December 2021 / INVESTMENT INSIGHTS

Above-Trend U.S. Growth Could See Smaller Companies Shine

U.S. smaller companies and a strong domestic recovery are closely aligned

Key Insights

- As the U.S. economic recovery continues to broaden, smaller companies, as the engine of the domestic economy, look well positioned to benefit.

- Above‑trend U.S. growth is supportive of smaller companies, encouraging investors down the market cap scale in search of tomorrow’s winners.

- The diverse and under‑researched nature of U.S. smaller companies offers opportunities for active investors to uncover hidden gems.

The rebound in investor confidence, following the most volatile period for global equity markets since the global financial crisis, has been extremely encouraging. What’s more, the rally in U.S. equities has not been confined to the large, well‑known, companies, but has extended down the market capitalization scale.

U.S. smaller company returns led the broader market from late 2020 into early 2021, before pulling back during the second and third quarters, only to re‑accelerate again more recently. Given this positive, albeit bumpy, trajectory, the question some investors are asking is: What does the near‑term environment look like for U.S. smaller companies?

At the outset, some recent market context is potentially helpful in looking forward. It is worth noting that U.S smaller companies have dramatically underperformed larger companies over the decade leading up to the start of the coronavirus pandemic. Since the nadir of the pandemic‑induced down market (March 15, 2020), U.S. smaller companies have notably outperformed larger companies, the Russell 2500 Index gaining 128.7% compared with a 103.8% return for the S&P 500 Index. In terms of the recent weaker period of performance from U.S. smaller companies, during the second and third quarter of 2021, this is more likely a simple pausing for breath in our view, rather than a sign of anything more fundamental. There is also an argument to make that the recent outperformance of larger companies is simply a catch‑up phase, having lagged small‑caps through the post‑pandemic rally. More recently, U.S. smaller companies have returned a healthy 18.8%, year‑to‑date in 2021 (Russell 2500), versus 23.3% for the S&P 500.1

Potential Drivers of Continuing U.S. Small‑Cap Success

Various Factors Point to a Supportive Environment

Source: T. Rowe Price.

As we move toward 2022, we expect the environment to remain broadly supportive of smaller companies. Clearly, the kind of returns generated since the pandemic‑related lows will not be repeated, but as the U.S. economic recovery continues to build and broaden, investors looking for tomorrow’s winners should include smaller capitalization companies within their universe.

Potential Drivers of Continuing U.S. Small‑Cap Success

While there are potential headwinds to be mindful of, there are also several factors that could continue to underpin the positive trend in small‑cap performance in 2022. Many small‑cap companies have come into success in their own right, thanks to some key opportunities presented by the pandemic:

Early beneficiaries of recovery: The U.S. economic recovery should continue to provide a supportive backdrop for U.S. smaller companies, which tend to be more sensitive to shifts in economic direction. A strong October jobs report—the U.S. economy added 531,000 jobs—adds to a picture of an American economy regaining its vigor after a sluggish summer. Meanwhile, Congress has finally approved a USD 1.2 trillion infrastructure bill after months of wrangling.

Drivers of the domestic economy: In 2019, the Small Business Administration reported that smaller companies employed 47.3% of the private workforce, making smaller companies the true engine of the U.S. economy. Small‑caps tend to do well as economies recover, and with the U.S. economy growing at an above‑trend rate, this represents a potentially significant tailwind for smaller companies over the coming year.

Inflation less of a concern: While the strong rebound in the U.S. economy has been very encouraging, less welcome has been the consequent rise in U.S. inflation. Annual consumer price index inflation soared to 6.2% in October 2021, the largest increase in 30 years. Whether this proves to be a transitory spike or the start of a potentially longer‑term trend, small‑caps have historically performed relatively well during periods of higher inflation.

Interest rate sensitivity: We are mindful of the fact that rising interest rates are worrying for many investors, who fear that higher yields will be accompanied by falling stock prices across the market cap spectrum. Historically, however, small‑caps and rising interest rates have enjoyed a reasonably harmonious relationship. Interest rates, and the shape of the yield curve, have been impactful on performance of small‑cap equities over time—i.e., better when the curve is steepening as this is tied to a strengthening economy. There is also more exposure to rate‑sensitive financials at the smaller end of the market versus large‑caps.

