June 2023 / MARKETS & ECONOMY

Global Markets Monthly Update

Key Insights

- Global markets were mixed in May, as investors worried about the potential for further rate hikes in the U.S. and Europe and slowing growth in China.

- Chinese stocks fell sharply as signs emerged that the world’s largest manufacturing sector was contracting as export growth slowed.

- Conversely, Japanese stocks rallied on assurances that the central bank would maintain its easy monetary policy despite signs of a revival in domestic consumption.

May 2023

U.S.

Stocks Record Overall Gains, but Sector, Style, and Capitalization Returns Vary Widely

Stocks recorded modest overall gains in May after some positive earnings surprises and encouraging inflation data fostered a month-end rally. Returns varied widely within the S&P 500 Index, however, with information technology stocks gaining 9.46% in total return (including dividends) terms, while energy shares lost 10.02%. Large-cap and growth stocks also outperformed their small-cap and value counterparts by wide margins.

Bonds recorded overall losses as U.S. Treasury yields increased across all maturities. Short-term bills saw the largest increase in yields as the date neared when the federal government would run out of money absent a deal to raise the debt ceiling, threatening a default on bill payments over the coming weeks. Yields decreased on the last two days of the month, however, following news that the White House and Republican leaders had reached a deal to raise the limit in exchange for spending cuts.

Negative Early Month Sentiment Toward Stocks

Stocks started the month on a down note, following the government takeover of another major regional bank, California’s First Republic Bank. A strong April payrolls report also raised worries that the Federal Reserve might not be finished raising rates after the quarter‑point increase announced on May 3—especially given that policymakers emphasized in the post-meeting statement that incoming economic data would guide their decision.

Mega-Cap Technology and Internet Stocks Rally on AI Hopes

Positive comments about the debt ceiling negotiations from President Joe Biden and Speaker of the House of Representatives Kevin McCarthy played a role in helping the broad benchmarks regain momentum, but another factor was a rally in some of the “mega-cap” technology stocks that dominate the benchmarks, especially the Nasdaq Composite Index. Google parent Alphabet, Facebook parent Meta Platforms, and advanced chipmaker NVIDIA recorded solid gains, with the last one gaining 36% over the month and nearing USD 1 trillion in market capitalization after the company beat earnings expectations and raised its profit outlook considerably. The three companies seemed to benefit in part from growing enthusiasm over generative artificial intelligence (AI), where all are leading players.

The month’s economic calendar, especially inflation reports, also seemed to drive sentiment. Core (less food and energy) consumer prices rose 5.5% for the year ended in April, in line with expectations, while core producer prices rose a bit less than consensus. However, the core personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose by a notch to 4.7%, indicating no progress in bringing inflation down since the start of the year.

Consumers Keep Spending but on Services Rather Than Goods

Data also suggested that consumers were equipped to keep driving prices higher. Personal spending jumped 0.8% in April, roughly double consensus expectations and supported by increases in spending on both goods and services. Likewise, retail sales, excluding the volatile auto and gas segments, rose more than expected in April, reversing a March decline.

Stocks pulled back on May 31 following news that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. March’s data were also revised higher. In the aftermath of the news, T. Rowe Price traders noted that futures markets began pricing in a 71% probability of a rate hike at the June Fed policy meeting—compared with only 23% a month earlier. The implied probability of a June rate increase fluctuated widely later in the month.

Consumers continued to turn away from spending on goods to spending on services, however, which was reflected by a continued decline in factory activity. The Institute for Supply Management’s gauge of national manufacturing activity remained in contraction territory for the seventh straight month, while several regional manufacturing indexes fell sharply.

Europe

In local currency terms, the pan‑European STOXX Europe 600 Index tumbled on worries about rising interest rates, a slowdown in China, and uncertainty surrounding negotiations over raising the federal debt ceiling in the U.S.

ECB Slows Rate Increases but Warns Rates Will Go Higher

The European Central Bank (ECB) raised its key deposit rate by a quarter of a percentage point to 3.25%, as expected, after three increases of 50 basis points this year. (A basis point is 0.01 percentage point.) ECB President Christine Lagarde said later that rates would rise to “sufficiently restrictive levels” until inflation was reduced to the 2% target. “Everybody agreed that increasing rates was necessary, that we are not pausing, that is very clear,” she said. Lagarde indicated that a majority of policymakers had voted for a quarter-point rate increase this time because turmoil in the banking industry was reducing the amount of credit to the economy.

Eurozone Inflation Picks Up, Jobless Rate Falls; Germany in Recession

Headline inflation in the eurozone accelerated in April to 7.0% year over year from the 6.9% in March. Excluding food, energy, alcohol, and tobacco prices, inflation unexpectedly ticked down to 5.6% from 5.7%. Separately, the labor market appeared to tighten, with the seasonally adjusted jobless rate falling to 6.5% in March from 6.6% in February.

In Germany, revised data indicated that the economy lapsed into recession in the first quarter. Gross domestic product (GDP) shrank 0.3% in the three months through March, a downward revision from an early estimate of zero growth that reflected a sizable drop in household consumption. Germany’s economy contracted 0.5% in the final three months of last year. Meanwhile, German companies became more uncertain about the year ahead, with the Ifo Institute’s business confidence index falling in May for the first time in seven months.

