September 2022 / U.S. EQUITIES

A Goldilocks Approach to Equity Investing

Durable dividend growers are "just right" in most markets.

Key Insights

- The view that higher-yielding large-cap stocks are a refuge because of their scale and defensive qualities may be due for a rethink.

- The likely durability of a company’s growth outlook is a critical consideration, even if the possible magnitude of growth gets more attention.

- We believe investing in quality companies with sustainable dividend growth is a superior approach to purely seeking high dividend yields.

Rising inflation and interest rates have taken their toll on markets in the first half of the year and sparked concerns about the extent to which economic growth and corporate earnings could deteriorate.

Dividend-paying1 stocks might strike some investors as a potential haven. After all, the appeal of income-oriented stocks typically increases during periods when the broader market is down or flat. In that environment, dividend payments become an important source of return and can serve as a bit of a shock absorber.

But selectivity is critical. And a refresher course on dividend stocks may be in order after an extended runup in growth names made these payouts somewhat of an afterthought.

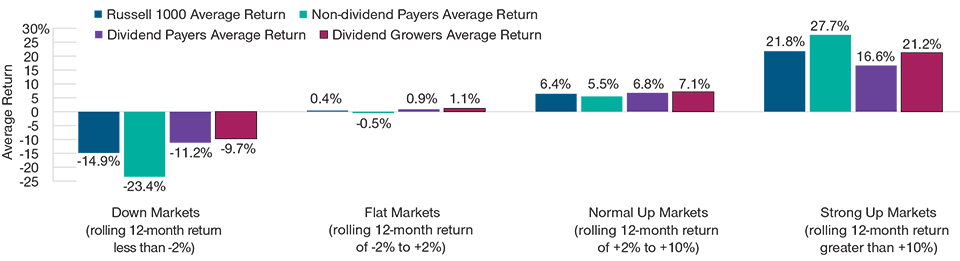

We believe that dividend growth stocks, which historically have run neither too cold during downturns nor too hot in speculative markets (Figure 1), are well positioned in the current environment and beyond. However, not all dividends and not all growth stories are created equal.

Dividend Growers Have Outperformed in All But the Strongest Up Markets

(Fig. 1) Performance in various market environments by dividend policy*

Past performance is not a reliable indicator of future performance.

December 31, 1986, to December 31, 2021.

Sources: Compustat and FTSE/Russell (see Additional Disclosures). Analysis by T. Rowe Price.

*Based on rolling 12-month returns, measured monthly.

At the start of every month, T. Rowe Price categorizes the Russell 1000 Index into various categories depending on dividend policy. We then calculate that month’s market cap-weighted returns for each category. We accumulate the returns during the full periods and calculate the annualized total returns for each category. Dividend growers consist of companies whose dividend growth over the prior 12 months was greater than zero. Dividend payers consist of companies whose current dividend yield is greater than zero. Non-dividend payers consist of companies whose current dividend yield equals zero.

The Case for Dividend Growers

The view that higher-yielding large-cap stocks are a port in the storm because of their scale and defensive qualities may be due for a rethink.

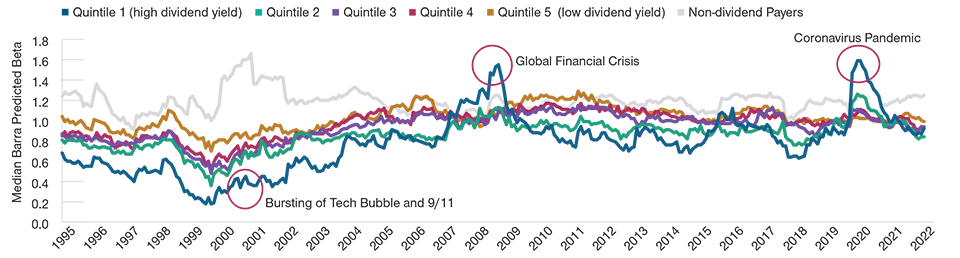

Over time, the highest-yielding quintile of the Russell 1000 Index has come to exhibit higher beta during periods of market stress—precisely when investor demand for safety was at its highest.

High-yielding large-cap stocks were relatively resilient when the information technology bubble burst in the early 2000s. However, the group experienced sharp volatility in the 2008-2009 financial crisis and the pandemic-driven sell-off in the back half of 2020 (Figure 2).

Highest-Yielding Dividend Payers Have Become More Volatile in Times of Stress

(Fig. 2) Beta by quintile of dividend yield for companies in the Russell 1000 Index*

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

June 30, 1995, to June 30, 2022.

