April 2022 / MARKETS & ECONOMY

Most Central Banks Have No Choice But to Remain Hawkish

Few have the scope to loosen policy if economic conditions worsen

Key Insights

- Central banks are under pressure to tighten policy on the back of surging commodity prices.

- How banks respond will depend on their autonomy and their dependence on global capital flows.

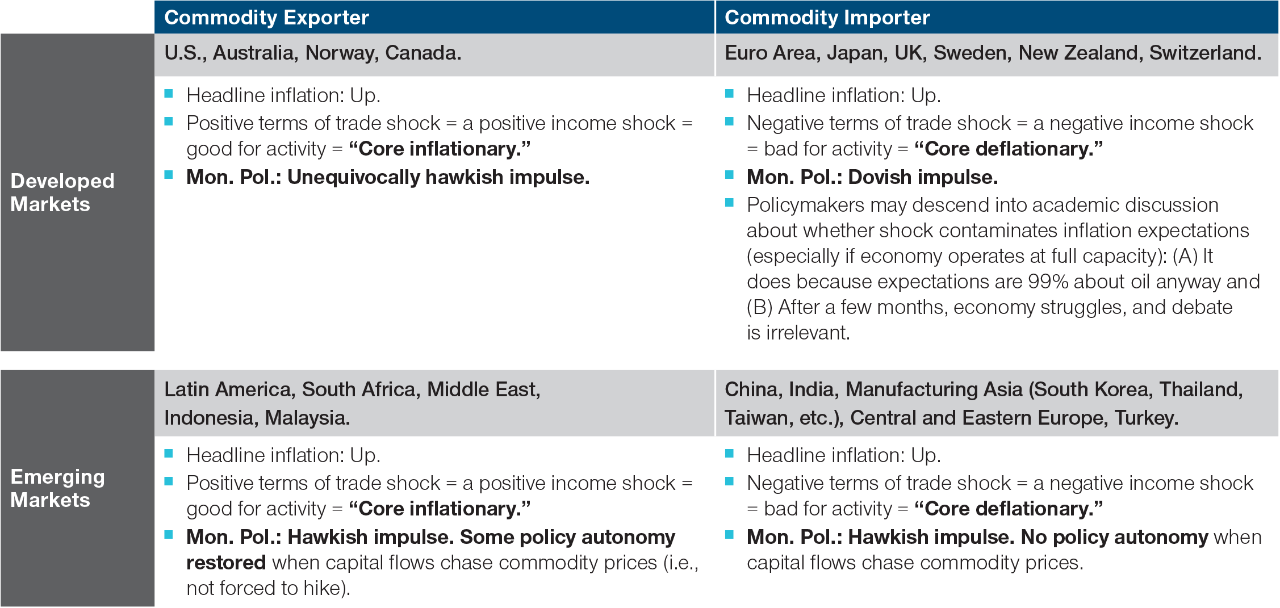

- Commodity-exporting countries and commodity-importing EM countries will likely stay hawkish; commodity-importing DM countries may become more dovish.

Commodity prices have surged since Russia invaded Ukraine. As a result, headline inflation in most countries will very likely rise rapidly over the next few months. Given that global headline inflation was already elevated before the invasion, this puts central banks under considerable pressure to act.

So, they should just accelerate the pace of monetary tightening, right? For the most part, this logic makes sense—however, the impact of rising commodity prices complicates the picture. For an energy importer, a surge in the oil price is normally a deflationary shock. Although headline inflation rises upon impact, the sudden rise in import prices is a negative terms of trade shock that drains income from the economy. Over time, this income drain produces a pronounced growth deceleration, which takes pressure off the labor market and slows wage growth. Given that wage pressure is the nucleus of core inflation, tightening policy while wage growth is slowing might not be such a good idea after all.

As well as being restricted by prevailing economic conditions, central banks are constrained by the credibility of their institutional frameworks and their dependence on global capital flows. In other words, we should expect a central bank’s response to surging commodity prices to depend on whether it operates in a developed market (DM) or emerging market (EM) country and whether that country is a commodity importer or a commodity exporter.

