11 June 2021 / FIXED INCOME

LIBOR Is Changing: Five Important Updates

T. Rowe Price’s LIBOR transition program shares its findings.

Key Insights

- Financial authorities continue to plan to replace the London Interbank Offered Rate (LIBOR) after the end of 2021 (non‑USD) and the middle of 2023 (USD) with new alternative reference rates (ARRs).

- Investors should be aware of key differences between LIBOR and the new ARRs that authorities will implement to alleviate potential disruption.

- T. Rowe Price’s LIBOR transition program has completed exposure analysis and firmwide transition plans.

The UK’s Financial Conduct Authority (FCA) confirmed in March the dates that the London Interbank Offered Rate (LIBOR) will be phased out. LIBOR will cease to be published on December 31, 2021, for sterling, euro, Swiss franc, and Japanese yen, and the one‑week and two‑month U.S. dollar settings. In the case of the remaining U.S. dollar settings, LIBOR will cease to be published after June 30, 2023.

The FCA first announced its intention to end LIBOR in July 2017. Since then, T. Rowe Price has monitored the situation closely as we formulated our strategy for managing the transition. In November 2019, we explained in an article that the decline in interbank borrowing and reduced trust in the veracity of the panel bank submissions created the need for a new benchmark rate for a wide array of financial products. Then in June last year, we highlighted five important changes that the cessation of LIBOR would bring about. Below, we provide an update on those changes.

1. What is going to replace LIBOR?

Plans remain to replace LIBOR with overnight and risk‑free benchmark rates, known as alternative reference rates. As the UK’s Financial Conduct Authority will not require banks to submit their interbank lending rates for some currencies after the end of 2021 and for U.S. dollars after June 2023, we expect authorities and market participants to implement different alternative reference rates (ARRs) as the key reference rates for securities priced in the five major currencies currently covered by LIBOR.

In the U.S., the planned ARR for dollar‑denominated assets is the Secured Overnight Financing Rate (SOFR), which is based on overnight loans in the U.S. Treasury repurchase (repo) market. The Alternative Reference Rate Committee (ARRC), a group of market participants convened by the Federal Reserve System and the Federal Reserve Bank of New York, has been leading the plans for the switch to SOFR.

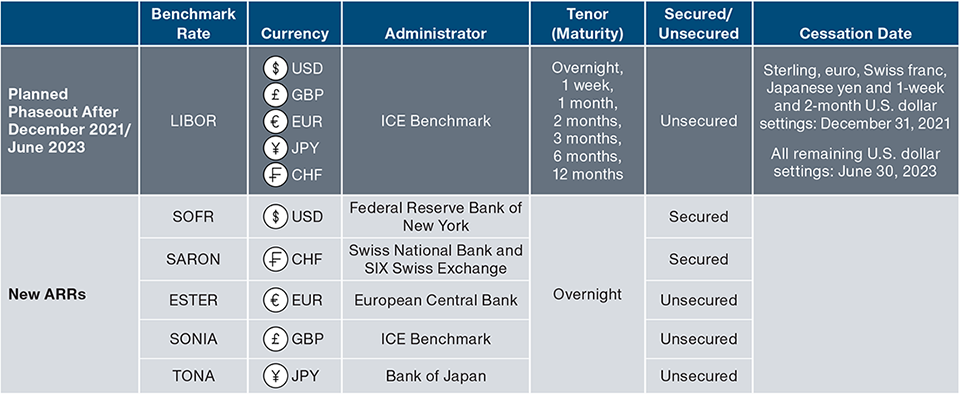

New Benchmark Rates Will Replace LIBOR

(Fig. 1) Key features and differences of the ARRs and LIBOR

As of May 1, 2021.

In the UK, authorities have identified the Sterling Overnight Indexed Average (SONIA) benchmark as the LIBOR replacement while the Euro Short‑Term Rate (ESTER) is the planned replacement for the eurozone. Elsewhere, the Swiss Average Rate Overnight (SARON) rate will be used for Swiss francs and the Tokyo Overnight Average Rate (TONA) for the Japanese yen.

The priority is to ensure that the ARRs comply with International Organization of Securities Commissions (IOSCO) standards. This means the new rates must be based on real‑world, verifiable transactions rather than more subjective quotes that could potentially be manipulated.

2. What are the key differences between the new ARRs and LIBOR?

LIBOR is set based on the average rate at which major global banks lend money to one another on a daily basis and for periods of various duration. We believe the most important differences between the new ARRs and LIBOR are the following:

- Tenor: LIBOR is available in seven different maturities, creating a curve for markets to use as a benchmark out to 12 months. By contrast, the new ARRs are overnight rates based on real‑world, verifiable transactions. Some ARRs, like SOFR, are secured, which means they are borrowings secured by government securities.

