March 2021 / INVESTMENT INSIGHTS

Why Credit Investors Need to Become Active Duration Managers

The importance of duration for credit performance and five ways to improve it

Key Insights

- Duration has become a key driver of credit returns over the past decade, highlighting the importance of active duration management for credit investors.

- Techniques to manage duration include using structural curve positioning, allocating across regions and currencies, and using derivatives.

- Actively managing the total duration of a portfolio by adjusting duration exposure for short periods can also significantly enhance returns.

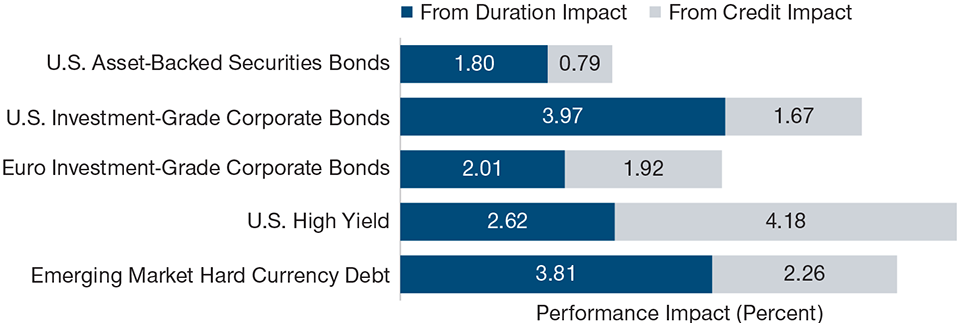

Duration Has Been a Major Driver of Credit Returns Over 10 Years

(Fig. 1) In most strategies, it has exceeded returns from credit impact

As of December 31, 2020.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Barclays U.S. Corporate Bond Index, Bloomberg Barclays U.S. ABS Index, Bloomberg Barclays Euro Corporate Bond Index, Bloomberg Barclays U.S. High Yield Bond Index, and Bloomberg Barclays EM Sovereign and Quasi Sovereign Bond Index (see Additional Disclosure). Analysis by T. Rowe Price.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.