2026 Global Market Outlook

Minds, machines and market shifts

AI is driving real change, but bubble concerns are growing. Investors must balance exposure to AI with broader opportunities and enduring risks in 2026.

Balancing AI winners with broader opportunities and enduring risks

AI is powering measurable change—and this will continue in 2026. But rapid capital deployment has led to stretched valuations in AI sectors, raising concerns about speculative bubbles and sustainability. Investors must balance excitement with disciplined analysis and risk management.

Meanwhile, the world continues to grapple with non-AI forces. Inflation remains stubborn in many developed economies, growth trajectories are diverging and geopolitical uncertainty—from trade tensions to the war in Ukraine—is adding further complexity to the global outlook.

Navigating this environment will require balancing exposure to enduring AI leaders with emerging opportunities in cyclical and international markets—while remaining vigilant to persistent macro risks. The age of speculation is giving way to real-world results, but investors must be mindful that old challenges—valuation, inflation, and geopolitical uncertainty—remain firmly in play.

Ritu Vohora

Summary Video – November 5, 2025

We are facing a rapidly evolving investment landscape shaped by the impact of AI, expansionary fiscal policies, and shifting geopolitics.

In the US, AI-driven investment and government stimulus are reigniting growth. However, with upside risks to inflation, the Fed faces a delicate balancing act. In Europe, as tariff-related front-loading fades, manufacturing may weaken - with the European Central Bank likely to ease policy. Japan faces rising inflation, though fiscal measures should support growth. Emerging markets have managed inflation and debt and shown tariff resilience. While the backdrop is favorable, trade policy remains a risk.

