October 2021 / INVESTMENT INSIGHTS

The U.S. Value Stock Rally—Expect a Shift to Quality

Higher-quality value stocks set to lead the next stage

Key Insights

- Despite the strong rally in U.S. value companies during late 2020 and early 2021, their full potential is not yet exhausted, in our view.

- As the U.S. economic recovery continues, we envisage a rotation in value stock leadership from early-cycle beneficiaries toward higher-quality value names.

- Looking ahead, there are four key factors that are likely to prove significant in shaping the outlook for U.S. value companies.

Given the unprecedented nature of the coronavirus pandemic, the strong recovery in U.S. economic growth during 2021 has been remarkable. The U.S. equity market has similarly rallied sharply, surpassing previous peak levels in just a few quarters, with some companies posting close to best‑ever earnings results in early 2021.

One of the dominant market themes to emerge in late 2020 and continue into early 2021 has been the sharp swing toward value companies at the expense of more richly priced growth‑oriented stocks. More recently, however, the strong impetus behind value companies has moderated, with some suggesting that the “great value stock rotation” is over already. We think this view could be premature.

The Value Stock Rally Is Not Yet Exhausted

Certainly, economically sensitive stocks have had a strong early‑year run, coming off historically depressed levels, so a pullback in these value areas was not entirely surprising. However, the fundamental landscape has not materially changed. At a broad market level, the continuing economic rebound is reason for optimism. U.S. consumers are in good shape with a large pool of excess savings ready to be deployed into spending; business inventories are lean, which is likely to lead to a pickup in capital spending; the government is set to roll out a significant fiscal stimulus plan; and the Fed appears comfortable keeping monetary policy accommodative for some time.

Looking forward, we are expecting continued fundamental improvement for many companies across the market. We are also anticipating a progressive rotation within the value stock landscape, with investors gradually shifting focus from early‑cycle and deep‑value companies toward higher‑quality value stocks as the next beneficiaries of the economic cycle.

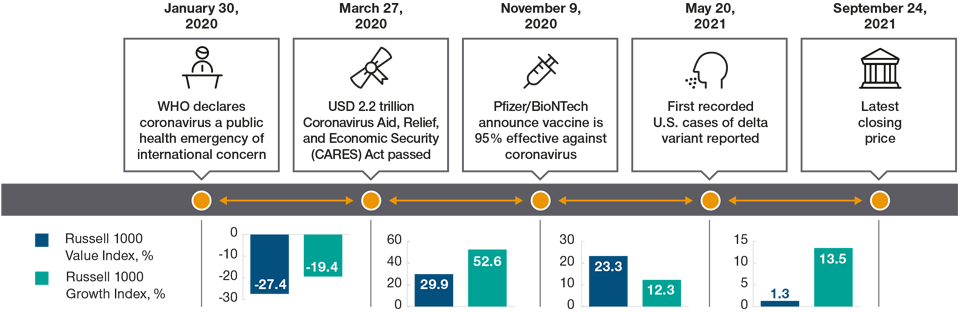

A Timeline of Key Coronavirus‑Related Events

(Fig. 1) And how U.S. equities have responded

Past performance is not a reliable indicator of future performance.

As of September 24, 2021.

Index performance depicts closing price to closing price returns, between each of the time periods referenced.

Source: Refinitiv DataStream, analysis by T. Rowe Price.

Looking longer term, there are four key factors that we believe are likely to play a significant part in shaping the outlook for U.S. value companies.

Market Landscape—Growth and Inflation

The U.S. economy continues to recover, and consensus expectations for growth in the region of 7%–8% in 2021 represent a resilient and robust turnaround. Certainly, part of this surge in economic growth has to do with the fact that it started from a low base, following a very difficult 2020 during which U.S. growth essentially collapsed. However, it is also worth noting that consensus expectations are for another year of similar growth in 2022, so the runway for above‑trend growth looks reasonable at this stage.

Deep value and cyclical companies have led the U.S. equity market rebound since November 2020. The broad rollout of coronavirus vaccines provided the impetus for a significant rotation trade, as investors sold richly priced growth names in favor of cyclical value stocks well positioned to benefit from the reopening of the U.S. economy. Previously unloved value areas, such as mining, travel, banks, and industrials, recorded sharp gains, leading the U.S. equity market higher until mid‑May 2021.

