February 2023 / INVESTMENT INSIGHTS

The Case for a Dedicated China Allocation Within EM

In China, change is the only constant

Key Insights

- The weight of China in indices such as the MSCI is small relative to its economy and equity markets. Most China equity indices are concentrated in mega-cap stocks.

- Research by ourselves and Mercer suggests that China provides many alpha opportunities. Low correlations with other markets make it a good portfolio diversifier.

- We believe that an increased China allocation in EM equity portfolios can enhance investment outcomes, taking advantage of attractive diversification benefits.

For China, change is the only constant. The pace of economic development that the country has experienced over the past few decades is unprecedented. This economic transformation has been matched in the stock market, where the universe has grown exponentially and new, disruptive businesses continue to appear.

Yet, despite now having the second‑largest economy and the second‑largest stock market, we believe China is a market that is often overlooked, or dismissed, by international investors. Short‑term news flow may be overwhelming at times and may distract investors from the longer‑term view. Below, we have set out some arguments as to why having a dedicated China allocation in an emerging market (EM) equity portfolio should be considered.

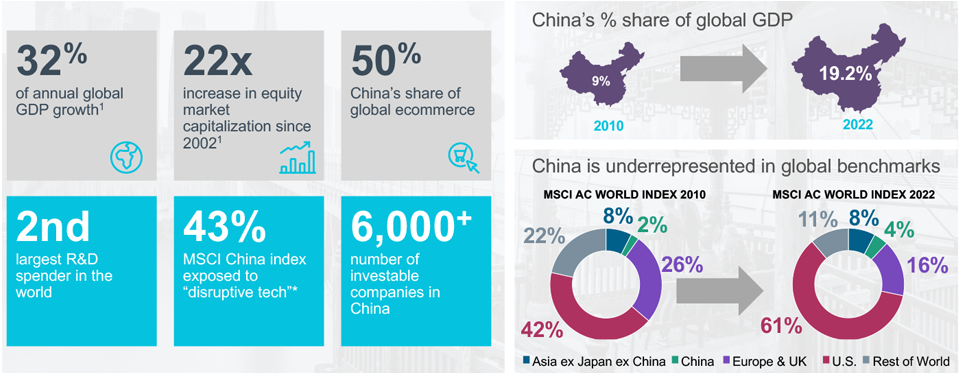

1. China Is Underrepresented in Global Indices

The weight of China in equity indices such as those provided by the MSCI is disproportionally small relative to the size of its economy and equity markets. Over the past decade, China has outgrown most major economies. As shown in Figure 1, China’s share in global gross domestic product (GDP) has increased from 9% in 2010 to 19% in 2022, overtaking Japan as the second‑largest economy in the world. While the global economic environment remains somewhat uncertain, we believe China will be a relative bright spot and continue to grow, albeit perhaps at lower rates than it historically has achieved. In contrast, China’s weight in the MSCI All Country World Index remained low, below Japan and the UK and just above Canada. Given the importance of China to the global economy and stock markets, a top‑up approach of China equity allocation is advocated to fairly reflect China’s current status.

China’s Economy Underrepresented in Global Equity Indices

(Fig. 1) The China investment opportunity

As of December 31, 2022.

*FactSet; T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. “Disruptive tech” is defined as the information technology sector, the internet, and direct marketing. Retail industry within the consumer discretionary sector, and the media and entertainment industry group within the communication services sector. Sources: Bloomberg Finance L.P., FactSet, Goldman Sachs Research and MSCI. Please see Additional Disclosures for information on this MSCI information.

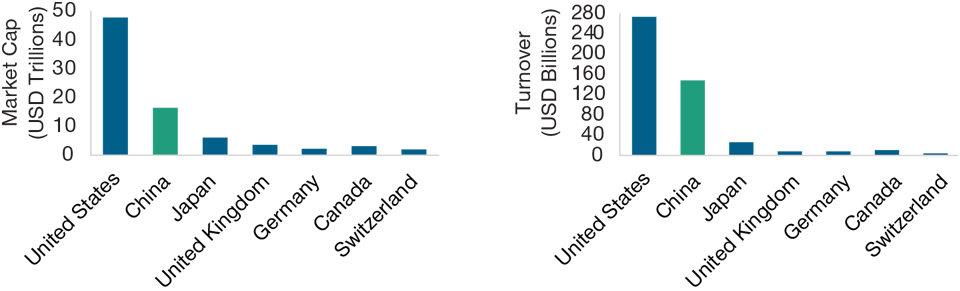

The total size of China’s equity markets is hard to ignore. As we can see in Figure 2, it has won the silver medal among all global equity markets in terms of both market capitalization and trading volume. The growth in the investable universe has been allied to market access reforms that make investing in the entire China universe much easier than ever before. China has now grown to a large liquid universe that is dynamic in terms of composition as new, innovative, disruptive businesses emerge.

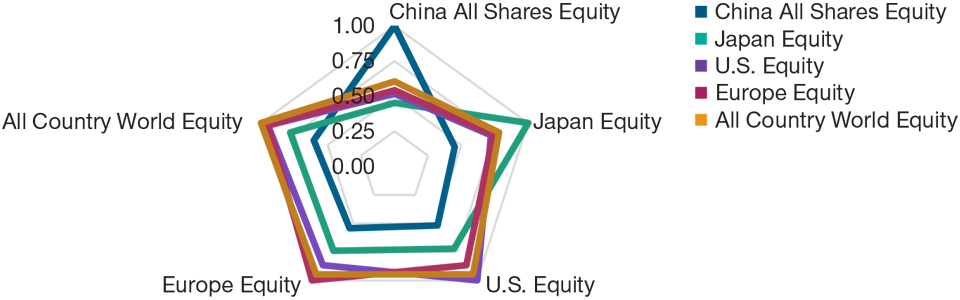

2. China Equity Is a Good Diversifier

While higher economic growth is often quoted as the primary reason for allocating to China equity markets, the direct link between GDP and stock market returns remains to be seen in China. We believe that the real attraction of Chinese equity stems from the enhancements it can make to an overall equity portfolio as a good diversifier.

