29 March 2024 / INVESTMENT INSIGHTS

Three-year anniversary reflections: A tumultuous market unveils Global Select Equity’s strengths

Style balance helped Portfolio Manager Peter Bates In a Tumultuous Market

Key Insights

- Peter Bates celebrated three years of managing the T. Rowe Price Global Select Equity Strategy, during which the market saw large factor swings between growth and value and high volatility.

- Despite increased volatility and factor momentum, the Global Select Equity Composite outperformed its benchmark, the MSCI World Index Net, for the three‑year period ended December 31, 2023 on a net-of-fees basis, during a time when many portfolios struggled to deliver alpha to clients.

- We believe that the strategy’s active, style-balanced approach and multifaceted view of risk, aimed at neutralizing macro variable exposures, have helped deliver alpha for the composite during one of the most difficult market environments in recent memory.

The Global Select Equity Strategy incepted on December 31, 2020, reaching its three-year anniversary at the end of 2023 and outperforming its benchmark, the MSCI World Index Net, by 189 basis points gross of fees and 124 basis points net of fees, as of December 31, 2023*. The strategy applies an active, style‑balanced approach to create a concentrated, global, and sector‑diversified portfolio of 30–45 high‑conviction investments with an aim to provide consistent, positive excess returns against the MSCI World Index Net over a full market cycle.

In this Q&A, Portfolio Manager Peter Bates reflects on his first three years managing the Global Select Equity Strategy, explains how the composite has held up so well during a volatile market environment, and provides his thoughts about the future. Mr. Bates has over 20 years of investment experience and previously ran the T. Rowe Price Global Industrials Equity Strategy for over six years.

It has been a remarkable and tumultuous three years since you started running the strategy in December 2020, yet the composite has outperformed and held up well. Why do you think that is, and what are some insights you’ve learned over the last three years?

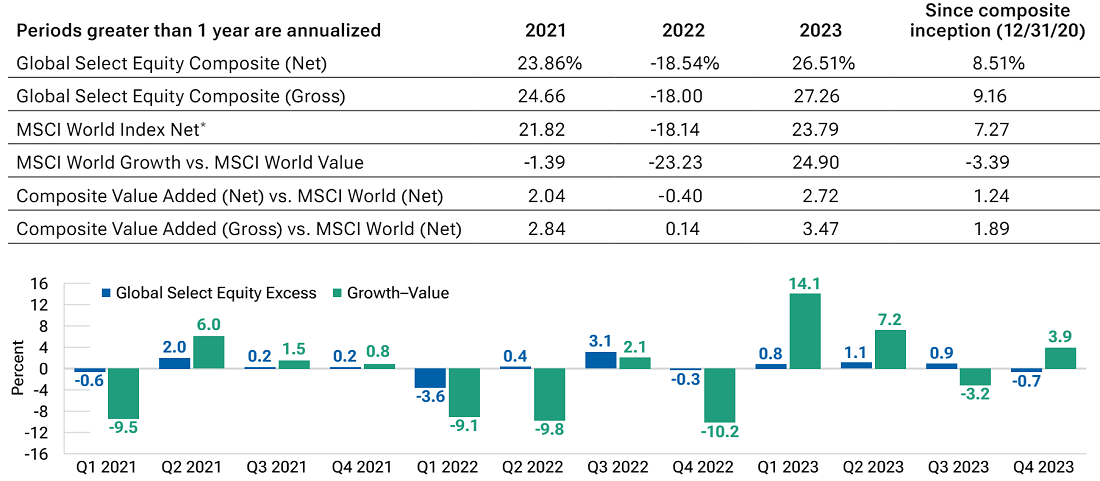

It really has been a bit of a crazy three years, hasn’t it? We saw a global pandemic for the first time in 100 years, and the world shut down. Then came COVID stimulus, with governments injecting massive amounts of capital into the system, which, along with other factors, led to a surge in global inflation to levels not seen in decades. This, in turn, led to central banks quickly pivoting their monetary policies to quell inflation, raising rates significantly over a short period of time. Such a stark change brought massive swings in the market and factor‑leading performance that vacillated between growth and value. When you have factor leading so much in markets, it’s easy to quickly become a victim of market fickleness, which, I think, is why our strategy’s construction and philosophy helped our performance. Part of my strategy mandate is to really manage growth-value risk and manage those portfolio tilts so that my stock picking can drive performance and that’s exactly what we’ve done—you can see in Figure 1 that we’ve seen monumental moves between both style factors, and the composite broadly outperformed regardless of whether growth or value was in favor. Our factor exposures have been fundamentally balanced, and that has helped our stock selection shine.

