November 2020 / INVESTMENT INSIGHTS

Secular Forces Are Carving New Paths for Active Investing

The coronavirus has accelerated and redirected long-term trends

Key Insights

- The “six Ds” of secular change are: constructive destruction, technological disruption, geopolitical disorder, demographics, mounting debt, and the coronavirus.

- The key to investing amid these changes is to look ahead to the future possibilities rather than relying on extrapolating past behaviors.

- While passive and rules‑based quantitative investment strategies rely on past events and data, active strategies can be more forward‑looking and anticipate change.

The world has taken a new turn in 2020, and the range of potential outcomes is almost impossible to quantify. We believe we are at the cusp of a new era because of the profound impact of the acceleration of a number of secular structural forces of change, which we call the “six Ds.” The first five of these are: constructive destruction, technological disruption, geopolitical disorder, demographics, and mounting public debt. While these forces have existed for some time, the coronavirus—the sixth D—has forced them into plain sight and may have accelerated some changes and added new ones, deflecting the future economic and market environment to a new trajectory.

Rather than expect the world to revert to the path it was on before the coronavirus, we believe investors should consider the extent to which the pandemic has changed the direction of travel:

- The scale and speed of the economic contraction has created uncertainty about the shape and length of the recovery, as well as potential opportunities;

- Technological disruption has gained momentum, and the ways in which we transport, work, and shop are unlikely to return to the way they were;

- Geopolitical disorder has become a persistent and significant concern for many investors;

- Aging demographics have been moderating economic growth and inflation, while the pandemic may change the health care needs and behaviors of the elderly; and

- Debt levels that were yet to return to normal following the 2008 global financial crisis (GFC) have soared.

While the pandemic is not the sole cause of these secular changes, it is proving to amplify and accelerate their impacts.

Let’s take a closer look at the various changes in turn.

Constructive Destruction: Positioning to Differentiate Between New Winners and Losers

Constructive destruction is the natural cleansing process that crises and recessions bring. Viable companies survive, while weaker ones do not. Credit rating downgrades exceed upgrades, indicating that widespread corporate failures are to be expected. This process ultimately leads to a more efficient allocation of resources as capital, labor, and investments concentrate on stronger businesses.

Different letters in the alphabet have typically been used to describe the potential shape of economic recoveries: V, U, W, or L. We believe this misses the point: Whatever path the recovery follows, gross domestic product (GDP) is likely to eventually recover to pre‑coronavirus levels. However, the drivers of output may well be different. For example, the relative contributions to GDP from technology, hospitality and leisure, and energy may change dramatically during and following a crisis. This is likely to have major implications for capital allocation.

Investment Implications

During periods of constructive destruction, active managers seek to identify the likely survivors—and non‑survivors—through in‑depth research focused on company fundamentals. In the current environment, when failures can lead to permanent losses, dodging the losers may be even more important than backing the winners.

Entire sectors and industries are likely to struggle for years in the wake of the current crisis. For example, companies across the “bricks and mortar” retail, travel, hospitality, and entertainment sectors might need to adapt to the new normal or disappear entirely. During such regime shifts, when disruption is abundant, careful selection can distinguish between those companies that are likely to adapt with new business models and those that are unlikely or unable to do so.

Technological Disruption: Active Has Flexibility to Adapt to New Paradigms

The pandemic has intensified a range of outcomes from revolutions in technology and communication. A few decades ago, the largest corporations in the U.S. were in the industrials, energy, and materials sectors. Now the information technology, consumer discretionary, and communication sectors dominate. Within sectors, the leaders have come and gone.

In a world of accelerated innovation and changing consumption patterns, the largest companies in 2025 and 2030 are likely to be different from those of today. The key to successful investing is to identify the leaders of tomorrow rather than simply invest in the leaders of yesterday.

