September 2022 / INVESTMENT INSIGHTS

How Value Can Benefit From a New Investment Cycle

Four factors set to drive a boom in capital expenditure

Key Insights

- There has been large‑scale underinvestment from both corporates and governments since the global financial crisis.

- However, we have identified four factors that can help drive a new capital expenditure cycle.

- Many of the companies that are likely to benefit from a new capex cycle reside within value‑oriented areas of the market.

The changing of the guard in terms of value versus growth has been attributed to the post‑pandemic recovery, decade‑high inflation, and the potential for aggressive monetary tightening. However, as bottom‑up investors, we are excited about the potential for a new capital investment cycle forming after many years of underinvestment. For value investors, this is a positive development, as increased spending can be a significant source of investment opportunities.

Case for a New Investment Cycle

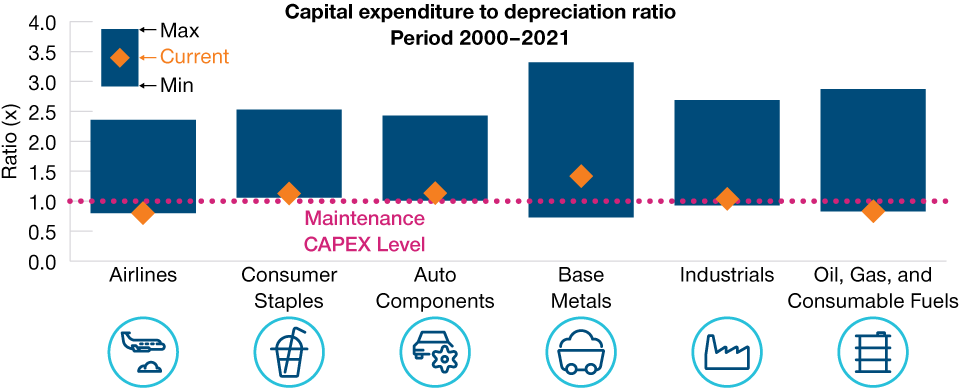

Since the global financial crisis (GFC) in 2008, we have seen large‑scale underinvestment from both corporates and governments. Both policymakers and companies have focused on repairing balance sheets. Many industries have invested only at “maintenance capex levels,” rather than investing to improve productivity or expansion (Figure 1).

After Years of Underinvestment, a New Capex Cycle Is Forming

(Fig. 1) Many companies have been investing only at maintenance capex levels

As of December 31, 2021.

Source: Financial data and analytics provider FactSet. Copyright 2022 FactSet. All Rights Reserved. Most recent data available.

We believe many industries are now long overdue investment, after many years of neglect. A good example is the shipping industry, which has seen a dire lack of investment for years—from port capacity to ships. As the world recovered from the pandemic and demand returned, the industry has struggled due to the lack of investment. This has caused a backlog at ports and a sharp rise in container prices.

Infrastructure Spending Is Well Overdue

We have heard phrases like “build back better” and “leveling up” as governments seek to recover after the pandemic. However, we have seen a chronic lack of investment at a top‑down level ever since the GFC, despite an era of ultralow financing costs. There are a number of interrelated reasons for this, but a major one has been the anemic economic rebound we have witnessed after the financial crisis. In previous economic cycles, economic recoveries have been much stronger, but economic growth in recent years has frequently undershot expectations. Meanwhile, at a corporate level, the lack of demand anticipated by companies is likely the reason for the past lack of investment spending. Businesses that aren’t predicting higher demand are less likely to invest.

