November 2022 / INVESTMENT INSIGHTS

Divided Government Likely to Usher in Legislative Gridlock

Investors should focus on fundamentals, not political changes.

Key Insights

- We expect limited legislative achievement in the next Congress, so corporations may find it easier to plan without having to anticipate changes in taxation.

- Divided government may prompt the Biden administration to use regulatory changes to implement its agenda, which could have implications for certain sectors.

- We believe investment decisions should be based on a longer view, not near‑term political outcomes.

With Republicans taking control of the House of Representatives and Democrats retaining control of the Senate in the midterm elections, we anticipate limited legislative achievement in the next Congress. Indeed, we see the potential for greater conflict between the political parties that could have economic repercussions. At the same time, we believe it is important for investors to guard against making investment decisions based on election outcomes that could prove ephemeral.

Eric Veiel, T. Rowe Price head of global equity and chief investment officer, says “the midterm elections are less important than the full election cycle, so the impact of the midterms is even smaller in the grand scheme of a long‑term investment horizon.” This may be particularly true in 2022, when extraordinary conditions such as the war in Ukraine, the global energy crisis, the highest U.S. inflation rate in four decades, and ongoing disruption caused by the coronavirus pandemic are likely to be more meaningful in the long term.

It is worth recalling that periods of divided government, in which one party controls the White House while the other party controls one or both chambers of Congress, often limit legislative success. In this environment, corporations may find it easier to plan without having to anticipate changes in taxation. The pivot to divided government is likely to prompt the Biden administration to use regulatory changes to implement parts of its agenda, which could have important implications for certain sectors and industries, in our view.

Impact of New Laws May Take Time to Flow Into Economy

President Joe Biden had some unexpected success in achieving legislative goals earlier in 2022, including implementation of the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act and the Inflation Reduction Act (IRA). The CHIPS and Science Act is designed to boost U.S. semiconductor manufacturing and improve technological competitiveness, while the IRA authorizes spending on clean energy technologies as well as health care and prescription drug pricing reforms.

The president also won approval of a significant infrastructure spending package that will finance everything from transportation to expanded broadband coverage. It will take years for the impact of these policies to fully flow into the economy, perhaps helping to dull the impact of legislative gridlock.

Indeed, as T. Rowe Price Washington, D.C., Associate Analyst Michael Pinkerton says, “the action will continue to be on the monetary side, not the fiscal side,” with little appetite among Republicans to pass any new taxes. It appears that following the government’s massive outlays in 2020 related to the pandemic, Republicans would also oppose meaningful fiscal aid to support the economy in 2023 if there is a relatively mild recession.

However, “a deep or severe recession could prompt Congress to enact more fiscal support, possibly in the form of stimulus checks,” according to T. Rowe Price U.S. Economist Blerina Uruci. Fiscal stabilizers, which are government policies that automatically boost spending without legislative authorization in times of economic difficulty, would also help underpin consumer demand. Unemployment insurance and income tax rates that decrease with falling income are two automatic fiscal stabilizers.

Debt Ceiling Brinkmanship Back in Play

The new Republican majority in the House could meaningfully change the dynamics of raising the debt ceiling— which is necessary for the U.S. Treasury to keep issuing debt to fund the government—by refusing to increase the ceiling without exacting spending‑related concessions from Democrats. While the lame‑duck session of Congress could increase the debt ceiling and avoid delaying the issue until the next Congress, Mr. Pinkerton sees that as unlikely.

“A group of 10 to 15 determined Republicans could drive brinkmanship related to the debt ceiling in 2023,” maintains Mr. Pinkerton. However, Ms. Uruci believes that Congress would not allow this type of political showdown to reach the point of triggering a credit rating downgrade for the U.S. along the lines of S&P’s 2011 downgrade to AA+. “With markets already struggling to absorb the effect of sharply increasing interest rates during 2022, chances are that nobody will want to add fuel to the fire and risk inducing that kind of pain in the markets,” she says.

With Republicans emboldened by their control of the House, Mr. Pinkerton notes that “Congress could turn more antagonistic versus the Federal Reserve when [Chair Jerome] Powell testifies.” Even so, Ms. Uruci says, “the Fed tries to operate as an independent institution that is run by bureaucrats, and pressure from Congress is unlikely to affect monetary policy if inflation remains high.”

China Trade Policy to Remain Hawkish

In terms of trade policy, limiting technology exports to China is one of the rare areas of bipartisan agreement, presenting the possibility of new legislation. To date, the Biden administration has left in place—or imposed more draconian limits, in some cases—essentially all of the tariffs on imports from China implemented under the Trump administration, and this stance is not likely to soften. Republicans could attempt to appear more hawkish toward China than Biden by forcing votes on nonbinding resolutions or convening committee hearings to amplify their messages.

