July 2023 / INVESTMENT INSIGHTS

Only a labour market downturn will solve the UK’s inflation problem

Unemployment will need to rise to at least 6%

Inflation has surged across the world over the past few years, fuelled by a chip shortage, an energy price shock and strong post-pandemic demand. Yet inflation in the UK is proving to be more persistent than inflation in other advanced economies, where core CPI inflation is now falling. To bring UK inflation back in line with other developed nations, the Bank of England will need to hike further and unemployment will need to rise – and this will have clear implications for gilts and UK stocks.

Domestically-generated UK inflation is mainly function of stronger wage growth. My analysis suggests that Britain’s very tight labour market is behind the recent persistent out-turns of wage inflation. Many economists use a labour market Phillips curve to forecast wage inflation – however, that requires knowing what the ‘natural rate of unemployment’ is. I prefer to use the vacancy-per-unemployed ratio.

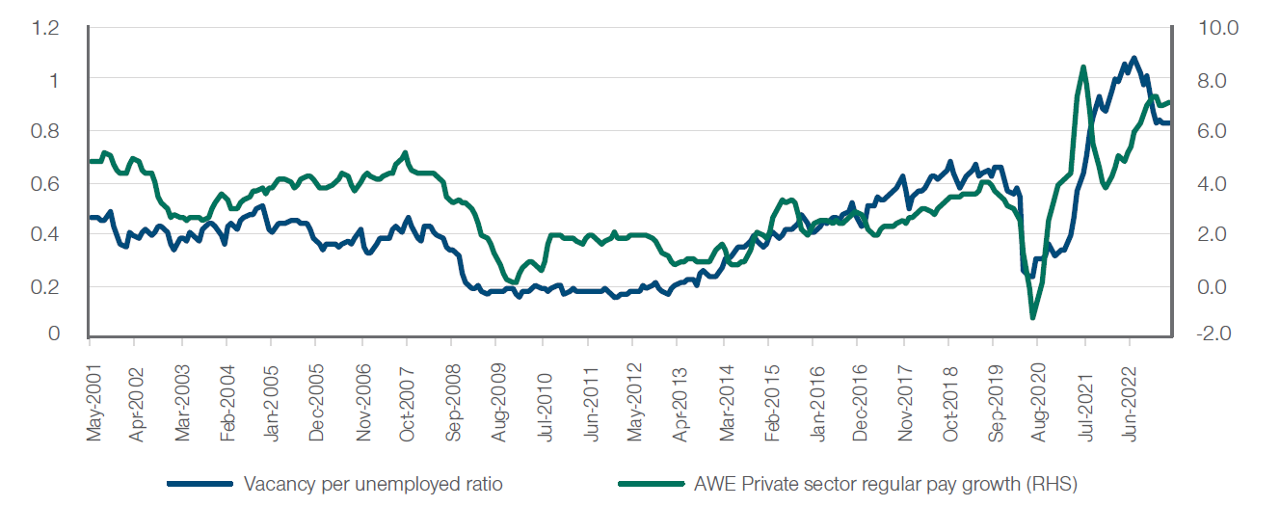

Simply put, lower availability of labour relative to the demands of the labour market is responsible for larger pay settlements. The vacancy-per-unemployed indicator has been a fairly reliable predictor of UK average weekly earnings private sector wage over the past two decades (Figure 1). While the vacancy-to-unemployment ratio has come down from its 2022 peak, it remains at the highest level since 1957 and is implying that wage growth will continue around 6% - a level that is consistent with 4-5% CPI inflation in the medium term.