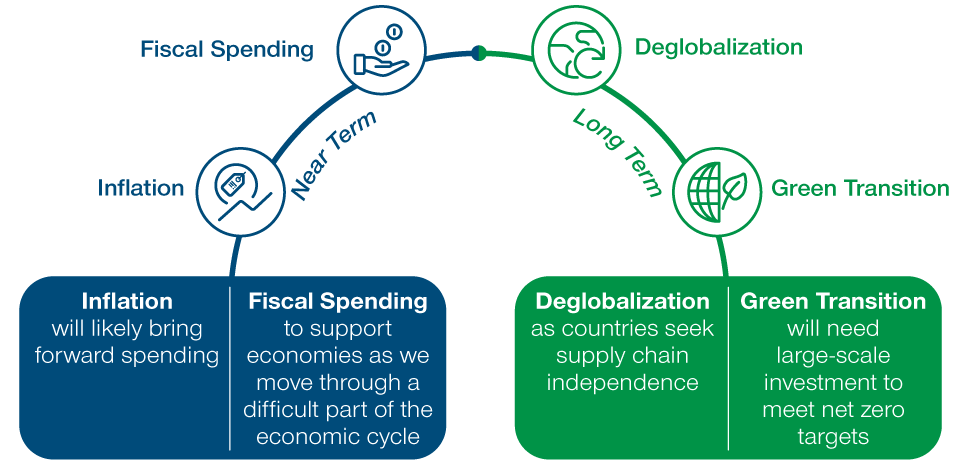

Looking forward, with the cost of everything going up (including wages), we believe the inflationary environment can be the catalyst to drive increased spending and awaken entrepreneurial spirits (at both a company and government level). We have identified both near‑ and long‑term reasons why a capex boom could be underway.

Four Drivers of Increase in Capital Expenditure

Inflation and fiscal spending to drive investment in the near term, while deglobalization and the green transition should support capex in the future

Near Term—Inflation

Returning demand after the pandemic has met with disrupted supply chains, whether that be through China’s zero‑COVID policy (periodically closing important manufacturing hubs) or Russia’s invasion of Ukraine (sending energy and agriculture prices sharply higher). Although we expect inflation to peak at some point as demand destruction takes hold, it is likely, in our view, to settle back at higher levels than experienced in the post‑GFC environment.

A major factor will be what we are calling “geopolitical inflation.” We believe it is unlikely that the conflict in Ukraine will be resolved quickly, and geopolitical tensions have also risen between China and Taiwan and—subsequently—China and the U.S. This heightened geopolitical friction is likely to prove inflationary as tensions remain elevated and supply chains continue to be disrupted. However, these inflationary pressures should encourage firms and governments to invest sooner—given that delaying would mean higher costs in the future.

Near Term—Fiscal Spending

We expect greater fiscal spending and investment to support economies, especially as countries move through a difficult part of the economic cycle. This is likely to come in the form of increased handouts to consumers (tax cuts, energy caps) and greater spending on infrastructure projects to help drive growth. Both of these are inflationary unless they are managed in a fiscally neutral way.

Infrastructure is very much the backbone of any economy and helps to provide the framework for both economic growth and modernization, but it has been neglected for many years. Historically, expenditure on infrastructure has been the primary responsibility of governments or policymakers, but governments are increasingly entering into public‑private partnerships with companies.

Importantly, the inelastic demand, high barriers to entry, and monopoly‑like characteristics of many infrastructure and utility assets mean that their financial performance is not as sensitive to economic cycles as others. These companies also tend to offer higher pricing power and, therefore, better inflation protection.

Long Term—Deglobalization

Deglobalization is already underway. We first heard about the potential in 2018 when the U.S.‑China trade war ignited, but concerns have increased with the onset of the Russia‑Ukraine conflict and supply chain disruptions stemming from the pandemic. This has focused policymakers’ minds on securing supply chain independence. With companies struggling to manufacture and deliver products throughout the pandemic, many companies are now telling us of their plans to regionalize, or “onshore,” their supply chains, despite the potential economic ramifications.

