June 2023 / MIDYEAR MARKET OUTLOOK

Australia: Midyear Outlook 2023

Waiting for the earnings shoe to drop.

Key Insights

- Global spillovers have proved manageable and the economic outlook for Australia for the next six to twelve months is one of subdued growth and increased likelihood of recession.

- Whilst the market was pre-occupied by de-rating and valuation risk last year, given rising bond yields, we expect the focus to change in H2 2023 to earnings as downgrades filter through.

- For now, we prefer to own quality defensive companies with lower earnings risk and more stable profit margins.

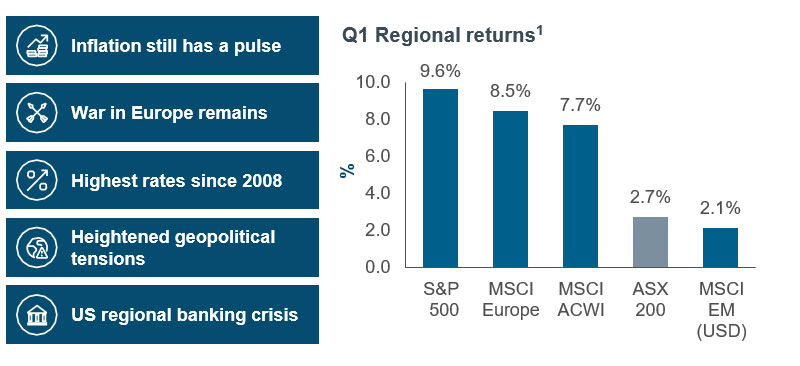

Last December, our outlook for Australia in 2023 was for an earnings recession irrespective of whether or not we have an economic recession. In early June this base case scenario remains on track, and we are inclined to make few changes. This is despite some significant first half surprises such as China’s sudden abandonment of zero Covid and economic reopening, US banking stress, stubbornly high inflation in the developed world, and further political tensions and bickering between the U.S. and China (Figure 1).

Strong Stock Markets YTD Despite Uncertainties

(Fig. 1) Regional equity returns to end-May

Past performance is not a reliable indicator of future performance.

As of May 31, 2023.

Source: T. Rowe Price analysis using data from Bloomberg Finance L.P.

1 Local currency returns. MSCI ACWI is in USD.

At the halfway point in 2023, global labour-market conditions remain tight while the inflation outlook remains quite challenging, more challenging than markets are prepared to acknowledge, in our view. Whilst headline CPI may have peaked and started to reduce from elevated levels, it remains uncomfortably high for central banks. Core inflation, which is what matters most to central banks, has remained sticky. Progress in taming inflation has been slow due to strong services price inflation that in turn has fed through to higher wages. Our view remains that Australia is a long way from interest rate cuts, and there indeed may be a few more rate hikes to come.

This scenario of ‘Waiting for Godot’ is likely to test the share market’s patience more than once in the coming months. Markets like to price things quickly, as we have seen with US Fed funds, which recently switched dramatically from significant rate cuts by December 2023 to almost no cuts at all. Volatility caused by short-term waves of over- and under-optimism by markets appear likely to continue.

Our base case scenario of slower global growth is taking shape quite slowly, as the negatives and positives are locked in a ‘tug-of-war,’ the outcome of which remains unclear to most investors. While a mild recession in order to bring down inflation seems likely, possibly taking place over a relatively lengthy time period, much worse economic scenarios than this, similar to 2008 or 2020, are not on our radar screen.

Global Spillovers Manageable But Few Catalysts

We wrote in December that negative spillovers from higher U.S. interest rates to global rates, liquidity, currencies and commodity prices could impose collateral damage on countries like Australia. So far, these spillovers have proved manageable and the economic outlook for Australia for the next six to twelve months is one of subdued growth but no recession.

In terms of economic activity, the RBA has only made a modest downward adjustment to its 2023 growth forecast. Whereas in February it projected 1.5% growth in real GDP, in May this was lowered to 1.25%. Still, low positive economic growth is not such a bad result given Australia’s high beta to world trade. 2023-24 is projected by the IMF to be the weakest two-year stretch for global growth in over 20 years.

