March 2021 / INVESTMENT INSIGHTS

Investing in the Infrastructure Behind the Digital Economy

We like firms supplying “picks and shovels” for the rush online

Key Insights

- Companies in all sectors of the economy are moving operations online and investing in building digital relationships with their customers.

- We are interested in the companies that provide the software, cloud infrastructure, chips, and cybersecurity enabling firms to digitalize.

- In many areas, digitalization remains in its early stages, potentially creating long growth runways for well‑positioned firms.

The dramatic shift to remote working, learning, and shopping as a result of the global pandemic may be at the leading edge of an even more profound technology transformation: Companies outside the technology sector, from health care to financial services, are accelerating efforts to build digital relationships with their customers.

The suppliers of technologies enabling this transformation are a key focus for us. We pursue companies that provide the key infrastructure and services for enterprises seeking to digitalize their businesses. In our view, firms providing crucial software, cloud resources, and cybersecurity could be poised to enjoy years of solid growth as technology deepens its impact on revenue, cost savings, and competitiveness.

Revolutions Upending Enterprise Software

We believe revolutions are underway in enterprise software. Better known and more established is the transition to cloud‑ and subscription‑based software, which provides significant cost savings to customers while helping ensure seamless access to incremental updates and improvements that come with the latest version. Since its beginnings two decades ago, the move to the cloud has upended the industry. Industry leaders, such as Oracle and SAP, that focused on installing and servicing systems on‑site have been supplanted by new giants, such as Workday, ServiceNow, and Salesforce.com.

The software industry is also undergoing a more recent transformation—the advent of platforms that allow customers to easily craft software tailored to their specific needs. In this new era, tools for software developers have become critical for innovation, while new applications are making it easier for users without programming experience to develop customized solutions for their businesses. We believe this change is in its early stages and is less appreciated by the market, amid the tech sector’s generally elevated valuations.

Technology developed by the Canadian firm Shopify has allowed small‑ and medium‑sized merchants to digitalize their operations, making Shopify a leading e‑commerce platform for independent merchants. Without relying on professional developers, businesses seeking to sell products and services online can use the Shopify platform to create websites, add products, manage promotions, and process orders—freeing many smaller merchants from reliance on Amazon.com, eBay, and other online marketplaces. Shopify’s recently unveiled “Shop App,” could become promising for consumers to initiate product searches, alongside Amazon and Google. Shopify is also partnering with Facebook, playing a key role in the latter’s efforts to monetize Instagram.

The accessibility of the Shopify platform is supported by application programming interfaces (APIs), which serve as building blocks in software development. For example, users without any technical background can deploy familiar “drag and drop” tools to make changes to their sites. We are playing close attention to the growing use and market potential of APIs. In particular, many small and early‑stage companies are pioneering the use of drag‑and‑drop interfaces for non‑experts, likely leading to a future in which software users become “programmers” without understanding a single line of code.

Sophisticated and large‑scale programming is not going away, of course, and the complexities posed by massive data sets and machine learning are giving rise to markets of their own. Australia‑based Atlassian is levered to the increasing importance of applications development and the growing ability of end users to purchase their own tools. Its application development software, Jira, has become the standard workflow platform for programmers worldwide. The surge in remote working has also boosted Atlassian’s collaboration tool, Confluence. Companies enabling remote communication such as Atlassian and Zoom Video Communications have benefited from the hybrid home office work model, which we believe is likely to persist following the pandemic.

Companies That Power the Cloud

We believe the infrastructure and platform companies that enable the cloud to function also appear to have many years of strong growth ahead of them. The pandemic has driven a greater appreciation of companies’ need to respond quickly to changing demand patterns and production constraints. Many management teams have come to realize that transitioning more computing capacity and data to the cloud enables greater agility.

The three dominant U.S. cloud platforms—Alphabet’s Google Cloud Platform, Microsoft’s Azure, and Amazon Web Services (AWS)—experienced growth in 2020. We expect all three to likely remain prominent parts of their parent companies’ businesses in the coming years. Indeed, a stronger post‑pandemic economy should reinvigorate demand from online travel and hospitality clients, as well as other hard‑hit customer segments.

Just as the first industrial revolution was built on steam, and the second on electricity, so the digitalization of the economy rests on a foundation of semiconductors. Even as demand for processing power is expanding exponentially, however, the challenges in manufacturing leading‑edge semiconductors are growing. For roughly four decades, chipmakers could be expected to double the number of transistors on a given area of a chip roughly every two years—a pattern known as Moore’s Law. Beginning around 2012, however, Intel and other leading semi firms began coming up against physical limits using existing technology.

