September 2022 / INVESTMENT INSIGHTS

Market Turbulence Puts Active Management in the Spotlight

Refocusing on company fundamentals favors quality stock picking

Key Insights

- In this article, we take a more nuanced view of the active versus passive debate, considering each approach in the context of different market cycles.

- Understanding these dynamics is particularly relevant today given that financial markets may be at an inflection point. Such an environment augurs well for active managers.

- Capital allocation is increasingly being driven by company fundamentals, rather than by macro factors, which have historically provided heightened opportunities for quality stock pickers.

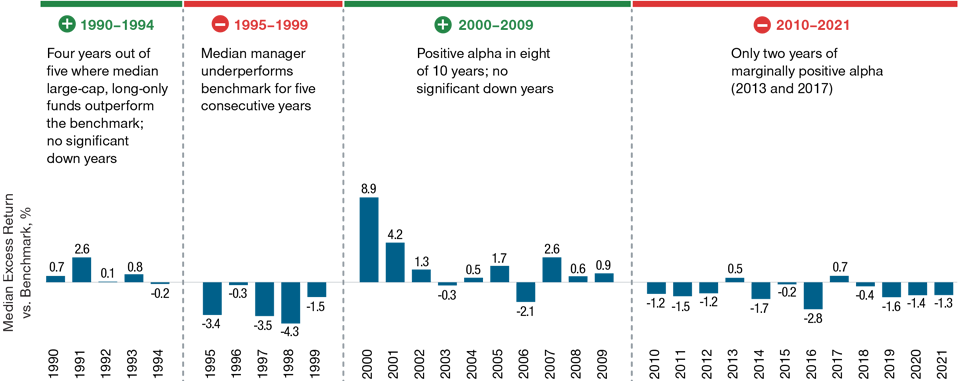

The active versus passive debate has raged for decades, with proponents on each side equally convinced that their approach is superior. Certainly, as highlighted in Figure 1, over the past 10 years, active U.S. large‑cap strategies have generally struggled to keep pace with the returns generated by passive benchmarks. Yet, for most of the preceding decade, active strategies consistently outperformed their passive counterparts, so which is better?

Unsurprisingly, there are data studies to support both active and passive management as the superior approach. And while questions about like‑for‑like comparisons cloud the analysis, often the answer depends on the period being covered. With this in mind, it is worth looking beyond the headline question of which approach is better and focusing instead on the more practical question of which has performed best during different market cycles?

A Potential Market Inflection Point?

Understanding these dynamics is particularly relevant today given that financial markets may be at an inflection point. After a decade‑long “Goldilocks” period of slow but steady growth, low inflation, low interest rates, and low market volatility—an environment generally supportive of a wider balance of sectors—we now face a new and uncertain stage, something already being reflected in the higher market volatility and more differentiated sector returns seen over the past year. This is where history can provide some guidance in the form of clearly observable performance trends during previous economic cycles and in varying market conditions.

Figure 1 shows that, during the 30+ years spanning 1990 through 2021, there have been four clear and distinct U.S. market cycles.1 It further reveals that passive strategies have generally outperformed their active counterparts during two of these market cycles: between 1995 and 1999 and, most recently, between 2010 and 2021. Significantly, both of these periods were characterized by economic expansion and strong bull markets, with U.S. stocks rising broadly on the back of upbeat sentiment/macro factors. This, in turn, saw stock correlations rise and the dispersion of returns between individual companies fall to low levels. This kind of “rising tide lifts all boats” scenario offers active managers fewer opportunities to differentiate between individual winners and losers and therefore add value.

Active vs. Passive Performance During Different U.S. Market Cycles

(Fig. 1) Median excess return of actively managed U.S. large‑cap funds vs. benchmark

Past performance is not a reliable indicator of future performance.

Data shown include all U.S.-domiciled, domestic-focused, long-only, large cap, actively managed equity funds (US Large Cap Growth, US Large Cap Core and US Large Cap Value universes) as defined by eVestment Alliance, LLC. Historical data include funds that are no longer active, either through closure, or merger with another fund. Returns are shown net of fees (managers providing gross only fees are excluded) and compared against each fund’s reported benchmark.

Sources: eVestment Alliance, LLC, and Goldman Sachs Global Investment Research (see Additional Disclosures).

Meanwhile, active strategies also outperformed during two of the market cycles: between 1990 and 1994 and from 2000 to 2009. Notably, both periods are associated with economic recession in the U.S., resulting in a more uncertain and volatile market environment. Amid the weaker macro environment, investors reverted to focusing more closely on company specifics, leading to a widening dispersion between stock returns as the good was sorted from the bad. Accordingly, more differentiated performance between companies, based on fundamental strengths, can provide more opportunities for active managers to selectively add value.