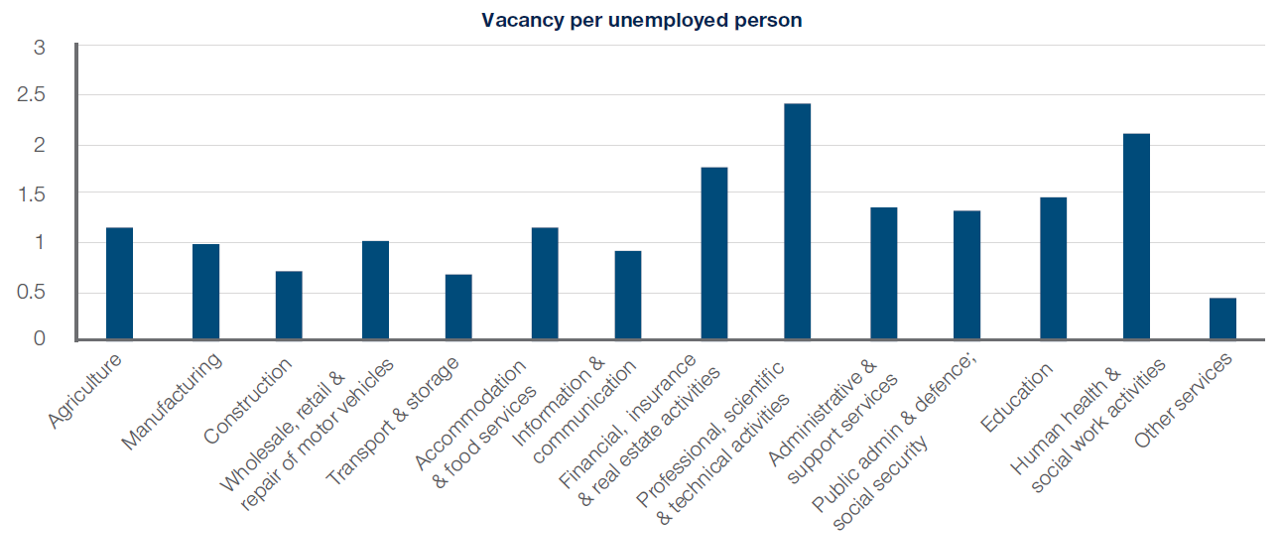

The current abundance of vacancies relative to unemployed workers is not only due to labour shortages, but also a skills mismatch. A sectoral decomposition of the unemployed-per-vacancy ratio clearly shows that vacancies per unemployed worker are highest in the professional, financial and health services (Figure 2). The good news is that the recent rise in student migration to the UK, due to new VISA regulations which allow graduates to look for work longer, will eventually fill this gap. The UK’s world class universities will create the necessary human capital – however, this will take several years and will likely not alleviate labour market pressures in the short term.

UK wage growth of 6% is consistent with 4-5% core CPI inflation

Figure 1: Labour market imbalances will keep UK wage growth around 6%.

Source: UK Office for National Statistics.

Why is the UK labour market the tightest it has been in 60 years? One likely factor is the strength of labour demand since the post- pandemic reopening. However, it is striking that UK real GDP still has not recovered to the pre-pandemic level – a milestone the eurozone surpassed in Q4 2021. This implies that supply is playing a bigger role than demand in the UK’s labour market tightness.

The Vacancy to Unemployed ratio is highest in professional, financial and health services

Figure 2. The UK has a skills mismatch in several key sectors.

Source: UK Office for National Statistics.

Consistent with the supply explanation, labour force participation has declined significantly during the pandemic, but only partially recovered. The key reasons behind this labour shortage are an ageing population, the health of the workforce, and skills mismatches in the UK Labour force, which were likely exacerbated by the transition to the new post-Brexit migration regime. All these factors are likely to be persistent: the labour market will not return to balance without a large decline in domestic demand.

To meet its inflation target, the Bank of England therefore needs to take out the heat out of the labour market. In an ideal world, monetary policy would just reduce the level of vacancies to a very low level. Such an optimistic outcome is unlikely, however, because different sectors have different sensitivities to monetary policy.

Interest rate-sensitive sectors such as manufacturing and construction may have to undergo a relatively greater contraction in demand and rise in unemployment for the labour market to return to balance in aggregate. It would take time-intensive reskilling for those workers to move to the sectors where the current vacancies are, such as IT or professional services. A rise in unemployment, even if only short term, is therefore inevitable.

If vacancies fall back to 2019 levels, a rise in the unemployment rate to levels between 6 – 6.5% would be necessary to return wage inflation to levels that are consistent with the Bank of England’s inflation target. Even if vacancies fell by 40%, as they did during the global financial crisis, the unemployment rate would need to rise significantly above 5% to ensure that UK wage inflation dynamics are consistent with the inflation target.

The level of wage inflation that is consistent with an inflation target of 2% crucially depends on labour productivity growth. If labour productivity grows by 1%, then 3% nominal wage inflation will result in 2% domestically-generated inflation in the medium term. However, the UK has struggled with historically very low labour productivity growth since the Global Financial Crisis. There is no reason to suspect this is going to change in the short term, especially since UK investment has remained low relative to other developed economies in the past couple of years. This means labour productivity growth will likely remain low and that, consequently, wage inflation will need to fall to around 3-3.5%. To achieve such a large reduction in wage inflation, and therefore CPI inflation, the unemployment rate will need to rise to around 6% or higher.

These developments will clearly have major implications for UK asset classes. As the Bank of England will continue to raise rates to fight inflation, indebted households will cut back on spending. Earnings of firms and the performance of the FTSE 250 will therefore likely continue to be subdued. Short-term gilts will likely continue to sell-off and the yield curve will continue to invert. However, long-term gilts are already cheap on a relative basis to Bunds. I believe that a 10-year gilt yield closer to 5% represents a good addition to any portfolio.

A key risk going forward is that the UK professional economics community continues to underestimate the inflationary momentum in the UK economy. This could mean that inflation remains above target in the medium term, a scenario that is currently not priced by financial markets.

Another risk is that the collective monetary tightening of central banks leads to a global recession in 2024. As financial markets continued to price the Bank of England’s peak policy year higher, sterling has had an excellent performance this year. However, in either the recession or inflation above target scenario, the pound could sell off.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

July 2023 / INVESTMENT INSIGHTS

July 2023 / INVESTMENT INSIGHTS