June 2021 / ASSET ALLOCATION VIEWPOINT

The Challenge of Rising Inflation

Key Insights

- In a highly inflationary environment, bonds could lose their typical hedging characteristics, posing a challenge for asset allocators.

- Bank loans may potentially benefit investors seeking a fixed income option with less sensitivity to rising interest rates.

Asset allocators face a challenging environment as inflation expectations continue to rise amid sharply higher commodity prices and rapidly rising wages. While bonds typically help to provide some downside risk mitigation to a portfolio when stocks decline, stock and bond returns tend to become more correlated in a highly inflationary environment.

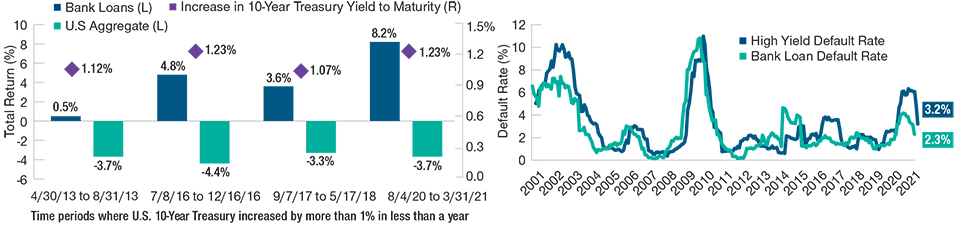

To account for this dynamic, the Asset Allocation Committee is overweight to bank loans, as their interest rate reset feature makes them less sensitive to rising rates than traditional bonds. As shown in Figure 1, during the last four periods where the 10-year U.S. Treasury yield increased by more than 1% in less than a year, bank loans posted positive returns and meaningfully outperformed the broader fixed income market.

Investors should note that although these loans offer an appealing alternative, they are vulnerable to credit risk and generally have high yield credit ratings. Fortunately, the current strong economic environment has driven down default rates (see Figure 2). Further, the fundamental outlook for bank loans appears attractive given the anticipated acceleration in growth as economies reopen globally.

Notably, these supportive expectations have—to some extent— already been priced into bank loan valuations, driving yields to below-average levels. However, bank loans still remain relatively attractive compared with other fixed income segments.

While sharply rising inflation may pose challenges for asset allocators, an allocation to bank loans could, in our view, potentially benefit investors seeking a fixed income option with less sensitivity to rising interest rates.

The Case for Bank Loans

The fundamental outlook for bank loans is attractive

Past performance is not a reliable indicator of future performance.

Sources: S&P/LSTA, Bloomberg Barclays. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures. Bank Loansrepresented by the S&P/LSTA Performing Loan Index, U.S. Aggregate represented by the Bloomberg Barclays U.S. Aggregate Bond Index. High yield default rate source:J.P. Morgan Global High Yield Index; Bank loans default rate source: J.P. Morgan Leveraged Loan Index. See Additional Disclosures.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

11 June 2021 / 2021 MIDYEAR MARKET OUTLOOK