February 2023 / INVESTMENT INSIGHTS

Four Factors Shaping a Brighter Outlook for U.S. Smaller Companies

The ‘Risk Off’ Pendulum Has Swung Too Far

- Uncertainty about the U.S. economic outlook has seen smaller companies bear the brunt of investor fears over the past year.

- Valuations have fallen to extreme lows, relative to larger companies, despite earnings holding up reasonably well.

- With the U.S. economy proving relatively resilient, compared to other major markets, smaller company stocks could be poised for a better year.

Few would argue that the current U.S. market environment remains challenging; inflation, rising interest rates, and weaker growth, are all weighing on investor confidence. Unsurprisingly, the uncertain landscape has seen riskier assets suffer most over the past year, with U.S. smaller companies coming under particularly heavy selling pressure. However, we believe that the ‘risk-off’ pendulum has swung too far for smaller companies, as extreme pessimism about the macro- outlook has become disconnected from underlying fundamentals. With this in mind, we consider four reasons why 2023 could be an opportune time for patient investors to lean into smaller companies, as the US economy proves more resilient than previously expected.

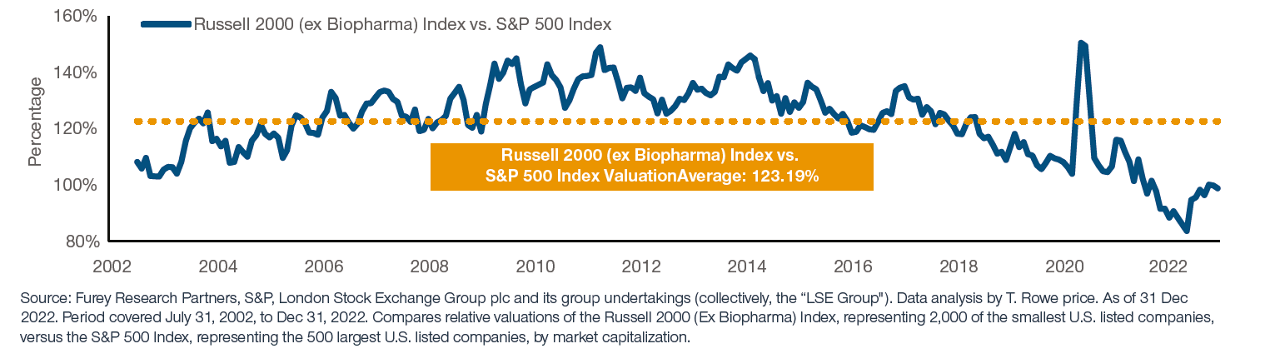

FIGURE 1: Small Cap Relative Valuations are Near All-Time Lows

Relative 12 Month Forward Price-to-Earnings Ratio

Source: Furey Research Partners, S&P, London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group"). Data analysis by T. Rowe price. As of 31 Dec 2022. Period covered July 31, 2002, to Dec 31, 2022. Compares relative valuations of the Russell 2000 (Ex Biopharma) Index, representing 2,000 of the smallest U.S. listed companies, versus the S&P 500 Index, representing the 500 largest U.S. listed companies, by market capitalization.

1. Extreme Valuations

The valuation argument has rarely been more compelling for U.S. smaller companies. Since the peak in November 2021, valuations have fallen precipitously and are now trading around historic low levels, relative to larger companies. Not since the collapse of the tech bubble have small cap relative valuations been this cheap. Investors have understandably been spooked by the backdrop of high inflation, hawkish monetary policy, and fears of recession, but the impact on smaller companies seems disproportionate. The extreme valuation discount currently being applied to U.S. smaller companies (Figure 1) suggests expectations of a deep and protracted economic recession – a worst case scenario, in our view. While the U.S. may see a period of recession in the near-term, we believe that any such downturn is likely to be shorter and shallower than today’s extreme valuation levels imply.

Significantly, history tells us that when smaller company valuations have reached similar extreme levels in the past, they have subsequently gone on to lead the eventual market recovery, outperforming their larger U.S. counterparts over multiple years.

2. Earnings Remain Resilient

Given the steep decline in smaller company valuations over the past year, one might reasonably assume that earnings have similarly fallen off a cliff. In fact, despite the challenging environment, earnings expectations for companies within the Russell 2000 index have remained relatively resilient (Figure 2) – yet prices have fallen sharply. In contrast, analysts’ earnings expectations for larger stocks, within the S&P 500 index, have seen bigger downward revisions, yet prices have generally not followed suit.

