August 2023 / ESG

2023 TRPIM Proxy Voting Summary

Key trends in T. Rowe Price Investment Management’s proxy voting activity over the past year.

Executive Summary

In this report, we summarize T. Rowe Price Investment Management’s (TRPIM) proxy voting record for the 12-month reporting period ended June 30, 2023. Our goal is to highlight some of the critical issues in corporate governance during the period and offer insights into how we approach voting decisions in these important areas. This report is not an all-inclusive list of each proxy voted during the year but is, instead, a summary of the year’s most important themes.

Stewardship and Voting Are Firmly Embedded in Our Investment Platform

T. Rowe Price Investment Management recognizes and adheres to the principle that one of the privileges of owning stock in a company is the right to vote on issues submitted to a shareholder vote. We support actions that we believe will enhance the long‑term value of the company and oppose actions and policies that we see as detrimental to value. To reflect this, we vote each proxy using internally developed guidelines and policies while also recognizing individual circumstances. To arrive at the best judgment, we leverage the expertise of our corporate governance experts and financial analysts, with portfolio managers maintaining ultimate responsibility for voting on behalf of their clients.

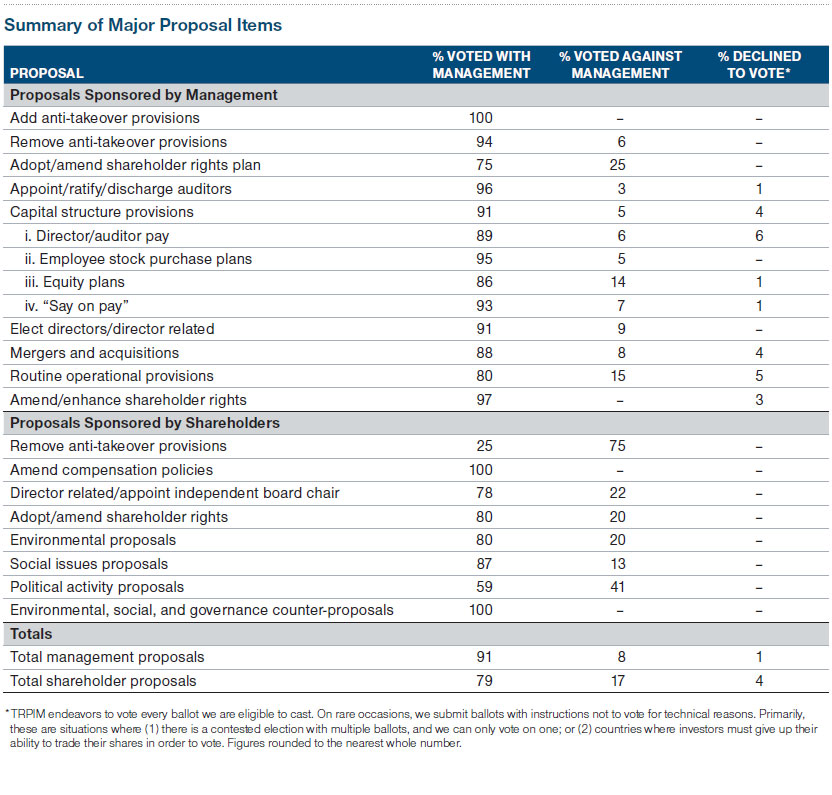

The table below is a broad overview of our voting actions, grouped into appropriate categories of interest, which we describe in more detail later in the report. As this is the first year that T. Rowe Price Investment Management is reporting standalone voting statistics, we will reference general key directional changes of our portfolio strategies.

Themes From Voting Results

A key theme to highlight during this reporting period is that our overall level of support for directors, at 91%, was lower than last year. This was partly due to our expanding existing policies, which brought more companies into scope (notably, hardening our stance on companies with dual class voting shares), as well as fully applying our long‑term classified board policy that was originated last year.

