11 June 2021 / 2021 MIDYEAR MARKET OUTLOOK

Positioning for a New Economic Landscape

Recovery is on track, but inflation pressures create risks.

Key Insights

- Global growth accelerated in early 2021, led by China and the U.S. The economic recovery from the pandemic appears set to broaden in the second half.

- Despite strong growth, earnings expectations could be difficult to meet. But there may be potential for earnings outperformance in some non‑U.S. markets.

- Strong institutional demand for U.S. Treasuries is holding yields down. Fixed income investors may want to consider credit sectors for opportunities.

- China’s tighter corporate governance standards, better capital allocation, and technical innovation are expanding the opportunity set for investors.

The strengthening economic recovery from the coronavirus pandemic appears poised to broaden across regions and countries in the second half of 2021, bolstered by vaccine progress, continued fiscal and monetary stimulus, and pent‑up consumer demand.

But this new economic landscape poses a number of critical questions for investors. A key one is whether growth will be strong enough to meet optimistic earnings expectations without fueling sustained inflationary pressures—the kind that could force the U.S. Federal Reserve and other central banks to speed up a turn toward tighter monetary policy.

“To make the case that broad equity valuations are attractive, you have to rely on an argument that there’s no practical alternative,” says Robert Sharps, president, head of Investments, and group chief investment officer (CIO). “That would rest on a continuation of low interest rates and low inflation.”

Justin Thomson, head of International Equity and CIO Equity, suggests that equities can do well with a modest uptick in inflation but not a significant acceleration. “Historically, periods of rising inflation have been relatively good for equities in aggregate—but only up to a point. Once inflation gets beyond 3% or 4%, it has tended to choke off returns.”

For bond investors, rising yields pose obvious risks but could create potential opportunities, notes Mark Vaselkiv, CIO Fixed Income. Higher yields could make some credit sectors potentially attractive relative to equities, he says, prompting an asset allocation shift.

“I think at some point many equity investors will want to try to lock in the gains they’ve enjoyed from the bull market,” Vaselkiv suggests. “If so, there could be a rotation back to fixed income.”

Building a Sustainable Recovery

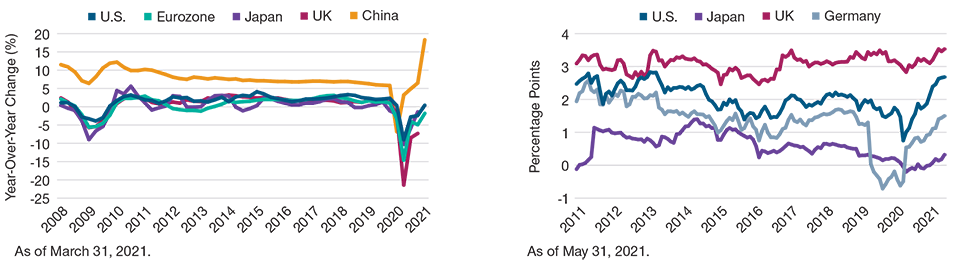

Accelerated vaccine campaigns in the developed countries, additional stimulus, and a surge in business activity as industries reopen all appear to have set the stage for robust global economic growth in the second half of 2021 (Figure 1).

Growth Surge Brings Rising Inflation Expectations

(Fig. 1) Real GDP year‑over‑year growth rates and 10‑year yields minus inflation‑linked 7- to 10-year yields*

Past performance is not a reliable indicator of future performance.

*Break‑even calculation uses the 10‑year benchmark government yield minus the Bloomberg Barclays Government Inflation‑Linked (7–10 Year) Index yield foreach country.

Sources: Bloomberg Finance L.P., data analysis by T. Rowe Price, and Haver Analytics (see Additional Disclosures). T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Pent‑up demand and fiscal and monetary stimulus should help sustain above‑average growth well into 2022, Sharps says. Recent forecasts from the Organisation for Economic Cooperation and Development (OECD), he notes, suggest that global gross domestic product (GDP) could grow almost 6% in 2021, and 4%–5% in 2022.1

If consumer demand continues to accelerate in the second half of 2021, Sharps adds, “we could experience an economic boom unlike anything we’ve seen in some time.”