Sources: Barra MSCI, Compustat, FTSE/Russell, and Refinitiv (see Additional Disclosures). © 2022 Refinitiv. All rights reserved. Analysis by T. Rowe Price Quantitative Equity Division.

*Beta measures the volatility of a stock relative to the broad market. Barra predicted beta seeks to quantify potential relative volatility by comparing a stock’s historical returns against those of a benchmark using company and industry risk factors. Barra re-estimates the risk factors monthly, so the predicted beta reflects changes in the company’s underlying risk structure in a timely manner. For this reason, we view this metric as a fair representation of potential market sensitivity. Here, the Barra predicted beta for non-dividend payers and each quintile of dividend payers in the Russell 1000 Index is based on the equally weighted median. Each month, the universe of stocks is sorted by indicated dividend yield, which extrapolates the most recent dividend per share at a point in time out for the next four quarters.

What changed?

The Russell 1000 Index’s highest-yielding quintile now includes fewer utilities, real estate investment trusts (REITs), and other defensive stocks than in the past. These names have given way to more companies from cyclical sectors, such as financials, energy, and consumer discretionary, that typically exhibit greater sensitivity to economic conditions.

The risk profile of the highest-yielding segment also tends to deteriorate during significant market drawdowns because the ranks start to include more stocks that have sold off on concerns about business risks or a possible dividend cut.

In the first half of 2022, exposure to energy stocks, which benefited from elevated oil and gas prices, helped the highest-yielding cohort in the Russell 1000 Index to gain ground. Recent strength aside, historical data suggest that investors seeking dividend-paying equities should go beyond yield to consider fundamental factors that help to sustain growth—for example, business quality and the potential consistency and durability of a company’s earnings.

Inflation and rising interest rates can also be headwinds for income-oriented equities, especially those with limited growth potential. Higher consumer prices can diminish the future purchasing power of a flat dividend. Meanwhile, rising rates and perceived safety may make bond yields more competitive with stocks on a relative basis.

Companies that can grow their cash flows and dividends at a strong rate, in contrast, may be able to offset some of the erosive effects of inflation and higher interest rates. Inflationary pressures and the risk of an economic slowdown are challenges for all companies, to varying degrees. However, the dividend payout ratio for the S&P 500 Index remained below the long-term historical average as of the end of the second quarter.2 Large-cap companies may have the capacity to increase their dividends—or at least have some cushion if earnings were to contract.

The Case for Durable Growth

Growth investing is based on the premise that stocks tend to track earnings and free cash flow over time.

But not all growth is created equal. The potential durability of a company’s growth story can be an important consideration.

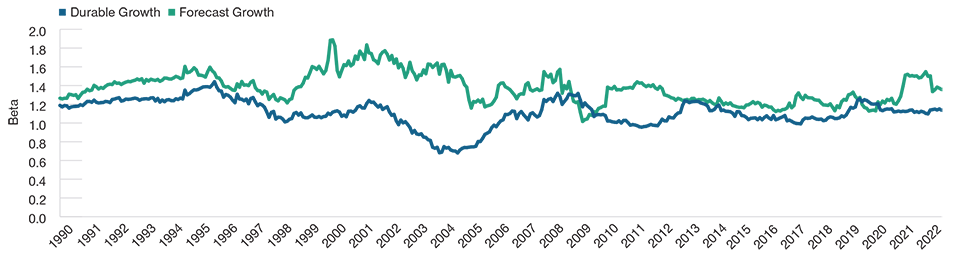

Research conducted by T. Rowe Price’s Quantitative Equity Division shows that companies with track records of sustained profitability and earnings increases tended to exhibit lower volatility, on average, than names with the highest multiyear consensus estimates for future earnings growth (Figure 3).

Durable Growth Stocks Have Exhibited Less Volatility Than Forecast Growth Stocks*

(Fig. 3) Equally weighted average beta†

Past performance is not a reliable indicator of future performance. For illustrative purposes only.

January 1, 1990, to June 30, 2022.

Sources: Compustat, FTSE/Russell, and Refinitiv (see Additional Disclosures). © 2022 Refinitiv. All rights reserved. Analysis by T. Rowe Price Quantitative Equity Division.

