April 2023 / MARKETS & ECONOMY

Global Markets Monthly Update

Key Insights

- Weak economic data deepened recession fears in the U.S., but moderating inflation and some upside earnings surprises supported a modest rise in the large-cap benchmarks.

- European shares outperformed as investors welcomed early signs of an economic recovery.

- Chinese stocks fell sharply, weighed down by growth fears and rising geopolitical tensions with the U.S.

U.S.

A rally over the last two trading days of the month helped the large-cap indexes record modest gains in April, while small‑cap stocks suffered further declines but stayed above their March intraday lows. Within the S&P 500 Index, industrials underperformed, dragged lower, in part, by declines in transportation stocks. Communication services stocks fared best, helped by a rally in Facebook1 parent Meta Platforms. The strong performance of Meta and other stocks with heavy weights in the index masked weaker performance for the average stock: An equally weighted index of S&P 500 stocks rose only 0.24% for the month (excluding dividends) versus 1.56% for the index itself.

A modest decrease in intermediate- and long-term Treasury yields supported bond prices. Credit spreads on corporate bonds also narrowed slightly, indicating that investors were demanding less additional yield to compensate for the bonds’ higher risk relative to Treasuries.

Data Raise Recession Fears

Signs of a weakening economy seemed to weigh on sentiment throughout much of April. On the first trading day of the month, the Institute for Supply Management’s (ISM) gauge of March factory activity fell to a nearly three‑year low, reversing a modest uptick in February. The ISM’s services sector gauge, released two days later, indicated that the services sector was still expanding, but at a significantly slower‑than-expected pace.

Late in the month, several measures of current regional manufacturing activity came in well below expectations and indicated that factories were continuing to cut back production in April. Our traders noted that investors also seemed worried by a negative outlook for shipping volumes from United Parcel Service, which tumbled 10% on the news.

The labor market also showed signs of cooling, although perhaps not enough to satisfy Federal Reserve officials that wage inflation was under control. Continuing jobless claims jumped by much more than anticipated and reached their highest level (1.87 million) since November 2021. Housing data were also soft, with March starts and permits slowing from February’s readings. Existing home sales fell, and year-over-year home prices dropped 0.9%, the largest decrease in 11 years.

Renewed turmoil in the banking industry also heightened fears of a slowdown and possible recession. On Tuesday, April 25, U.S. markets ended on session lows following First Republic Bank’s earnings release, which revealed that the California-based bank had suffered more than USD 100 billion in deposit outflows in the first quarter. The news sent the stock down by roughly half and weighed on the overall regional banking space. On Friday, April 28, First Republic’s stock fell further after CNBC reported that the Federal Deposit Insurance Corporation was planning to take the bank into receivership. The bank did fall into receivership the following Monday morning, marking the second-largest bank failure in U.S. history.

Earnings and Better Inflation Outlook Support Sentiment

Mostly positive first-quarter earnings surprises compensated somewhat for the weakening economic outlook. By the end of the month, analysts polled by FactSet were expecting overall first‑quarter earnings for the S&P 500 to have declined by 3.7% versus the year before, compared with an expected decline of 6.7% before the start of earnings season. This would mark the second quarter of falling earnings, however, and FactSet researchers noted that Amazon.com2 accounted for roughly half of the better earnings estimates—further reflecting the market’s narrow advance.

A better inflation picture also appeared to support sentiment. Stocks jumped on the news that the consumer price index (CPI) rose only 0.1% for March, a tick below expectations, bringing the year‑over‑year rate to 5.0%, the slowest pace since May 2021. The core (excluding food and energy) producer price index declined 0.1% in March, marking the first decrease in the prices businesses pay for inputs since the height of the pandemic shutdowns in April 2020.

Europe

In local currency terms, the pan‑European STOXX Europe 600 Index advanced on optimism about an economic recovery and hopes that interest rates were near their peak. However, a chorus of central bank comments that rates could stay higher for longer curbed gains as the month wound down. Major equity indexes in Germany, France, Italy, and the UK also ended higher.