To address this difference, authorities are considering constructing forward‑looking term rates based on the ARRs. One reason for this need is because the term SOFR is the preferred recommended replacement rate (by the ARRC) for some of the most widely held cash instruments, such as floating rate bonds. A liquid curve based on real‑world transactions is an important tool to help prevent volatility during the transition. At the time of this writing, no viable or widely accepted ARR term rates exist, which remains one of the crucial gaps in the transition process. However, we have seen some institutions begin to publish term rates based on derivatives transactions, which is an encouraging sign. - No Credit Premium: SOFR, the proposed rate for the U.S. dollar market, is a secured rate backed by underlying government assets. Conversely, LIBOR is based on the cost of unsecured funding in the London interbank market, which means it incorporates the underlying credit risk of the financial institution involved in the trade. Without this additional credit premium, the new ARRs are generally lower than LIBOR.

Leading industry groups, in conjunction with the ARRC and other official bodies, have created a credit premium to help ease the conversion of existing LIBOR exposures to the ARRs to avoid market disruption and pricing discrepancies. In the case of SOFR for the U.S. dollar market (and applying to both cash instruments and derivatives), the International Swaps and Derivatives Association (ISDA) and the ARRC proposed that the spread be equivalent to the historical five‑year median difference between LIBOR and the SOFR fallback and calculated as of the cessation of LIBOR announcement date. Since the cessation announcement was made on March 5, 2021, the spread is now known and will be applied to all derivatives subject to the ISDA definitions. It will also be applied to all cash instruments that incorporate the ARRC‑recommended fallback language.

SARON, the proposed ARR for the Swiss franc market, faces a similar situation in that it is secured against underlying government securities. The ARRs planned for the sterling, euro, and yen markets are unsecured rates. However, since they are overnight rates, there is very little credit premium incorporated into the rates as credit risk increases with longer maturities.

3. How will the transition impact different asset classes?

Roughly USD 223 trillion1 worth of assets are based on interbank offered rates. Securities that are priced against the LIBOR benchmark rate will be directly impacted.

Much attention over the past year has been devoted to “tough legacy” instruments—securities whose governing documents do not establish clear fallbacks in the event of a permanent cessation of LIBOR and are also difficult to amend to incorporate fallbacks. In March, the New York State legislature passed a law to introduce the ARRC‑recommended fallbacks into tough legacy contracts that are governed by New York law. Similar efforts are underway at the federal level.

These solutions will go a long way toward making the transition less disruptive. The prolonged cessation date for most popular U.S. dollar tenors will also help in this regard as it will give markets more time to develop liquidity in ARRs and allow a portion of existing LIBOR debt to mature before 2023. An additional push will come from the regulators, such as the Federal Reserve and the FCA, which have said they will strongly discourage any new LIBOR issuance after the end of 2021.

Specific asset classes will require different steps to help ensure securities do not become untradeable or experience high degrees of pricing volatility:

- Leveraged Loans: In many areas of the loan market, recent loan documentation incorporates language developed by the Loan Syndications and Trading Association (LSTA) and other trade groups. Many leveraged loans also typically include built‑in alternative rates, which may apply if LIBOR cannot be determined. Even if these rates are often not appropriate as permanent LIBOR replacements, they do provide certainty to the parties that the loan will have a contractually provided fallback rate to LIBOR. The parties are always free to amend underlying documentation to provide for different fallbacks, if they so choose.

Consequently, the ARRC has published recommended fallback language for syndicated loans incorporating the new ARRs. New loans should incorporate the new language. Most of the typical syndicated loans in the U.S. are governed by New York law but would be out of scope of the newly passed legislation as they already contain fallbacks that are not based on LIBOR. - Floating Rate Notes and Asset‑Backed Securities: Existing floating rate notes (FRNs) and asset‑backed securities form a challenge as they often require the consent of the majority of holders to change the interest rates. In addition, the power to initiate such amendments typically lies squarely with the issuers and not the bondholders. The process of addressing the differences between LIBOR and the new ARRs should help smooth the transition for existing securities referencing LIBOR.

Newly issued securities will need to include recommended fallback language for the transition to the new ARRs. Current recommendations for U.S. dollar market are that new FRN issues priced after the end of 2021 should reference the new ARRs directly. Other markets will also be expected to begin pricing new issues directly off the new ARRs rather than LIBOR. - Derivatives: LIBOR is used in the pricing of, and as a reference rate in, a wide range of derivatives contracts. Liquid derivatives markets for hedging exposures to the new ARRs are being developed, most notably in the futures markets. In addition, the ISDA has amended the applicable definitions for interest rate derivatives currently referencing LIBOR and other interbank rates to provide for a fallback to the ARRs upon the permanent discontinuance of LIBOR. The ISDA has also opened a market‑wide protocol, which allows market participants to amend derivatives contracts that predate the new ISDA definitions. We expect wide adherence by market participants, with regulators applying the pressure toward that end.

4. What challenges still need to be addressed?

Central banks, regulatory bodies, and other financial institutions globally continue to work to encourage the adoption of the new ARRs ahead of time to ensure market participants understand the new system and trust it as a reliable benchmark.

The markets based on the ARRs are also less mature than LIBOR, which has been in use for well over 30 years. For the U.S. dollar market, the ARRC continues to work toward building market liquidity for SOFR. Other industry‑led working groups are focused on the ARRs to replace LIBOR rates in other currencies. However, the lack of an international central authority could make coordination difficult.

