August 2022 / INVESTMENT INSIGHTS

High Yield Bonds Appear Well Positioned for a Recession

The sector is in better health than prior to previous downturns.

Key Insights

- As the next recession is likely to be inflation‑driven rather than credit‑driven, high yield issuers should be better placed to withstand it than in previous downturns.

- Corporate balance sheets have strengthened significantly since 2020, giving high yield issuers further protection against a recession.

- The credit default cycle in 2020 was brutal, but it left the high yield sector in a much better state of health.

Recession fears are mounting as central banks continue to hike rates and issue increasingly hawkish guidance in response to surging inflation. Asset prices across the board have plummeted, particularly those of investments considered higher risk, such as high yield debt. Such is the level of anxiety in markets that investors may be forgiven for wondering whether the current crisis will come to resemble the 2001 dot-com bubble or the 2008 global financial crisis (GFC).

The good news is that if a recession does occur this time, it is likely to inflict far less damage on corporate earnings than in those previous downturns. Although current valuations imply that corporate debt defaults will surge in 2023, we do not believe this is a realistic assessment. We have three main reasons for thinking this, which we discuss here.

Why High Yield Issuers Are in a Stronger Position Than in the Past

Three key reasons

For illustrative purposes only.

1. This Recession Will Be Inflation‑Driven, Not Credit‑Driven

Apart from the pandemic‑induced recession in 2020, most other recent recessions have been credit‑driven—in other words, they have been caused by concern over the creditworthiness of certain assets. The GFC and dot-com bust, for example, were caused primarily by the buildup of debt‑related excesses in the U.S. housing sector and internet infrastructure, respectively.

If the current downturn becomes a recession, inflation will be the main cause. Inflation‑driven recessions are rare—the last one occurred in 1982–1983. There is a risk of one now because of the colossal amount of fiscal and monetary stimulus pumped into the global economy in recent years, first following the GFC and later during the pandemic crisis. This liquidity has inflated asset prices and driven speculation, resulting in the surging inflation we see today.

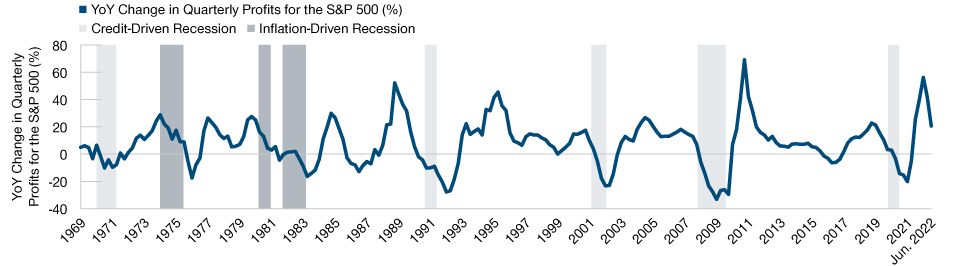

Whether a recession is credit‑driven or inflation‑driven is an important distinction to make for investors. Historically, damage to corporate earnings tended to be more modest during inflation‑driven recessions. For example, in the inflation‑driven recession of 1982–1983, when the Fed hiked its policy rate to 20%, S&P 500 Index profits fell by 18%.1 In the 1973– 1974 inflation‑driven recession, when the interest rate reached 13%, profits also fell by 18%. This contrasts sharply with the GFC and dot-com crash, when profits fell by 49% and 25%, respectively.

Credit‑Driven Recessions Have Been Worse for Corporate Earnings

(Fig. 1) Inflation‑driven recessions inflict less damage

As of June 30, 2022.

Past performance is not a reliable indicator of future performance.

YoY = Year over year.

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

2. Corporate Balance Sheets Have Strengthened Since 2020

Corporations entered 2022 in a position of real strength, underpinned by robust fundamentals. Cash ratios (a measure of liquidity that shows a company’s ability to cover its short‑term obligations) reached post‑GFC highs just a few months ago, while leverage ratios (which show how much of a company’s capital comes from debt) were at their lowest levels since the crisis, according to Goldman Sachs research.

In addition, the vast majority of high yield bond‑issuing firms were able to benefit from attractive funding conditions last year to push out their maturity profiles.

Just 1% of the debt of both U.S. and European high yield firms will mature this year, with a relatively small amount of debt maturing in 2023. The bulk of the “maturity walls” of high yield issuers will come in 2025 or later, indicating that balance sheets are strong.

3. We Have Just Been Through a Default Cycle

Many businesses have defaulted on their debt because of COVID. In 2020, default rates among U.S. high yield energy firms reached almost 30% while debt restructurings surged among European retail firms. Default cycles are useful for separating stronger firms from weaker ones, however. Those with the potential to survive and thrive beyond a crisis tend to be well supported by their sponsor investors, who inject cash when necessary or provide lines of credit in order to realize their investment further down the line. Companies with little prospect of long‑term success are typically allowed to go bust.

The recent default cycle was brutal, but it has left the high yield sector in a much better state of health: The current default rates in U.S. and European high yield are 0.36% and 0.01%, respectively.2 These ultralow levels are not sustainable in an environment of slowing growth and high inflation, so defaults will inevitably rise. Indeed, current market valuations imply a global high yield default rate of 3.9% over the next 12 months (assuming an excess spread of 350bps).3 However, we believe the market valuations are being driven partly by general macroeconomic concerns and that the actual default rate is likely to come in lower.

Key Markets Look Healthy

In addition to the three factors outlined above, it is important to stress that the key U.S. financial and housing markets are in much better shape than they were in previous recessions. Banks recently passed their stress tests with ease and have solid balance sheets. Housing debt obligations as a percentage of income are much lower than they were in 2007–2008 following hefty government payouts and elevated savings rates.

Labor markets are also generally in very good health. Baby boomers are retiring, and the immigration policies of the U.S. and Europe mean that their positions are not being filled by foreign labor. This means that companies are much less likely to shed staff in any future downturn.

For these reasons, we believe that high yield debt is much better placed to navigate a recession than it has been in the past.

Important Information:

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is only for investment professionals that are eligible to access the T. Rowe Price Asia Regional Institutional Website. Not for further distribution.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

July 2022 / INVESTMENT INSIGHTS