August 2021 / INVESTMENT INSIGHTS

ETFs in EM Local Currency Debt: Do they work?

A brief look at the performance of exchange traded funds in EM local currency sovereign bond space

In recent years we’ve seen a surge of interest in exchange traded funds (ETFs) as a cost efficient and effective way to try and replicate market index performance. But are ETFs as effective as investors think? As part of our regular competitor analysis, we took a look at how leading ETFs in our asset class—emerging markets local currency sovereign bonds—had performed over the Covid crisis, and over the longer term.

Replicating index performance in highly efficient markets, (e.g. US equities), is less challenging than it is in more complex asset classes. For example, emerging market ETFs may not be able to invest in all the securities that their benchmark does and some securities are subject to local market taxes that are not reflected in benchmark performance. ETF providers may need to rely more on derivatives to synthesise index performance. Derivative contracts cost money, and they don’t always perfectly track the underlying index components, especially at times of market volatility when trading conditions become difficult.

We looked at the five largest EM local ETFs available to European investors. Since inception, their tracking errors versus their respective benchmarks ranged from 1.5% to 3% a year (0% would be a perfect replication). We also found that, without exception, all five ETFs’ price performance lagged the benchmark return.

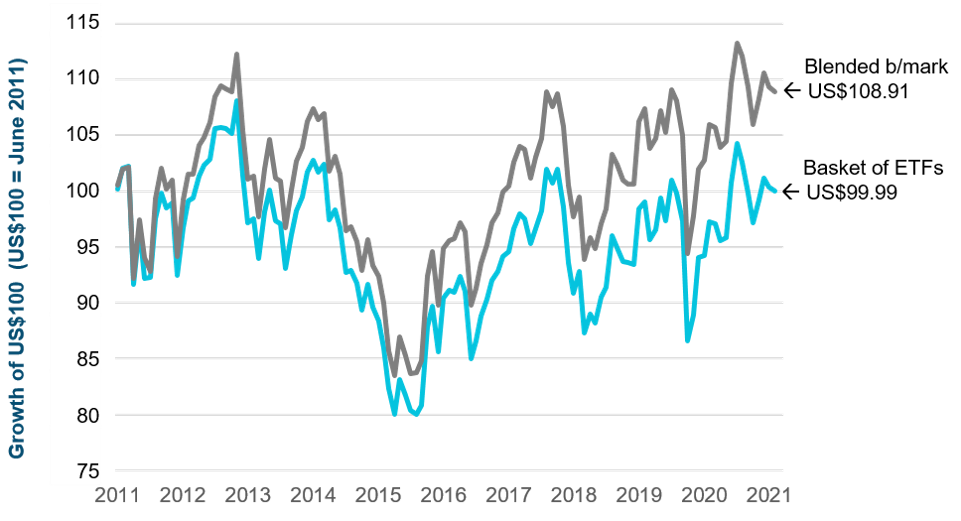

In the chart below, we blended the five ETFs into a single composite, equally weighted at 20%. The ETFs don’t all track the same index, so we also created a composite benchmark. The chart shows cumulative performance over the past decade and illustrates that, while the blended benchmark stood 8.9% higher by the end of July 2021, US$100 invested in the composite of ETFs in 2011 would have shrunk to US$99.99 – underperforming by roughly 9% over the decade.This is not to argue that ETFs in EM local currency space are always a bad idea. For example, investors can achieve better results by buying when the ETF is trading at a significant discount to net asset value (NAV). Nevertheless, this requires careful timing, and can be difficult to do in volatile markets. Investors often cite inconsistent performance by active managers as a reason to choose ETFs, but active funds offer the potential to beat the benchmark. There is a risk that an ETF, by locking in inefficiencies and costs, may consistently fail to deliver over time.

Cumulative returns of a basket of ETFs versus benchmark

From June 2011 to July 2021

Past performance is not a reliable indicator of future performance

Source: T. Rowe Price, Bloomberg Finance L.P.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

August 2021 / INVESTMENT INSIGHTS