December 2020 / INVESTMENT INSIGHTS

Credit Investing Roadmap for 2021

Navigating the credit cycle and the road ahead

Key Points

- Unprecedented monetary and fiscal stimulus has helped steady the credit markets. The next leg of growth will need to come from a successful vaccine rollout and a resumption of services consumption.

- We think emerging markets (EM) currently offer attractive diversification and spread premium, backed by stable fundamentals and supportive technicals.

- We believe Asia credit offers particularly attractive risk-adjusted returns.

- Risks to monitor include a potential commodity price pull-back, deteriorating liquidity, and geopolitical risks.

- Investment-grade (IG) bond supply and demand dynamics remain supportive, and we expect to see a fundamental improvement through 2021.

- While IG valuations have tightened, spread dispersion is currently wide, offering opportunities for active security selection.

- In high yield and loans, we are generally constructive. The market has rallied significantly, but spreads remain interesting. We believe loans are attractive on a risk-adjusted basis.

- We currently see the most value in cyclical and/or out-of-favour industries.

If, like a modern-day Rip Van Winkle, you had magically slept through 2020 and then looked at the year-to-date credit returns, you might have thought: “Quite a boring year, then”. Dramatic selloffs have been largely retraced by equally dramatic rallies, leaving valuations close to where they started. So, after the rollercoaster ride, what has changed, and where are we in the credit cycle?

We believe that the current credit cycle could be extended by this year’s unprecedented fiscal and monetary stimulus in response to the Covid shock (globally, we have seen more than 185 rate cuts this year). The stimulus has helped sustain some growth, specifically on the manufacturing and retail side. That said, governments have largely exhausted their monetary and fiscal toolkit, so the next leg of growth will need to come from a successful vaccine rollout and a resumption of services consumption. Further Covid restrictions in the US and Europe will weigh on activity in coming months but, over time, the release of pent-up household demand and inventory restocking should be supportive. Many of the emerging countries have had lower virus case numbers than the developed world, and we would expect them to outperform as they catch up faster.

Overall, we are reasonably optimistic that global demand will hold up long enough for governments to get the pandemic under control – most likely in the second half of 2021.

In the meantime, we see scope for further tightening in spreads. As we discuss below, we’re particularly positive on Asia credit and we see some good value in high yield. Investment grade spreads are tight, but they are also more dispersed than they were, so we continue to see opportunities there.

Emerging Market Corporates

Carolyn Chu—Director of Fixed Income Credit Research

In the context of record low global yields and high equity valuations, we see compelling opportunities in emerging market corporates. At the end of November, EM high-yield credit spreads averaged 5.4%, compared with about 3.8% in the US high yield market excluding energy. EM investment grade spreads averaged about 1.9%.

In terms of default risk, fiscal stimulus employed broadly by EM governments has helped alleviate pressures for many companies. That, together with manageable 2021 maturities (in some cases due to proactive liability management by corporates), points to lower refinancing risk. Hence, the estimated 2021 default forecast for EM high yield corporates is quite modest, at 2.5% to 3%, compared with a long-term average of about 3.5%. For context: in the global high yield market the trailing 12-month default rate was 6.6% at the end of October.

Within EM, we are particularly positive on Asia credit, which today is a roughly US$1.2 trillion asset class. This is a predominantly investment grade market (more than 75% of the debt outstanding is BBB or above), and it offers reasonable diversification both by country and by industry. Over the past decade, the J.P. Morgan Asia Credit Index (JACI) Diversified has delivered annualised returns of 5.4%, at a volatility of 4.6%. This compares favourably with EM corporates and euro investment grade corporates, which have broadly similar annualized returns, but higher volatility of returns (about 6.1% and 9.1%, respectively).