Long Term—Green Transition

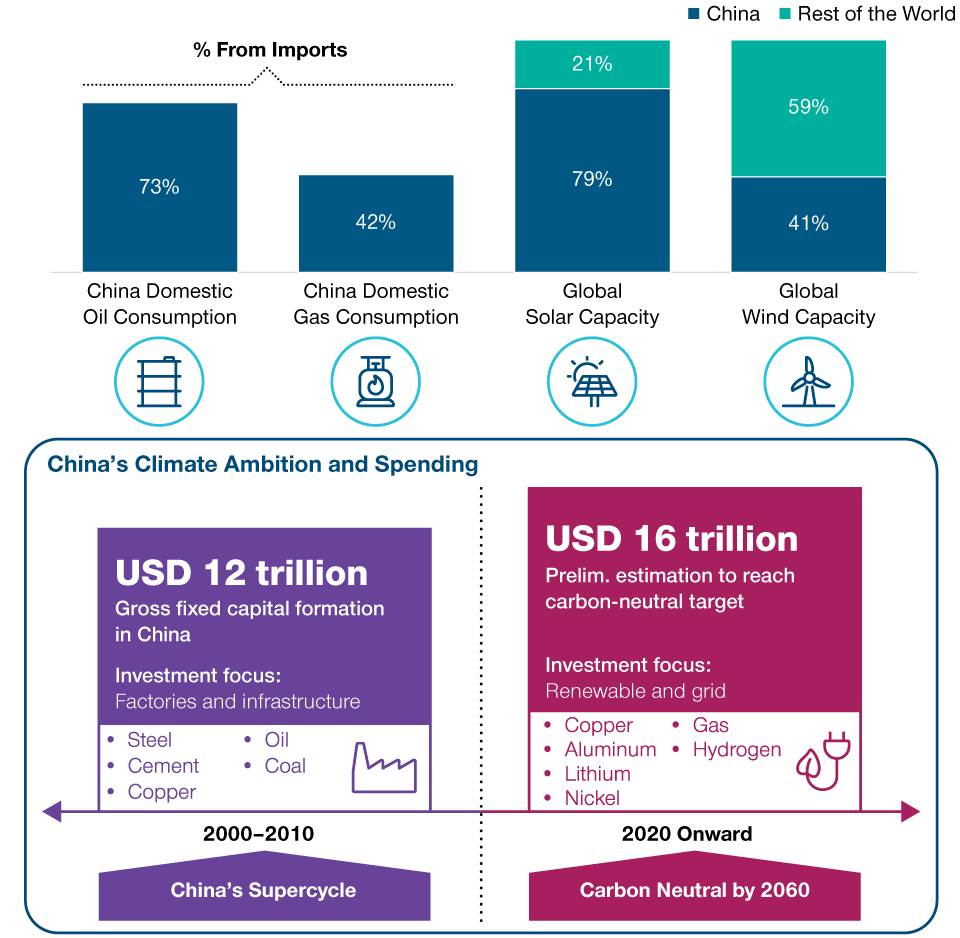

Many countries have set ambitious carbon reduction targets, but achieving them will require huge levels of investment. China is a great example, being the world’s largest fossil fuel emitter. Currently, China imports 73% of its oil and 42% of its gas needs (Figure 2). However, it has plans to take advantage of its dominance in solar and wind capacity to make greater use of renewable energy that will allow it to become much more self‑sufficient. With China having spent around USD 12 trillion during its supercycle from 2000 to 2010 (building roads, bridges, airports, and other infrastructure projects), it is now forecast to spend almost USD 16 trillion on its green transition to meet its carbon neutrality goal by 2060.

China Needs to Spend to Meet “Green” Targets

(Fig. 2) Spending forecasts far exceed China’s supercycle

As of March 31, 2022.

Sources: SolarZoom, CPIA, Jefferies estimates, Credit Suisse. © 2022 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

New Capex Cycle Could Drive Better Returns for Value‑Oriented Companies

With a new capex/investment cycle in the offing, we expect this to support earnings growth, particularly in areas like utilities and industrials. Meanwhile, with inflation likely to remain elevated, we expect central banks to continue to raise interest rates, benefiting financials—banks in particular. With financials, industrials, and utilities making up large parts of the value investment universe, we are excited about the potential opportunities that lie ahead.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

September 2022 / VIDEO

September 2022 / INVESTMENT INSIGHTS