The result of this has been a significant compression in the P/E multiples of smaller companies, despite underlying business prospects not being materially impacted. To provide some context, current P/E multiple levels are pricing in a sharp decline in smaller company earnings – one similar to that seen in the aftermath of the global financial crisis. This is unlikely, in our view.

FIGURE 2: Small Cap Earnings Expectations Remain More Resilient Than Larger Peers

Yet Small Cap Valuations Have Seen Steeper Relative Declines

Past performance is not a reliable indicator of future performance.

Source: Furey Research Partners, S&P, London Stock Exchange Group plc and its group undertakings (collectively the ‘LSE Group’). Analysis by T. Rowe Price. As of 31 Dec 2022. Period covered 30 September 2021– 31 December 2022. Estimated 3-5 year earnings per share growth, on a quarterly basis, for small caps represented by Russell 2000 Index versus large caps represented by Russell 1000 Index.

FIGURE 3: Average Annual Small Cap Returns in Various Inflation Environments

High, But Easing, Inflation Has Historically Been a ‘Sweet Spot’ for Small Caps

Past performance is not a reliable indicator of future performance

Source: Furey Research Partners, S&P, London Stock Exchange Group plc and its group undertakings (collectively the ‘LSE Group’). Analysis by T. Rowe Price. As of 31 Dec 2022. Period covered 1 Jan 1950 – 31 Dec 2022. Small caps represented by Russell 2000 Index; Large caps represented by S&P 500 Index

3. Nimble With Pricing Power

Historically, smaller companies have recorded their best performance, both in absolute terms, and relative to large caps, during periods of high, but easing, inflation (Figure 3) – the environment in which we currently find ourselves in the United States. This is at least partly due to smaller companies being more nimble businesses, and so quicker to respond to the changing environment than larger counterparts.

Meanwhile, smaller companies are often assumed to be price takers, with limited ability to exert pricing power. In fact, many smaller businesses operate in niche industries or under-served areas of the market, and so command more pricing power than their size might suggest. As such, when these businesses begin to experience inflationary pressure, be it through wage increases or because of rising input costs, they can pass on these higher costs to customers, thereby protecting their margins.

Even if a company cannot control the price of an end product, this does not mean it is powerless to influence profits. For example, many smaller companies can be critical components within more complicated processes or supply chains. As has been abundantly clear in recent years, low supply and high demand of any component anywhere along the supply chain translates to higher prices for its producer.

4. Powerful Secular Tailwinds

Smaller companies stand to benefit most from an emerging shift away from globalization, and towards a more regionalized world economy. This domestic re-orientation is particularly apparent in the U.S., where ‘onshoring’ of business operations and processes is a key priority in the wake of pandemic- era supply chain disruption.

U.S. authorities are incentivizing manufacturers to bring their operations onshore, with substantial investment being directed toward ensuring supply chain security. Various legislative changes have also been introduced, driving a new wave of domestic investment that far outweighs any similar initiatives in other countries. Smaller companies are likely to experience a significant demand tailwind from this onshoring trend, given they are typically more sensitive to the domestic economy than their large- cap counterparts.

Meanwhile, a strong U.S. dollar environment has historically been supportive of U.S. smaller company stocks. This is largely due to smaller companies deriving most of their revenue from U.S.-based operations. Conversely, larger companies, with greater exposure to international markets, tend to be disadvantaged by a stronger dollar due to currency- translation factors, as well as potentially weaker demand for their goods and services as a strong dollar makes these less internationally competitive.

Investor risk aversion has understandably increased in recent times, a direct reflection of the more uncertain U.S. market and global economic outlook. However, U.S. smaller companies appear to have been disproportionately impacted by the ‘risk off’ trade over the past 12 months. Relative valuations, versus larger companies, have fallen to historically low levels, despite earnings remaining relatively resilient. This suggests a disconnect between small cap prices and underlying fundamentals – one that could quickly revert on signs that inflation is contained, rate rises have peaked, and the economy is proving more resilient than generally expected. Meanwhile, history tells us that small caps tend outperform strongly coming out of a slowdown and leading into recovery. With powerful onshoring trends and a strong dollar also providing tailwinds, we would argue that now is the time to start thinking about adding small cap exposure.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.