June 2023 / MARKETS & ECONOMY

The Fed Signals More Rate Increases Amid a Resilient Economy

Sticky inflation and further rate hikes reduce soft landing odds.

Key Insights

- The healthy employment picture has supported consumer spending, but it has also prompted the Fed to signal that more interest rate increases are coming this year.

- The labor market needs to loosen further for core inflation to meaningfully decrease toward the Fed’s 2% target.

- My baseline scenario for the Fed is one or two more rate increases in 2023 as the central bank shifts to increasing rates at every other meeting.

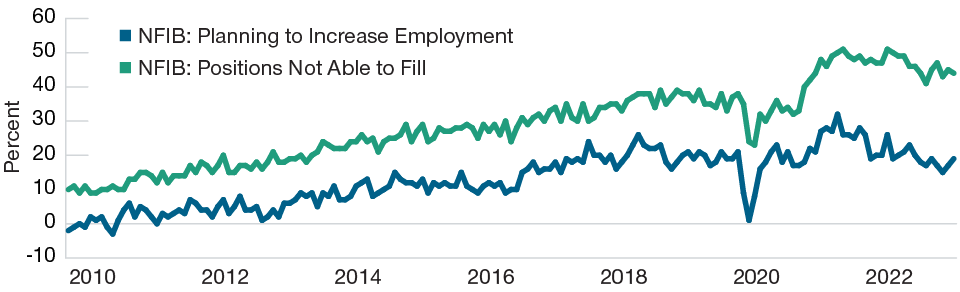

The U.S. economy continues to defy widespread expectations for a meaningful slowdown. The labor market remains strong, though demand for workers has started to moderate from its peak in 2022, as evidenced by lower vacancies and hiring intentions by small businesses. Strong employment growth and aggregate income have supported consumer spending, but this has made the Federal Reserve’s job to bring down inflation harder. As a result, the Fed seems set to hike interest rates further this year and keep them at a higher level for longer than markets anticipate. But how long can this economic resilience last?

Consumption Shifting to Services, but Consumer Balance Sheets Are Healthy

Consumer spending on goods—particularly vehicles—has been surprisingly strong. However, we expect vehicle sales to slow as the combination of higher interest rates and elevated average selling prices dampen demand.

Small Business Labor Market Still Tight

(Fig. 1) Sentiment based on surveys of small companies

As of May 31, 2023.

Source: National Federation of Independent Business (NFIB).

Slowing vehicle sales will contribute to the ongoing shift in consumption from goods to services. Despite this trend, it’s important to note that consumers are still spending. This contrasts sharply with the years after the global financial crisis of 2008–2009 and the “great recession,” when consumer balance sheets were heavily impaired and people needed to deleverage—which explains why that economic recovery was so shallow and slow.

No Major Cracks in the Employment Picture

The labor market appears to be slowly loosening. The unemployment rate crept up to 3.7% in May, although it is still near the lowest level since the late 1960s. Weekly claims for unemployment have also been on a gradual upward trend, average hours worked have declined, and wage inflation has slowed somewhat as demand for workers is not as strong as last year.

However, the number of job vacancies per unemployed person was still a historically high 1.8 as of April, so it would require many fewer vacancies and more unemployed workers to return to the 2019 level of about 1.2.1 In fact, I don’t see any major cracks in the employment picture. These broad trends are consistent with a labor market that is normalizing, not an economy facing imminent recession. Overall, I anticipate only a small additional uptick in the historically low unemployment rate by the end of 2023.

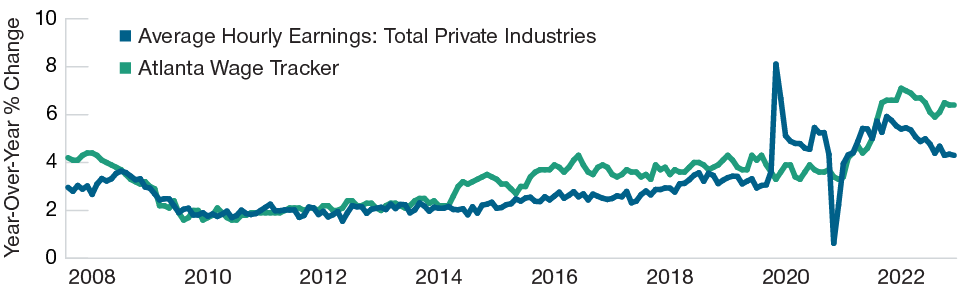

The overarching question about the labor market is whether wage growth is decelerating fast enough to prevent a wage-price spiral from taking hold. The more time the economy spends in a high‑inflation regime with a very tight labor market, the higher the risk that inflation expectations can become un-anchored and higher wage demands from workers reinforce the inflationary impulse.

Some measures have shown signs of progress on this front, and wage inflation appears to have peaked across a range of measures, but progress still appears very slow. It is becoming increasingly clear that the economy needs more labor market slack for core inflation to meaningfully decrease toward the Fed’s 2% target from over 5% as of May. The job on inflation is not yet done.

Interest Rates Are Set to Increase Further, but at a Slower Pace

Against this backdrop of core inflation that is still too high, the Fed needs to balance the risks of trying to slow the economy without pushing it into recession. My baseline scenario for the Fed is one or two more rate increases in 2023. However, the pace at which interest rates will increase is going to be much slower, with the most likely outcome a 25-basis-point increase at every other meeting.

Very Slow Progress on Wage Inflation

(Fig. 2) Atlanta Fed’s wage tracker recently reaccelerated

As of May 31, 2023.

Sources: Federal Reserve Bank of Atlanta, Bureau of Labor Statistics.

As interest rates increase further, the question of whether the Fed will overtighten policy and cause a recession is going to loom over markets. While a soft landing is possible, I think a recession is probably the more likely scenario. The stickiness of core inflation, coupled with the Fed’s determination to bring inflation down, will lead the central bank to overtighten and tip the economy into recession, in my view. This has been the outcome of the majority of past Fed tightening cycles. On the question of timing, a downturn does not appear imminent, but I believe the economy will likely slide into a recession by the end of the year or in early 2024.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

July 2023 / INVESTMENT INSIGHTS