November 2021 / INVESTMENT INSIGHTS

Are You Positioned on the Right Side of Change in China?

China has been one of the fastest recovering economies since the onset of the global coronavirus pandemic

China has been one of the fastest recovering economies since the onset of the global coronavirus pandemic. It was one of the few countries in the world (and certainly the most sizeable) to generate positive GDP growth in 2020. In China: Too big to ignore? we highlighted what we believe is the compelling investment opportunity that China offers, a market characterised by innovation and disruption. So, where can investors find the companies that are driving and harnessing the grass roots growth in China that can deliver durable shareholder returns?

As we have advocated previously, it’s important for investors to look beyond the largest mega caps where the majority of investor flows are directed. We believe the large universe of over 5,300 stocks offers a huge opportunity for active managers to invest in under-researched and under-owned companies in China today.

Change equals opportunity

China is a fast-evolving market, with a high volume of IPOs (initial public offerings) in contrast to developed world markets. The share prices of well-managed, higher quality or innovative companies in China are increasingly driven by idiosyncratic factors rather than broader macro shifts or commodity cycles. And importantly for investors, growth is increasingly being sourced domestically through innovative industries such as technology, healthcare and other consumer-led sectors.

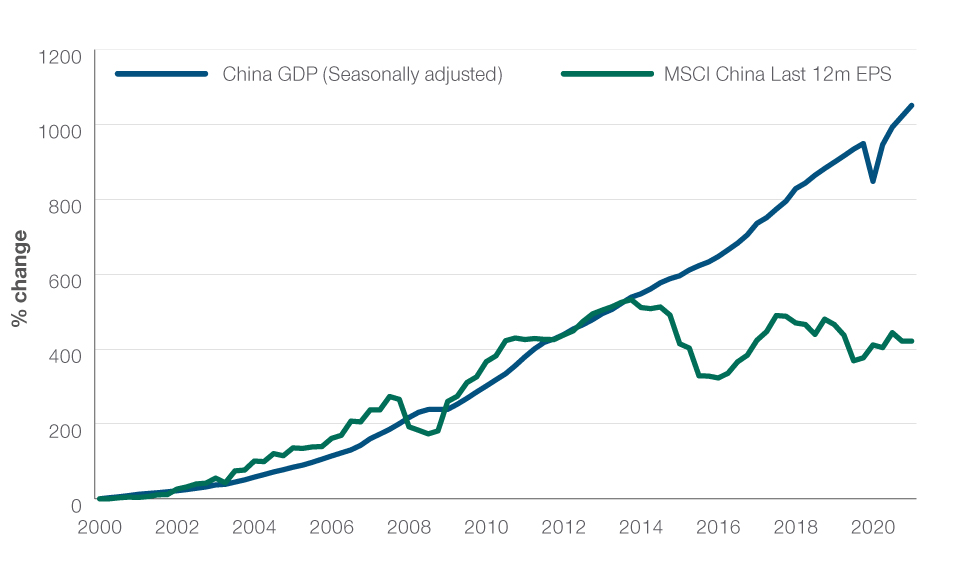

Fig. 1: China’s economy and market have decoupled

China GDP and MSCI China EPS change (%) as at 30 June 2021

Sources: Haver Analytics, Bloomberg Finance LP

One unique dynamic about China is the constant change, both in terms of scope and pace. The process of industrialisation and modernisation was a 200 to 300-year process in most western countries. In China, this was condensed into several decades. The result is rapid change in economic structure and investment opportunities.

While the status quo is generally well understood, and efficiently valued, mispricing and opportunities for alpha generation arise in areas where future fundamentals will be different to the past. The change in sector weightings in the MSCI China Index illustrates this well. Two decades ago, telecoms was the largest sector with a weighting around 60% of the index. Ten years ago, financials dominated with a 40%-50% weighting. Today, internet plays the major role with over 40% of the index. In a few years’ time, it is possible the index could see other meaningful changes.

