June 2022 / MARKET OUTLOOK

Are the Clouds Set to Clear for Chinese Equities?

Embracing uncertainty and inefficiencies to focus on future drivers of growth

Key Insights

- While economic growth has been challenged, we believe China is in a favorable position where monetary policy is expected to ease as inflation remains contained.

- Attractive valuations and diminishing regulatory headwinds help provide a more favorable backdrop.

- With a large but inefficient market, we believe there is ample scope to pursue genuine alpha opportunities.

Chinese equity markets have endured a tough year. A confluence of factors has weighed on the market, including regulatory crackdowns, geopolitical tensions, the potential delisting of Chinese ADRs, an ongoing property sector downturn, and an outbreak of the highly contagious omicron variant of COVID‑19. Some investors have even questioned the logic of investing in Chinese equities. However, we remain constructive as we believe there are both cyclical and structural reasons why Chinese equities remain attractive for investors.

China in a Unique Position to Loosen Economic Policy

Many governments provided aggressive stimulus packages during the pandemic. While those policies were necessary to support economies, they have resulted in decade‑high inflation rates in many countries. Most now find themselves needing to aggressively tighten economic policies. In contrast, China is in a relatively unique position in these current times where inflation remains under control. That provides room for economic policies to loosen as policymakers seek to support economic growth.

This is possible, in large part, thanks to the preemptive action taken by Chinese policymakers. China recovered quickly from the first wave of COVID‑19, so much so that after the third quarter of 2020, the government began to withdraw some of the pandemic stimulus and tighten policy, including fiscal, monetary, and regulatory policy. Beijing’s policy‑tightening bias continued well into 2021 and is one of the main reasons why inflation has remained under control and also why we are now experiencing a slowdown in economic activity, along with the impact from pandemic‑associated lockdowns.

The early post‑pandemic tightening and limited concerns around inflation afford policymakers much more room to maneuver to stimulate the economy going forward.

Focus on the Full Economic Cycle and Not Short‑Term Weakness

It is important to not focus solely on specific GDP growth figures but instead on where China stands in its economic cycle. We believe the economy is currently passing through its trough and should begin to improve over the coming quarters. The drag from COVID‑19 outbreaks and a weak property market are likely to alleviate. At the same time, we should start to see supportive polices come through that could help the real economy.

Many question whether the zero‑COVID policy is sustainable, given the highly infectious nature of the omicron variant of COVID‑19. While we think we could continue to see mini outbreaks from time to time, we would expect China to avoid another major disruption like we saw in Shanghai. At the same time, while there is no clear timeline on when China will adopt a living‑with‑COVID policy, the acceleration of vaccination and approval of COVID‑19 drugs are positive signs. We believe that beyond short‑term challenges, China’s economy will be much better positioned in one to two years.

China’s Equity Cycle Is Turning as Regulatory Concerns Abate

China suffered an onslaught of credit and regulatory tightening across several sectors last year. A string of regulations introduced in pursuit of common prosperity goals cast skepticism about prospective return on invested capital (ROICs), reinvestment rates, and total addressable markets, prompting a protracted sell‑off in many of the market favorites. Internet platforms, health care, and real estate stocks sold off sharply as a result. We are of the view that these sectors have likely passed the peak of the regulatory cycle, and we see policy prescription moving away from new regulations toward ones that should be more supportive of growth.

We have already started to see a more positive tone on the regulatory front, but the market remains muted due to a combination of previous concerns and negative headlines in a market that is currently very fragile. Some Chinese stocks are trading at one to two standard deviations below their Western peers. History suggests that these types of dislocations tend to provide longer‑term opportunities.

Market Volatility and Inefficiencies Play Into the Hands of Long‑Term Investors

Many would agree that 2022 has, so far, been an extremely difficult period for investing, with a confluence of disparate factors causing a sharp rise in volatility, driving equity markets lower. Many of these factors, however, are transitory in nature. We believe that some of the fundamental drivers of stocks have been forgotten in the haze of extreme volatility.

Volatility and inefficiency have the potential to bring opportunities for long‑term active investors. China’s market, with its heavy retail investor base, has always featured inefficiencies that we look to exploit. The spike in volatility has presented fundamental investors with additional opportunities to invest in mispriced assets.

High‑end manufacturing is an area where we find ample opportunities. While many companies are well positioned with strong competitive advantages, their near‑term outlook has been clouded. First by rising input costs driven by the Russia‑Ukraine conflict, then by supply chain disruptions from renewed pandemic lockdowns. Neither event alters our longer‑term views on those businesses. Rather, we believe the recent correction enhances the outlook for their future returns.

Chinese Electric Vehicles are Leading the Way

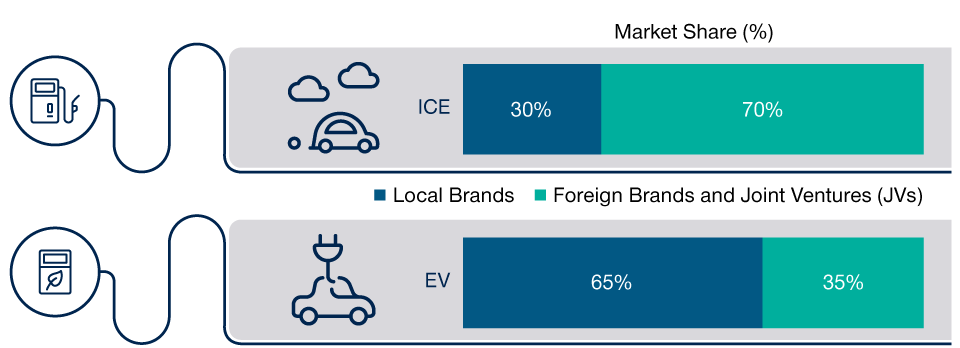

(Fig. 1) The potential for EVs is large, both from a domestic and an international perspective

As of December 31, 2021.