(Fig. 1) Value added across changing macro and factor dynamics

Periods ended December 31, 2023.

Figures are calculated in U.S. dollars.

Past performance is not a reliable indicator of future performance.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net-of-fees performance reflects the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of all non-reclaimable withholding taxes on dividends, interest income, and capital gains. Please see the GIPS® Composite Report for additional information on the composite.

* Index returns shown with reinvestment of dividends after the deduction of withholding taxes. Growth–Value represents the difference in return of the MSCI World Growth Index and the MSCI World Value Index. Composite Value Added represents the difference in return of the Global Select Equity Composite (Net) and the MSCI World Index (Net).

This really speaks to what I think is the strength of our portfolio construction and philosophy: having a high-conviction, concentrated portfolio of 30–45 names; using the full power of TRPA’s global, fundamental research capabilities1 to find companies with what we think are clear reasons why they can win; viewing stocks through a lens of three “buckets” rather than the growth-value binary; and taking a multifaceted view of risk to neutralize factor exposures.

I think these features will become even more important as we look forward to the next 10 years, which are likely to be meaningfully different from the environment we’ve experienced since the 2008 global financial crisis. There is a high degree of uncertainty, and I think having a balanced portfolio that highlights fundamental stock selection can help deliver alpha.

In terms of lessons I’ve learned over the last three years, I would say it’s important to remember what you don’t know so that you don’t take macro bets that overwhelm your performance. The last three years show that finding companies on the right side of macro is really hard and it is not what all my experience has led me to do. I want to try my best to control the macro so that I can pick good stocks. I want to be true to our competitive advantages—leaning on our global research platform and knowing and understanding companies and why they could potentially be good investments.

We like to refer to the portfolio as “style balanced.” What do you think differentiates the portfolio from perhaps other core or core-related portfolios?

I think there are a few things that differentiate us from other core portfolios. First, I believe I take a bit of a different approach when I’m thinking about style in terms of constructing the portfolio. From a qualitative perspective, I view each stock in the portfolio as being in one of three buckets rather than a growth-value binary. These buckets consist of companies that we view as (1) steady, durable growers, (2) disruptors, and (3) cyclicals/turnarounds2. Broadly, I aim for the portfolio to be 50%–65% steady growers, 15%–25% disruptors, and 15%–25% cyclicals/turnarounds. I think viewing companies this way helps drill down into their fundamental factors and identify what really is a catalyst for improvement. Thinking about stocks as purely “growth” or “value” can lead to taking hidden bets between growth and value, which then means you’re taking hidden factor risk. I want to avoid doing that.

Another area of differentiation would be, in my opinion, our degree of concentration. I own about 35 stocks, give or take, with a range of 30–45 that gives me some flexibility. But I have owned 35 stocks consistently in the representative portfolio, which I think is the right balance between getting the benefits of diversification without diluting conviction.

Finally, I think the way we view risk is a differentiator. I think of risk at three levels: The first two are stock-level risk, and the third is portfolio-level risk. Level 1 is qualitative company risk: Is the company getting better or getting worse? Does it have pricing power? Is the company gaining market share, improving cost structure, getting stronger compared with competitors, or being disrupted? We try to answer those questions, and we want to avoid companies that aren’t getting better. Then Level 2 is stock‑specific risk/return: Valuation matters, and doing the work to determine if a stock is overvalued is important in managing risk. Level 3 is portfolio risk—making sure that the 30–45 stocks we own are diversified and not all exposed to the same macro factor.