ECB Minutes Show Split Over Rates but a Clear Majority of Hawks

European Central Bank (ECB) policymakers were split over the decision to raise benchmark interest rates by half a percentage point in March, minutes of the meeting showed. A “very large majority” voted in favor of the decision, as “inflation remained far too high and was projected to remain high for too long.” Still, some members of the Governing Council said they would prefer a pause until tensions in the financial markets subsided. Subsequent comments by policymakers echoed this divergence in views.

Latest Eurozone Inflation Data Still Concerning, Economy Staves Off Recession

Although economists expected headline annual inflation for the eurozone to slow in April—as the rise in last year’s energy costs falls out of the calculation— the latest data points indicated that consumer price growth remained elevated. In Germany, the consumer price index fell to an annual 7.6% from 7.8% in March. In France, inflation accelerated to 6.9% from a rate of 6.7% in the preceding month. Spain’s headline rate reached 3.8%, up from 3.1%.

Meanwhile, a preliminary estimate indicated that the eurozone economy grew 0.1% in the first quarter, a step up from the final three months of last year, when gross domestic product was flat. Meanwhile, surveys of purchasing managers in the manufacturing and services sectors pointed to an expansion in business activity for a sixth straight month in April, a sign that a recovery could be underway.

Bank of England Seen Raising Rates Amid Persistently High Inflation

Stronger-than-expected inflation and economic data in the UK prompted financial markets to price in at least two more interest rate hikes, one in May and one in June. Annual consumer price growth in March slowed by less than expected to 10.1% from 10.4% in February, as food and drink prices surged. Pay growth showed few signs of moderating in the three months through February. Excluding bonuses, wages rose 6.6% compared with a year ago.

The UK economy appeared to be on course to defy a Bank of England forecast for a recession in the first quarter. Gross domestic product remained flat month over month in February, as strikes weighed on public services. However, the figure for January was revised up to 0.4% sequentially. Even so, the International Monetary Fund said it expected the UK economy to shrink this year, although its updated forecast called for a 0.3% contraction—half its prior estimate.

French Pension Protests Continue After Constitutional Council Backs Reform Law

France’s Constitutional Council, the equivalent of the U.S. Supreme Court, ruled that an executive order to increase the pension age from 62 to 64 years was valid, raising the prospect of continuing public protests. A string of demonstrations and strikes caused business activity to shrink in March, according to a purchasing managers’ survey from S&P Global.

Japan

Japanese equities rose in April, with the MSCI Japan Index gaining 2.7% in yen terms. Core consumer price inflation remained above the Bank of Japan’s (BoJ) 2% target in March, adding pressure on the central bank under its new governor, Kazuo Ueda, to take steps to normalize monetary policy. At its April meeting, however, the BoJ signaled a continued commitment to its ultra-loose stance by leaving monetary policy, including its yield curve control framework, unchanged. The yield on the 10-year Japanese government bond (JGB) rose to 0.39% from 0.33% at the end of the prior month. The yen weakened, to about JPY 136 against the U.S. dollar from around JPY 133 at the end of March.

BoJ Pursues Policy Continuity Under New Governor

The BoJ’s April 27–28 meeting, the first under new Governor Kazuo Ueda, signaled policy continuity. The central bank kept its short-term policy interest rate at -0.1% and left unchanged its yield curve control framework, under which 10-year JGB yields are allowed to fluctuate in the range of around plus or minus half a percentage point from the 0% target level.

However, given challenges around achieving its price stability target over the past 25 years, the BoJ announced that it would conduct a broad‑perspective review of monetary policy, with a planned time frame of around one and a half years. Ueda emphasized that policy change can take place while the review is being conducted. In its statement, the BoJ removed the forward guidance on interest rates and the mention of the need to closely monitor the impact of COVID, while reiterating a continued commitment to easing.

Inflation Forecasts Upgraded

In its separate Outlook report, the BoJ upgraded its forecasts for Japan’s core inflation slightly, to 1.8% in this 2023 fiscal year (FY) from the 1.6% it anticipated in January, and to 2.0% in FY2024 from 1.8%. The FY2025 forecast is at 1.6%. In the post-meeting press conference, Ueda said that while a positive price trend is emerging, it has not reached a level where the BoJ could confidently declare that it had met its 2% inflation target.

Japan’s core consumer price index rose 3.1% year on year in March, in line with expectations and matching February’s reading. After reaching a 41-year high in January, increases in the core CPI moderated somewhat, largely due to the effect of government subsidies to curb household utility bills.