With Legislation Less Likely, Attention Shifts to Regulatory Agencies

“House and Senate Republicans will have little incentive for bipartisan compromise,” observes Mr. Pinkerton. “Energy security, however, might be a possible exception.” Here, the focus would likely be on reforms that would ease the permitting process for energy‑related projects given the surge in oil and natural gas prices amid the war in Ukraine.

Legislative gridlock also spotlights the likely shift to actions at the federal agencies, several of which will be focused on implementing the terms of the CHIPS and Science Act and the IRA. The regulations could have implications for chipmakers, the electric vehicle industry, and pharmaceutical companies.

What about new rule‑making? Here are some of the areas that Mr. Pinkerton plans to monitor:

- Capital Markets: The Securities and Exchange Commission could be active. New disclosure requirements related to climate change, for example, are likely.

- Consumer Finance: The Consumer Finance Protection Bureau is expected to be busy in rule‑making and enforcement, with a focus on improving fee‑related disclosures and a crackdown on “junk fees.” Consumer credit reporting agencies could also face new compliance burdens.

- Health Care: Whether the Department of Health and Human Services ends or extends the public health emergency declaration issued during the pandemic could affect certain subsidies and the number of people covered under Medicaid. This decision could have implications for hospitals and managed care companies.

- Big Tech: The Federal Trade Commission is working on data privacy rules, but Mr. Pinkerton believes their impact should be manageable. Antitrust lawsuits could also be filed regarding some of Big Tech’s business activities. However, these cases would take a significant amount of time to reach a decision. “The outcomes are also far from clear‑cut,” according to Mr. Pinkerton.

Historical Record Must Be Considered in Context

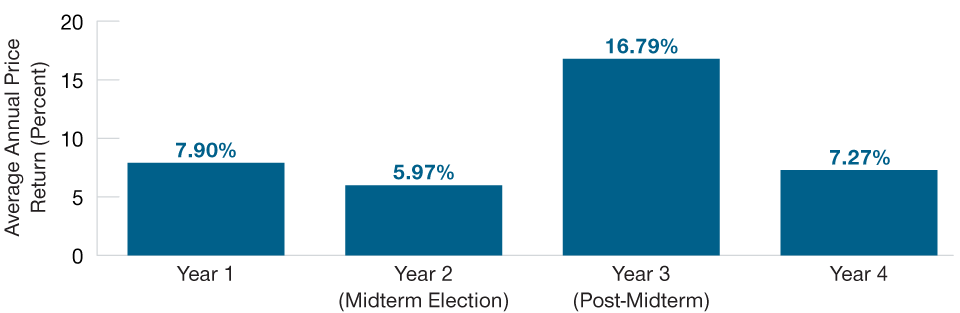

The S&P 500 Index’s annual returns dating to 1950 reveal that midterm years featured the lowest average returns of the four‑year presidential cycle (Figure 1). These years also included the most down markets, with the S&P 500 Index registering an annual loss in eight of the 18 years analyzed.

However, the S&P 500 Index posted the strongest average returns in the third year of a president’s term, the year after the midterms, with the market gaining ground in 16 of the 18 years analyzed.

Market Returns Have Been Strongest in the Year After Midterms

(Fig. 1) Average annual price return for each year in presidential term

December 31, 1949, to December 31, 2021.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

See Additional Disclosure.

How did the stock market perform when the midterms shifted from a unified government, where the party in the White House also had majorities in both congressional chambers, to a divided one? The results were mixed. The year after the 1954, 1994, and 2018 general elections, the S&P 500 Index gained 25% or more. However, after the 2006 midterm, the index advanced only 3.5% and was roughly flat in the year following the 2010 election.1

Narratives highlighting correlations between election outcomes and market performance often circulate in the runup to the election. As always, investors should bear in mind that past performance does not guarantee future results. And as Mr. Veiel notes, 2023 could be unpredictable. “The Fed is aggressively raising interest rates and driving monetary tightening into slowing economic data,” notes Mr. Veiel. “This is a rare occurrence through history and one that has contributed to the recent pullback in stocks and other risk assets. Until the markets see clarity on the Fed’s path for interest rates, volatility is likely to last.”

Focus on Fundamentals

The midterm election looms large in the national psyche, thanks to steady media coverage and a barrage of political advertising. But investment decisions should be based on a longer view, not near‑term political outcomes, Mr. Veiel says.

“Staying invested with a long‑term time horizon and avoiding market timing is a well‑grounded path,” notes Mr. Veiel. “Investors who try to move ‘all in’ and ‘all out’ of the equity market based on short‑term dynamics like midterm elections, geopolitical tensions, or short‑term volatility are more likely to miss out on the market recovery and do worse than investors who stay the course through volatile times over the long‑term.”

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

October 2022 / INVESTMENT INSIGHTS

November 2022 / INVESTMENT INSIGHTS