March 2021 / INVESTMENT INSIGHTS

T. Rowe Price Strategy Focus on Global Impact Equity

Read more about our Strategy Focus on Global Impact Equity

Key Insights

- The Global Impact Equity Strategy seeks long-term growth of capital. It aims to achieve its objective by seeking positive environmental or social impact and to outperform the MSCI All Country World Index Net.

- The strategy maintains a focus on companies that we believe offer a positive impact today and an underappreciated impact in the future, as well as sustainability and robustness in their future earnings and cash flow growth.

- Our fundamental research platform and dedicated Responsible Investing (RI) team—which is focused on environmental, social, and governance (ESG) issues—provide the breadth of resources and global perspective necessary in building a positive impact portfolio.

- The strategy’s investment approach is anchored to the United Nations Sustainable Development Goals (UN SDGs), a globally recognized framework of 17 goals designed to end poverty, protect the planet, and ensure prosperity.

- Furthermore, every investment decision is aligned to our three defined impact pillars—climate and resource impact, social equity and quality of life, and sustainable innovation and productivity—in aiming to ensure material and measurable environmental or social impact as businesses address globally recognized pressure points.

- We quantify impact outcomes individually and collectively as we translate intentionality into a defined impact measurement framework.

- We will actively engage with companies on ESG issues and apply a strategy‑specific proxy voting policy that reflects the dual nature of our mandate.

FEATURES

Investment Philosophy

Four principles act as the foundation of our investment philosophy:

- Make a positive impact that is material and measurable

Our approach aligns with the UN SDGs, a globally recognized framework designed to end poverty, protect the planet, and ensure prosperity. In turn, we assess the impact across three pillars, addressing (1) climate and resource impact, (2) social equity and quality of life, and (3) sustainable innovation and productivity. We believe this approach is the best way to align all stakeholders, encompassing our clients, our investment team, and the businesses our strategy owns. To ensure that our approach has substance, we adopt a forward‑looking perspective on change, while aiming to ensure that all investment decisions are based on a clearly defined, positive impact thesis that is material and measurable.

- Durability and time horizon are key

Stocks have the potential to deliver superior returns when the durability and persistence of earnings and cash flow are underappreciated by the market or where economic return improvement is mispriced. Adopting a long‑term view allows us to identify inefficiencies embedded in equity markets, especially in an era of change, disruption, and shortened time horizons.

- Secular change matters

Investing in companies that we believe are on the right side of secular change is key to unlocking improving economic returns in business models, especially in an era of shifting consumer, business, and regulatory preferences. While impact investing has traditionally been associated with private investments, the opportunity to own and engage with companies that create a positive impact is broader than ever before in public equity markets.

- Research is critical

Based on our fundamental and responsible investment research resources, our approach produces a holistic view of companies and embodies the different perspectives necessary to invest for future impact and pursue better investment outcomes. We integrate our stock perspectives to identify, in our view, underappreciated impact and mispriced economic return improvement on a truly global, stock‑by‑stock basis. We apply a forward‑looking, research‑driven and, high‑conviction approach to our stock choices. This is important with respect to prudent risk management, as well as aligning with the UN SDGs, as we seek to engage with the full breadth of impact opportunities that exist in an evolving and complex world.

Portfolio Management

The Global Impact Equity Strategy is managed by Hari Balkrishna, who has ultimate responsibility for investment decisions. He has 15 years of investment experience and, between 2015 and 2020, was the associate portfolio manager of our Global Growth Equity Strategy. Hari has lived and worked on five continents and has a deep appreciation for the many different social systems around the world as well a personal passion for addressing climate change. In his new role, he will continue to be supported by experienced regional and global sector advisors who act as a counseling body and provide critical insights as needed. This resource enables a global perspective, a critical foundation of success for traditional or impact investors aiming to address truly global issues. Hari will also leverage the expertise of our dedicated RI team from the very start of the investment process as we seek to identify compelling impact‑driven stock candidates. We firmly believe that research is critical because secular change implies stock dispersion, while identifying positive change as it emerges, and should be a key advantage as the impact universe itself evolves.

Defining the Investment Universe

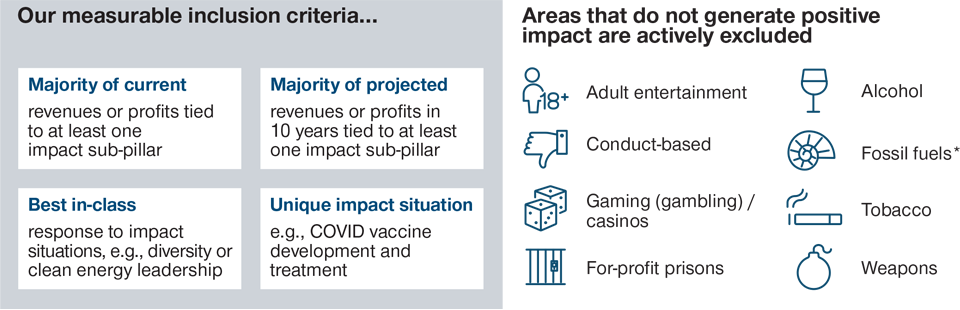

Areas of the global economy that we do not believe can generate a positive impact are excluded from the outset. These include adult entertainment, alcohol, fossil fuels,1 gambling, tobacco, for‑profit prisons, weapons, and stocks that screen individually on conduct‑based metrics.

The RI team establishes impact inclusion criteria at the industry level to further assess and narrow the universe, guided by three investment pillars and eight sub‑pillars aligned to the UN SDGs.

Our impact universe comprises companies meeting at least one of four criteria for inclusion in the portfolio: majority of current revenues or profits are tied to at least one impact sub‑pillar, majority of projected revenues or profits in 10 years are tied to at least one impact sub‑pillar, best‑in‑class response to impact situations, or unique impact situation.

