October 2020 / INVESTMENT INSIGHTS

Why ESG Is Integral to Analysis of Mining Companies

Integrating ESG factors helps better understand long-term sustainability

Key Insights

- ESG factors serve as an important input in the research process for mining companies in emerging markets.

- It is imperative to assess a company’s safety records and integrate this into our overall evaluation of risks and opportunities.

- For companies within our emerging market bond investment universe, we review six key safety factors, ranging from fatality rates to qualitative assessments, such as staff training.

Mining remains one of the world’s most dangerous industries to work in. That’s why it’s imperative that our fixed income bottom‑up research comprises assessing environmental, social, and governance (ESG) factors alongside the more traditional areas, such as a company’s balance sheet. Of particular importance is the area of safety, which is embedded in our analysis of a company’s social factors. A company’s safety record is a key variable in determining its operational uptime, license to operate, and ability to attract workers. These are all critical factors to a company’s long‑term economic sustainability.

Building a Profile of Risks and Opportunities

For mining companies anywhere in the world, the impact of poor safety standards can be significant. When incidents, such as fatalities, occur on a large scale or on repeat occasions, there’s a risk of potentially lasting damage to a company’s reputation and credibility. That’s because authorities have the power to place a company into state curatorship or even revoke a company’s mining license in a worst‑case scenario. In emerging markets, where safety regulations can be less stringent, we find that the risk of accidents can be higher.

Conversely, prioritizing safety may be a sign of a high‑quality company, which enhances its viability as a long‑term investment. We believe that valuable insights can be gained from scrutinizing how mining companies in emerging markets approach safety. That’s why we integrate this into our overall bond evaluation.

Safety Assessment Factors Within Mining

Six Safety Factors to Assess

Central to our approach is the assessment of six key safety factors.

- Total Recordable Incident Rate (TRIR): The total number of incidents per 200,000 hours worked during a time period of a year. This incorporates all incidents during that time period regardless of whether it results in time away from work or not. For example, a TRIR of 10 indicates that for every 200,000 hours worked in a particular year there are 10 incidents.

- Lost Time Incident Rate (LTIR): The number of incidents per 200,000 hours worked that result in time away from work during a time period of a year. For example, a LTIR of 5 indicates that for every 200,000 hours worked in a particular year there are five incidents that result in time away from work.

- Total Fatality Rate: Total number of lives lost because of incidents in the workplace over a particular time period.

- Trends: Assessing trends in TRIR, LTIR, and fatality rates gives us additional information above just looking at these metrics in isolation. For example, multiyear increases in these rates indicate that a company is on a deteriorating trajectory and that a risk premium potentially needs to be built into our models.

- Absolute Versus Relative Rates: On top of assessing trends in rates, it’s also important to look at a company’s rates of TRIR, LTIR, and total fatality relative to the industry average and peers. This allows us to make comparisons between companies. Similar to trends, a company that is consistently above peers in these metrics could require the incorporation of a safety premium into our assessment.

- Qualitative: Within this factor, a number of different aspects are evaluated and monitored, including employee safety training and system maintenance processes. We also examine whistleblower procedures as it’s important that employees are able to report when there is possible wrongdoing or breaches of safety practices. Valuable information can also be gleaned from how compensation is taken. For example, if the compensation structure is linked to a short‑term production target, there’s a risk that employees cut corners with respect to safety in order to meet that specific goal. A key part of evaluating qualitative safety issues involves talking to the company and conducting on‑site research trips. Going beyond the numbers and assessing these features may give us insights into safety that others might miss.

Assessing these six factors enables us to make comparisons among mining companies in emerging markets.

Scenario Analysis

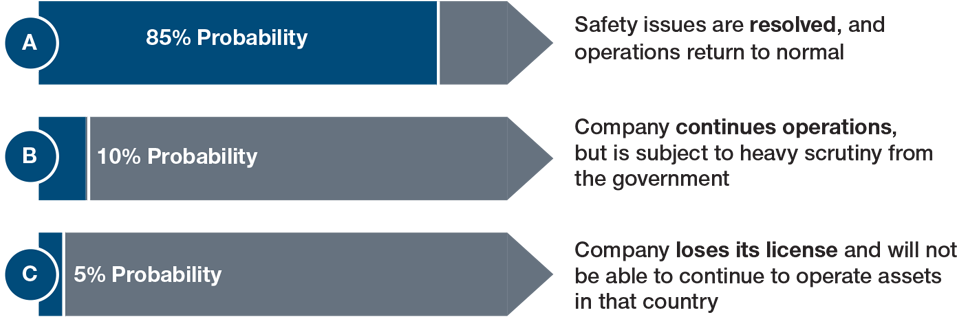

In some instances, it might also be necessary to include in our bond evaluation a risk premium for safety. We might do this if a company is experiencing persistent major safety incidents. To calculate this, we use scenario analysis, assigning a probability of three possible outcomes, each with an estimate of the possible impact on the company’s bond price. An illustration of this exercise is provided below.