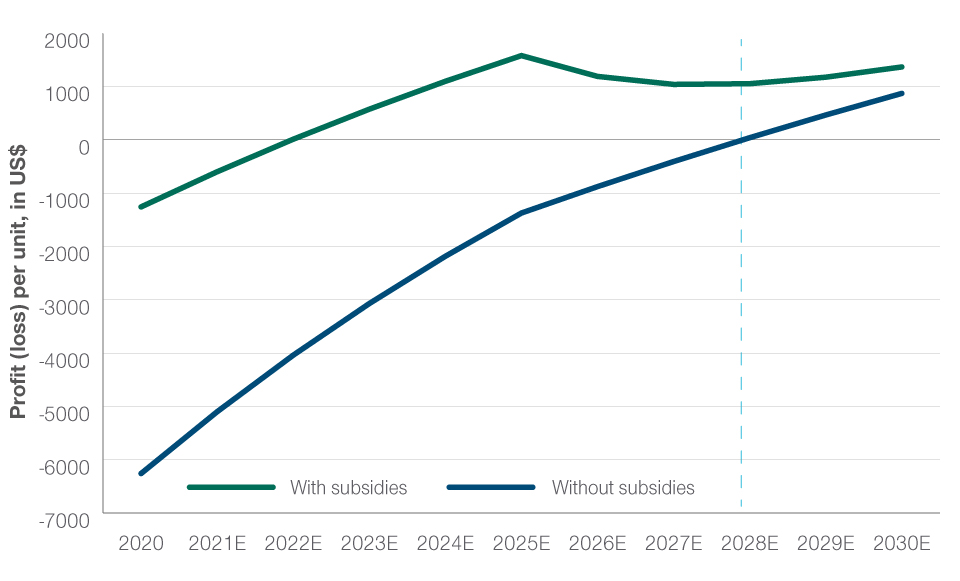

According to Goldman Sachs, the market cap of EV (electric vehicle) stocks in China expanded by more than 320% between May 2018 and May 2021. Yet, it is estimated that these firms will not be generating an operating profit without being subsidised until 2028 at least (see Fig. 2), owing to the massive cost differential between manufacturing EVs and internal combustion engines.

Fig. 2: Electric vehicle profit (loss) per unit

As at 31 December 2020, data in US$

Source: Goldman Sachs Global Investment Research. Latest data available.

Whilst the path to profitability of OEMs (original equipment manufacturers) lacks visibility, the EV supply chain, where China arguably benefits from being the most comprehensive and competitive in the world, offers a fertile hunting ground for bottom-up stock pickers. This might be an auto glass manufacturer that can benefit from the higher glass content in EVs, for example, or a gear box manufacturer that can meet the higer technological content of EVs. Such companies that are on the right side of the “product cycle” can experience very rapid growth in a short period of time until competition eventually catches up. Understanding the idiosyncratic drivers of product and industry cycles is key in these circumstances.