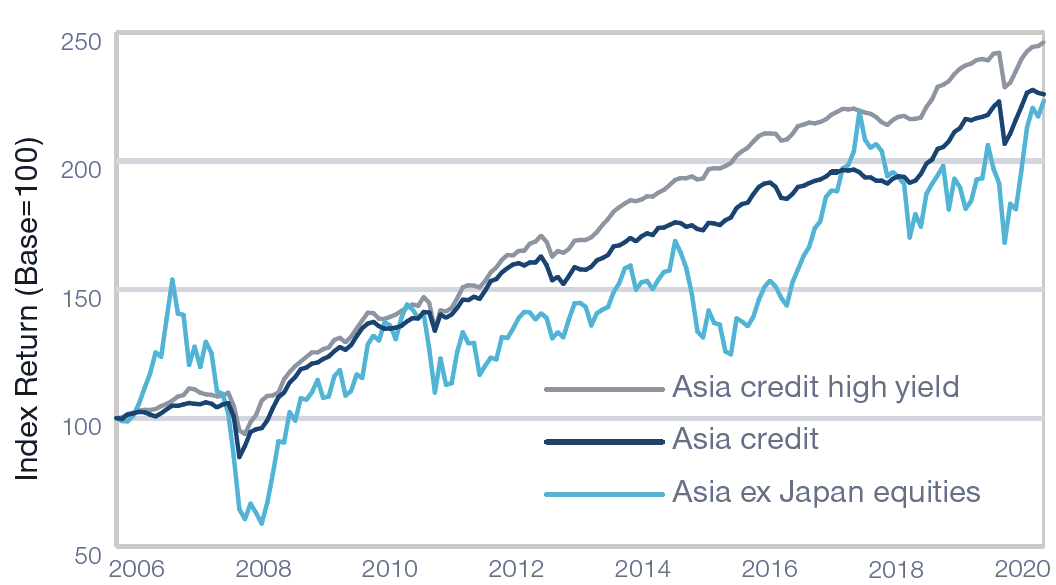

Figure 1. Asia high yield credit has achieved higher, stable returns

Past performance is not a reliable indicator of future performance.

As of 31 October 2020. Asia credit – J.P. Morgan Asia Credit Index Diversified; Asia credit high yield – J.P. Morgan Asia Credit Index Diversified High Yield; Asia ex Japan equities – MSCI AC Asia ex Japan Net Total Return Index Global HY is the J.P. Morgan Global High Yield, JACI HY is the J.P. Morgan Asia Credit Index Diversified High Yield. Sources JP Morgan, MSCI. See Additional Disclosures.

Figure 1 shows how Asia HY credit has matched and outperformed Asia ex-Japan equities over the long run, with a less volatile return path (notwithstanding the fact that Asian bonds are hard currency whereas equity indices are EM currency denominated). Whilst Asia HY credit often does exhibit strong correlation to Asian equities (negative 0.2 to positive 0.9 since 2006), there have been periods (most recently since 2016), where the correlation has been lower, at an average of 0.6.

In terms of return potential, the high yield segment of the Asia credit market is currently trading at a relatively wide discount to Asia investment grade, so we continue to see value there. We think the Chinese property sector offers a particularly interesting combination of yield and fundamentals. As always, careful credit selection is key.

What are the risks? Broadly: fundamentals, liquidity and geopolitical. For example:

- Whilst OPEC+ recently agreed on a modest output increase, any pull-back in oil prices (and commodity prices more generally) would be negative for many EM economies.

- Regional default pressures are a risk to watch. Weaker than expected GDP growth would further strain weakened government fiscal positions following stimulus spending to combat the negative impact of Covid during 2020.

- Regulatory risk in Argentina, which could constrain issuers’ ability to service dollar-denominated debt.

- In China, a more rapid tightening in onshore liquidity conditions (as the government returns its focus to deleveraging) would have implications both domestically and for the rest of the region.

- Banking system stress as Covid-related fiscal support rolls off, insofar as we see a surge in nonperforming loans.

- US-China relations will be one to watch. With President Elect Joe Biden in the driving seat, expectations are that the narrative will be less confrontational than under Donald Trump, though the overall direction of travel is unlikely to change.