In our view, the key challenges that remain are development of liquid derivatives markets in ARRs and the creation of viable term rates. The sheer operational complexity of transferring trillions of securities onto new rate calculations should also not be underestimated.

Although we believe that most key concerns regarding the transition can be addressed ahead of time, differing views regarding the new rates will have to be incorporated into pricing and trading of securities referencing the ARRs. Investors need to understand that, to some degree, market forces will impact the transition.

We believe it is essential that investors understand their exposure and the risks in their investments. This is equally true both before and after the transition dates of December 2021 and June 2023 because market functionality with the ARRs may not be the same as under LIBOR. All changes and plans need to be clearly and widely communicated to all market participants.

Even if everything goes smoothly, some value transfer is possible even with the credit spread. This risk is amplified by the fact that the credit spread is fixed in March 2021 while most instruments will transition more than two years later. Further, LIBOR typically moves opposite of SOFR in distressed markets (meaning LIBOR goes up, while SOFR goes down). In such instances, that would hurt creditors/noteholders and benefit borrowers.

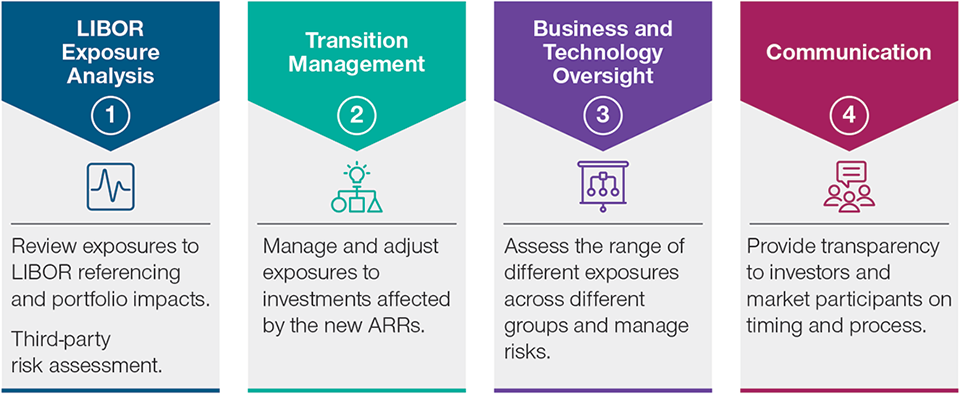

What T. Rowe Price Is Doing to Prepare for the Transition

(Fig. 2) Our four key areas of focus

5. What is T. Rowe Price doing to prepare for the transition?

Our primary aim is to keep any disruption to our clients’ investments to a minimum. T. Rowe Price’s LIBOR transition program, which consists of senior members from across the firm’s business units, is focused on the following:

- LIBOR Exposure Analysis: Work has been completed to determine the extent of exposures to investments referencing LIBOR or other interbank offered rates across all T. Rowe Price‑managed portfolios. The group is now working in conjunction with portfolio managers to assess how the transition from LIBOR to ARRs could impact clients’ investments in different portfolios.

We have reviewed all legal agreements on investments in LIBOR‑referencing securities. This information is helping us gauge how a change in the underlying interest rate will impact markets down to the level of individual holdings.

In addition to our in‑house analysis, we contracted outside legal counsel to provide a third‑party assessment of T. Rowe Price’s exposure and potential risks for certain securities. - Transition Management: As more details about the new ARRs and the transition process emerge, the group continues to implement its plan for navigating the shift. This includes managing and adjusting exposures to investments affected by the new ARRs. On the derivatives side, T. Rowe Price has adhered to the ISDA LIBOR protocol on behalf of its client funds and accounts. As a result, any current derivatives exposures that are outstanding at either of the transition dates should benefit from clear fallback provisions.

The LIBOR transition program has shared its findings with portfolio managers and analysts to help them prepare and make decisions for the client portfolios and multi‑asset products they manage.

We are also aware of LIBOR risks embedded in any new deals and have incorporated these transition risks into our investment selection process. Overall, we will prioritize pursuing the best outcome for our clients during the transition while also seeking to protect their long‑term investments from potential disruption under the new ARRs. - Firmwide Business and Technology Impact: We have assessed the range of different exposures the firm faces across different groups and departments globally, including product benchmarks, quantitative research, trading, client operations, technology, accounting, and reporting, and we are currently working to mitigate these risks.

Our aim is to ensure our systems are fully prepared for the upcoming transition and are then able to value, manage, and report products based on the new ARRs with minimal disruption. - Communication: Communication and engagement with internal and external partners are key. Our LIBOR transition program is directing external communications with investors as well as other market participants to ensure transparency about the process and the timing of the transition. The group is in frequent contact with regulators to stay informed about the formulation of the ARRs and other changes in the industry precipitated by LIBOR cessation.

T. Rowe Price has dedicated resources and an action plan in place to help ensure client portfolios are well positioned to adjust to the impending LIBOR replacement developments.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

14 June 2021 / FIXED INCOME