February 2021 / INVESTMENT INSIGHTS

Five Reasons to Consider EM Local Bonds

Attractive yields and cheap currencies make the sector stand out

Key Insights

- Emerging market (EM) currencies benefit from compelling valuations and the possibility of a turn in the U.S. dollar cycle.

- EM local bonds offer real income potential in a world of very low and negative‑yielding bonds across developed markets.

- Shorter duration profile and potential inflows are also supportive for EM local bonds.

With investors struggling to find much‑needed yield, we believe emerging market (EM) local bonds offer attractive opportunities. The yields on offer from a number of EM local bond markets are among the highest currently available in fixed income, while EM currencies are attractively valued and look set to benefit from the U.S. dollar cycle potentially turning. Below, we identify five factors that we believe support the case for this sometimes underappreciated asset class.

Why EM Local Bonds Could Shine

1. Compelling Valuations in EM Currencies

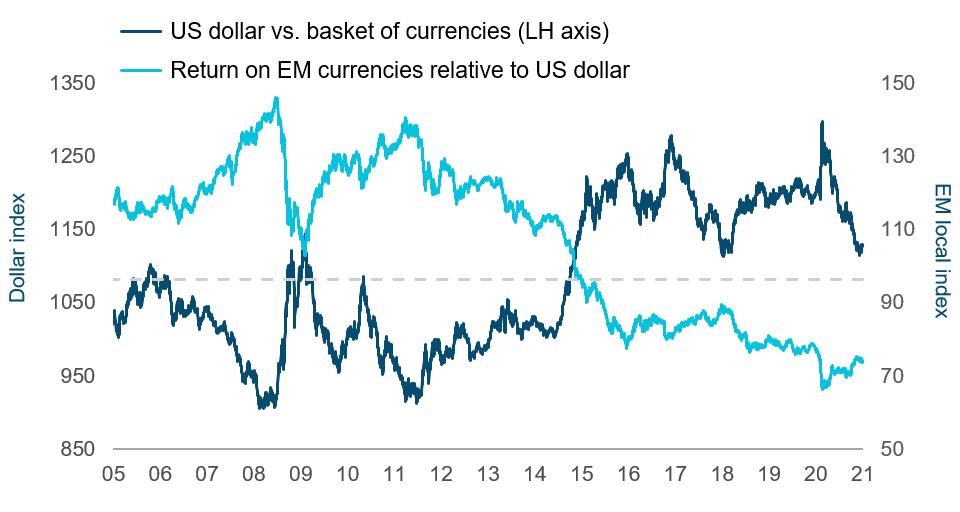

EM currencies still look attractive, in our view. The multiyear U.S. dollar bull run has driven developing currency values down: the value of a basket of EM currencies fell by about 43% between July 2010 and January 2021. The US dollar index appreciated by about 11% against a basket of currencies over the same period. This suggests that there is ample room for EM currencies to appreciate against the dollar over the medium term.

2. U.S. Dollar Weakness a Potential Game Changer for EM Local Bonds

The U.S. dollar appears to be at a key inflection point. Several indicators, including ultra‑easy Federal Reserve policy, and large internal and external imbalances, point to dollar weakness ahead. Such a scenario could see EM currencies finally start to appreciate against the dollar—and, as our research shows, there is some way to go before EM currencies even reach our estimates of fair value.

For EM local bonds, currency appreciation is also beneficial. Why? EM local bond returns consist of three components: interest return, price return and currency return. When EM currencies strengthen against the U.S. dollar, that last factor will contribute to performance and typically will drive gains and flows into the asset class.

3. A Rare Find When It Comes to Yield

For investors, EM local debt offers an increasingly rare source of income in the bond space. Currently, there is more than USD 16 trillion1 of negatively yielding developed market debt. At the end of January, the average yield on EM local currency sovereign bonds was 4.27%, compared with US Treasuries at 0.65% and Bunds at negative 0.58%2.

With major central banks expected to keep accommodative policies in place for some time, that picture is unlikely to materially change anytime soon. Against this backdrop, securing yield is likely to become increasingly important.

The dollar's shine has started fading

Time for a turn in EM currencies' fortunes?

As of 31 January 2021. Past performance is not a reliable indicator of future performance. Source: Bloomberg. Please refer to the additional disclosures for further source information. BBDXY is the Bloomberg dollar spot index. EM FX Index is the J.P. Morgan GBI‑EM Global Diversified FX component return relative to the USD.

4. Attractive Duration Profile

It is not just a yield story. The lower‑duration characteristics of EM local are also more favourable than developed markets, where the maturity of outstanding debt is longer. Why is this an attractive feature? Because the longer the duration, the greater the level of potential volatility and sensitivity to changes in interest rate rises. At the end of January, the average duration in EM local bonds was 5.4 years compared with an average of 7.1 years for U.S. Treasuries and 8.5 years for German Bunds2.

5. Room to Absorb Investor Inflows

From a technical perspective, investment flows into EM local have fluctuated since last year’s selloff, but have been relatively modest compared with (for example) EM hard currency corporates and sovereigns, which have received substantial inflows. Given that EM Local has been relatively underinvested for several years, there is some way to go before concerns emerge about excess inflows or a potential price bubble.

Taking these five factors into account, we believe the case for EM local bonds remains compelling. We believe it is much more than just an attractive yield story—the sector’s duration profile and the potential to gain from EM currency appreciation are also supportive. But it is important to take a long‑term view because, like most risk assets, EM local bonds are vulnerable during periods of risk aversion. For now, though, the path ahead for risk assets looks a bit smoother with the U.S. election risk out of the way and progress being made the rollout of vaccines for the coronavirus.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2021 / INVESTMENT INSIGHTS