February 2023 / INVESTMENT INSIGHTS

Lessons From the Fall: Key Changes for Growth Investors

Market pain can bring change and long-term opportunity

Key Insights

- Albeit painful, bear markets can drive durable changes that can reward patient investors.

- Three shifts could create opportunities for growth investors: cyclicality in big tech, higher base inflation and interest rates, and deglobalization.

- Against this backdrop, the setups in select consumer internet, insurance, and semiconductor companies look appealing.

Last year was difficult for growth stocks, with this investing style underperforming value by a wide margin. However, as long‑term investors, we have learned valuable lessons from bear markets—notably that the resulting changes can shape future returns. These shifts can reward patient investors, in time.

Active managers may be able to take advantage by identifying companies that are strengthening their businesses and, near‑term challenges aside, appear well positioned to sustain a high rate of earnings and cash flow growth.

Three shifts could create opportunities for growth investors: cyclicality in big tech, higher base inflation and interest rates, and deglobalization.

Cyclicality in Big Tech

After more than a decade of strong stock performance, the dominant consumer internet platforms—Alphabet (Google’s parent company), Amazon.com, Meta Platforms (Facebook’s parent), and Netflix—came under significant pressure last year.

The past 12 to 18 months have reinforced that popular growth stories are not immune to disruption and weakness in the broader economy—a marked shift from the narrative that surrounded these companies before and during the coronavirus pandemic.

Some headwinds have been industry‑specific, such as changes to data privacy policies that undermined the efficacy of targeted online advertising on some popular social media platforms. More broadly, the size and maturity of the large consumer internet companies appear to have made their core businesses more cyclical, or sensitive to fluctuations in the economy. And the fading of the demand tailwinds that these companies enjoyed during the coronavirus pandemic has magnified this cyclicality.

This change should influence the price the market is willing to pay for these businesses. Our approach to investing in these names must also adjust.

On the plus side, the big consumer internet companies have still generated significant cash flow and are pursuing sizable markets. Larger companies also may have more room to adjust to revenue pressures in ways that could create value for shareholders—for example, by refocusing on profit margins, honing their spending plans, and seeking to rein in costs.

Of course, management must be willing to make these changes. And investors must consider the degree of difficulty in tackling company‑specific challenges. Scaling back investments in money‑losing initiatives that appear unlikely to bear fruit, for instance, should, in theory, be easier than restoring the efficacy of targeted online advertising or improving the profitability of a massive retail business.

Attractive valuations and the cyclicality of online advertising and shopping could give consumer internet stocks meaningful upside potential in an eventual recovery. But it could be a slog until then. For the long term, however, we are focusing on the extent to which yesterday’s tech winners are embracing and executing self‑help measures to make themselves more competitive and more compelling to investors.

The Possibility of a New Inflation and Interest Rate Regime

The next market cycle could differ from the last one in important ways.

Inflation and interest rates should moderate from wherever they peak but, in our view, are likely to settle at higher levels than where they stood over the past decade.

Easy solutions are unlikely to emerge for some of the main drivers behind the U.S. labor shortage and recent wage inflation, which include:

- Demographic Headwinds: An aging population and falling immigration to the U.S.

- Health Headwinds: The opioid epidemic and the lasting effects of COVID‑19.

Higher base levels of inflation suggest that the era of near‑zero interest rates has ended. In this environment, valuation—or how much investors are willing to pay for a share of a company’s earnings or cash flow—would likely matter more.

Competition is one reason: Higher bond yields give investors more alternatives to stocks. Meanwhile, a regime of higher inflation and rates would reduce purchasing power and could shorten how far into the future the market is willing to look when evaluating a company’s growth prospects.

In such an environment, increasing earnings and free cash flow (as opposed to increasing valuations) could become important drivers of returns. This scenario could favor growth strategies that emphasize valuation discipline and business quality.

Taking Advantage of Higher Rates

A new inflation and interest rate regime could create fresh opportunities in areas that are outside growth investors’ usual hunting grounds.

For example, higher interest rates would provide a lift to parts of the financials sector, although credit risk is a near‑term concern if the slowing economy translates into meaningful job losses.

We see potential in well‑positioned property and casualty (P&C) insurers.

These companies should benefit from a period where interest rates remain above the levels that prevailed during the last bull market, even if rates recede from the highs hit as the Federal Reserve tightens monetary policy.

Higher bond yields increase the income that insurers can generate on the “float,” or the massive portfolios where customers’ premiums are invested before claims are paid out. If interest rates remain higher than during the past decade, this process of reinvesting maturing bonds into higher‑yielding securities could be a multiyear tailwind.

More important, the industry offers exposure to potentially resilient growth trends that do not depend on Fed policy or the economy’s health—complex factors that are outside companies’ control. P&C insurers that focus on the commercial market should enjoy strong pricing power when annual premiums are redetermined:

- Exposure Growth: The array of risks to which businesses are exposed is expanding. Think of the rise in cyberattacks and the new disruptions experienced during the pandemic.

