November 2021 / INVESTMENT INSIGHTS

Supply Bottlenecks May Be Peaking

Data suggest that supply chain issues may have stopped getting worse

Key Insights

- While consumer demand has rebounded sharply amid widespread coronavirus vaccinations, restoration of global supply chains has been more sluggish.

- Supply chain disruptions have caused shortages and driven up prices; however, key data suggest that supply bottlenecks may be peaking.

The coronavirus pandemic caused a sudden and unprecedented stop and restart of the global economy. Although consumer demand has since rebounded rapidly as vaccination campaigns have progressed, a corresponding restart of global supply chains has lagged, causing shortages and driving up prices globally.

Recently, the term “stagflation”—an economic environment featuring soaring inflation, high unemployment, and slow growth—has begun to creep into the economic discourse. A major area of concern is the shipping industry, where extensive labor shortages at ports are leaving many container ships waiting offshore for weeks to offload their cargo, driving up shipping costs.

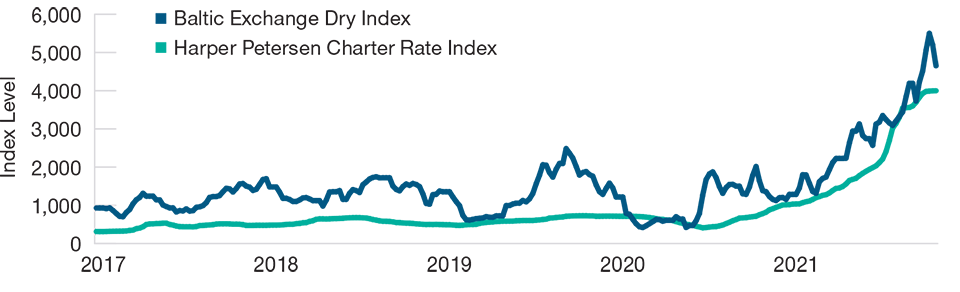

A review of the Baltic Exchange Dry Index, which shows average prices for transporting dry bulk materials across more than 20 routes, and the Harper Petersen Charter Rate Index (HARPEX), which shows price developments in the global charter market for container ships, (Figure 1), illustrates the considerable rise in costs since early 2020. However, recent pricing trends—particularly in the HARPEX—indicate that issues may have at least stopped getting worse.

Global Traffic Jam on the Seas May Be Abating

(Fig. 1) Shipping costs appear to have peaked

January 3, 2017, through October 15, 2021

Sources: The Baltic Exchange and Harper Petersen/Haver Analytics.

Supplier delivery times are another barometer for possible supply chain problems. In the U.S., these key data are tracked in monthly manufacturing surveys conducted in several U.S. Federal Reserve districts. An average of five of these surveys shows that delivery times began to deteriorate during the second half of 2020 and reached elevated levels during the summer of 2021 (Figure 2). However, the average leveled off in May and recently turned downward.

Consumer Wait Times Could Ease

(Fig. 2) Supply delivery times may have stopped getting worse

January 1, 2015, through September 30, 2021

Past performance is not a reliable indicator of future performance.

1 Manufacturing surveys conducted in Chicago, Dallas, Kansas City, New York, and Philadelphia.

Sources: Federal Reserve Banks of Dallas, Kansas City, New York, and Philadelphia, MNI Market News/Haver Analytics. Data analysis by T. Rowe Price.

Overall, we are experiencing the impact of the mismatch in timing between the rebound in demand versus a ramp-up in supply. In our view, the worst appears to be behind us. While markets may face a challenging combination of high inflation and moderating economic growth in the near term, we believe that the longer-term economic outlook remains favorable.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.