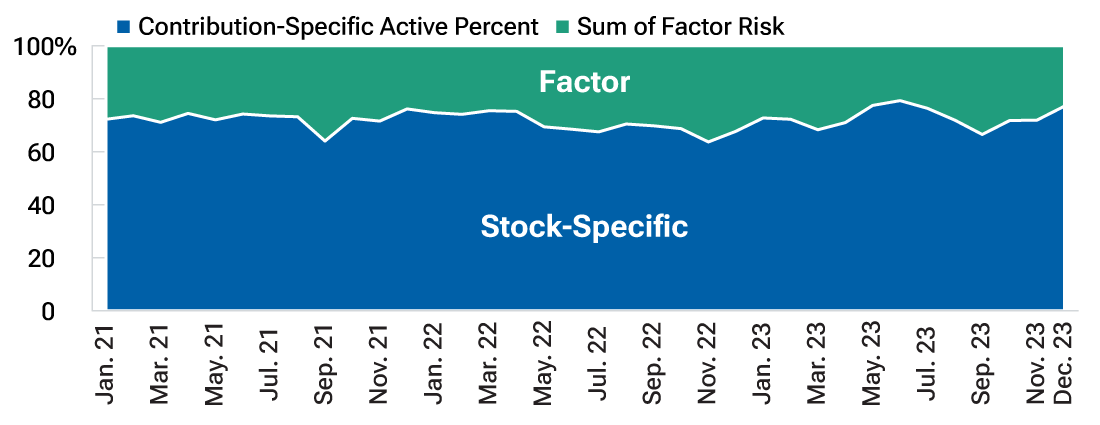

Our ability to manage risk is reflected in the data: Annualized three‑year tracking error as of December 31, 2023 was 4.16%3, with around 75% stock-specific risk and 25% factor risk (see Figure 2). I think having a portfolio that can deliver consistent alpha with low historical tracking error while keeping factor and style risk within a low range is a uniquely attractive proposition for clients.

Not just a factor

(Fig. 2) Global Select Equity representative portfolio source of active risk

Periods ended December 31, 2023.

Figures are calculated in U.S. dollars.

Past performance is not a reliable indicator of future performance.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net-of-fees performance reflects the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of all non-reclaimable withholding taxes on dividends, interest income, and capital gains. Please see the GIPS® Composite Report for additional information on the composite.

* Index returns shown with reinvestment of dividends after the deduction of withholding taxes.

Growth–Value represents the difference in return of the MSCI World Growth Index and the MSCI World Value Index.

Composite Value Added represents the difference in return of the Global Select Equity Composite (Net) and the MSCI World Index (Net).

Before building and conceiving of the Global Select Equity portfolio, you were the portfolio manager for T. Rowe Price’s Global Industrials Equity Strategy and an industrials analyst before that. How do you feel your experience has helped you in running Global Select?

Industrials are incredibly broad, so in terms of being a training ground for becoming a diversified portfolio manager, I think it was crucial. Industrials have exposure to health care, technology, mining, energy—even financials—because a lot of industrials have financial companies to help finance their equipment. You get a broad awareness of the global economy and numerous end markets because industrials touch so many different areas.

Importantly, analyzing the industrials space helped me learn to trade around the economic cycle and understand how to create cyclical balance within my portfolio because part of risk control is managing cyclical risk, not just factor risk. For instance, if you’re all in on the idea that we’re going to have a recession and you decide to buy a lot of consumer staples and health care, but then we don’t have a recession, you may underperform. So just like I work to manage my factor tilts, I also work to manage cyclical tilts so that my performance is driven by stock picking, not my bet on the economy.

I think it’s also worth noting that my framework of managing factor and style balance to highlight stock picking was employed and honed during my years as the portfolio manager of the Global Industrials Equity Strategy. Seeking to neutralize the factors I can’t control is something I’ve been doing for many years.