Portfolio Construction

In constructing the portfolio, Hari leverages the analysis undertaken by the global investment team and the RI team and applies his judgment to construct a global portfolio of typically 55 to 85 of our highest‑conviction opportunities within the impact universe. The RI team’s proprietary Responsible Investing Indicator Model (RIIM), which systematically and proactively evaluates the RI profile of over 15,000 corporate securities, helps assess the quality and long‑term sustainability of the companies in which Hari chooses to invest.

Hari seeks stocks with clear impact and financial return markers, based on product, industry, governance, and growth potential. He collaborates closely with our global team of sector analysts and regional specialists to conduct in‑depth, fundamental research to identify the most attractive stock‑based opportunities, integrating our perspectives on financial returns alongside the positive and negative impact of business activity.

ESG Integration, Active Engagement, and Stewardship

All our stock selection decisions begin with a clearly defined positive impact thesis, which proactively and systematically integrates ESG considerations. Credible ESG solutions require investment, and we have been building capability in the field of responsible investing for a number of years in order to fully embed ESG integration within our decisions. Our philosophy is that ESG factors cannot be a separate or tangential part of a traditional investment thesis; they have to be integrated alongside fundamental factors to create the best outcome for clients.

The process of ESG integration takes place on three levels: first, as our fundamental and responsible investment research analysts incorporate ESG factors into their analysis; second, as we use T. Rowe Price’s proprietary RIIM analysis at regular intervals to help us understand the ESG characteristics of single stocks and the aggregate portfolio; and third, as the portfolio manager integrates ESG considerations within his company interactions and the portfolio construction process.

Our Impact Investment Pillars Guide Our Decision-Making

“Do no harm,” governance, and sustainability analysis are all embedded in our choices

Our ESG specialist teams provide investment research on ESG issues at the company level and on thematic topics. Additionally, they have built tools, including RIIM, to help proactively and systematically analyze the ESG factors that could impact our investments. Deep research resources are needed to embrace the complexity of ESG best practices today and in the future, and we have invested on behalf of our clients.

Engagement activity is another crucial tool to enhance our analysis of a company. We typically seek to understand how a company is progressing in its impact journey and achieving specific positive outcomes. Our engagements focus on the ESG factors that we consider most likely to have a material impact on the performance of the investments in our clients’ portfolios. Engagement also provides an opportunity to influence and monitor a company’s improvement concerning ESG oversight and disclosure.

Proxy voting is also integral to our investment process, and it is a crucial link in the chain of stewardship responsibilities that we execute on behalf of our clients. We use our customized proxy voting guidelines to help us establish governance norms, but the Global Impact Equity team follows an enhanced governance and proxy voting approach. Any company flagging outside of our guidelines undergoes further analysis by the governance team, with an action‑oriented recommendation to the portfolio manager and analysts.

All Decisions Endure Careful Impact Screening to Ensure Materiality and Measurability

*Fossil fuel exclusion has the potential to adapt over time as companies with exposure to fossil fuel production demonstrate a clear path to energy transition with substantive reporting and targets.

Measuring Impact

Given our mandate’s dual nature, impact measurement and management is integral to our investment process. We believe that measuring and managing impact fulfills three objectives:

- To monitor our investments’ progress toward clearly defined outcomes through key performance indicators (KPIs).

- To assist in our corporate engagements and to ensure that we identify any deviation from our impact and investment thesis.

- To report progress and impact delivery to our clients.

All our investments start with a stock‑by‑stock assessment of impact materiality. Our impact universe is defined by our responsible investment team through industry‑specific, forward‑looking impact inclusion criteria, assessing business activities and how they align with our three investment pillars and eight sub‑pillars, guided by the UN SDGs.

Each investment thesis embeds stock‑specific KPIs as our analysts collaborate with the portfolio management team, to define our investment thesis. This fundamental road map helps to clarify our thesis at every step of the ownership journey, including the point of exit, should our impact thesis fail to materialize as we expect. Our thesis also assists in individual security impact measurement as we look back on both single and long‑term compounded time periods, during the period of ownership.

Disciplined Approach to Risk

We do not believe that an investment approach can be successful if risk is viewed as something distinct from the rest of portfolio management. Accordingly, we incorporate risk management throughout every step of our investment processes.

The Global Impact Equity Strategy applies a high‑conviction, impact‑oriented approach, but with a mindset that valuation matters in generating alpha and in managing absolute and relative risks. We maintain a focus on companies that we believe offer a positive impact today and an underappreciated impact in the future, as well as sustainability and robustness in their future earnings and cash flow growth with compelling management quality and expert capital allocation. We inherently believe in our ability to identify such businesses during challenging times and will always take an active approach to diversification, challenging ourselves on the individual and aggregate risks that we are exposed to.

MAIN RISK

The following risk is materially relevant to the portfolio:

Style risk—different investment styles typically go in and out of favour depending on market conditions and investor sentiment. We apply a high conviction, and long term approach to investing. While we believe this is beneficial to returns and specifically, the compounding of returns over time, there will be times where markets are driven by factors not related to long-term earnings and cashflow fundamentals. Our bottom up focus may mean that periods of intense macro or top down focus create headwinds to return, but these tend to be transient as a driver of stock prices.

GENERAL PORTFOLIO RISKS

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Environment, social and governance (“ESG”) and sustainability (“SU”) risk—due to environmental changes, shifting societal views, and an evolving regulatory landscape related to sustainability issues, the earnings and/or profitability of companies that a fund invests in may be impacted.

Equity risk—in general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

March 2021 / PODCAST

March 2021 / INVESTMENT INSIGHTS