UK Interest Rates Hiked to Highest Level Since 2008; Economy Avoids Recession

The Bank of England (BoE) raised its key interest rate by a quarter point to 4.25%, the highest level since 2008. The central bank also raised its inflation forecast and called for zero economic growth in the second quarter, an improvement from an earlier projection for a 0.7% contraction. BoE Governor Andrew Bailey later said that inflation was likely to start slowing significantly in April as sharp energy increases drop out of the annual comparison. But he stressed that monetary policy would have to tighten further if there was evidence of more persistent inflationary pressures.

Official data showed that inflation declined to 8.7% in April from 10.1% in March. However, core inflation, which excludes volatile energy, food, alcohol, and tobacco prices, rose to a 21-year high of 6.8%. In addition, the labor market remained tight, and pay growth showed little sign of moderating. Average weekly wages excluding bonuses rose to 6.7% in the three months through March compared with a year earlier. GDP was also stronger than expected, growing 0.1% in the first quarter despite a drop in output in March due to strikes in the services sector.

The International Monetary Fund (IMF) revised its forecast for the UK economy, predicting that resilient demand and falling energy costs would help GDP to grow 0.4%. Its projection from April had called for the UK’s economy to shrink 0.3%.

Japan

Amid continued strong foreign investor interest, the Japanese equity market outperformed its large developed market peers in May. The MSCI Japan Index returned 4.52% in local currency terms, supported by solid domestic earnings, yen weakness, and the Bank of Japan’s (BoJ’s) staunch commitment to its ultra-loose monetary policy stance. Sentiment was also boosted by the agreement reached near month-end that ensured that the U.S. government would not default on its debt, as well as some indications that the U.S. Federal Reserve could pause its interest rate hikes in June.

Against this backdrop, the yield on the 10-year Japanese government bond fell to 0.42% from 0.43% at the end of April, contained by expectations that the BoJ has no imminent plans to tweak its yield curve control framework. The yen weakened to about JPY 139.37 against the U.S. dollar from around JPY 136.31 at the end of the prior month, dipping to a six-month low on the continued monetary policy divergence between Japan and the U.S. This prompted Japan’s top financial authorities to meet and state that they will closely watch currency market moves and respond appropriately as needed, not ruling out any option available if necessary.

Economy Grew More Than Expected in Q1, Boosted by Revival in Consumption

Japan’s GDP grew at an annualized rate of 1.6% in the first quarter of the year, ahead of expectations. Economic expansion was attributable primarily to resurgent consumption, with consumers and businesses spending more than had been anticipated as COVID restrictions were eased. Conversely, net trade was a drag on growth given the weakness in exports.

Japanese manufacturing activity expanded for the first time in seven months in May. The services sector also reported robust growth, as the return of domestic and international tourism fueled a record rise in business activity. Inbound tourism was buoyed by the weak yen, an increase in international air traffic, and the start of Japan’s cherry blossom season. Expectations remained high that tourism will continue to rebound following the lifting of Japan’s COVID border controls for all arrivals on April 29.

Despite Hot Consumer Inflation Print, BoJ to Patiently Maintain Ultra‑loose Stance

Japan’s core consumer price index in April rose 3.4% year on year, largely driven by food price hikes. While in line with expectations, the reading marked a reacceleration in inflation and is well above the BoJ’s 2% target. It led to some speculation that the BoJ would have to raise its inflation forecasts further and potentially tweak its massive stimulus program.

However, BoJ Governor Kazuo Ueda said it was premature for the central bank to discuss details of an exit from its ultra-easy monetary policy and that there was no set time frame for achieving its 2% inflation target, given uncertainty about the outlook for prices. Ueda also expressed some concerns about whether wage growth would be sustained—indeed, Japanese workers’ nominal wages grew a mere 0.8% year on year in March, while real (inflation‑adjusted) wages fell 2.9% from a year earlier. The BoJ is adamant that its 2% price stability target be achieved, accompanied by wage increases.

China

Chinese equities retreated after a batch of disappointing indicators raised concerns that the country’s post‑pandemic recovery is losing momentum. The MSCI China Index fell 8.42%, while the China A Onshore Index gave up 7.31%, both in U.S. dollar terms.

China’s CPI edged up 0.1% in April from a year earlier, down from a 0.7% rise in March. The latest consumer price index (CPI) marked the lowest rate since February 2021 and missed economists’ forecasts. It also trailed the government’s 2023 consumer inflation target of around 3% growth. Core inflation, which excludes volatile food and energy prices, was unchanged from the previous month, suggesting little demand-driven inflation in the economy. The producer price index fell a worse‑than-expected 3.6% and marked the lowest reading since May 2020.

China’s official manufacturing purchasing managers’ index (PMI) fell to 49.2 in April from March’s 51.9, marking a return to contraction for the first time since December, when Beijing abandoned its zero-COVID policy. The nonmanufacturing PMI also softened in April but remained above 50, the level separating growth from contraction. Separately, the private Caixin/S&P Global survey of manufacturing activity eased to 49.5 in April from 50.0 in March. The Caixin/S&P Global survey of services activity also weakened but remained in expansion territory.