- Scenario A: 85% probability that noise will blow over: In this scenario, the safety issues are resolved, and operations return to normal.

- Scenario B: 10% probability that operations will be put under curatorship: In this scenario, the company continues operations but is subject to heavy scrutiny from the government.

- Scenario C: 5% probability that licenses are revoked: In this scenario, the company loses its license and will not be able to continue to operate assets in the country where it has been revoked.

This exercise helps us arrive at a risk‑adjusted fair value bond price for the company that incorporates a risk premium for safety.

Scenario Analysis

For illustration purposes only.

Source: T. Rowe Price

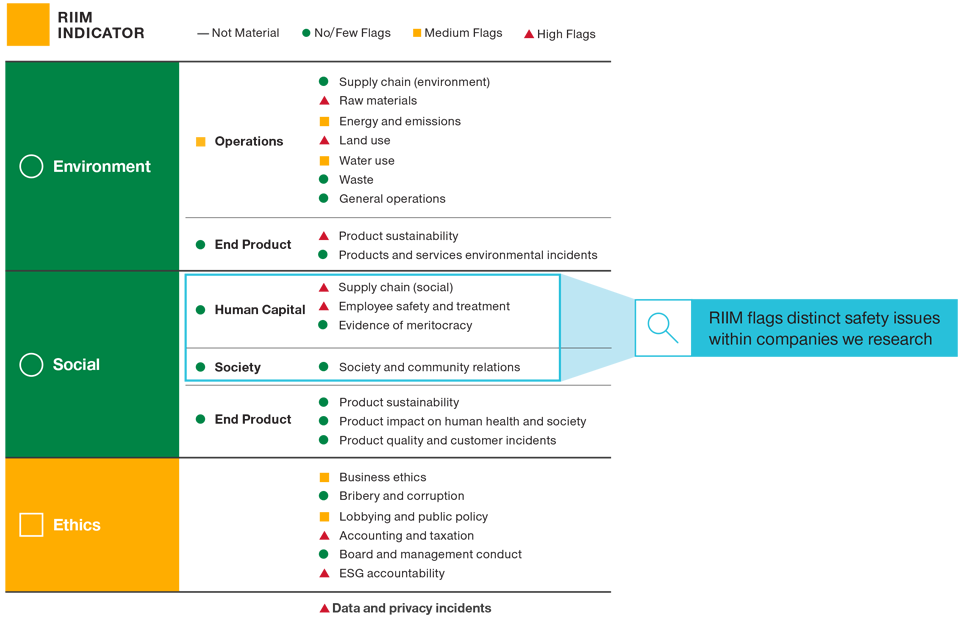

Dedicated ESG Resources Enhance Identification and Analysis of Safety Issues

To support our analysis of company safety, our investment team leverages dedicated, in‑house resources. Our ESG specialist teams provide investment research on ESG issues at the issuer level and on thematic topics. Additionally, they have built tools to help proactively and systematically analyze ESG factors. The foundation of the analysis is a proprietary framework called the Responsible Investing Indicator Model (RIIM). It builds a distinct responsible investing (RI) profile for each corporate entity, flagging any elevated environmental, social, and ethical risks or positive characteristics. This includes an analysis of corporate safety statistics and programs, which sits within the social pillar in the employee safety and treatment subcategory. As illustrated in Fig. 1, RIIM rates corporate issuers in a traffic light system (red, orange, green).

(Fig. 1) RIIM Analysis—Individual Company Level

For illustration purposes only.

Source: T. Rowe Price.

From these inputs, an overall score is calculated, and depending on that number, a rating of either red, orange, or green will be assigned. This flagging system complements our analyst research and, in the scenario of a red or orange rating, we regularly collaborate with our dedicated RI analysts to investigate further. The dual approach really helps us to identify safety risks, as well as gauge the potential impact of these on the company in the future.

Identification and assessment of safety issues in the mining sector are crucial to our investment process. It helps us assess both positive and negative social characteristics that contribute to understanding the long‑term sustainability of companies in our investment universe.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.