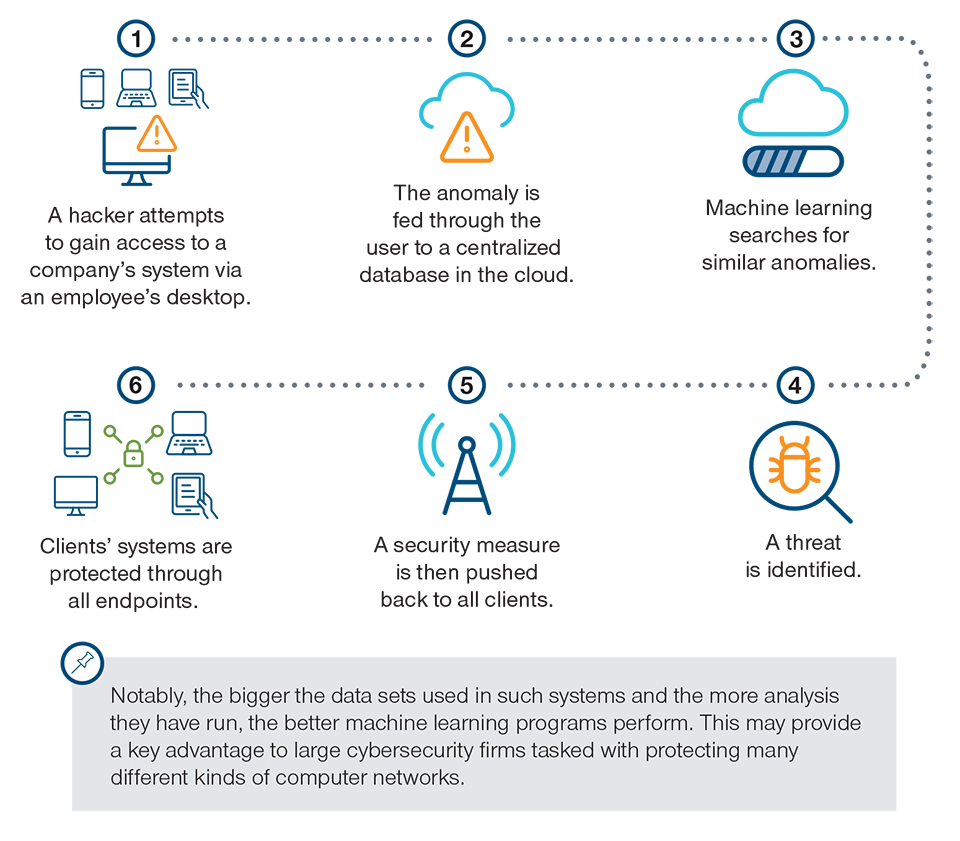

The Power of Cloud-Based Security

For illustrative purposes only.

A group of “linchpin” semiconductor equipment firms have recently enabled chipmakers to move beyond those limits, if at a slower pace. Perhaps counterintuitively, the semiconductor industry has had to become more innovative as shrinking chips has become harder. We believe that the firms able to stay at the leading edge of innovation will be able to demand higher prices in a less commodified and cyclical industry.

The Netherlands’ ASML Holding is the world’s sole supplier of extreme ultraviolet (EUV) lithography equipment used in laying down circuitry, the most critical step in manufacturing the latest generation of chips (such as the Apple “Bionic” chips). In our view, this unique technological advantage could give ASML strong pricing power in what had been a notoriously cyclical industry. After investing roughly USD 10 billion in developing EUV technologies, ASML sells its machines for well over USD 100 million each.

Applied Materials supplies equipment used in the later stages of the semiconductor manufacturing process, and we believe their tools will also be crucial in allowing further chip advances.

Cybersecurity: A Key Industry

As the economy digitalizes, cybersecurity has become a leading concern for nearly every business. Moreover, prominent recent breaches, such as the suspected state‑sponsored attack on network manager SolarWinds, have highlighted the costs of having vulnerable systems. We estimate that security currently represents 5% to 10% of corporate technology budgets and has been one of the most resilient areas of investment throughout the pandemic.

Historically, security software has been a highly fragmented market, with many small vendors offering targeted solutions to each new specific threat. Companies that were ahead of the curve could quickly fall behind given the rapid pace at which adversaries move.

The use of the cloud appears to be helping companies with the right architecture gain a sustainable advantage, however. Crowdstrike Holdings cloud‑hosted architecture uses agents installed on each endpoint (such as an employee’s desktop computer) to send data to a centralized cloud database. The crowdsourced data are then used to train artificial intelligence (AI) models to detect threats. We believe this has created a virtuous cycle for Crowdstrike—its growing customer base feeds into its growing database, helping improve its AI models and attracting, in turn, more customers.

Opportunities as We Return to the “New Normal”

To be sure, the accelerating growth of leading technology firms in 2020 caught investors’ attention, and valuations have become elevated in areas. In addition, year‑over‑year earnings and revenue comparisons are likely to be challenging in the coming months, as many firms are unlikely to match their pace of growth in 2020. In some cases, we have been trimming into strength, as in semiconductor companies that appear to be in the latter innings of their earnings cycle.

In other areas, however, we see the potential for continued solid gains for investors in 2021. Some innovative software firms, for example, had significant exposure to the downturn in business activity following the pandemic. This should make year‑over‑year comparisons much less of a hurdle as they hopefully benefit from an economic rebound. In other cases, we are maintaining bets on companies that enjoyed strong performance last year but still invested aggressively to further bolster their competitive positioning. For many, we anticipate that the returns on those investments are still to come and should result in stronger business results than the market appreciates.

What we’re watching next

Even as chipmakers struggle to keep up with demand, the industry is in flux. New leaders have emerged to challenge Intel’s dominance in making advanced chips, and homogeneous central processing units (CPUs) are being supplanted in many cases by specialty chips, such as graphics processing units (GPUs) and data processing units (DPUs). Meanwhile, the challenges posed by Moore’s Law and rising costs are driving consolidation in the industry. We are closely monitoring how these changes are shifting the competitive landscape and affecting a range of manufacturing, software, design, and equipment firms.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

March 2021 / INVESTMENT INSIGHTS

March 2021 / MARKETS & ECONOMY