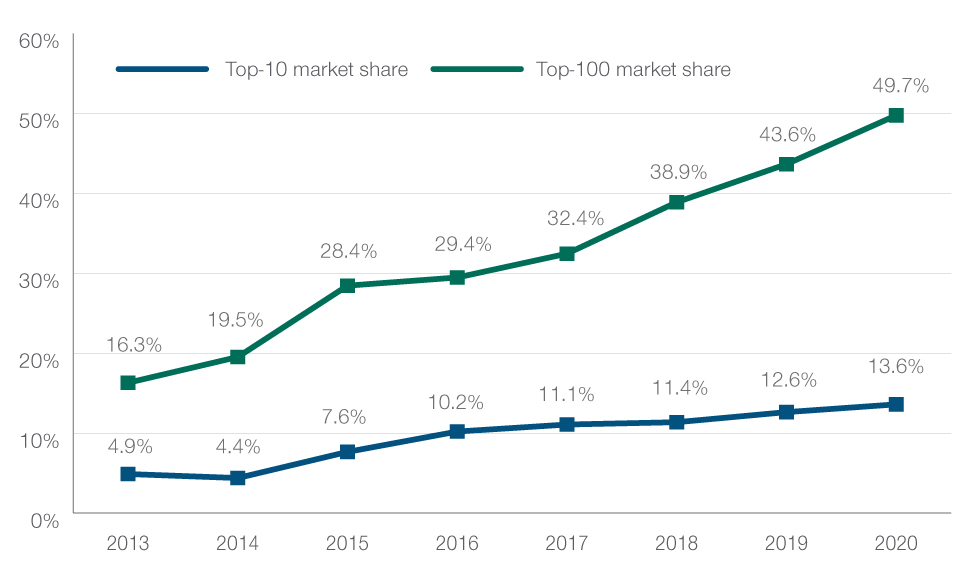

Fragmented markets provide room for leading companies to grow

Unlike many western markets, where there are typically a handful of dominant players in any particular industry, the Chinese market is still hugely fragmented which allows the most efficient and well-managed companies to structurally grow their businesses and take market share. As is typical in emerging markets, China is littered with nascent industries and nascent companies with a long runway for growth, whose potential is not recognised by the short-term nature of most market participants.

Take the property management sector, for example, where the top 10 companies account for just under 14% of total market share! It’s a similar story across many varied industries such as hotels, drug stores, restaurants and so on. However, these areas can offer an abundant source of mispriced but good quality companies with a clear visibility of growth at an early stage, with the potential for sizeable market share gains and industry consolidation.

Fig 3: China’s market is still highly fragmented

Property management sector

Source: Goldman Sachs Global Investment Research.

Change is the only constant

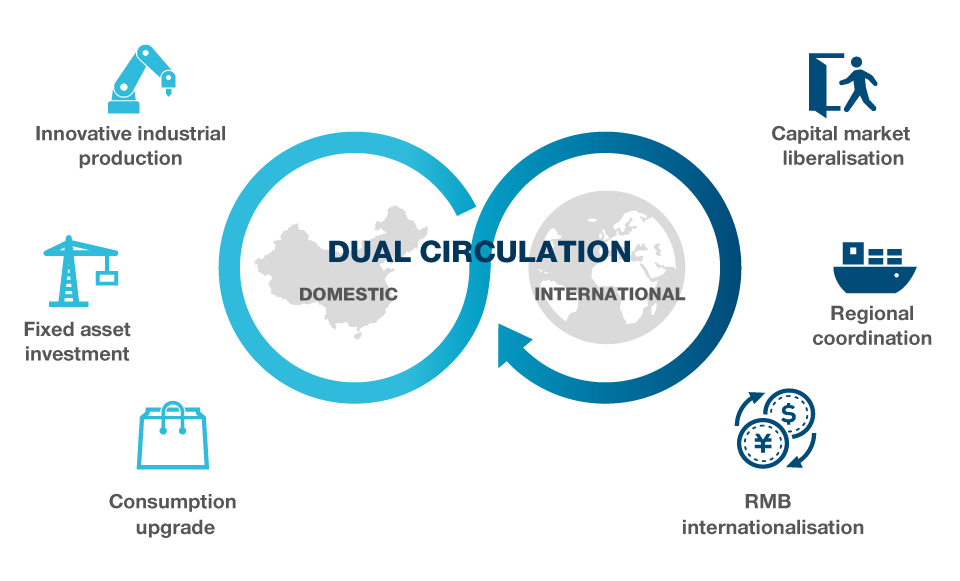

Since the founding of The Republic of China, its growth model has undergone several phases. The first phase, between 1949-1978, focused on “internal circulation”. Since the economic reforms in late 1970s, growth was more levered on “external circulation”. We are now entering the third phase called “dual circulation”.

Fig 4: China’s dual circulation policy

Sources: Goldman Sachs, People’s Bank of China, Organization for Economic Cooperation & Development

Under dual circulation, the domestic market is expected to play a larger role to drive economic growth, industrial upgrade, and address potential vulnerabilities in supply chains. China continues to invest in more R&D to support home-grown companies, providing opportunities to invest in more innovative businesses. At the same time, it continues to emphasise the importance of “opening up” and internationalising its capital markets in an orderly fashion to promote growth. All of this translates into a dynamic and fast evolving market that requires investors to constantly look for emerging trends and changes, rather than rest on current mega cap incumbents. Experience tells us that investing through the rear-view mirror is generally not a winning strategy, particularly when it comes to investing in China.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

November 2021 / INVESTMENT INSIGHTS