- Finally, with upcoming elections in Latin America in 2021, there is always the risk of escalating rhetoric and sometimes poor policy decisions that are populist in nature.

Investment Grade Credit

Michael Lambe, CFA— Investment Grade Team Leader

As we come to the end of 2020, investment grade corporate bond spreads are relatively tight. The Covid shock has taken its toll on credit metrics, and the proportion of BBBs within the asset class has continued to rise, so the case for IG credit is not as strong as it is for high yield and EM.

That said, we’re expecting new issue supply to tail off significantly after this year’s surge. On the demand side, investors need income more than ever. The stock of negatively yielding debt in the Barclays Global Aggregate Index had reached 25% by the third quarter of 2020. And demand should be supported as investors are crowded out of the sovereign and government agency bond markets by stimulus-related bond buying programmes.

On the fundamental side, many companies are cash rich, having raised liquidity to bridge the pandemic downturn. But, talking to management teams, we think many of them remain ‘early cycle’ in their thought process, so it’s too early to be thinking about major M&A activity or equity buybacks. The focus is more likely to be about consolidating their balance sheets, so we think that (unless animal spirits come back much faster than we expect) the tone in 2021 is going to remain more credit friendly than shareholder friendly, and the benefits of a cyclical recovery will first accrue to bondholders.

While overall IG index valuations are largely back where they started, at the issuer level there have been leaders and laggards as some sectors have been more resilient to the Covid shock than others. Dispersion of valuations is therefore significantly wider than it was a year ago, and that improves the terrain for active credit selectors. Our focus is on identifying issuers with uncompromised business models, strong liquidity positions and management teams that continue to be balance sheet aware.

Portfolio themes for 2021 include a preference for BBBs over single As, and we have selective overweights to some Covid recovery names in sectors including global REITS, hotels, online travel and airports. It’s not all about Covid: positions our analysts have high conviction on include some discount retailers in the US, and selected names in beverages and European telecoms infrastructure.

ESG will remain a driving force

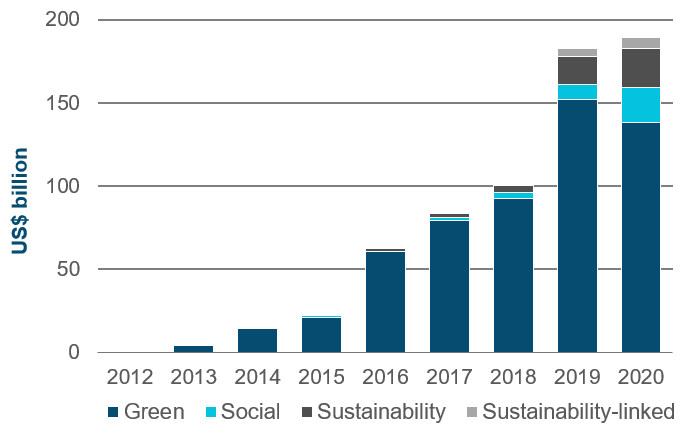

Flows into SRI-branded bond issues continued strongly in 2020 and corporate and financial sustainable issuance remained strong (Display 2). We expect that to continue in 2021.

Our research suggests that, in 2020, issuers were generally paying about 10 to 15 basis points less on green versus non-green bonds. As the market matures, the challenge for investors is to navigate the ‘shades of green’ and assess the projects underlying new bond issues for genuine impact. For sustainable finance to have an impact on areas like energy transition and climate change, we need to make sure that the funds are being directed to the right places.

This includes looking at the marginal impact of green financing. For example, utility companies are natural issuers of green bonds to finance projects such as solar or wind farms, but their costs of funding tend to be quite low already. Some of the more interesting deals we’re seeing are from companies that are not normally considered green, but are launching green projects. For these issuers, access to cheaper funding for these projects could have greater impact.

Figure 2: Global corporate and financial sustainable bond issuance

As of September 2020. Source: T. Rowe Price Research, Bloomberg New Energy Finance.