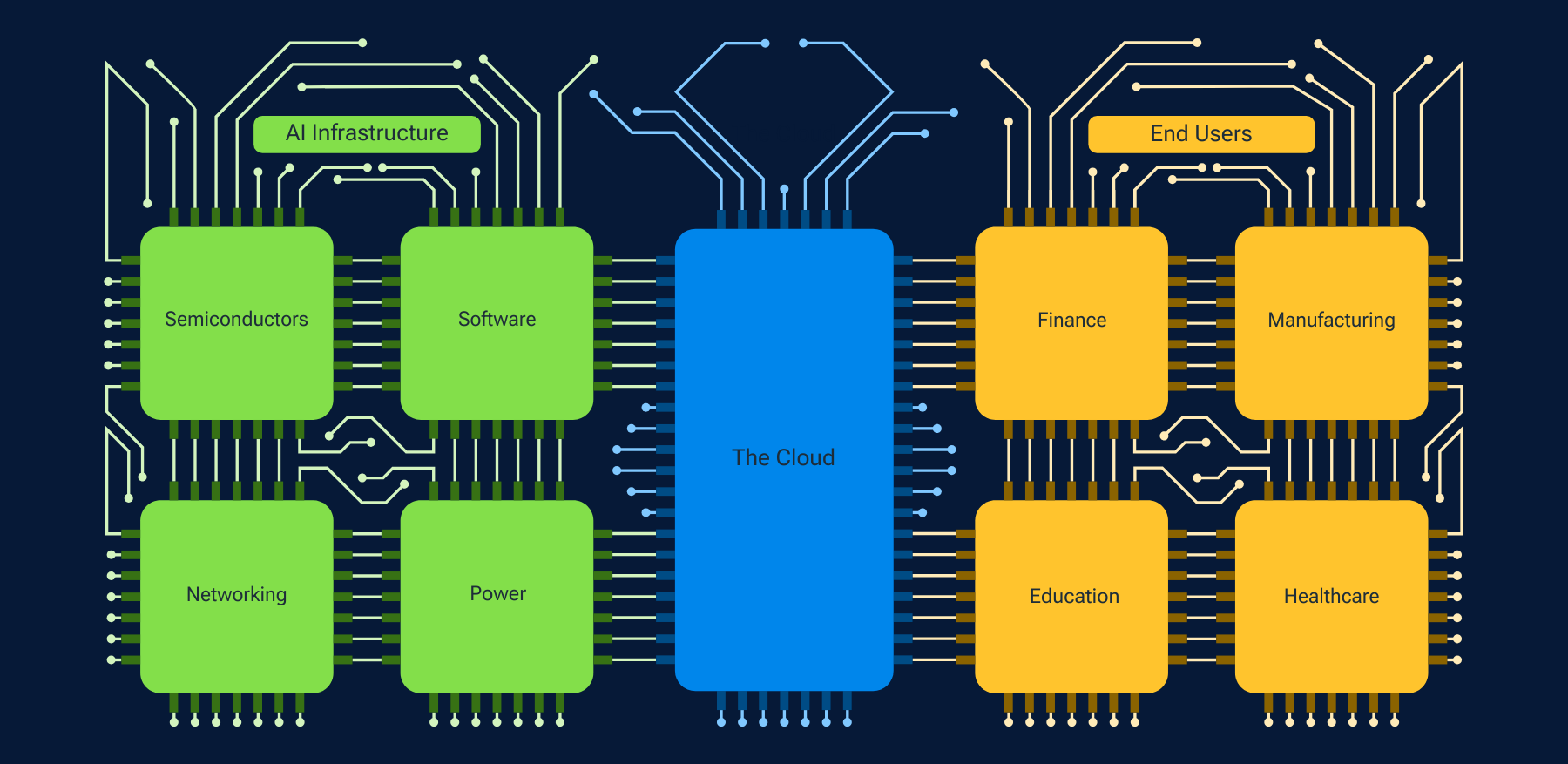

Equity markets are broadening, both within AI-related sectors and beyond. AI enters a new phase with clear signs of monetization. Hardware and hyperscalers will still lead the way, but the evolution from digital AI, like software, to physical AI infrastructure is unlocking opportunities across materials, energy, and industrials. International and small-cap equities are increasingly appealing, supported by fiscal stimulus and improving cyclical conditions.

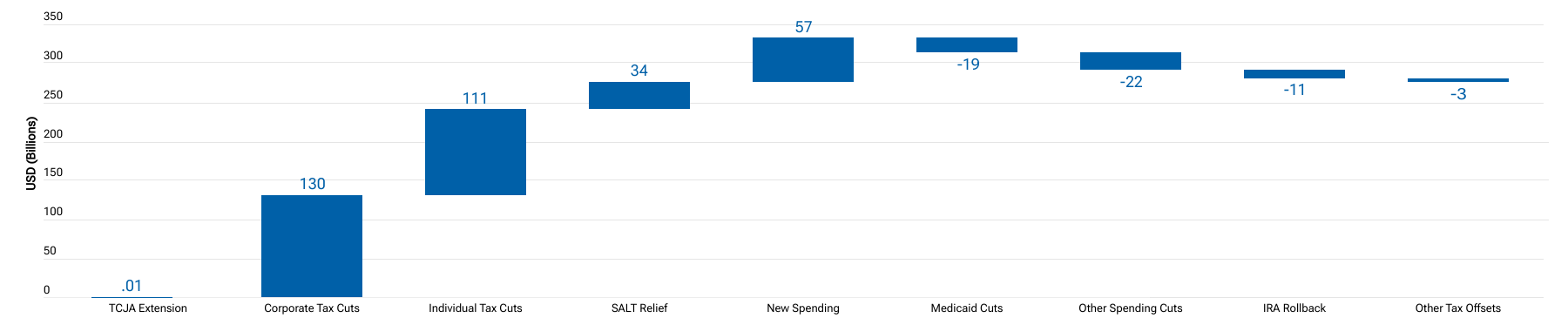

In fixed income, we expect higher yields and steeper curves reflecting ambitious fiscal agendas. High yield bonds and bank loans offer compelling income, but credit selection is key. Inflation-protected bonds and select emerging markets provide tactical opportunities.

Private markets are being revitalized. Stable rates and high demand for capital—especially for AI infrastructure—are fueling a wave of dealmaking and bespoke credit solutions. While fundamentals are robust, idiosyncratic risks must be tightly managed.

2026 will require agility. The age of speculation is giving way to real-world results, but old challenges—valuation, inflation, and geopolitics —remain. Navigating this new era calls for adaptability, a global lens, and a focus on both innovation and resilience.