In monetary policy news, the People’s Bank of China (PBOC) injected RMB 125 billion into the banking system via its one-year medium-term lending facility compared with RMB 100 billion in maturing loans. The medium-term lending rate was left unchanged, as expected. In its quarterly monetary policy report, the PBOC pledged to maintain sufficient credit growth and liquidity in the economy, raising expectations that the central bank would step up easing measures in the coming months.

On the trade front, China’s exports rose 8.5% in April from a year ago, easing from 14.8% growth in March. Imports fell a greater-than-expected 7.9%, reinforcing growth concerns following the disappointing PMI readings.

Other Key Markets

Turkish Stocks Decline Amid Elections

Stocks in Turkey/Türkiye, as measured by MSCI, returned -1.56% versus -1.65% for the MSCI Emerging Markets Index.

On May 14, Turkey held its presidential and general elections. The voter participation rate was high, as expected, with over 56 million voters casting ballots. In the general election, the ruling two-party People’s Alliance coalition received more than 50% of the votes and will have 323 seats in the 600-seat parliament when legislators are sworn in on June 1. While the coalition lost a small number of seats, it will maintain a simple majority in the parliament.

After performing best in a first‑round presidential election, incumbent President Recep Tayyip Erdogan secured another term in office with a 52% to 48% victory over opposition leader Kemal Kilicdaroglu. The official results were scheduled to be published in early June, and Erdogan will be sworn in for another five-year term by June 10. While Erdogan appointed new ministers on June 3—including replacements for cabinet ministers who were elected to parliament and a new economic team under his treasury and finance minister—T. Rowe Price sovereign analyst Peter Botoucharov does not believe changes in the government’s policy framework will occur until after a new government is in place.

Hungarian Equities Post Gains

Stocks in Hungary, as measured by MSCI, returned 3.29% versus -1.65% for the MSCI Emerging Markets Index.

Early in the month, the government reported that year-over-year inflation in April was 24.0%, in line with expectations and slightly lower than March’s 25.2% reading. T. Rowe Price credit analyst Ivan Morozov notes that inflation momentum slowed to 0.7% month over month—an important development—and that core inflation momentum also slowed to an annualized rate of about 15%. Overall, he believes that the latest inflation data are consistent with the central bank’s expectation for high-single-digit percentage inflation by the end of 2023. In addition, he believes that disinflation (a slowing in the rate of rising prices) in Hungary will show signs of accelerating in the third quarter of the year.

Toward the end of May, the National Bank of Hungary (NBH) reduced its depo rate—the interest rate paid on optional reserves—by 100 basis points, from 18.00% to 17.00%. The NBH also reduced the overnight collateralized lending rate from 20.5% to 19.5%. This interest rate is considered the upper limit of an interest rate “corridor” for the central bank base rate, which remained at 13.0%. The lower limit of the corridor is the overnight deposit rate, which remained at 12.5%.

In their post-meeting statement, policymakers cited “the persistent improvement in risk perceptions” as the reason for their actions. Morozov believes that this could be a central bank gesture in response to the government’s efforts to procure more European Union funds that had previously been suspended. Nevertheless, he sees the central bank remaining vigilant in its efforts to bring inflation down, and he believes the NBH is unlikely to reduce the base rate anytime soon. Policymakers expressed their belief that it is “necessary to maintain the current level of the base rate over a prolonged period, which will ensure that inflation expectations are anchored and the inflation target is achieved in a sustainable manner.”

That said, Morozov would not be surprised to see additional depo rate cuts in the months ahead, as long as the forint remains fairly stable in the foreign exchange market against the euro.

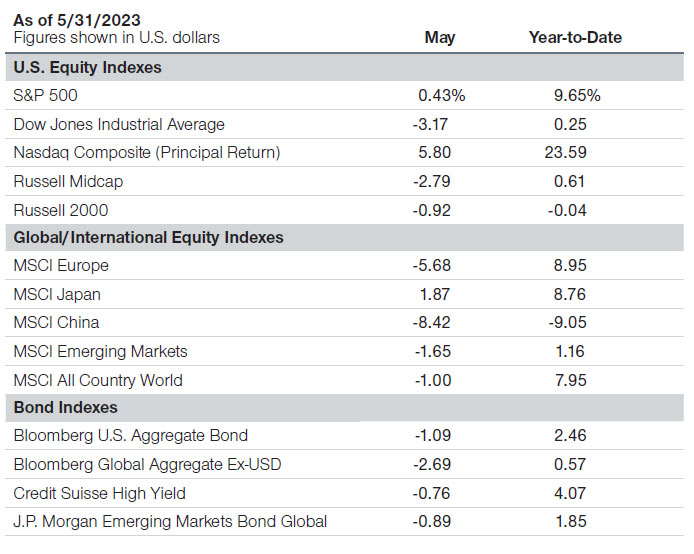

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended May 31, 2023. The returns include dividends and interest income based on data supplied by third-party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor's, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

May 2023 / INVESTMENT INSIGHTS