December 2021 / GLOBAL MARKET OUTLOOK

Playbook for a Shifting Economic Landscape

Looking for Growth in Challenging Markets

Key Insights

- The global economic recovery appears on track, but policymakers may be challenged to restrain inflation without stifling growth.

- Equity valuations are vulnerable to rising interest rates. Slower U.S. earnings growth could favor less expensive, more cyclical ex-U.S. markets.

- Risk of central bank missteps could keep bond markets volatile in 2022. With U.S. credit spreads tight, investors may want to cast wider global nets.

- Investment in global supply chains, public infrastructure, and renewable energy development could benefit capital goods and related industries.

Looking for Growth in Challenging Markets

After back‑to‑back years of strong performance across most equity and credit sectors, global markets face more uncertain prospects in 2022, according to T. Rowe Price investment leaders. Investors will need to use greater selectivity to identify potential opportunities, they say.

Higher inflation, a shift toward monetary tightening, and new coronavirus variants all pose potential challenges for economic growth and earnings—at a time when valuations appear elevated across many asset categories.

On the positive side, household wealth gains, pent‑up consumer demand, and a potential boom in capital expenditures could sustain growth even as monetary policy turns less supportive.

“Over the next year, I think the bottom line is that we will face slowing growth, but still very high growth,” predicts Sébastien Page, head of Global Multi‑Asset.

But strong growth and rising wages also could put further upward pressure on U.S. commodity and consumer prices, which accelerated sharply in the second half of 2021.

Mark Vaselkiv, CIO, Fixed Income, worries that the U.S. Federal Reserve may have fallen behind in the fight against inflation. As of mid‑November 2021, interest rate futures markets indicated the Fed wasn’t expected to begin raising rates until mid‑2022.

“The Fed may already be behind the curve,” Vaselkiv warns. “That could be the biggest risk for 2022.”

Economic growth should continue to support corporate earnings and credit quality in 2022. But the earnings momentum seen in 2021 is unlikely to be repeated, suggests Justin Thomson, head of International Equity and CIO. “It seems highly unlikely that positive [earnings] revisions will be of the same level of magnitude as we’ve been seeing.”

This could make the interest rate outlook an even more critical factor for equity performance. “If U.S. rate expectations get brought forward, I think equity markets will take their cue from that,” Thomson says.

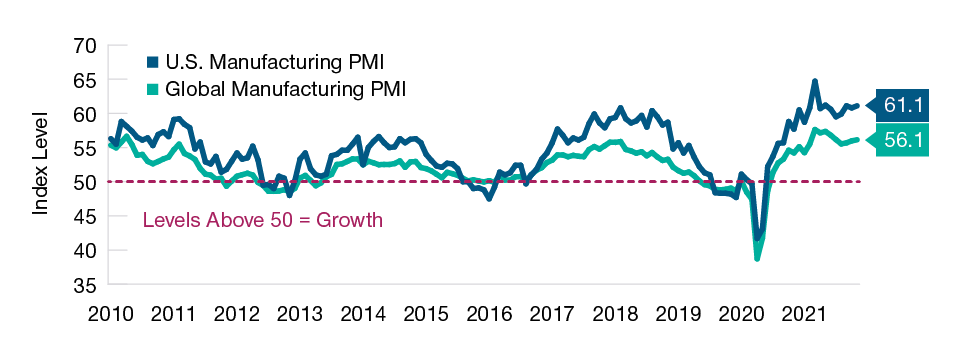

The Global Recovery Has Slowed but Still Appears on Track

(Fig. 1) U.S. and global Purchasing Managers’ Indexes (PMI) for manufacturing

As of November 30, 2021. Sources: Institute for Supply Management and J.P. Morgan/IHS Markit/Haver Analytics (see Additional Disclosures).

Explore our four themes:

Growth Delayed, Not Derailed

The global economic recovery appears on track, but policymakers may be challenged to restrain inflation without stifling growth.

Focus on Fundamentals

Equity valuations are vulnerable to rising interest rates. Slower U.S. earnings growth could favor less expensive, more cyclical ex‑U.S. markets.

Navigating Policy Shifts

Risk of central bank missteps could keep bond markets volatile in 2022. With U.S. credit spreads tight, investors may want to cast wider global nets.

Path to Global Sustainability

Investment in global supply chains, public infrastructure, and renewable energy development could benefit capital goods and related industries.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

December 2021 / MARKETS & ECONOMY