*The study universe comprises the 1,000 largest U.S. companies by market capitalization, rebalanced monthly. Within this universe, the durable growth group is the quintile that scores the highest on 5 criteria: (1) consistency of sales growth over the trailing 5 years, (2) consistency of earnings growth over the trailing 5 years, (3) stability of earnings over the trailing 5 years, (4) profitability over the trailing 12 months, and (5) balance sheet strength over the trailing 12 months. The forecast growth group is the quintile with the highest level of predicted growth. Prior to 2005, forecast growth is based on the consensus estimate for earnings per share 5 years out; thereafter, the defining metric is the consensus forward sales estimate for 2 years into the future. This shift in methodology reflects data availability but still captures forward-looking growth. The durable growth and forecast growth quintiles are re-sorted each month.

†Here, the betas for the durable growth and forecast growth groups are relative to the Russell 1000 Index.

These different risk profiles appear to be rooted in the interplay between business fundamentals and market expectations.

The “durable growth” segment in this analysis comprised companies with solid balance sheets that generate a profit, have track records of consistent growth on the top and bottom lines, and historically have exhibited less variability in their earnings. Companies with these qualities may not necessarily look cheap on a valuation basis.

But the consistency of their past earnings growth can help to anchor investor expectations and may help to blunt the pain when valuation multiples contract.

For the stocks that landed in the “forecast growth” category, the consensus estimates for future earnings and sales implied a greater degree of speculation regarding how the underlying business would perform over time. Here, the possibility of a wider range of outcomes likely contributed to the higher level of volatility in these stocks.

These two groups of growth stocks have exhibited much different return profiles.

The same study found that the durable growth companies typically outperformed, with their equally weighted average return beating that of the forecast growth cohort in 72% of the two-year periods, rolled monthly, from January 1990 to June 30, 2022. Relative to the Russell 1000 Index, the durable growth group in our study outperformed in 69% of these rolling two-year periods.3

In contrast, the forecast growth group’s stronger excess returns typically coincided with speculative markets, such as the internet bubble of the late 1990s and early 2000.

The Sweet Spot of Income and Growth Investing

The stocks that we target typically sit at what we view as the sweet spot of income and growth investing. We believe investing in companies with sustainable dividend growth is a superior approach to purely seeking high dividend yields. We also gravitate toward high-quality businesses that should be durable enough to sustain a strong run of earnings, cash flow, and dividend growth.

Where we are finding these sorts of opportunities has evolved considerably over the past two decades. Focusing on high dividend growth allows us to invest in a wider range of industries beyond legacy telecoms, REITs, and others that traditionally have offered high dividend yields. Whether we are evaluating opportunities in a defensive or a cyclical sector, the potential durability of a company’s earnings and dividend growth remains our north star.

We are especially interested in pursuing established companies that offer exposure to powerful secular growth trends while also generating a consistent and rising stream of free cash flow to fund dividend increases.

For example, Microsoft and information technology consulting firm Accenture offer exposure to the growing digitalization of the economy and its ongoing shift to cloud-based software and services. Enterprise spending on information technology could slow with the economy. But the longer-term trend should remain intact: Investments in these capabilities tend to improve productivity and are critical for businesses to remain competitive.

Other key transformations where we are finding opportunities include the wave of innovation-fueled capital investment taking place in drug development as well as the rise of digital payments, clean energy, and electric vehicles. It’s not always necessary to sacrifice a dividend when looking for investments in these areas of structural growth.

Dividend growth stocks have held up relatively well in the first half of the year. We believe that thoughtful and nuanced investing in high-quality dividend growers can be an all-weather approach. Market history shows that these kinds of stocks have tended to hold up better in the bad times while capturing a good portion of the upside in all but the most speculative markets.

What We're Watching Next

We are always on the lookout for any near-term dislocations, broad-based or company-specific, that could create a compelling opportunity in dividend growers that meet our criteria for quality and potential sustainability. Valuations in many traditional defensive sectors strike us as somewhat full. We are finding opportunities in industrials, though we are being thoughtful and methodical in our positioning.

Risks: All investments are subject to risks, including possible loss of principal. Dividend-paying stocks may lag shares of smaller, faster-growing companies. Also, stocks that appear temporarily out of favor may remain out of favor for a long time.

GENERAL PORTFOLIO RISKS

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Environmental, social, and governance (ESG) and sustainability risk—These risks result in a material negative impact on the value of an investment and performance of the portfolio.

Equity risk—In general, equities involve higher risks than bonds or money market instruments. Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

Additional Disclosures

Copyright © 2022, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.

Barra and its affiliates and third-party sources and providers (collectively, “Barra”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any Barra data contained herein. The Barra data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by Barra. Historical Barra data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the Barra data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

September 2022 / VIDEO

September 2022 / VIDEO