Investment Implications

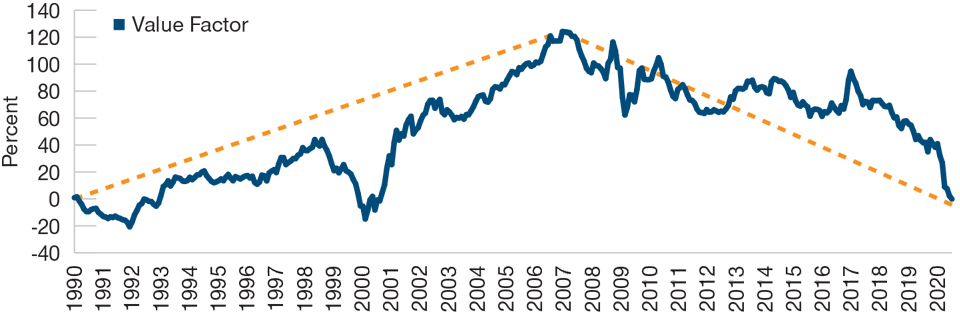

Technological disruption has significantly affected the relative performance of value and growth investment styles. Growth and value stocks have historically taken turns to outperform each other for relatively short periods, but the current growth cycle, which began after the GFC, has been the longest ever. Growth overweights technology stocks, which have performed well since 2007 and are expected to continue doing so. Value, which is often favored by rules‑based factor and smart beta strategies, overweights financials, where banks face challenges because of low interest rates. Investors need to rethink whether some strategies that systematically overweight value rely on old paradigms. If so, they may need to redesign them or use adaptive active management.

Growth Has Outperformed Value Since the GFC

(Fig. 1) Technology stocks have dominated

As of October 31, 2020.

Fama French value factor (HML, high minus low book‑to‑market), January 1990 through September 2020. The dotted lines are the linear trend from January 1990 to December 2006 and from January 2007 to September 2020.

Source: Fama French data library; calculations by T. Rowe Price.

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Fracking—another technological development—has led to lower energy prices. Falling energy prices are not only deflationary, they are also a headwind for commodity exporters and a tailwind for commodity importers. Another source of disruption, it leads to dispersion—the domain of active managers. This presents another source of discretionary alpha, and it gives momentum to moving away from fossil fuel and a potential advantage to portfolios integrating environmental, social, and corporate governance (ESG) factors.

We believe that active management is better positioned to benefit from ESG integration than passive investing, not just by excluding certain types of company (which passive strategies can also do to some degree), but also by investing in firms developing green energy, promoting social fairness, and adhering to good governance practices. Investors should consider ESG as a potential source of return, not just a way to do good, especially in the post COVID‑19 (the disease caused by the coronavirus) world, as interest in green technology and ESG may increase.

Geopolitical Disorder: Adapting to the Future Shape of Markets

Since the GFC, consumer price inflation has diminished, and wage growth has been muted. However, the prices of assets—both financial and property—have skyrocketed. This has led to a widening wealth gap in many countries across the globe. The coronavirus crisis has only served to widen the chasm between the haves and have nots, amplifying the potential for political changes and social unrest. The crisis has also put the spotlight on a range of other geopolitical conflicts and tensions, including the intensifying rivalry between the U.S. and China, the dire economic situation of some energy- and commodity-exporting countries, and the pace of deglobalization as countries and companies reconsider the security of supply chains.

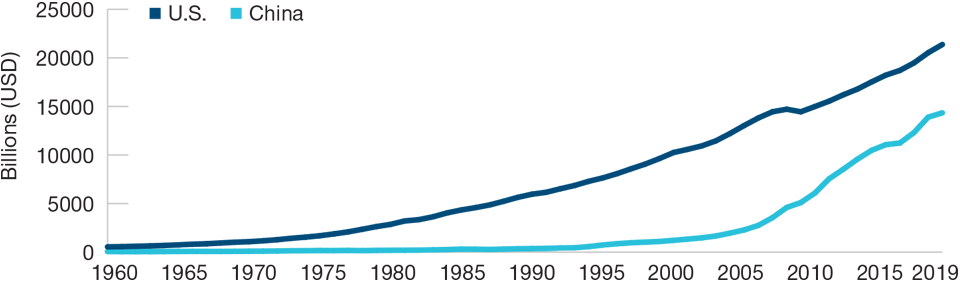

The Gap Between the U.S. and China Is Closing

(Fig. 2) China’s GDP may soon exceed that of its major rival

As of January 1, 2019.

