June 2022 / INVESTMENT INSIGHTS

Investing in Companies at the Start of the Runway

We focus on firms that we believe have years of strong growth potential ahead

Key Insights

- Select global technology companies have been able to maintain double‑digit growth rates over many years—a largely unprecedented track record.

- We search for these opportunities in companies with a variety of what we believe have forceful advantages in their markets.

- Despite recent volatility, we believe investors will eventually return to the companies with compelling long‑term earnings potential.

The past two decades have seen a compelling development for investors: Many technology firms—even very large ones—have been able to maintain double‑digit growth rates in earnings and revenues amid sluggish overall economic growth. We describe this phenomenon as “long growth runways,” and we are particularly interested in companies with plenty of runway remaining.

Since the Federal Reserve’s hawkish pivot late last year, stocks in many fast‑growing companies across all sectors have suffered a pullback as rising interest rates have caused investors to favor companies generating near‑term cash flows versus companies with much higher earnings potential in the future. Investors have also been bracing for a slowdown in earnings growth as the bounce that the pandemic and lockdown created for many online‑oriented firms fades. Results this year will also generally be compared against 2021’s very strong growth, making underlying and structural growth rates more difficult to ascertain.

While we have not ignored these challenges, we have remained steadfast in our investment approach, which is based on the twin pillars of our careful fundamental research and our willingness to be patient in times of volatility. Below, I discuss in order how our top eight holdings1 reflect our investment process. Despite the negative short-term performance of the strategy’s composite, we remain convinced that these companies may represent an opportunity for investors who are willing and able to focus on the long run.

We Look for Not Only Best‑in‑Class Products or Technologies, but Best‑in‑Class Execution

Atlassian is a leading technology firm that may be a familiar name only to those within the technology sector. Yet its application development software, Jira, has become a vital tool for companies and their programmers seeking to deploy vast data pools as a strategic asset. Atlassian pioneered a unique enterprise software business model that forgoes traditional sales reps and instead relies on the product to sell itself through viral, word‑of‑mouth marketing. Moreover, Atlassian has expansion products around collaboration (Confluence, Trello) and information technology (Jira Service Management). When I was a software analyst at T. Rowe Price, I covered Atlassian before it went public in late 2015, and I have been consistently impressed by the management’s disciplined approach to investments and execution. Building familiarity and conviction with companies like Atlassian before they go public is reflective of the deep fundamental diligence process that underpins our investment approach.

Software Is Eating the World

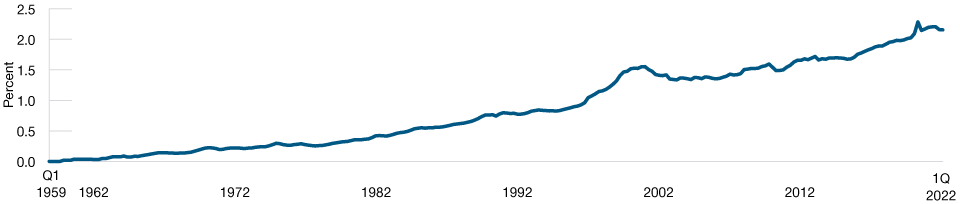

Software as a Percentage of U.S. Gross Domestic Product, 1Q59–1Q22

One of technology’s most prominent investors once wrote that “software is eating the world”—an overstatement, to be sure, but perhaps an understandable one looking at long-term trends. Our heavy weighting in the software industry (58.1%* as of March 31, 2022) reflects the growing importance of the industry. We are particularly attracted to the strength and potential durability of growth found within the enterprise software subsector, which has recently been the portfolio’s largest position on both an absolute and relative basis. Cloud‑based software‑as‑a‑service has upended the subsector and continues to create opportunities for investors, in our view. More broadly, technology is gaining share in most sectors of the economy as an increasing number of companies focus on digitizing workflows. This trend accelerated during the pandemic, and it is one that we believe to be durable.

