May 2023 / INVESTMENT INSIGHTS

Foundations of Emerging Markets Bond Investing

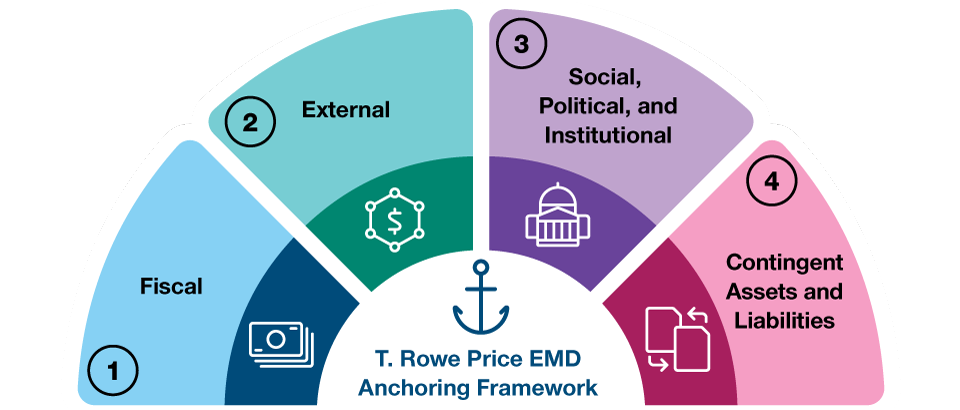

Four-part anchoring framework fundamental to debt sustainability

Key Insights

- We undertake a country‑specific debt sustainability analysis looking at four interrelated components that are potential anchors to maintaining market confidence and access to capital markets throughout an economic cycle.

- Sustainable economic development and sustainability in an environmental, social, and governance context are intrinsically linked together in emerging markets and should be looked at in tandem, in our view.

- There are some emerging market countries that are going through distress at present, and while this may take time to work through, we are optimistic that it may lead to reforms and better policies in the future.

The multi‑trillion‑dollar emerging market (EM) bond market covers a multitude of countries with distinct and changing geopolitical and economic profiles. To traverse this vast and diverse market as an investor, we believe that the starting point should be assessing a country’s debt sustainability profile. That’s because while debt is a necessary component for financing economic development, when it becomes unsustainable, it can be an accelerator for distress and a macroeconomic crisis. This underscores why it is so important to undertake a country‑specific debt sustainability analysis—it’s the foundation from which we build upon when investing in emerging market debt (EMD).

Four‑Part EMD Anchoring Framework

The bond market is a tool for intermediating between a country’s present and its future. Key to a country’s ability to sustain its debt profile is maintaining access to the bond market. After all, very few countries generate enough tax revenue to be able to pay back their debt without needing to return to the capital markets for refinancing.

To evaluate this, we take a step back and reimagine a developing country as an interconnected system with four component parts, which are outlined below.

1. Fiscal

Assessing growth of the country’s economy relative to its interest payments.

2. External

Evaluating how a country interacts with the world through its balance of payments and how that ties into reserve management and monetary policy.

EMD Anchoring Framework

(Fig. 1) Four components critical to maintaining bond market access

For illustrative purposes only.

Source: T. Rowe Price

3. Social, Political, and Institutional

Analyzing the political climate and the credibility of the country’s key institutions that help govern policy.

4. Contingent Assets and Liabilities

Examining the assets of a country, such as sovereign wealth funds, in contrast to its liabilities, such as environmental costs relating to climate change.

As part of our country‑specific debt sustainability analysis, we believe that it’s necessary to evaluate all four of these components, as each one represents a potential anchor for maintaining market confidence and access to capital markets. When a country loses these anchors, it may lead to a loss of market access, and therein rises the probability of debt distress and/or macroeconomic crisis. By contrast, when there is improvement in these factors, this is likely to be a positive sign of potential sustainable growth in a developing economy. So, from both perspectives (positive and negative) our anchoring framework can help provide us with important investment signals. For example, in the final quarter of 2021, our fundamental analysis recognized a deterioration in anchor 3 (social, political, and institutional) in Russia. This prompted us to significantly reduce our Russian exposure across our EMD portfolios ahead of the February 2022 invasion of Ukraine, which resulted in deep and wide‑ranging economic sanctions.

The anchoring framework is our starting point for investing in emerging market bonds. It’s done on a country‑by‑country basis in continuum, which is essential given that dynamics and the market environment can change quickly. Most countries can withstand shocks to some factors, but multiple weaknesses may lead to a loss of market access and debt restructuring.

Sustainable Economic Growth and ESG Sustainability Intrinsically Linked

Within each anchor, there are elements of environmental, social, and governance (ESG) factors embedded. Sustainable economic growth and ESG sustainability are intrinsically linked, in our view, which is why we integrate ESG factors throughout our investment process, rather than look at it in isolation.

The foundation of our approach is utilizing T. Rowe Price’s proprietary Responsible Investing Indicator Model (RIIM), which is a tool that helps to proactively and systematically analyze ESG factors that could impact our investments. A key component of our sovereign RIIM is the State Society Pillar, which emphasizes the social aspect of ESG and involves de‑anchoring a country’s rating from its level of income. We believe this approach is important. The World Bank highlighted in its paper titled “Demystifying Sovereign ESG” that several external ESG sovereign scores can often be explained by the country’s level of development, thus are bias toward higher‑income countries.

In our approach, we seek to avoid an income bias, evaluating a country’s economic and political institutions and then scoring them as either inclusive or extractive. So, an inclusive institution is one that facilitates upward prosperity for a large majority of the population. By contrast, an extractive institution is one that systematically drains a country’s resources for the benefit of very narrow actors.

We believe that improving sustainability‑linked outcomes requires debt sustainability. Angola is a good example of a country that has gone from debt distress toward more debt sustainability. Since the near four‑decade presidency of José Eduardo dos Santos ended, we have seen a slow improvement in the trajectory of governance in the country, with signs of more inclusive political institutions. At the same time, there’s more orthodox macroeconomic policy and the implementation of an International Monetary Fund reform program. These combined factors have led to Angola’s rating being upgraded out of distress, and we see scope for further improvement.

This underscores that direction of travel is an important factor, so if a country is showing ESG improvements, even if it’s from a low base, we believe that is a positive sign.

Current Perspectives on EM

The direction of travel is an important factor to remember when looking at the current market environment. Emerging markets are going through their greatest period of debt distress since the 1990s. It’s a consequence of three issues. First, a narrow group of developing countries losing market access due to policy slippage. Second, this slippage is occurring at a time of aggressive tightening in financial conditions—the Fed has hiked policy rates in the U.S. by 500 basis points since March 2022.1 And third, untested policy architecture is slowing the adoption of sustainable, multilateral supported solutions.

But we have been here before, and it’s critical to remember that. It’s the concept of creative destruction—the best policies are formed from being in a period of stress. This happened in the 1990s when we had the Asia financial crisis and the Russian default. What followed then was a five‑year period of reform implementation that set off a 20‑year boom in emerging markets.

So, it may take a few years for those emerging market countries currently in distress to work through their issues, but we are optimistic that it may lead to reforms and better policies in the future. Fundamental to monitoring this is our four‑part anchoring framework, which can help give us important signals around the direction of travel with respect to policies and institutions. When we see signs of improvement, this could be a positive sign that these countries are moving out of debt distress and more toward debt sustainability—which we believe is a key ingredient for sustainable economic development.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.