December 2021 / MULTI-ASSET STRATEGY

Revisiting Inflation Concerns

Key Insights

- Inflation has increased worldwide and could prove to be higher and more persistent than expected.

- An increased allocation to assets that help provide an effective hedge against inflation risk could be beneficial.

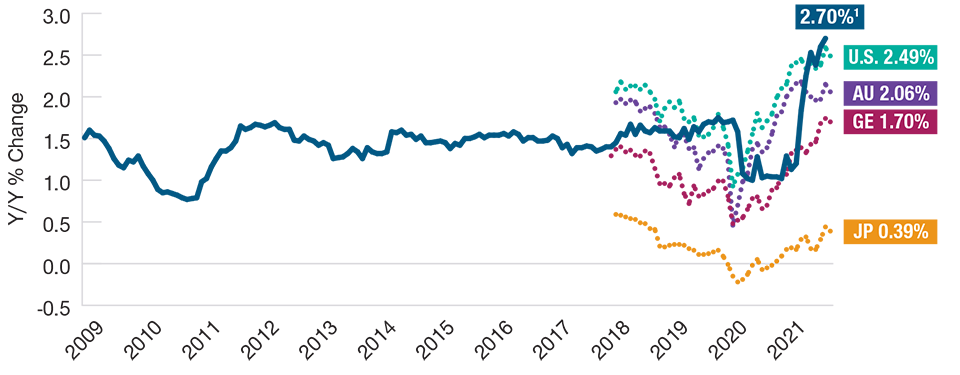

Overall, inflation has proven to be higher and more persistent than both the Federal Reserve and the market had expected. From March through October, inflation measures across the globe increased meaningfully (Figure 1), and future expectations have shifted dramatically.

Inflationary Pressures May Be More Than Transitory

(Fig. 1) Core prices continued to climb

As of September 2021

1Line represents the market-implied inflation expectations for G‑10 countries over the next 10 years.

Sources: Bloomberg Finance L.P./Haver Analytics. Russell. See Additional Disclosures.

The spike in prices has primarily been driven by supply bottlenecks and labor shortages and could be exacerbated by higher housing costs or a resurgence in the pandemic due to a new coronavirus variant. In this environment, we believe an increased allocation to assets that effectively hedge against the eroding effects of inflation may be beneficial.

Historically, commodities and stocks in commodity-related sectors—including energy and industrials—have generated strong gains during periods of high inflation. However, although commodity prices have surged this year, their upward trend has reversed sharply over the past month. Further upside may be limited given notable headwinds, including fading demand for industrial metals due to slowing industrial production in China. Also, even as U.S. oil rig counts rapidly increase, the U.S., and potentially China, plan to release strategic oil reserves, which could help to alleviate the oil demand and supply imbalance.

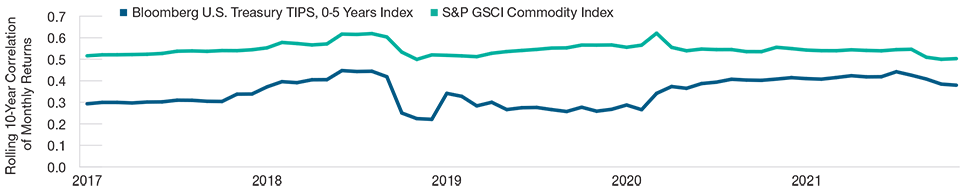

For investors seeking to hedge inflation risk, inflation-linked bonds such as U.S. Treasury inflation protected securities (TIPS) could offer an alternate option. TIPS are indexed to an inflation gauge to mitigate an investor’s risk from the decline in purchasing power typically caused by inflation. A review of monthly returns over a rolling 10-year period shows that, historically, short-maturity TIPS consistently have had a lower correlation to the S&P 500 Index than commodities (Figure 2), and may, therefore, provide better diversification benefits. Both commodities and commodities-related equities have also historically been much more volatile than TIPS.

TIPS Could Offer More Ballast Given Lower Correlation1 to Equities

(Fig. 2) TIPS have had a lower correlation to the S&P 500 Index than commodities

15 years ended November 2021, monthly data.

Source: Standard & Poor’s, Goldman Sachs, Bloomberg Finance L.P. See Additional Disclosures.

1Correlation measures how one asset class, style or individual group may be related to another. A perfect positive correlation means that the correlation coefficient is exactly 1. This implies that as one security moves, either up or down, the other security moves in lockstep, in the same direction. A perfect negative correlation means that two assets move in opposite directions, while a zero correlation implies no relationship at all.

As a result, our Asset Allocation Committee recently increased the allocation to TIPS, as they could, in our view, offer an attractive hedge against inflation and also help to mitigate overall portfolio risk.

IMPORTANT INFORMATION

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.