Manufacturers Continue to Lag Expanding Services Sector

April purchasing managers’ index data showed that Japan’s private sector registered solid expansion, as a resurgent services sector, benefiting from the post-COVID reopening, helped offset weakness in manufacturing, which was weighed down by subdued global demand.

Although manufacturing activity contracted, the details were slightly more positive given improvement in the new orders-to-inventories ratio and an easing in supply chain pressures. The April Reuters Tankan sentiment index for manufacturers suggested that the prospects of an export-led recovery were hurt by banking sector turmoil and global growth concerns.

China

Chinese equities retreated as rising tensions with the U.S. and skepticism the strength of the country’s economic recovery dampened sentiment. The MSCI China Index declined 5.16% while the China A Onshore Index gave up 2.07% in U.S. dollar terms.

China’s gross domestic product expanded a better-than-expected 4.5% in the first quarter of 2023 from a year earlier, compared with last year’s growth pace of 3.0%. Inflation eased for a second straight month as the country’s consumer price index rose 0.7% in March from a year earlier, down from February’s 1% rise. The latest reading trailed the government’s CPI target of around 3% growth this year. Core inflation, which excludes volatile food and energy prices, increased 0.7% in March, up from 0.6% in February. The producer prices fell 2.5%, the most since June 2020.

Government Vows Fiscal and Monetary Support

The Politburo, China’s topdecision‑making body, vowed to continue its “forceful” fiscal and monetary policy stance to support the economy, according to state media. Although China’s economy expanded at its fastest pace in a year in this year’s first quarter, policymakers remained cautious on headwinds ranging from high youth unemployment and slowing global growth. Separately, the State Council, China’s cabinet, announced measures to support the country’s trade sector amid weakening export demand. The reforms include consolidating the shipment of vehicles and issuing visas for overseas businesspeople.

In monetary policy news, the People’s Bank of China injected a lower‑than‑expected RMB 170 billion into the banking system via its one-year medium-term lending facility, compared with RMB 150 billion in maturing loans. The central bank’s latest cash injection was the smallest since November, which markets interpreted as a sign that policymakers were evaluating the impact of prior easing measures. The central bank left the medium-term lending rate unchanged, as expected.

China’s new home sales rose 55.7% in March, up from 31.9% in February, according to a private survey of 14 cities. Increased demand was attributed to an array of stimulus measures that China’s central and local governments rolled out at the end of 2022 to bolster homebuying sentiment. Meanwhile, official data showed that new home prices increased for a third consecutive month, rising 0.5% in March in the fastest monthly increase since June 2021, signaling newfound stability in the property sector.

Other Key Markets

Colombian Equities Outperform Despite Late-Month Volatility

Stocks in Colombia, as measured by MSCI, returned 5.42% in April versus -1.11% for the MSCI Emerging Markets Index.

Colombian assets turned volatile toward the end of the month, as President Gustavo Petro called for his entire cabinet to step down even as he announced a formal rupture in his ruling coalition. Petro has been frustrated that the leadership from the more moderate parties in the coalition have stymied his reform efforts, the latest involving health care. Petro also complained about the removal of text within his National Development Plan related to the purchase and redistribution of land to peasant farmers.

T. Rowe Price emerging markets sovereign analyst Aaron Gifford’s initial reaction is that Petro’s decision to reshuffle his cabinet and part ways with the moderate bloc is likely to manifest itself in greater policy uncertainty, at least where the president can have a direct influence (such as minimum wage setting, regulations, and trade policy). Also, without the support of moderate parties, he won’t have enough votes to pass the likes of health, labor, political, and, potentially, pension reform—or at least not without significant dilution.

With the new Cabinet ministers taking office on May 1, which is a holiday across most of Latin America, Gifford will be assessing the policy direction of the new Cabinet in the days ahead as well as their initial policy actions. Overall, Gifford is not convinced that the Cabinet shakeup will strengthen Petro; in fact, he believes that Petro is losing political capital, as evidenced by his lower approval ratings among voters and periodic protests against him and his government.

Stocks Decline in Turkey

Stocks in Turkey, as measured by MSCI, returned -5.08% versus -1.11% for the MSCI Emerging Markets Index.