Not All Central Banks Can Act Freely

DM countries tend to respond differently to external shocks than EM countries. Typically, DMs have well‑established and credible institutional frameworks, usually including an independent central bank. With greater institutional resiliency comes a stronger anchoring of inflation expectations. This provides the central bank with policy autonomy: The central bank can “look through” shocks to headline inflation without undue concerns about de‑anchoring inflation expectations and without fears of destabilizing capital outflows.

EM countries usually have young institutional frameworks that have yet to prove their resistance to political pressure. For the populations of these economies, low and stable inflation is not something that can be taken for granted. Consequently, as adverse external shocks hit, the populations have learned from painful experience to try to preserve purchasing power by obtaining U.S. dollars. Therefore, as inflationary shocks wash up on the shores of emerging markets, EM central banks will very likely be forced to hike interest rates to prevent painful surges in inflation expectations and associated disruptive capital outflows. The ability to look through headline inflation shocks is virtually absent as there is little policy autonomy.

Regarding capital flows, for commodity importers, a rise in commodity prices is a negative terms of trade shock that drains income from the economy and slows activity. Headline inflation may initially increase, but, over time, slowing activity would reduce inflationary pressures.

For commodity exporters, a rise in commodity prices is a positive terms of trade shock that brings an income windfall. Higher incomes would increase consumers’ purchasing power, which raises economic activity. Activity gains further as surging commodity prices prompt a capex expansion in the extractive industries. As such, for commodity exporters, inflationary pressures rise in response to rising commodity prices as both headline inflation surges and as a higher level of economic activity leads to additional wage pressures.

How We Expect Central Banks to Act

When we put all this together, we can see that a surge in commodity prices will very likely result in higher headline inflation and a positive term of trade shock for a commodity‑exporting DM country. The income windfall will in turn very likely drive activity and push core inflation up, resulting in an unequivocally hawkish response from the central bank.

How We Expect Central Banks to Act

(Fig. 1) Location and dependence on capital flows is key

(Fig. 1) Location and dependence on capital flows is key

As of March 25, 2022.

The views contained herein are as of the date noted and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates.

Rising commodity prices will likely also lead to a positive in terms of trade shock for an EM commodity exporter. As with the DM commodity exporter, the income windfall will likely fuel activity and push core inflation higher. The central bank’s impulse will very likely be hawkish and will benefit from the restoration of some policy autonomy if capital flows chase the rise in commodity prices.

For a commodity‑importing EM country, a rise in commodity prices will likely lead to higher headline inflation and a negative in terms of trade shock. The associated fall in income will likely depress activity, which, over time, will likely weigh on core inflation. The prospect of capital outflows likely means that the central bank will adopt a hawkish stance despite the projected slowdown in economic activity. In other words, the absence of policy autonomy will likely effectively force the central bank to adopt a more hawkish policy stance than it would ideally like to.

Finally, for the commodity‑importing DM country, the surge in commodity prices very likely results in higher headline inflation and the negative terms of trade shock erodes purchasing power, which, over time, reduces activity and puts downward pressure on core inflation. In this instance, however, the relatively high degree of autonomy enjoyed by the central bank should enable it to adopt a slightly more dovish stance than its commodity‑importing EM counterpart.

Commodity‑Producing DM Currencies Look Strong

These divergent policy responses have a few straightforward implications for fixed income investors: Across the currency complex, investors should generally favor long positions in commodity‑producing DMs, like Australia, Norway, and Canada, financed by short positions in commodity‑importing EMs and DMs, like Korea, the eurozone, the UK, and central Europe. Interestingly, with a relatively neutral oil trade balance, the U.S. dollar is approximately in the middle of the pack.

When it comes to interest rates trades, investors should look for bond markets to underperform and for yield curves to flatten more in the commodity‑producing DMs versus their commodity‑importing counterparts.

As with any analysis, initial conditions matter. Most countries enter the current inflationary period with economies that need tighter financial conditions. Apart from the European Central Bank, commodity‑importing DM central banks do not have space for a meaningful dovish shift. In practice, this means that while marginal decisions might favor the dovish option, I expect the overall policy direction will not change until there is a significant impact on economic activity.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.