We see China’s reopening in 2023 as initially having held out false hope for the global economy and for a resources exporter like Australia. China’s initial rebound has been concentrated on consumer services like travel, hotels and restaurants. The rebound in manufacturing has been weak, reflected in shrinking import demand. Based on the latest monthly PMIs, the reopening boost to the Chinese economy appears to be fading.

So far there is no sign that Beijing is prepared to unleash significant fiscal stimulus in order to boost domestic demand, since the government’s 5% GDP growth target for 2023 remains a relatively low bar to beat. However, if April’s disappointing data for residential property and construction is repeated in May, Beijing may yet buckle and introduce more meaningful fiscal stimulus. In the short-term, this should be positive for the price of iron ore, for resources stocks and for the Australian dollar. Of all the G-10 currency pairs, the Aussie dollar has the highest correlation to indicators of global activity such as the U.S. ISM.

Swimming Against The Tide?

For many Australian investors, it still feels like they are swimming against the tide, with fading economic growth, ingrained inflation, hawkish central banks, and falling earnings expectations (Figure 2). Add to this the lagged impact of past rate hikes and it’s not a pretty picture. Though in Australia there are many quality growth companies that are both reasonably valued and well-positioned. Fallen angels in this environment can also present some interesting opportunities for longer-term investors.

Earnings Expectations For 2023 Still Too High

(Fig. 2) Forward earnings growth, financial conditions and earnings corrections

Past performance is not a reliable indicator of future performance.

As of May 31, 2023.

There is no guarantee that any forecasts made will come to pass. Advisors, DataStream.

Sources: Credit Suisse, Financial data and analytics provider FactSet. Copyright 2023 FactSet. All Rights Reserved.

Historically, high earnings expectations are vulnerable as the economy contracts and consumption rolls over. Global cyclicals are likely to prove vulnerable to a mild growth recession. For the U.S. the unexpected resilience of the economy in 2023 could simply mean that the necessary recession has simply been pushed out by twelve to eighteen months. Alternatively, it may still possible that recession can be avoided, in which case a market bottom may be a lot closer than many investors expect, including ourselves.

With regard to China, we feel that reacceleration is more likely to be led by government-led construction than by private consumption, where the initial rebound phase has been disappointing, with consumer confidence having only partially recovered from its deep lock-down driven through late last year. With access to the Chinese iron ore market fully restored, Australia is best placed to benefit from any China-driven recovery in the price of iron ore, although for now the short-term trends in steel, cement etc are to the downside.

The recent “normalisation” of trade relations between Australia and China (which happened without any major concessions by Australia) is clearly a very positive development. Australia is one of the few countries that enjoys a significant bilateral current account and trade surplus with China. This external surplus in turn - via sectoral savings and investment balances or net acquisition of financial assets - is reflected in a small budget surplus.

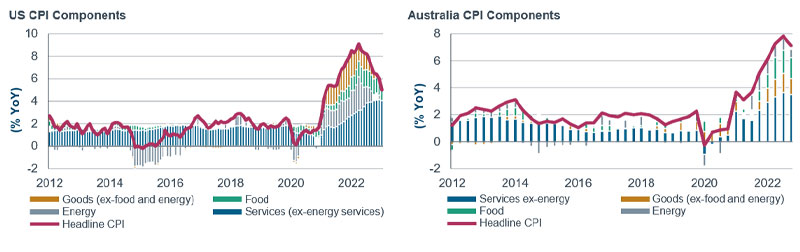

Slow Progress on Inflation

Whilst inflation has most likely peaked in the major developed economies, the key global macro issue for us remains how high interest rates need to rise to slow economic growth and get inflation back down to central bank targets. The main problem is that labour markets in the US, UK and Europe are too tight and conditions there in our view are not consistent with inflation reaching central bank targets. This therefore requires the unemployment rate in these economies to rise, while so far it has not done so.

The resilience to date in economic activity and employment is creating a bigger risk of a nastier downturn by potentially forcing major central banks to be more aggressive than market expectations. The collateral damage from rising rates will be corporate earnings, which are expected to be downgraded going forward. It is likely any policy error will be one of overtightening causing a recession. Whether or not we have an economic recession in Australia it is highly likely we will have an earnings recession as economies slow. So far, analysts have not adapted to this reality, as earnings revision ratios have recently increased in all major regions, while the flattish EPS forecasts for CY2023 are not compatible with even mild recession.