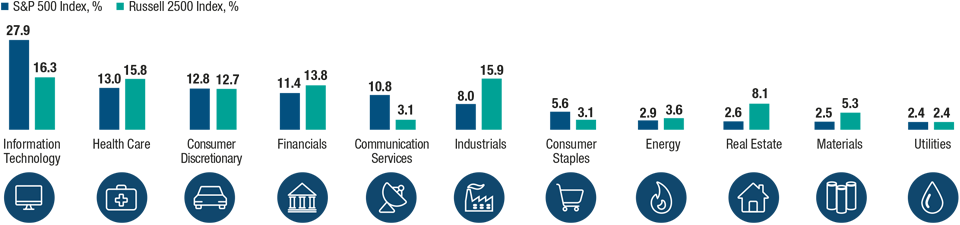

U.S. Small‑Cap Sector Weightings Closely Aligned to Domestic Recovery

(Fig. 1) GICS* Weightings for the S&P 500 Index vs. the Russell 2500 Index (% of Total Index)

*Global Industry Classification Standard (GICS) sector weightings.

Note: Rounding may mean sector wights do not total 100%.

As of September 30, 2021.

Sources: S&P Global and FTSE Russell Group, and T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. (See Additional Disclosures.)

Diverse, under‑researched landscape: The ≈2,500 U.S. mid‑ and small‑cap companies that make up the Russell 2500 Index provide a broad and diverse mix of businesses in which to invest—from established industry leaders to new and innovative “micro‑caps” at the smallest end of the size spectrum. In comparison, the larger end of the market tends to be more concentrated, and significantly skewed toward a few main sectors, in particular. At the same time, small and medium‑sized companies are often under‑researched by investors, which creates good opportunities for research‑driven, active stock‑pickers to uncover hidden gems.

Corporate Results Have Been Encouraging

U.S. smaller company earnings results have been encouraging over the past 18 months, a fact that has underpinned strong investment returns.

While we expect further positive returns from U.S. smaller companies in 2022, gains are likely to be more modest, compared with the past 12–18 months. Going forward, we believe that the market is nearing a point where fundamental quality is likely to matter more, and increasing differentiation across smaller company results will greatly impact returns.

The pandemic had the effect of highlighting companies with quality business models, effectively forcing them to prove their durability. High‑quality companies across a range of industries—including those hit hardest by the pandemic—were able to strengthen their competitive positions and are now poised to emerge with greater earnings and cash flow power as the economy reopens. Many of the defensive measures that companies took to preserve cash flow have evolved into permanently reduced cost structures, such as reductions in bricks and mortar real estate, due to moving to full‑ or part‑time work‑from‑home models. These actions, combined with proactive moves made by some quality companies, while their smaller or more highly leveraged competitors were focused on pure survival, have strengthened their advantages, broadened their addressable markets, and increased their long‑term earnings profile relative to pre‑pandemic levels.

Moving forward, we believe it will be even more important to allocate to businesses that can continue to grow profits due to benefiting from sustainable competitive advantages, rather than depending on government lifelines.

A Final Word Heading Into 2022

Our view is for a continuing economic recovery over the next 12–18 months at least, but not without some bumps along the way. Markets are likely to remain highly sensitive to news on economic indicators and also on the lingering effects of the pandemic. But, while we think smaller company returns will slow from their recent pace, we also think that an ongoing economic recovery with improving macro indicators, will produce a market environment that supports small‑cap performance.

Of course, as always, it is important to stay watchful. Resurgent coronavirus cases could easily undermine the economic recovery and market confidence, for example. We would like to see further improvement in data across consumer industries, such as restaurants and hospitality, and in retail sales and purchasing managers’ index data. From a sector perspective, we favor certain secular growth areas with a cyclical tilt, such as industrials and business services and materials, as well as select growth‑oriented names in more traditionally defensive areas, such as utilities.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

December 2021 / INVESTMENT INSIGHTS