ICE vehicles are conventional vehicles powered solely by an internal combustion engine (ICE).Source: Goldman Sachs.

The pandemic will remain a headwind for the economy, but we also see it as a catalyst for accelerating industry consolidation. We have seen meaningful capacity reduction in sectors like hotels, restaurants, and furniture retail. Industry leaders are widening their advantage gap versus smaller players. As the situation normalizes, we could potentially see a stronger pricing cycle over the next couple of years with rising margins. It will require patience, but ultimately, we believe that we will potentially be rewarded with better returns.

Long term, we believe technology and innovation will continue to drive opportunities in China. Over the past decade, smartphone and mobile internet have been major sources of value creation. For the next five to 10 years, we believe electric vehicles (EVs) and the transition to greener energy will be the main drivers.

Opportunities From a Global and Local Transition to a Greener Economy

The EV sector is an area where the potential is large from both a domestic and international perspective. (Globally, the auto industry is around eight times larger than smartphones.) As opposed to cars powered by internal combustion engines (ICEs), where Chinese brands are viewed as offering inferior quality and technology, the picture is much better for Chinese manufactured EVs. While local manufacturers have a 30% share of the domestic ICE auto market, for EVs that share jumps to 65% (Figure 1).

China clearly has the potential to become a major global manufacturing base for EV autos and components. It is already building one of the world’s most comprehensive electric vehicle supply chains. As a result, many global auto original equipment manufacturers (OEMs) have started to use China as their manufacturing base to export electric vehicles around the world. The investment opportunity is not just in obvious areas like electric car batteries and auto OEMs, but also in upstream areas like auto parts, automation companies, and semiconductors. We think EVs could become a critical driver for China’s industrial upgrade over the next decade.

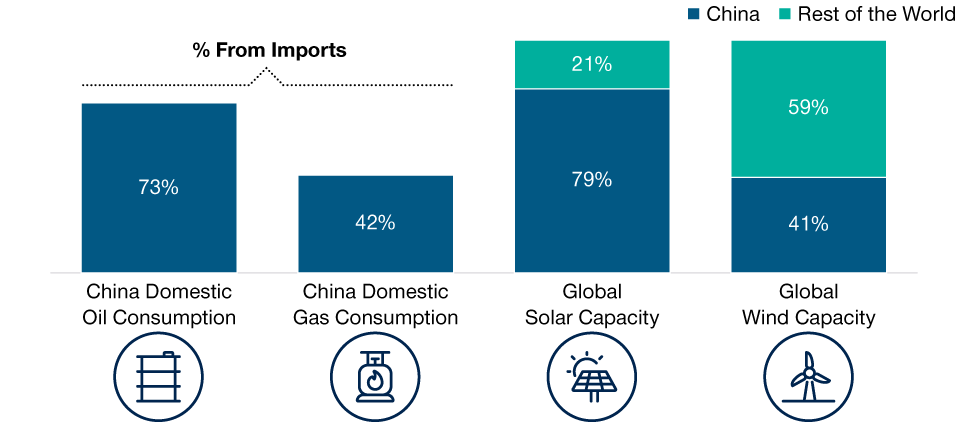

China remains the world’s largest fossil fuel emitter, but we believe there is a real commitment to a green transition, and we have already seen policy shifting in that direction. The country is a significant importer of traditional energy today—importing 73% of its oil and 42% of its gas needs (Figure 2). A future that makes greater use of renewable sources of energy will allow China to become more self‑sufficient and serve both economic and social goals—helping to reduce the damaging effects of pollution on society.

Oil and Gas Import Dependency Is Driving China’s Green Transition

(Fig. 2) China dominates in solar and wind capacity

As of March 31, 2022.

Sources: SolarZoom, CPIA, Jefferies estimates, Credit Suisse. © 2022 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

The transition away from a carbon‑intensive economy to a more sustainable economy also offers a tailwind to industrial transformation. It is forecast that China plans to spend in the region of USD 16 trillion on its green transition to achieve its goal of carbon neutrality by 2060. It also aims to achieve a peak in its emissions by 2030. We believe it is well placed to meet those targets. China already enjoys a 79% share of the global market for solar power and a 41% share in wind power (Figure 2). As more countries increase their focus on renewable energy sources, we believe China has the potential to gain from the green transition both at home and abroad.

Structural and Cyclical Reasons Why Chinese Equities Look Attractive

China has different regulatory framework and business cycles, which means that headlines can often drive the narrative.

However, investing in China demands a look beyond the immediate headlines to the longer‑term opportunity. China remains supported by strong domestic consumption, continuing industrialization, and increasing technology and innovation. We believe these will help to deliver the sustainable economic growth that Chinese policymakers are seeking.

From a cyclical perspective, with monetary policy easing to support economic growth, along with depressed valuations in many areas of the market, we are constructive on the outlook for Chinese equities. The dynamism, size, and depth of Chinese stock markets continue to excite us, and this rapidly expanding opportunity set offers real opportunity for long‑term fundamental investors to deliver alpha for clients.

As the headwinds that have negatively impacted Chinese equities in recent times begin to dissipate, we believe that better opportunities will present themselves. The sky may not currently be blue, but we believe the clouds are beginning to clear.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.