Early in 2023 we had expected inflation trends in Australia to lag behind those in the U.S. and Europe. More recently, however, there have been clear signs of growing wage pressure in Australia that lead us to question whether the RBA (Reserve Bank of Australia) will be able to meet its inflation target without further hikes in the cash rate above the current level (See Figure 3).

Not all inflation is the same – Services remain sticky

(Fig. 3) Contributions to year-on-year inflation

As of February 28, 2023.

Sources: BLS, ABS & Jarden.

While the RBA’s 25 basis points1 rate increase in June to 4.1% was seen by many as the last hike in the cycle, we think more needs to be done. Australia’s central bank has been very clear on its objectives – the need to reduce inflation remains paramount, with services price inflation in particular too high for comfort. Service sector inflation rose in Q1 2023 compared to Q4 2022. The RBA’s forecast for CPI inflation in CY2023 of 4.5% is far above its longer 4-term forecast of 3.0% by mid-2025. There is a risk of Australia lagging behind the U.S. in terms of its disinflation trend because of domestic wage pressures. The annual CPI inflation of 7.8% in Q4 2022 was a 30- year high, falling to 7.0% in Q1 2023.

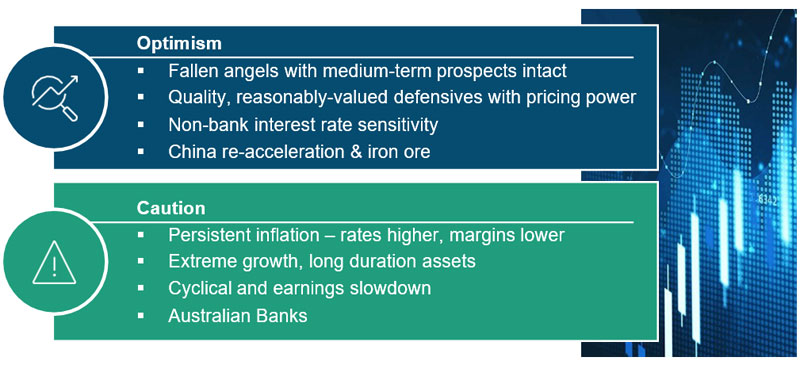

Opportunities: Stay Cautious, Be Selective

Our quality growth investment approach remains focused on the key drivers of excess return: profitability, earnings growth, and valuation. Whilst the market was pre-occupied by de- rating and valuation risk last year, given rising bond yields, we expect the focus to change in H2 2023 to earnings as downgrades filter through. Cracks have already started to appear in various sectors. We thus maintain a defensive posture in the face of rising earnings risks and also continue to look selectively for opportunities in oversold growth names. We expect the more cyclical parts of the market to come under earnings pressure going forward, which should see quality, defensive and growth companies outperform as their earnings prove to be more resilient.

The large losses in financial wealth in 2022 as both bond and equity prices fell sharply keeps us cautious on the consumer discretionary sector. Slower global growth curbs our enthusiasm for energy and natural resources.

There are some selective opportunities, however, and we own a couple of lithium producers that we believe are well placed to take advantage of the strong demand for EV batteries, while recognising that lithium is only a niche sector within natural resources.

The big mining companies Rio Tinto and BHP have struggled recently due to the weakness in Chinese steel production largely driven by sluggishness in the Chinese property sector and weak Chinese steel producer margins. Whilst the property sector is showing tentative signs of stabilizing, the market was expecting a faster improvement after the Chinese economy reopened in December. This did not materialize. Despite near term iron ore price weakness, Australia’s mega resource stocks are well positioned for any improvement in Chinese steel production, have strong balance sheets and are producing very high levels of free cashflow.

Conclusion

We reiterate what we said in December: Australia is relatively well-positioned for the new global investment regime that is unfolding, with many good long-term investment opportunities. In the short term, however, we advise caution toward the more expensive high P/E names, to banks that face rising bad debts, and to businesses generally that are vulnerable to a cyclical slowdown. For now, we prefer to own quality defensive companies with lower earnings risk and more stable profit margins (Figure 4).

Positioning themes for Second Half of 2023

(Fig. 4) Positive and negative factors

Source: T. Rowe Price.

The views contained herein are as of the date of this report and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2023 / INVESTMENT INSIGHTS