July 2023 / INVESTMENT INSIGHTS

Offense and Defense—Health Care Offers Exposure to Both Worlds

Few sectors offer defensive characteristics and attractive growth potential

Key Insights

- Amid a more uncertain market environment, we believe health care is one of the few sectors that offer defensive attributes as well as attractive growth opportunities.

- Socioeconomic trends and the coronavirus pandemic are driving significant spending in health care—underpinning a potentially exciting period of innovation, consolidation, and optimization.

- The multifaceted, complex, and innovative nature of health care makes it a rich landscape for differentiated insights and fundamental, bottom-up stock selection.

Following a challenging year in 2022, during which both equity and fixed income markets delivered negative returns, financial markets have, so far, rebounded confidently in 2023. However, many of the root causes of recent uncertainty have not gone away, as inflationary pressure, elevated interest rates, mixed macroeconomic signals, and geopolitical concerns all persist. These risks create a more uncertain environment and make appealing growth opportunities harder to find. Given this market backdrop, there are few sectors that offer both important defensive characteristics and also the opportunity to achieve target investment growth thresholds. We believe health care is one such sector.

Health Care Is a Rare Investment Dichotomy

Health care has historically displayed relative resilience during periods of market uncertainty. This is due to the general inelasticity of demand for many health care products and services. Whatever might be happening in the wider economy, in good times and in bad, people still get sick, ensuring constant demand for hospital care, medical insurance, consumable products, and treatments for chronic conditions. This resilience was again displayed in what was a difficult 2022 market environment, in which the health care sector outperformed the broader S&P 500 Index by 15.8%.1

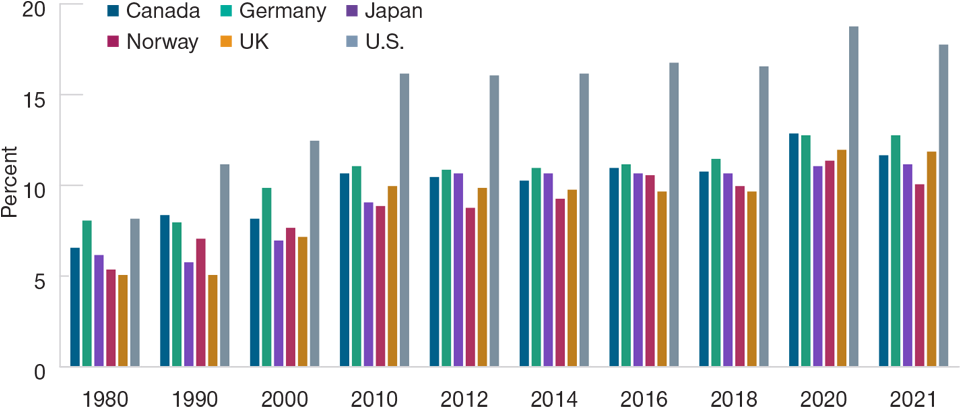

The U.S. Is a World Outlier in Terms of Health Care Spending

(Fig. 1) Percentage of national GDP spent on health care

As of June 2023 (latest data available to December 31, 2021).

Current expenditure on all health care functions, as a share of national gross domestic product (GDP).

Source: OECD Health Statistics.

At the same time, health care continues to offer attractive growth potential in the form of game‑changing advancement in drug therapies and medical devices. The most attractive companies in these fields not only command strong pricing power due to the innovative nature of their products, but patents and regulatory approvals also create clear barriers to entry.

Structural Growth in Spending

Structural socioeconomic trends also support continuing growth in health care spending. People are living longer, and the elderly population is growing, leading to increased consumption of health care products and services.

Advancements in technology and biological discovery are also resulting in increased health care provision, and the development of new treatments for unmet clinical needs has the potential to affect large patient populations.

The coronavirus pandemic served as a wake‑up call for global governments as national health systems—and hospitals in particular—came under immense strain. The U.S. was no exception, as the need for sufficient equipment in intensive care units and other health settings to avoid potentially catastrophic delays in diagnosing and treating patients was laid bare. The need for greater operational efficiency was also highlighted, most notably the technology infrastructure required to monitor population health more effectively, both in acute situations and longer term.

To strengthen the resilience of global health systems, significant, ongoing investment is required. Governments have been jolted into action by the pandemic, and we are seeing increased capital flows being allocated toward health care across a range of industries. This is positive for the sector and supportive of a potentially exciting period of innovation, consolidation, and optimization in this pivotal area of society.

A Complex, Multifaceted Landscape

From an investment perspective, the health care universe is a rich landscape for differentiated opportunities—multifaceted, complex, innovative, and with a generally low correlation to global macro conditions. Within the broad diversity of the health care sector, three areas, or subsectors, currently look especially attractive, in our view, and, thus, warrant closer inspection.

Health Care Subsectors Offer a Range of Investment Opportunities

Certain areas look particularly attractive currently

As of March 31, 2023.

Healthcare subsector characteristics apply to the U.S. market. For illustrative purposes only.

Source: T. Rowe Price.

Managed care—Within the health services sector we particularly like managed care companies, which are the providers of U.S. health insurance. These businesses are attractive, in part, due to their more defensive attributes but also because the market underappreciates the significant value that these companies create. By contracting with a range of providers, such as hospitals, doctors, laboratories, and other specialist facilities, they can offer reduced health insurance rates to plan members while still maintaining quality of care. From an investment perspective, many of these companies are currently trading at valuation multiples that appear to substantially underestimate their durable growth potential.

Medical devices—A number of these companies are changing health outcomes through innovation, from insulin delivery for diabetic patients to robotic surgery. The influence of surgical robots in operating rooms, for example, is growing rapidly. Enhanced dexterity allows surgeons to operate in very tight spaces that would have previously only been accessible via open surgery. Surgical robots also help provide surgeons with greater precision and control of instruments, both of which lead to improved outcomes, faster recovery times, shorter hospital stays, and generally lower readmission rates. The percentage of surgeries conducted with robots is still relatively small, meaning the growth potential is significant.

Therapeutics—These companies are at the forefront of developing new drugs or therapies to improve patient care and health outcomes. Biotechnology, for example, is transforming the way diseases are treated. Research and development progress is ongoing, and commercial success is also a feature, despite the more challenging macro conditions impacting more cyclical sectors. Some of the companies reporting excellent clinical data updates are attracting investor attention and being rewarded with large share price moves. Larger pharma companies are also seeking opportunities to acquire biotech companies for their products and technologies. These fundamental trends arguably have only been strengthened by the emergence of the coronavirus pandemic.

Election Year Uncertainty Is a Risk

The outlook for health care is not without risks, however. One of the key near‑term risks is the U.S. presidential election in 2024. Election years are typically a source of considerable uncertainty for the health care sector. Not only is the eventual presidential winner unknown, often the candidates who are running are not known until late in the race. The potential variance in health care policies, not only between the Republican and Democratic parties, but also between candidates within each party, can be significant, creating major uncertainty, particularly within the managed care industry, in the lead‑up to the election.

Looking Forward

The macroeconomic environment looks set to be challenging through 2023 and beyond. Indeed, we believe a recession is likely. Health care tends to be less cyclically sensitive, and its defensive characteristics should help the sector weather any slowdown in the broader economy.

The diversity of health care also makes it a particularly rich landscape—from innovation in the areas of therapeutics and medical devices, to the rapid adoption of new technology and care delivery models, to the defensive growth characteristics of the managed care industry.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

June 2023 / INVESTMENT INSIGHTS

July 2023 / MARKETS & ECONOMY