Although China and the U.S. have led the recovery so far, Sharps predicts that faster growth will extend to other economies as 2021 progresses. “This might be better characterized as a sequenced global recovery, rather than a synchronized global recovery,” he says. However, the timing of that sequence is likely to remain uneven, as some countries and regions, including India and Latin America, continue to struggle with the pandemic.

A quickening recovery is reshaping the demand in ways that could create both short‑term and long‑term potential opportunities for investors, Sharps says. Areas that could potentially benefit include the travel and hospitality industries, airlines, restaurants, and medical services.

By speeding up the adoption of more efficient technologies and business models, the pandemic also could set the stage for future productivity gains, Sharps argues. That could raise the long‑term global potential for economic and earnings growth.

THE INFLATION DEBATE

Although signs of inflationary pressures— such as surging commodity prices and a global semiconductor shortage—periodically rattled markets in the first half, central bankers and other financial officials have taken a relatively dovish view, Thomson notes. “The received wisdom is that the monetary authorities understand inflation and have the tools to deal with it,” he adds.

The optimistic case, Thomson says, is that the acceleration is a transitory effect that will fade as supply bottlenecks are overcome and the surge in post‑pandemic demand runs its course. But Thomson cites several longer‑term trends that he thinks could produce a structural shift to higher inflation rates:

- Large U.S. fiscal deficits, which have been dramatically enlarged by pandemic stimulus efforts.

- Demographics, as retired baby boomers spend their savings and labor shortages push wages up.

- “Deglobalization”—a turn toward higher tariffs, immigration barriers, and supply onshoring.

Vaselkiv says wage hikes by leading U.S. companies also suggest that the balance of economic power has tilted toward workers in ways that won’t be reversed quickly. This is not entirely bad news, since rising consumer income could help sustain the recovery as fiscal and monetary stimulus efforts wind down.

But Sharps cites another potential inflation threat that decidedly lacks any upside: cyberterrorism. Recent extortionary attacks on a primary U.S. pipeline and a major meat supplier show how fragile global supply chains could be in a wired age. “You could argue that these were one‑off events,” he says, “but at this point they seem to be turning into serial one‑offs.”

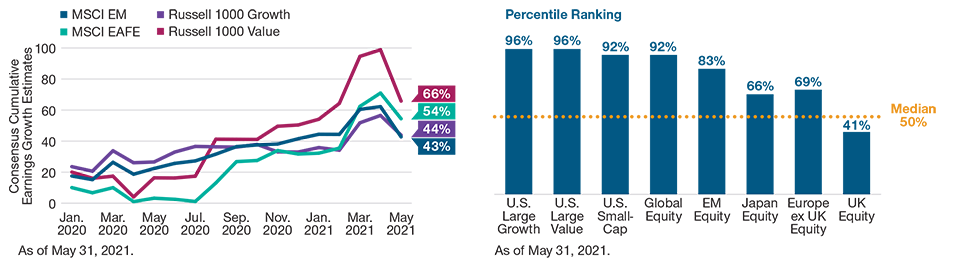

A Focus on Earnings Growth

Corporate earnings and earnings growth expectations both surged in the first quarter, particularly in the U.S. However, equity prices rose even faster, pushing valuations in many markets toward historic extremes (Figure 2). Year‑over‑year earnings comparisons also are becoming more challenging as economies move further away from the depths of the pandemic recession.

Earnings Growth Forecasts Have Risen but Valuations Are High

(Fig. 2) Consensus estimates for EPS growth next two fiscal years vs. trailing 12 months, valuation percentiles vs. past 15 years*

*Relative valuation percentiles vs. past 15 years are based on an equal‑weighted average of next 12‑month price/earnings, price/book, and price/cash flow ratios.

Sources: MSCI and FTSE/Russell (see Additional Disclosures). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

Indexes: U.S. Large Growth: Russell 1000 Growth Index; U.S. Large Value: Russell 1000 Value Index; U.S. Small‑Cap: Russell 2000 Index; Global Equity: MSCI All Country World Index; EM Equity: MSCI Emerging Markets Index; Japan Equity: MSCI Japan Index; Europe ex UK Equity: MSCI Europe ex UK Index; UK Equity: MSCI UK Index.