- Claims Inflation: The frequency and magnitude of losses related to severe weather events have increased. Along with “social inflation” in lawsuit awards, this trend has enabled insurance carriers to push for higher premiums.

- Tight Reinsurance Market: The availability of reinsurance—basically, insurance for insurers—for P&C companies has shrunk, creating an imbalance that should pressure prices higher.

Valuations suggest that the market may not fully appreciate the possible magnitude and durability of these growth drivers for well‑run P&C companies that have scale and a history of conservative underwriting.

Deglobalization Trends Could Benefit Semiconductors

The disruptions stemming from the coronavirus pandemic and Russia’s invasion of Ukraine, as well as rising geopolitical tensions in Asia, highlighted vulnerabilities created by decades of globalization that built a complicated web of supply chains optimized for cost and efficiency.

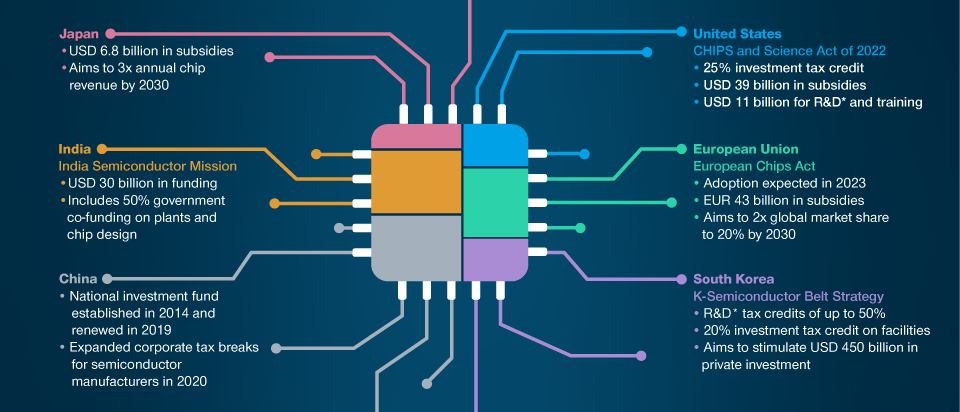

Deglobalization in Action: Passing the Chips (Incentives)

(Fig. 1) Domestic production of advanced semiconductors has emerged as a strategic priority

As of January 31, 2023. For Illustrative Purposes Only.

Sources: The White House, European Commission, and Bloomberg Finance LP.

*R&D is research and development.

Shoring up critical supply chains has emerged as a strategic priority—a potentially inflationary trend that could create investment opportunities in certain industries.

Consider semiconductors. Policymakers view access to these chips as crucial to a country’s economic competitiveness and security.

With the passage of the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022, the U.S. joined the wave of countries enacting policies to support domestic semiconductor manufacturing (Figure 1).

The strategic push to “re‑shore” semiconductor production over the coming years should increase the need for the tools and equipment used in the complex process of chip fabrication. This trend would enhance other long‑term demand tailwinds, such as the broader pushes to electrify and digitalize the economy.

But supply is just as important.

Especially for advanced semiconductors, the technological challenges of increasing processing power by squeezing more transistors onto smaller chips mean that the industry faces higher costs to expand manufacturing capacity. And these new lines are typically less productive than in the past.

The combination of growing demand and the increasing cost of incremental production should translate into higher sales volumes and prices for semiconductors over time, which could bolster some chipmakers’ profit margins.

Still, the semiconductor industry’s fortunes fluctuate with the economy. Therein lies the near‑term risk and the longer‑term opportunity.

The setup in select chipmakers and semiconductor equipment companies looks appealing on a three‑ to five‑year basis—particularly for those with leading‑edge technologies that have already taken some lumps this downturn and serve markets with strong growth prospects over the long term.

At the same time, we are mindful of the uncertain economic outlook and the likelihood that chip demand in data centers and autos could be next to weaken.

Focused on Growth

Our investment approach to growth investing is based on a simple premise: Stocks tend to follow their earnings and free cash flow over the long term. We seek to identify and stick with the rare companies that we believe have the potential to sustain strong growth.

WHAT WE’RE WATCHING NEXT

The rise of artificial intelligence (AI) has attracted a lot of buzz. But the recent launch and popularity of so‑called generative AI models that can produce textual and graphical responses to user‑submitted questions or prompts—however serious or inane—has made this theme more tangible to industry and investors. These advances came up frequently on our investment team’s annual trip to Silicon Valley to meet with public and private technology companies.

We are paying close attention to how generative AI and self‑learning algorithms could drive innovation and disruption throughout the digital and real‑world economies. At this early stage in the adoption curve, we are finding opportunities among the companies that supply the advanced chips and data infrastructure that are enabling the emerging AI arms race.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.