Another prominent theme evident over the past 12 months was a continued increase in the number of shareholder proposals of an environmental and social nature. This follows on from a dramatic increase in 2022 as the U.S. Securities and Exchange Commission (SEC) expanded its interpretation of the types of resolutions eligible to be added to a company’s proxy. Additionally, proponents and companies are showing less willingness to settle, with a higher number brought to the vote.

However, in 2023, we continued to see many proposals that were poorly targeted, overly prescriptive, and brought by proponents seemingly motivated by reasons outside of fiduciary considerations. As always, we approached all shareholder proposals on a case‑by‑case basis.

Social, Environmental, and Political Proposals

As mentioned, 2023 saw a record number of proposals of an environmental and social nature across the Russell 3000 Index, with over 800 proposals. The level of overall shareholder support continued to fall from 2021 highs (over 30%) to the low 20% range in 2023 for proposals of an environmental and social nature.

Climate‑Related Proposals

Climate‑related proposals continued to expand, from calls to increase disclosure of emissions (which we are in favor of; transparency of disclosure directly helps investors assess risks) to calls for companies to adopt typically science‑based targets to reduce emissions. A number of these proposals in 2023 imposed too short and unrealistic time frames to allow companies to properly evaluate and assess the size and appropriateness of targets, and, in these cases, we did not support the proposal.

As with all proposals, we assess climate‑related proposals through a fiduciary lens, taking into consideration the company’s business model, competitive landscape, and performance in this area.

An important consideration here is also our perspective that ultimate accountability and oversight of environmental, social, and governance matters resides with the board of directors. As such, and post‑engagement, we may express any reservations by withholding support for accountable directors.

When considering all types of climate‑related shareholder proposals, we supported management around 80% of the time.

Social Proposals

Regarding shareholder proposals of a social nature, we continued to see a significant number calling for third‑party racial audits; transparency around fair treatment of workers when collectively organizing; as well as, following the Supreme Court’s Dobbs ruling in 2023, proposals around reproductive rights.

In 2023, we considered only a minority of proposals to be in our interest. Our framework here is to identify whether the proposal addresses a material issue of relevance to the company. We examine company disclosure and look at whether the company has a track record of controversies. Where these coincident factors were present—especially if we were not satisfied with the company’s response to engagement efforts— we supported the proposal. In 2023, we supported around 13% of shareholder proposals that dealt with social issues.

Political and Lobbying Activity Proposals

We witnessed a higher number of proposals asking for companies—or, in some cases, a third party—to report on values congruency between corporate policies and political expenditure.

We were more sympathetic to those proposals that focused on how election spending aligns with corporate policy, coupled with disclosure deficiencies or evidence of controversies at the company in question. Of the 26 proposals of this type, we supported 11 (40%).

Election of Directors

In this reporting period, we fully implemented our long‑term classified board policy, where we withhold support for directors accountable for governance and the lead independent director. In 2022, the general approach we took was to support directors while we positively engaged for change. Following an extensive engagement program, we were successful in playing a part in the eventual declassification of boards at a number of our holdings. After our 2022 engagement campaign, in 2023, we escalated remaining concerns via withholding support for accountable directors.

Additionally, in 2023, we hardened our approach to companies where dual‑class voting is materially present—where, typically, a narrow shareholding base exerts disproportionate voting influence relative to their economics. This latter policy change resulted in more company directors being brought into scope of policies to withhold support.

These policies complement our existing approach to assessing a board’s composition and includes factors, such as level of independence, balance of tenure, and diversity, measured through multiple lenses. Where there is cause for concern, we vote against the reelection of individual directors, the members of a key board committee, or, in some cases, the entire board. Examples of situations where we believe shareholders are best served by voting to remove directors include:

- failing to remove a fellow director who received less than majority support in the prior year

- failing to implement a shareholder resolution that was approved by a majority vote in the prior year

- adopting takeover defenses or bylaw changes that we see as contrary to shareholders’ interests

- a director maintaining multiple directorships—especially if the CEO of an outside company—which could lead to “over boarding”

- maintaining the decoupling of economic interests and voting rights in a company through the use of dual‑class stock without the presence of a reasonable time‑based sunset mechanism

- failing to consistently attend scheduled board or committee meetings

- maintaining an insufficient level of diversity at the board level

As in previous years, there were several proxy contests at investee companies—some settled and some brought to the vote. These situations always require careful company‑specific evaluation and engagement. In cases where we believe that a new perspective or change of strategic direction would unlock value, we support the dissident. Of the three cases that came to the vote in this period, we supported change in two of these situations.