President Recep Tayyip Erdogan and the ruling AKP-MHP coalition—known as the Peoples’ Alliance—published their official Election Declaration ahead of the May 14 general and presidential elections. According to T. Rowe Price sovereign analyst Peter Botoucharov, the majority of their high-level, long‑term, sociopolitical, and growth-oriented economic targets are similar to the plans announced by the six-party opposition coalition called the National Alliance, including a commitment to seek consensus on comprehensive legislative reforms, although there are some important differences.

Toward the end of the month, preelection polls indicated that the ruling AKP-MHP coalition and the National Alliance are in a tight race, with roughly 39% to 40% of voters’ support for each. The pro‑Kurdish HDP party has about 10% of voters’ support. While some believe that the opposition’s presidential candidate, Kemal Kilicdaroglu, is favored to defeat the incumbent Erdogan, Botoucharov has lower conviction in that outcome.

The rules for the presidential election indicate that the winner must achieve a valid vote count of at least 50% plus 1 vote either in the first round on May 14 or, if necessary, in the runoff on May 28. There are four official candidates in the first round: Erdogan, Kilicdaroglu, Homeland Party leader Muharrem Ince, and the candidate of the nationalist, anti-immigration alliance, Sinan Ogan. If no one wins at least 50% plus 1 vote in the first round, the top two qualified candidates will advance to the second round.

Past performance is not a reliable indicator of future performance.

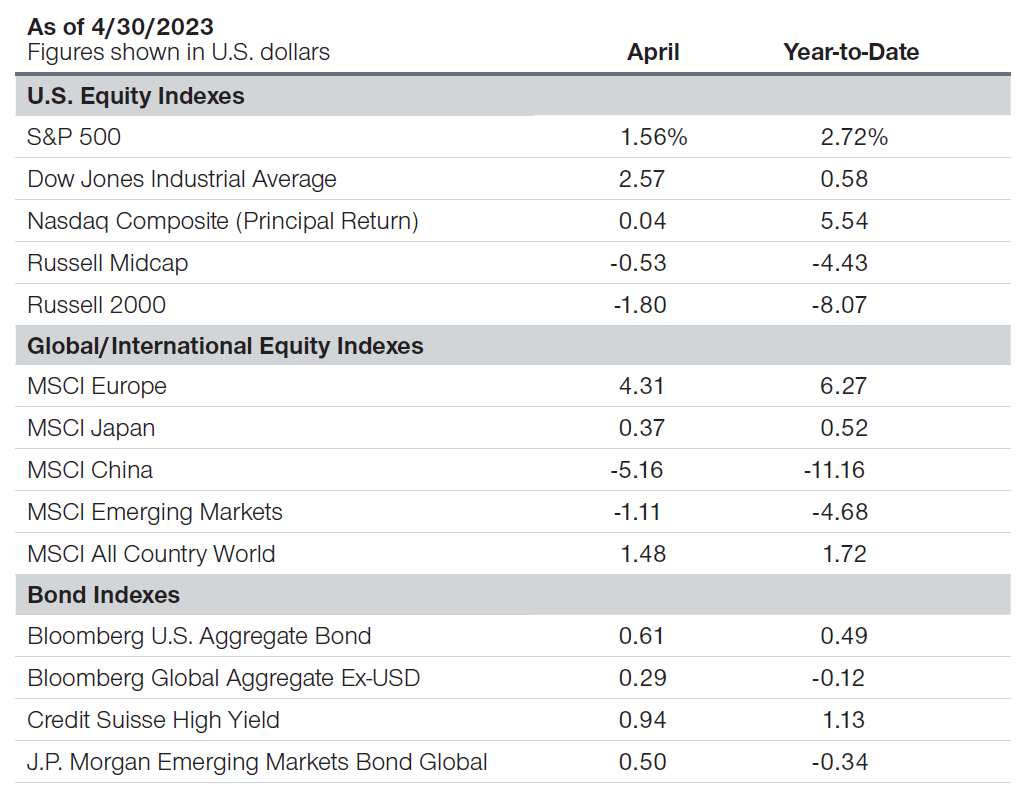

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended April 30, 2023. The returns include dividends and interest income based on data supplied by third‑party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

Additional Disclosure

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.