Although speculative excesses have appeared in areas such as cybercurrencies, special purpose acquisition companies (SPACs), electric vehicles, and some stocks traded by retail investors, global and U.S. equity markets overall do not appear to be in bubble territory, Sharps contends.

That said, many broad equity averages appear stretched even after factoring in ultralow interest rates, Sharps adds. This suggests that equity investors could face more subdued return prospects going forward even if economic growth remains relatively strong.

“Valuation historically has not been a good tactical timing tool,” Sharps says. “But it’s typically been a good forward indicator of return potential relative to longer‑term averages. I don’t think the starting point today bodes very well for robust returns going forward.”

Thomson agrees that the economic recovery largely has been priced into U.S. equities. But earnings per share (EPS) for companies in many other markets have yet to rebound as quickly or strongly as they have for the S&P 500 Index. This creates the potential for non‑U.S. equities to outperform as the recovery broadens, he argues. “The reflation theme plays well in cyclicals, and [non‑U.S.] markets tend to be more cyclical.”

Such a shift, Thomson notes, would break a record 12‑year‑long streak of U.S. equity outperformance relative to non‑U.S. markets. He cites several factors that he thinks potentially could reverse that trend:

- Sector rotation: Technology stocks have fueled much of the U.S. performance edge. But a slowdown in technology adoption, plus the risk of regulation and higher taxes, may neutralize that advantage.

- Higher interest rates: While the U.S. market is technology heavy, banks play a leading role in major European benchmarks. Higher rates and steepening yield curves could boost bank profitability.

- Attractive emerging market (EM) currencies: Many EM currencies appear undervalued against the U.S. dollar and other major currencies, Thomson argues. Historically, EM assets—both equity and fixed income— were most attractive when EM currencies were low, he says.

CYCLICAL REBOUND DRIVES ROTATION

The strength of the cyclical economic recovery also could help determine the course of an ongoing style rotation from growth to value.

The value style has outperformed the growth style strongly since late 2020, Thomson notes. Although that relative advantage could moderate in the second half, the cyclical recovery theme “still has legs,” he says. Global small‑cap stocks appear well positioned to benefit, as do many EM equity markets.

Thomson says the relative underperformance of Japanese equities in the first five months of 2021 was something of a surprise, given that earnings beat expectations at many firms—despite what he says is a tendency among Japanese corporate managers to give realistic guidance to analysts.

Earnings results for the broad Japanese averages should remain strong in the second half, Thomson predicts. Historically, he notes, cyclical recoveries have generated powerful tailwinds for many Japanese companies, because high fixed costs mean that revenue gains tend to translate directly into profits.

Creativity in an Era of Rising Yields

Through the first half of 2021, the correct strategy for high‑quality fixed income sectors was to keep duration2 short, Vaselkiv says. That could change in the second half, he adds, but only if demand from large institutional investors—Japanese institutions in particular—doesn’t continue to suppress U.S. Treasury yields.

In Vaselkiv’s view, yields on U.S. Treasuries and investment‑grade corporate bonds remain surprisingly low given the strength of the recovery. Average durations are still historically extended (Figure 3), which doesn’t suggest a market deeply worried about interest rate risk.

Interest Rate Pressures Are Building, and Some Sectors Are Potentially Exposed

(Fig. 3) Duration and yield across fixed income sectors

As of May 31, 2021.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance LP and J.P. Morgan Chase (see Additional Disclosures). Data analysis by T. Rowe Price.

