report - Retirement Plan Monitor. January 2025.

For U.S. investors, visit troweprice.com/glossary for definitions of financial terms.

Investment Risks

The principal value of target date strategies is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These products typically invest in a broad range of underlying strategies that include asset classes such as stocks, bonds, and short-term investments and are subject to the risks of different areas of the market. A substantial allocation to equities both prior to and after the target date can result in greater volatility over short-term horizons. In addition, the objectives of target date strategies typically change over time to become more conservative.

International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk.

Personalized solutions are subject to risks including possible loss of principal. There is no assurance that any investment objective will be met.

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

Passive investing may lag the performance of actively managed peers as holdings are not reallocated based on changes in market conditions or outlooks on specific securities.

Diversification cannot assure a profit or protect against loss in a declining market.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you.

Any tax‑related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

© 2026 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners. Use does not imply endorsement, sponsorship, or affiliation of T. Rowe Price with any of the trademark owners.

202602-5222191