China Market Too Big to Ignore

(Fig. 2) Major equity markets’ market cap and turnover

Sources: Goldman Sachs, Morgan Stanley Research. Data as of June 30, 2022.

Figure 3 shows the monthly return correlations between major equity markets. The center of the chart represents zero correlation, and correlation increases from the center to the outside. Chinese equity, which is represented by the dark-blue line, showed lower correlations to other major equity markets. This could at least partially be attributed to China’s closed market structure, corporate governance, and political backdrop. Besides, the dominating ownership of China equity markets by domestic market participants, who are relatively insulated from global factors, may also have a role to play. Lastly, the fact that China demonstrates its own business cycles adds to its diversification benefits.

China Has Been Less Correlated With Other Equity Markets

(Fig. 3) Monthly return correlations

As of September 30, 2022.

Source: T. Rowe Price calculations based on MSCI data (see Additional Disclosures). Monthly return correlations are from December 31, 2008, to September 30, 2022.

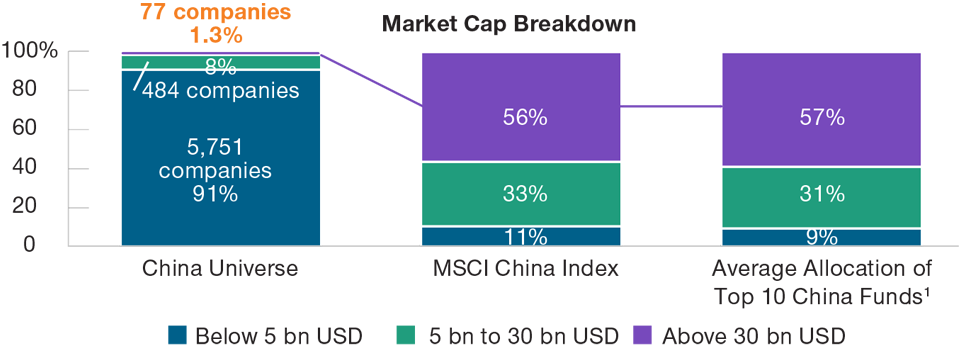

3. Most China Equity Indices Concentrated in Mega‑Cap Stocks

Looking under the hood, the market cap‑weighted MSCI China Index shows a high concentration on the largest companies. Out of the 6,000+ companies in the China equity universe, the weight of the largest 77 companies counts for more than half of the MSCI China Index (see Figure 4). However, in a market as dynamic as China, the exciting alpha opportunities lie in the companies that can become the winners of tomorrow, which tend to exist outside of the mega‑cap space and, thus, are often overlooked by many international investors. We believe this reality creates inefficiencies that active fundamental managers can exploit and makes the case for a top‑up allocation to China equity focusing on the underrepresented stocks. Selective investments in small- and mid‑cap companies can broaden the exposure to various drivers of the Chinese economy.

4. China Provides an Abundance of Alpha Opportunities

Chinese companies are typically underresearched relative to international peers. This is especially true when you look outside of the well‑owned mega‑cap stocks as well as the A‑share market, which has a largely domestic, retail‑driven investor base. Moreover, China’s stock market, especially the A‑share market, is driven by high retail participation. These two conditions create inefficiencies that skilled managers can potentially harvest.

5. Complementing Your Existing China Exposure

T. Rowe Price China Evolution Equity strategy takes a holistic approach to investing in China and looks for the best risk/reward proposition across the full spectrum of Greater China markets. The strategy excludes the top 100 companies by market capitalization in the China universe and provides exposure to the more dynamic and inefficient part of the market by investing in stocks that are typically overlooked by other investors. Based on data at the end of June 30, 2022, we estimated that the overlap between our T. Rowe Price China Evolution strategy and the MSCI EM Index was only 2.6%, while the overlap between MSCI China All Shares Index and the MSCI EM Index was 35.8%.2 This reinforces the potential benefits of a differentiated active China strategy to be used in the top‑up framework as opposed to an index‑based approach.

Popular China Indices Favor the Largest Companies

(Fig. 4) China Universe vs. the MSCI China Index and the Top 10 Funds

As of June 30, 2022.

1 The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by assets under management. Numbers may not total due to rounding. Cash is excluded from the analysis. The market cap breakdown of China Universe is based on stock count, while the market cap breakdown of the MSCI China Index and the average allocation of the top 10 China funds is based on dollar value of assets held. Sources: MSCI, HKex, FactSet, Wind, and Morningstar (see Additional Disclosures). Financial data and analytics provider, FactSet. Copyright 2023 FactSet. All Rights Reserved.

Summary and Conclusions

China as the world’s second‑largest stock market by market cap is significantly underrepresented in broad market indices. Investment consultant Mercer’s frequently viewed research “Positioning your portfolio for the future of emerging markets” even took a step further to zoom in on China onshore markets. Research by ourselves and Mercer came to the same conclusion: that an increased China allocation in an EM equity portfolio may enhance investment outcomes by taking advantage of China’s dominant economic position, attractive diversification benefits, and abundant alpha opportunities.

2Based on the representative portfolio. The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy. The GIPS® Composite Report is available upon request.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS

February 2023 / ASSET ALLOCATION VIEWPOINT