High Yield and Bank Loans

Jason Bauer, CFA — High Yield Sector Portfolio Manager

We’re optimistic about the high yield bond and bank loan markets as we go into 2021. We’ve been ‘vaccine bulls’ since the Summer, but the November announcements from Pzifer and Moderna exceeded our expectations in terms of efficacy.

The Covid pandemic created ‘haves’ and ‘have nots’. The ‘haves’ were industries associated with sheltering in place (such as food and supermarkets) and those that enabled a working from home environment (such as telecom, cable and tech). The ‘have nots’ included airlines, aerospace, energy, and the entertainment and leisure space, such as theatres, cruise lines and gyms. While we’re optimistic that many of the ‘have nots’ will be able to return to normal as the pandemic is contained, we think the theatre and cruise sectors will be more challenged.

Fallen angel activity has been brisk this year. In March we identified about US$300 billion of potential fallen angel supply. About US$225 billion has now entered high yield space. Many of the new entrants have attractive asset quality and scale compared with traditional high yield issuers. From a technical perspective, the scale of the downgrades, and some forced selling by investors who are not able to hold ‘crossover’ credit, created a fertile hunting ground for our high yield portfolios.

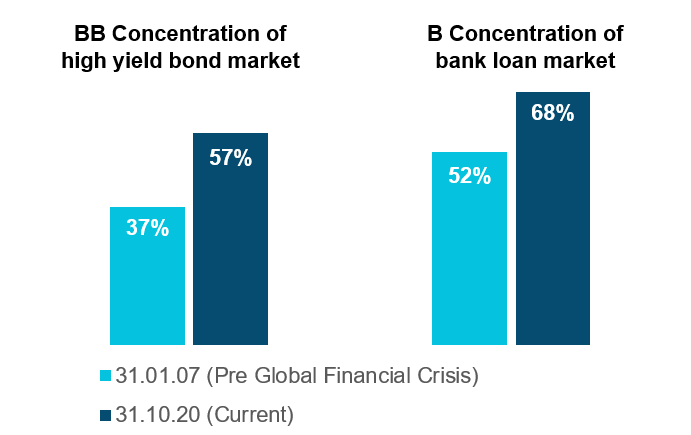

Fallen angels, together with more muted LBO activity, have led to a higher-quality high yield bond market than the last major cycle which culminated in the Global Financial Crisis (GFC). Almost 60% of the market today carries a BB rating (Figure 3).

Figure 3: Credit composition of bank loan and high yield markets

As of 31 October 2020.

Bank loans – Credit Suisse Leveraged Loan Index; High yield bond market – Credit Suisse High Yield Index. Source: Credit Suisse. See Additional Disclosures.

In loans, by contrast, lower-rated single Bs have grown as a proportion of the market. But we think the composition of industries in the loan market helps to soften the impact. There is much less exposure to cyclical sectors, notably energy, and more weighting in defensive sectors such as healthcare and technology.

The default outlook

In the Spring, we did a bottom-up default study in which our analysts predicted a roughly 10% default rate, compared with about 11% during the GFC. But the speed and success of the policy response have been greater this time around.

So far, 2020 default rates in the US have peaked at around 6% and they have been slowly ticking down. There will be more to come, but many companies in stressed industries have been able to access the primary markets and build a liquidity bridge, which will hopefully stave off defaults for some if not for all.

Potential winners in 2021

In terms of where we see opportunities, we remain positive on both high yield bonds and loans, currently with a preference for loans, where in many cases we see potential for capital appreciation.

In bonds, we’ve been leaning into Covid recovery plays since the summer, with a preference for the gaming, lodging and restaurant sectors. In energy, we’ve been focusing on fallen angel E&P (exploration & production) and have had a continued overweight in the midstream part of the energy sector (such as pipelines). We have been selectively buying airline paper, including bonds secured against loyalty or mileage programmes.

In loans we’re playing a similar recovery theme across similar sectors, and we are focusing on the shorter maturities (around 2024, 2025) and/or instruments with LIBOR floors.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.