However, given the unprecedented events of the past year, the recovery, when it came, was unlikely to be linear, but rather characterized by fluctuation in line with bouts of shifting investor confidence and sentiment. The current spike in U.S. inflation is a good example of this. Consumer price index inflation hit 5.4% in July 2021, year‑on‑year—the highest level since 2008—undermining confidence and prompting market volatility. The sharp increase raises questions about whether rising prices in some pockets of the economy are transitory or are the first signs of an enduring higher‑inflation regime.

While a significantly higher, long‑term inflation regime is unlikely, in our view, there are some current inflationary elements that are likely to be more transient and some that are also likely to prove “stickier” and a source of upward pressure for longer. For example, some of the supply shock-related disruption that we are seeing currently is expected to be short term in nature. Just recently, the world’s third‑busiest cargo port, Ningbo‑Zhoushan in China, shut down one its terminals completely for two weeks due to coronavirus concerns, causing a huge disruption to global supply chains. However, we believe this short‑term shock is unlikely to have a lasting, disruptive impact on global freight and transportation input costs. On the other hand, two other key inflationary sources currently—rising housing costs and employee wages—look set to remain prominent components over the next months.

Sector Performance

The respective performance of value‑ and growth‑oriented sectors during different stages of the economic cycle is likely to be a key consideration over the coming year and beyond. Broadly speaking, the principal difference between the two areas of investment is the large allocation toward the technology sector for growth investors versus a similarly significant allocation to financials as for value investors. To the extent that technology stocks outperform, most likely, growth investors will outperform their value counterparts, while the opposite is generally true if financial companies outperform, with value investors outperforming growth. Historically, value‑oriented areas have tended to perform best in the earlier stages of economic recovery and during periods of higher inflation and/or rising bond yields.

Innovation

While innovation is a concept more often associated with growth‑oriented companies, we spend a great deal of time trying to understand the secular change that is occurring across the market and the potential risks and opportunities being created.

We are continually looking for opportunities to invest in innovative, potentially disruptive companies at attractive valuation points—for example, if the company has fallen out of favor with investors due to some short‑term issue or challenge. Microsoft, a company that has been held across a number of our U.S. value portfolios for many years, is a good example of a company where we were able to identify value in a business that many value investors were not willing to consider. At the time of our investment, Microsoft had fallen out of favor with investors, with both the range and quality of its products seen as lagging major competitors like Apple and Alphabet. With the company announcing a change in senior management and plans to refocus the business, we took the opportunity to build a position at what we felt were attractive valuations. In the time since our initial investment, Microsoft has invested heavily in upgrading the range and quality of its product set, entered into strategic partnerships to expand the market for those products, and entering new, high‑growth business areas, such as cloud systems and services.

Sentiment

From the third quarter of 2020 through to the end of the first quarter of 2021, we saw a very strong, value‑led, U.S. equity market. Central to this rally was the positive shift in investor sentiment toward value companies. The announcement by Pfizer that it had developed an effective coronavirus vaccine raised hopes of an economic reopening. This, in turn, sparked a significant reallocation trade, as investors shifted large sums into early‑cycle value companies as the likely main beneficiaries during a post‑pandemic U.S. economic recovery.

More recently, however, sentiment toward value companies appears to have shifted once more, with some of the stronger-performing value areas giving up much of their earlier‑year gains. A resurgence in coronavirus cases in recent months, including the emergence of the delta variant, has raised concerns about the nascent U.S. economic recovery and undermined confidence in the value stocks most directly impacted. This has seen a lot of the early‑year investment flows into value companies reversed in recent months. However, it is worth noting that, within the value landscape, we are seeing early signs of the expected rotation, with investors moving out of cheaper, economically sensitive value areas and reallocating toward higher‑quality value companies instead. Going forward, we anticipate company quality being a more influential factor in driving the returns of U.S. value companies.

The Durability of Value

Our ongoing view is that investors may consider maintaining a consistent exposure to U.S. value-oriented companies. This argument has certainly been more difficult to make over the past 10 years, as growth-oriented companies have substantially outperformed their value counterparts. However, it is the potential durability of value that underpins our investment approach. By investing in quality value companies during periods of concern or controversy, we aim to reap the rewards over a potentially extended time frame, as company fundamentals improve and earnings and cash flow growth are ultimately reflected in higher valuations.

General Portfolio Risks

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and Sustainability risk—may result in a material negative impact on the value of an investment and performance of the fund.

Counterparty risk—an entity with which the portfolio transacts may not meet its obligations to the portfolio.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio's attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

October 2021 / MARKETS & ECONOMY