Tell us a little about how you’re positioned as of the fourth quarter of 2023 in the representative portfolio and why?4

At this time last year (the end of 2022), we were modestly overweight cyclical risk because we were getting paid to take that risk. I want to take cyclical risk when I can get paid to take it, but right now, valuations are more stretched than they were in 2022 and uncertainty is higher, so my beta is below 1.0 and I’m cautious moving into 2024. The risk of recession makes cyclicality a bit of a liability, so we have dialed down our cyclical exposure, mainly by reducing our semiconductor positions, which had an incredible run in 2023 but are vulnerable to slowing demand in a recessionary environment and are still not at the trough of their industry cycle. We are overweight durable growers that we think can perform well in an uncertain environment.

Our focus on a combination of idiosyncratic stock picking and balancing style and cyclical exposures means that we’re currently overweight in areas like health care and industrials and business services, which we believe are fertile ground for all three of our style buckets. We are underweight information technology and consumer discretionary, where we believe many valuations are stretched and businesses have more challenges in a higher‑interest rate, lower‑growth world.

As a concentrated portfolio, it is necessary that we make significant sector bets, but we maintain diversification by understanding how areas of the market correlate and where we can find opportunities with the lowest stock‑specific valuation risk. For instance, as of the fourth quarter of 2023, we don’t own any credit-sensitive financials given our concerns about lagging effects of higher interest rates but, in turn, invest in companies that have interest rate sensitivity without the credit risk.

We look at our exposure to the Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) as a single sector, as we feel this is the best way to manage risk to a group of stocks that dominates both the MSCI World Index and the market. As of the fourth quarter of 2023, we were modestly underweight the Magnificent Seven, mainly due to not owning Apple and Tesla, which was driven by stock-specific concerns. I think a good example of how we manage market correlations and risk to create diversification is the fact that, in 2023, I had enough factor exposure to artificial intelligence to participate in the broad market rally but was simultaneously underweight information technology and the Magnificent Seven. I was able to avoid the inherent risks there, particularly Tesla’s and Alphabet’s uneven performance.

Why do you feel the portfolio can generate alpha for investors in the current economy, and how do you think it can help investors navigate what could be a new landscape and increased uncertainty in the future?

I think one of the strategy’s greatest strengths is our ability to balance style and cyclical exposures such that stock picking should drive performance no matter the environment. I believe my experience as a stock picker along with the support of our broad and deep global research platform means I can truly find the best ideas in the market, apply disciplined valuation, all while neutralizing factor risk.

Right now, there is a great debate going on about whether 2024 will be a year for the bulls or the bears. My secret is that I don’t think I need to take a side in this debate: I can balance the portfolio in order to take advantage of whatever scenario arises and instead focus on pursuing the most durable and resilient companies with clear catalysts for delivering alpha. I think we are heading into a much more uncertain time, even beyond 2024, than we have experienced over the last 15 years. Having a portfolio that doesn’t try to predict the future but can neutralize macro variables and instead focus on fundamentals is more important than ever before.

Risks – The following risks are materially relevant to the portfolio:

Currency - Currency exchange rate movements could reduce investment gains or increase investment losses.

Emerging markets - Emerging markets are less established than developed markets and, therefore, involve higher risks.

Issuer concentration - Issuer concentration risk may result in performance being more strongly affected by any business, industry, economic, financial, or market conditions affecting those issuers in which the portfolio’s assets are concentrated.

Sector concentration - Sector concentration risk may result in performance being more strongly affected by any business, industry, economic, financial, or market conditions affecting a particular sector in which the portfolio’s assets are concentrated.

Small-cap and mid-cap - Small and mid-size company stock prices can be more volatile than stock prices of larger companies.

General portfolio risks:

Counterparty - Counterparty risk may materialize if an entity with which the portfolio does business becomes unwilling or unable to meet its obligations to the portfolio.

ESG and sustainability - ESG and sustainability risk may result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration - Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental, or market conditions affecting those countries or regions in which the portfolio's assets are concentrated.

Hedging - Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely.

Investment portfolio – Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management - Management risk may result in potential conflicts of interest relating to the obligations of the investment manager.

Market - Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors.

Operational - Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients, and no assumptions should be made that investments in the securities identified and discussed were or will be profitable.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

March 2024 / INVESTMENT INSIGHTS