Source: The World Bank; calculations by T. Rowe Price. GDP in current billions of U.S. dollars. 1960 through 2019.

Investment Implications

Geopolitical disorder has implications for market capitalization weighting schemes often used by indices. The weights of securities, sectors, and countries’ financial markets are set by their market value. However, this method is not only backward‑looking, reflecting the performance of investments up to the present, it ignores global structural changes.

For example, if China’s rate of economic expansion continues, its current weighting in global stock indices will soon be understated (Figure 2). While China has the second-largest GDP in the world after the U.S. and may surpass the U.S. economy in the near future, the weight of China’s stock market in global indices, such as MSCI All Country World Index (ACWI), is less than 5%, while the U.S. is weighted at over 50%. Passive index trackers, following market cap indices, cannot account for potential future developments using today’s market values. Active managers have greater potential to monitor and anticipate global trends and position their portfolios accordingly.

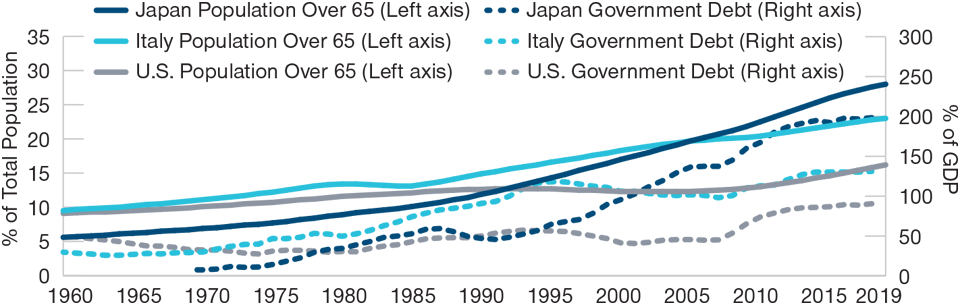

Demographics and Mounting Debt: The Japanification of the Developed World

Describing Japan’s nearly 30‑year battle against deflation and anemic economic growth, Japanification is characterized by ineffective monetary measures, near‑zero bond yields, and ballooning public debt. There are signs that Japanification may become a phenomenon throughout the developed world. For example, Europe’s aging population and a rigid economy may mean the region suffers from slower economic expansion, persistent lower inflation, and sub‑zero real interest rates over time. Similarly, the U.S. may face Japanification because of its diminishing inflation, faltering economic growth, and very low interest rates (Figure 3).

Japanification May Be Spreading

(Fig. 3) The U.S. and Europe face persistent weak growth and low yields

As of January 1, 2019.

Sources: The World Bank (population ages 65 and above % of total population), International Monetary Fund (central government debt % of GDP); calculations by T. Rowe Price. Japan, Italy, and the U.S., 1960 through 2019.

Investment Implications

Lower interest rates make income‑oriented investments less attractive. Some illiquid investments, such as real estate and infrastructure, supposedly offer a stable, inflation‑linked stream of long‑term income. When interest rates and inflation remain low, however, the cash flows generated by such investments are lower and may no longer be an adequate compensation for their illiquidity and high transaction costs. Instead of being forced into less liquid asset classes, investors seeking income should broaden their universe and consider other, more liquid investments. For example, emerging market corporate bonds and multi‑asset income strategies both offer higher cash flows than government bonds while providing greater liquidity than real estate and infrastructure.