Indexes used: U.S. Treasuries: Bloomberg Barclays U.S. Treasury Index; U.S. IG Corporates: Bloomberg Barclays U.S. Corporate IG Index; U.S. Aggregate: Bloomberg Barclays U.S. Aggregate Bond Index; U.S. High Yield: Bloomberg Barclays U.S. High Yield Index; EM Sovereign USD: J.P. Morgan EMBI Global Diversified Index; EM Sovereign Local Currency: J.P. Morgan GBI EM GD Index; EM Corporates: J.P. Morgan CEMBI Broad Diversified Index; Japan Gov’t. Bonds: Bloomberg Barclays Asian Pacific Japan Index; German Bunds: Bloomberg Barclays Global Treasury Germany Index; Global High Yield: Bloomberg Barclays Global High Yield Index; Global Aggregate USD Hedged: Bloomberg Barclays Global Aggregate Index USD Hedged; Bank Loans: J.P. Morgan Levered Loan Index; U.S. Short‑Term Gov’t./Credit: Bloomberg Barclays Short‑Term Government/Corporate Total Return Index Value Unhedged USD.

Part of the explanation can be found in the negligible or negative yields offered by Japanese and German government debt, Vaselkiv says. This has fueled demand for U.S. Treasuries from income‑hungry but risk‑averse institutional investors.

Vaselkiv thinks many portfolio managers would extend duration if the 10‑year Treasury yield rose above 2.00% or 2.25%, which also would lift the income potential of mortgage‑backed securities and corporate bonds. However, such a move might attract even heavier institutional demand, pushing yields back down again.

CREDIT SPREADS ARE TIGHT BUT APPEAR REASONABLE

Fixed income investors seeking attractive opportunities in the second half may need to look to riskier credit sectors, such as U.S. and global high yield, bank loans, and EM corporate bonds, Vaselkiv says.

A number of analysts, Vaselkiv notes, have argued that credit spreads—the difference between yields on bonds exposed to default risk and those on Treasuries of comparable maturity—are extremely tight by historical standards, perhaps signaling a potential bubble. But Vaselkiv takes a contrarian view, arguing that tight spreads appropriately reflect a benign credit outlook:

- Corporate defaults have plummeted, and there are relatively few distressed companies left in the high yield sector, even in the energy industry.

- Companies have repaired their balance sheets, thanks to almost USD 2.8 trillion of U.S. corporate credit issuance in 2020 and another USD 1.4 trillion in the first five months of 2021.3

- Credit upgrades rose above credit downgrades in the first half of 2021,4 and Vaselkiv says he thinks they are poised to remain higher going forward.

Floating rate bank loans, Vaselkiv adds, currently offer a particularly attractive combination of relatively high yields and very short duration (an average of 90 days). This could provide benefits all the way through the next Fed tightening cycle, he argues.

Investors may need to factor a weaker U.S. dollar into their thinking, Sharps says. Huge U.S. fiscal and trade deficits, plus continued stimulus by the Fed, create room for a gradual dollar decline, he says. This could add to inflation pressures by pushing prices of dollar‑denominated commodities higher.

But the implications are not entirely negative. Risky assets historically performed well during periods of U.S. dollar decline, Sharps says. A weaker dollar also potentially could boost returns for U.S. companies with large overseas earnings and strengthen the creditworthiness of EM firms that borrow in dollars.

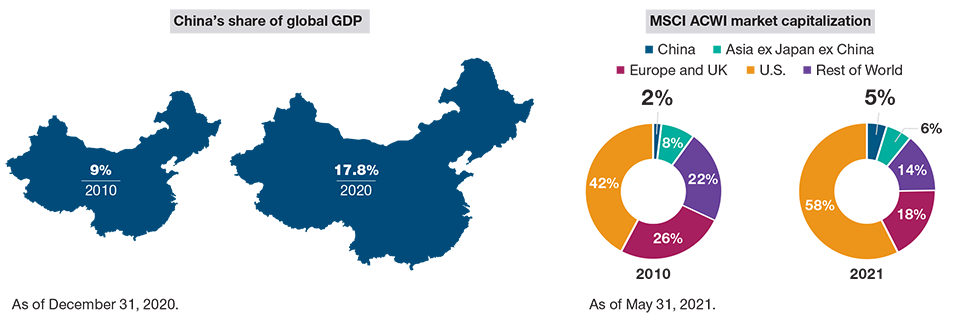

China: Too Big to Ignore

China’s economic and financial evolution appears poised to accelerate in the wake of the pandemic. The implications are sizable both for the global economy and for the geopolitical balance of power. Yet, many investors may be underexposed to one of the world’s powerhouses of growth potential.