Company Specifics Driving Capital Allocation

This historical analysis is important as we believe that we have once again entered a more uncertain and volatile period. The latest data suggest that the U.S. economy is in technical recession (following two consecutive quarters of declining gross domestic product), inflation is at 40‑year highs, interest rates are rising sharply, and market volatility has notably increased. While it is impossible to know how long this stage will last, this represents an ideal stock‑picking environment for quality active managers—as has been the case in the past. Indeed, for the first time since the immediate aftermath of the global financial crisis in 2009, it appears that capital allocation in the U.S. is being driven predominantly by company‑specific fundamentals rather than by the macroeconomic factors that have prevailed over much of the past decade.

Recent analysis appears to confirm this, as U.S. stock correlations have continued to fall since early 2021, increasing the breadth of idiosyncratic investment opportunities. These market dynamics underscore the importance of finding companies with competitive advantages and defined moats and the ability to pass higher prices on to end consumers. Only an active approach allows this selectivity within the current uncertain market backdrop, heightening the potential for active strategies to generate excess returns over passive strategies.

The Asymmetry of Alpha in U.S. Equities

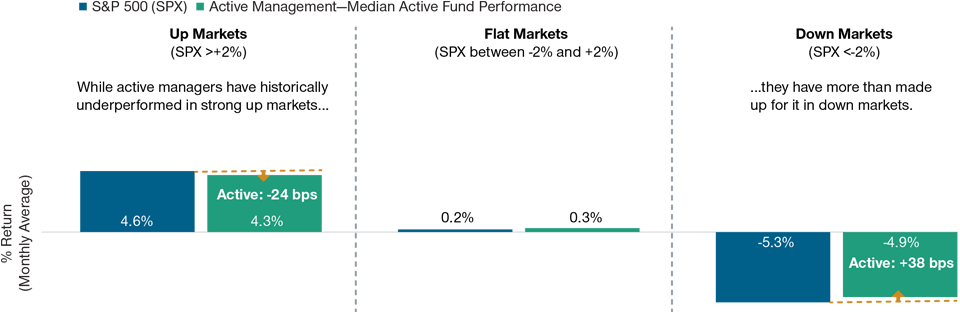

Meanwhile, the volatility that has returned to the U.S. market over the past year has shone a spotlight on the flip side of passive investing, namely that while these strategies allow investors to fully participate in rising markets, they provide no buffer against a market in decline. By their very nature, passive strategies are guaranteed to fall as far as the market does. In contrast, active managers can act to limit potential downside. And as Figure 2 confirms, active strategies in the large U.S. equity market have been successful in this, outperforming passive strategies during down market periods.

It is also noteworthy that the alpha generated by active U.S. equity managers in up and down markets is not symmetric. This means that, while active U.S. managers have historically.captured less upside than passive managers in rising markets (‑24 basis points), this is more than made up for by the relative outperformance achieved by active managers in down markets (+38 basis points). This is not to say that active managers cannot outperform passive counterparts in rising markets also, they can and regularly do, with much ultimately depending on the time frame being covered.

U.S. Active vs. Passive Performance in Up, Flat, and Down Markets

(Fig. 2) Median U.S. active fund performance vs. benchmark (S&P 500 Index)

January 1990 to December 2021

Past performance is not a reliable indicator of future performance.

Data shown include all actively managed, long‑only, U.S. large-cap funds benchmarked against the S&P 500 Index as defined by eVestment Alliance, LLC. Historical data include funds that are no longer active. T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Sources: S&P Global Market Intelligence, eVestment Alliance, LLC, and Goldman Sachs Global Investment Research (see Additional Disclosures).

Favorable Dynamics for Active Management

We believe that the challenging market environment currently marks an inflection point as financial markets transition to a new paradigm. However, this is an environment that augurs well for active managers. High inflation, rising interest rates, stimulus withdrawal, weaker growth—for many, this backdrop is new and unfamiliar territory. Understandably, this is creating uncertainty, which is being directly reflected in increased market volatility. However, while there are numerous headwinds to negotiate ahead, we believe that the current market will continue to present favorable dynamics for active management. This kind of landscape has historically provided rich opportunities for skilled active investors as company‑specific factors should reassert themselves—and getting investment decisions right matters more.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

September 2022 / INVESTMENT INSIGHTS

September 2022 / INVESTMENT INSIGHTS