Another implication of falling rates is the benign economic conditions after the GFC. Falling interest rates have boosted the prices of most assets. In this environment, passive investing was attractive as asset values tended to increase. However, the drop in interest rates has mostly completed its downward journey—after falling from 4% to 0%, rates are unlikely to drop to -4%. Going forward, implementing investment strategies via passively tracking indices may not work so well.

The Disease: Volatile Markets Heighten Opportunity for Research‑Led Selection

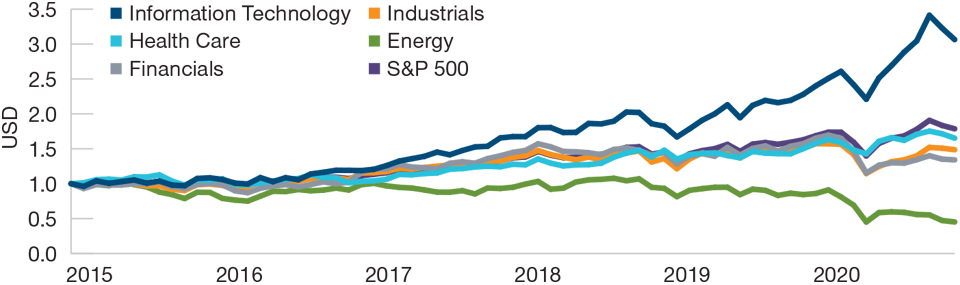

The pandemic has disrupted global financial markets, reigniting volatility and widening the dispersion of returns across sectors (Figure 4). It also appears to be changing the way we live and work.

Investment Implications

The coronavirus pandemic has unsettled markets, sending investments in various directions. For active managers, these dynamics bring welcome dispersion from which skilled managers can identify investments with tailwind stories and deselect those facing headwinds.

For example, in a world in which a global health crisis has resulted in people across the world having to work from home and self‑isolate, sectors such as health care, connectivity‑enabling technology, and online commerce could be long‑term winners. On the other hand, an economic standstill will negatively impact demand for commodities and transportation and will be challenging for banks and physical retailers. Skillful active managers have the opportunity to flourish in this environment.

The Coronavirus Has Driven Dispersion

(Fig. 4) Technology has soared ahead of financials and energy

As of October 30, 2020.

January 2015 through October 2020, total returns of selected sectors in the S&P 500, calculated in U.S. dollars.

Source: S&P; calculations by T. Rowe Price. (See Additional Disclosure.)

Volatility was low for much of the past decade but rose abruptly this year. When crises occur, investors constantly calibrate expectations to an evolving reality—like aiming at moving targets, market prices constantly change, trying to reflect the most probable scenarios. During such volatile periods of adjustments, emotional irrationality leads to deviations of market prices from fundamentals. This is the time when prices mostly diverge from intrinsic values, so acute investors with a keen eye, a clear head, and patience can identify openings, waiting for prices to eventually converge with valuations over time. Volatility is helpful because it creates abundant investment opportunities for skilled active managers.

The virus may also mean that people work more from home, travel less, and maintain social distance from each other for an extended period. This may mean that some investments, such as commercial property investing in office space and capital allocated to airports, may suffer. Investors in such assets may need to reassess those holdings.

Active Management Better Placed to Embrace the Future

When the future takes a different turn, it is more difficult to infer from past trends and relationships. Only investors who can acclimatize are likely to succeed. Passive index trackers, for example, base their investments on the shape of markets today; similarly, rules‑based, quantitative strategies, such as factor investing and smart beta, are based on extrapolating past behaviors and relationships. When things change, those strategies are unlikely to adapt unless they are redesigned. Redesigning them, however, requires the accumulation of extensive data, so these strategies may struggle during transitionary periods.

We believe that only active management can imagine and adapt to the new future. Investors should rethink whether by opting for passive they will not only be exposing themselves to hidden biases, concentration risk, and wider systemic risk, but they also could miss out on the unique opportunities provided by a forward‑looking, judgment‑based approach.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

November 2020 / INVESTMENT INSIGHTS