While the change of administrations in Washington has eased some tensions, the U.S.‑China relationship is likely to remain contentious, Sharps predicts. This doesn’t rule out cooperation on specific issues like climate change, he says. But the Biden administration’s decision to keep some of the tariffs imposed by his predecessor demonstrates that the relationship has permanently changed.

“China’s economic influence is undeniable, but I think it’s turned out differently from what most Western policymakers expected when China was admitted to the World Trade Organization,” Sharps argues. “It hasn’t necessarily resulted in China becoming a more open society.”

Despite these frictions, China continues to free some sectors—such as financial services—for increased foreign participation, Sharps notes. But potential investors need to recognize that China is determined to control the terms of their involvement. “I think Beijing basically has decided to forge its own way and play by a different set of rules, which I think are still unfolding.”

At a time when short‑term rates in many developed countries hover near zero, China’s credit markets offer attractive current income potential, according to Vaselkiv. “With a 10‑year Chinese government bond yield sitting at around 3%, plus an appropriate credit spread above that, there clearly are opportunities for credit pickers,” he says. But active management, backed by locally based research, could be critical to success.

Although efforts by Chinese regulators to slow credit growth and several recent high‑profile defaults have raised concerns about financial stability— particularly in China’s real estate sector— Vaselkiv views stricter market discipline as a long‑term positive. “That’s how credit markets mature over time,” he says.

A BROADER VIEW OF CHINESE EQUITIES

Chinese equities also provide a rapidly growing opportunity set for global investors, but one that may be underestimated, according to Thomson. Despite the rapid rise in China’s share of global GDP, the country still carries a relatively small weight in Morgan Stanley Capital International’s All Country World Index (MSCI ACWI) (Figure 4). Thomson cites several reasons why he believes limiting exposure to benchmark levels could be a mistake:

- Better corporate governance and capital allocation policies. “They still have some way to go, but things are improving,” Thomson says.

- Market breadth. Over 5,200 public companies are now listed on Chinese exchanges—more than in the U.S.5

- Initial public offerings. From the end of 2018 through May 2021, almost 900 Chinese firms went public.6

China Is Underrepresented in Global Equity Benchmarks

(Fig. 4) Change in China’s share of global GDP vs. change in MSCI ACWI market capitalization*

*MSCI ACWI shares may not total to 100% due to rounding.

Sources: International Monetary Fund, MSCI, and FactSet (see Additional Disclosures).

Yet, international investors still tend to focus on a handful of well‑known stocks in China’s e‑commerce and technology industries, Thomson says. He thinks more attractive potential opportunities may be available in areas such as biotech, health care, and financial technology. “China is innovating in these areas, and overall spending on research and development has accelerated,” he adds.

Conclusions

While the global economic recovery was faster and stronger in the first half of 2021 than markets seemed to expect at the start of the year, T. Rowe Price investment leaders say there also are potential risks to growth that they will be monitoring in the months ahead. These include:

- The coronavirus. While vaccine campaigns have gathered speed in some developed countries, progress remains slower elsewhere. Meanwhile, new variants remain a potential threat.

- U.S. fiscal policy. Although the Biden administration is seeking to raise the U.S. corporate tax rate, Sharps says he expects only a modest increase, which he views as neutral for U.S. equity markets. However, proposed increases in capital gains and dividend taxes, if enacted, would be negative for after‑tax returns on most asset classes.

- Valuations. Price/earnings multiples in some sectors and stocks imply demanding profit growth expectations, Sharps reiterates. Even relatively strong second‑half results might fail to meet those expectations, generating market volatility.

- Political instability. Latin America, Eastern Europe, and the Middle East all contain potential flash points that could disrupt the global recovery, Vaselkiv cautions.

That said, a transformed global economic landscape is generating potential opportunities as well as risks, the CIOs observe. Post‑pandemic trends have the potential to create both winners and losers, giving active portfolio managers greater scope to seek excess returns.

Strong fundamental research skills, backed by adequate global resources, are vital assets in that search, Vaselkiv argues. “To me, that means having analysts around the world who can meet with management and communicate on strategy and capital structure.”

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.