November 2021 / INVESTMENT INSIGHTS

U.S. Infrastructure Bill Could Strengthen Secular Trends

Investors should remain selective and focus on fundamentals.

The recently ratified bipartisan USD 1.2 trillion Infrastructure Investment and Jobs Act (IIJA) comprises about USD 650 billion in reauthorized spending and USD 550 billion in new expenditures. These earmarks include significant funding for surface transportation upgrades over the next five years that would help to improve economic productivity. Line items that help to modernize the power grid and expand the network of charging stations for electric vehicles would provide further support for key secular trends.

Surface Transportation and Municipalities

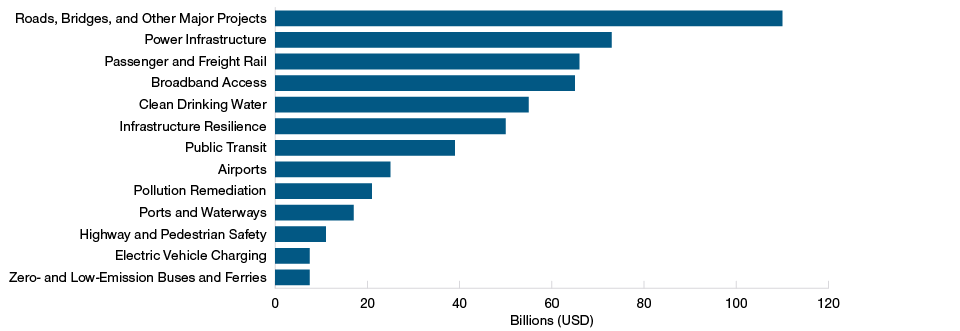

Transportation‑related investments account for a little more than half of the USD 550 billion worth of new spending in the bipartisan infrastructure bill, including USD 110 billion for roads and bridges, USD 66 billion for passenger and freight rail, USD 25 billion for airports, and USD 17 billion for ports and waterways.

This influx of federal money should pull forward the start date for needed infrastructure upgrades while increasing the market’s confidence in the potential capacity of municipalities to pay for these projects. Research conducted by the National Association of State Budget Officers estimates that federal grants historically have accounted for almost one‑third of state government funding.1 Although the project‑specific competitive federal grants available under the auspices of the IIJA run for five years, these earmarks potentially could cover a larger proportion of a project’s total cost. At the same time, T. Rowe Price research shows that many municipalities’ fiscal health strengthened during the coronavirus pandemic, as in some instances the hit to tax revenues did not necessarily materialize to the extent expected.

The projects themselves have the potential to improve productivity by reducing the dangers and business disruptions that become more common as infrastructure ages. These upgrades also have the potential to address bottlenecks where investment in physical assets has not kept up with how public and business needs have evolved.

However, investors seeking companies that might benefit from a wave of infrastructure spending should bear in mind that hastening the start dates for needed projects does not necessarily expand the overall addressable market or contribute to fundamental changes in longer‑term industry dynamics. In our view, selectivity and a deep understanding of companies’ business models could be key to identifying potential investment opportunities.

Key Areas of New Spending Authorized by the IIJA

Road infrastructure tops the list for new spending

As of November 15, 2021.

Source: WhiteHouse.gov.

Broadband, Power, and Electrification

Outside of traditional transportation‑related projects, the bipartisan infrastructure package includes USD 65 billion to improve internet connectivity in unserved and underserved communities. Given the importance of broadband access for remote work and school, these investments have the potential to improve the dynamism of the economy, especially in rural areas.

The infrastructure measure also finances the procurement of electric buses and charging stations for electric vehicles. These line items are significantly smaller than the earmarks for traditional transportation infrastructure. That said, we would expect this funding to contribute to the adoption of electric vehicles—a powerful secular trend that should accelerate as carmakers expand their offerings in this segment.

Although the bipartisan infrastructure package does not explicitly include funding for renewable energy, the massive USD 73 billion for upgrades to the nation’s electricity grid will be critical to building a flexible, resilient system that can accommodate variable generation from wind and solar power as well as increased demand from the electrification of transportation and—perhaps in the future—residential and commercial heating.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

November 2021 / INVESTMENT INSIGHTS