Executive Compensation

In the U.S., the most meaningful signal of shareholders’ views on executive pay is through the annual or triannual “say on pay.” While this is advisory, focusing only on backward‑looking awards, this item targets a central issue—how and why executives are incentivized and compensated—and so it is a key focus of dialogue between companies and shareholders.

We take a nonprescriptive approach to say on pay. However, the key principles of our approach are that pay should be linked to company performance (typically, as measured by shareholder return), especially over a meaningful time frame, and that pay should also be broadly in proportion to the size of the company, referenced to the market value and earnings. We generally prefer awards linked to performance metrics, such as shareholder returns or financial metrics, and for these targets to be set over the appropriate time periods.

We saw a continued improvement in both the structure of compensation and companies disclosing more fully the details and rationale of awards. In 2023, we voted against 7% of say on pay items.

Equity Compensation Plans

We believe that equity compensation and ownership of equity by management is key to promoting alignment between shareholders and management. When analyzing the appropriateness of the equity ask from companies, we view this through various lenses. We look at how appropriately equity has been used in the past; how widely equity is awarded throughout an organization; a wider distribution aliging with our interests. Two central considerations are the degree of dilution that we as shareholders are exposed to, as well as plan features, especially those that could lead to outcomes incompatible with our interests (such as evergreen renewal features). In 2023, we supported 85% of new equity plans and existing plan amendments.

Mergers and Acquisitions

While we generally vote in favor of merger and acquisition proposals put forward by our investee companies. This follows a careful assessment of the likely value creation that will ensue from the proposed transaction. Exceptions are where we identify that our clients are not receiving full value, or we question the financial or strategic rationale of a transaction. As with all investment decisions, individual portfolio managers have ultimate responsibility and make the decision on behalf of their clients. In 2023, we voted against 8% of items in this area.

Takeover Defenses

We consistently vote to limit or remove antitakeover devices at investee companies. We oppose the introduction of shareholder rights plans (so‑called Poison Pills), and we will oppose the reelection of directors at companies that adopt such plans without them being submitted to a shareholder vote. We believe they act as mechanisms that can thwart full value realization to the detriment of shareholders. Happily, we see companies increasingly moving to reduce antitakeover mechanisms such as supermajority vote requirements. In 2023, we uniformly voted to remove antitakeover measures. The only vote registered that is not in line with this is a result of “mirror voting” at entities where, due to our ownership size, we are obliged to vote holdings in excess of 10% in line with votes cast by other shareholders.

Shareholder Rights

Our perspective as representatives of our clients is to champion shareholder rights. Happily, we have seen that, in response to shareholder pressure, companies continue to make progress in improving rights, such as by moving to declassify boards and adopting majority voting standards. These are proposals that we consistently vote in favor of. In terms of the ability to call a special meeting and the appropriate ownership threshold needed to achieve this, our policy is more nuanced. Provided that there is an existing ability to call a meeting under provisions that we regard as acceptable, we generally do not support shareholder proposals that call for lower limits.

Separate Board Chair and CEO

While regional standards vary in terms of board leadership, U.S. companies are required to outline and discuss their adopted structure. Our approach mirrors this in that our policy is to examine the need for an independent chair on a case‑by‑case basis and depending on whether it is appropriate to separate the roles of chair and CEO. In 2023, we supported 22% of shareholder proposals that called for an independent chair.

Conclusion

For company‑specific voting records for the 12‑month period from July 1, 2022, to June 30, 2023, please see our corporate website on or around August 31, 2023. This report seeks to give a high‑level overview of voting themes for this period and how we approached them.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.