February 2022 / ASSET ALLOCATION VIEWPOINT

What Pivot to Higher Rates May Mean for Stocks

Higher interest rates pose near-term challenges for stocks.

Key Insights

- Global equity markets sold off in the opening weeks of 2022 as investors weighed the potential impact of higher interest rates on their stock portfolios.

- To manage near‑term risks, the Asset Allocation Committee currently is underweight equities, tilting away from areas vulnerable to rising rates.

After maintaining a dovish position for most of 2021, the U.S. Federal Reserve (Fed) recently pivoted to a notably hawkish stance. As a result, interest rates are on the rise, which, in part, has driven recent equity market volatility.

While the Fed is still in the very early stages of a hiking cycle, we believe a review of yield premiums across a range of past economic cycles could provide useful insights for investors concerned about the potential impact of higher rates on their portfolios.

By comparing the current yield to maturity of the 10‑year U.S. Treasury note to the earnings yield on the S&P 500 Index—earnings per share divided by price—investors can measure the premium that equities have historically offered over bonds. While this premium was fairly consistent over the five years ended January 25, 2022, it has varied widely over the last 25 years (Fig. 1) and was significantly lower prior to the 2008 global financial crisis.

Equity Yield Premium Averaged Higher in Last Five Years

(Fig. 1) Rising interest rates could bring lower equity yield premiums

Based on historical data for the 25 years ended January 25, 2022.

Past performance is not a reliable indicator of future performance.

1 Equity yield premium = S&P 500 Index earnings yield (earnings/price) - Yield to maturity of U.S. 10-year Treasury note.

Sources: Bloomberg Finance L.P. and S&P (see Additional Disclosures).

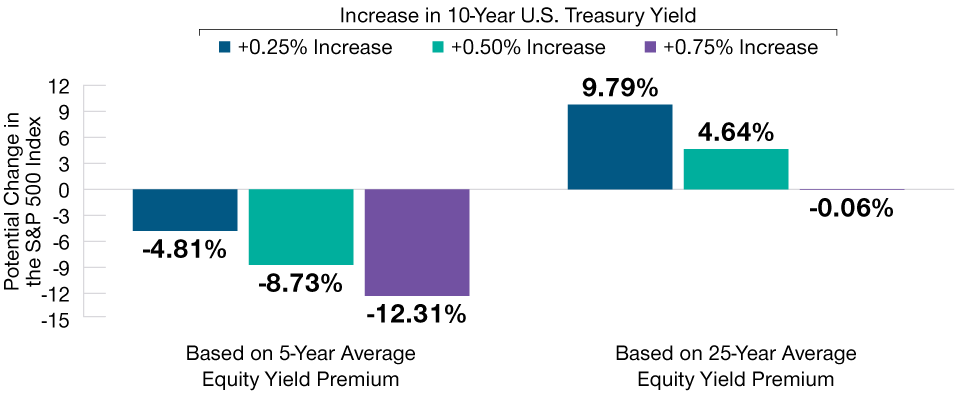

The derived equity premium can be used to estimate the potential impact of higher interest rates on valuations and even on stock prices. For example, if interest rates were to move higher while the equity yield premium remained relatively unchanged—as it has over the past five years—our analysis suggests that stock prices could hypothetically fall further, even after the recent meaningful sell‑off (Fig. 2). However, if we assume a yield premium equal to the 25‑year average, the impact of rate increases appears muted.

Hypothetical Impact of Higher Interest Rates on Stock Prices

(Fig. 2) Rate hikes could potentially pose challenges for stock prices over the near term

Based on historical data for the 25 years ended January 25, 2022.

Our analysis did not include any returns from dividends and did not incorporate changes in earnings expectations.

Sources: T. Rowe Price analysis using data from Bloomberg Finance L.P. and S&P

(see Additional Disclosures).

Actual results may differ materially from estimates.

Analysis is hypothetical and for illustrative purposes only. Figures do not represent actual results.

In our view, further rate increases could be a headwind for equities—at least over the near term—but the overall impact could be somewhat mitigated as investors adjust their equity yield premium expectations. In an effort to manage the near‑term risks, our Asset Allocation Committee has an underweight tactical position in equities, tilting away from areas vulnerable to rising rates. Within equities, the committee currently is underweight growth and U.S. stocks relative to value and other global regions, respectively.

IMPORTANT INFORMATION

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

February 2022 / GLOBAL ECONOMY