One of technology’s most prominent investors once wrote that “software is eating the world”—an overstatement, to be sure, but perhaps an understandable one looking at long-term trends. Our heavy weighting in the software industry (58.1%* as of March 31, 2022) reflects the growing importance of the industry. We are particularly attracted to the strength and potential durability of growth found within the enterprise software subsector, which has recently been the portfolio’s largest position on both an absolute and relative basis. Cloud‑based software‑as‑a‑service has upended the subsector and continues to create opportunities for investors, in our view. More broadly, technology is gaining share in most sectors of the economy as an increasing number of companies focus on digitizing workflows. This trend accelerated during the pandemic, and it is one that we believe to be durable.

As of March 31, 2022.

*T. Rowe Price uses a custom structure for sector and industry reporting for this product. The custom structure changed on August 31, 2019, and historical representations have been restated. The comparable custom weighting for the MSCI All Country World Technology Index as of March 31, 2022, was 29.1%.

The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy.

Source: Bureau of Economic Analysis.

We Are Attracted to Firms Targeting Lucrative and Underserved Markets

HubSpot may also be an unfamiliar name, although it is gaining prominence with marketers seeking to build out their company’s Web presence and has been expanding into customer relationship management (CRM) and other products. HubSpot’s services allow a wide range of customers—from those with a handful of employees to a few thousand—to improve how they draw visitors to their websites and, once there, convert them to customers. The small and mid‑size business market is a tough one given the greater tendency for companies to go out of business and have more limited budgets, but HubSpot has figured out how to go to market efficiently. In addition, last fall, the company rolled out HubSpot Payments, which allows companies to easily accept digital purchases—which can be a daunting exercise for many smaller businesses and their customers alike.

Valuation Is Important, but We’ll Revisit a Company When We Judge the Time Is Right

Tesla needs little introduction. The electric vehicle (EV) maker attracted investor attention even before it released its groundbreaking Roadster in 2008. We invested in Tesla soon after its public offering but reduced or even exited our position when we judged its valuation to be too extreme. Despite intensifying competition in the EV market, Tesla recently reemerged as one of our top holdings, as we believe that Tesla is best positioned to bring down EV costs—the top consideration for consumers, according to our research. The company is ramping multiple factories for scaled production around the world. Additionally, Tesla’s vehicles and battery packs may play an important role in the home energy market, and CEO Elon Musk’s vision for autonomous vehicles continues to make steady progress.

We Are Interested in Companies With Large Total Addressable Markets (TAMs)

As data have proliferated and the cost of the hardware used for storing them has plummeted, the focus has intensified on the software and services that allow massive databases to be searched and manipulated. MongoDB has emerged as a leading provider of non‑relational databases, which provide developers greater flexibility and speed in building applications utilizing vast amounts of data. We think one of MongoDB’s key advantages in this new market is that it was an early entrant in providing scalable database services in the cloud, allowing companies of all sizes to purchase exactly as much of the services as they need versus making a big upfront payment. The TAM for database cloud services appears to be so large that we believe MongoDB can easily make room for itself alongside existing giants, such as Amazon Web Services or Microsoft’s Azure.

Similarly, Canadian‑based Shopify is one of the leading omnichannel commerce platforms for independent merchants. Its cloud‑based, self‑service product unlocked a large market of underserved small merchants, and the company has been leveraging this first act to address larger, more complex merchants and international markets. Shopify has been enabling a large, growing ecosystem of app and agency partners, and its data helps support the business. The stock has suffered recently as investors have reacted poorly to new investments in fulfillment centers, but we believe this caution overlooks the longer‑term potential of Shopify to add value across multiple vectors in addition to fulfillment—such as payments and advertising—in the vast global retail market.

We Like Companies That Are Able to Leverage Strength in One Market Into Another

In a matter of just several years, NVIDIA has gone from being a well‑known maker of video gaming chips to a firm at the leading edge of a wide range of semiconductor development. In part, this is because its graphics processing units (GPUs) have proven especially adept at handling the extreme computing loads required for artificial intelligence (AI) and machine learning (ML). But we are especially interested in how NVIDIA will continue to leverage its expertise in AI/ML chips and software to create a datacenter ecosystem that firms seeking to build out their capabilities in this vital new area can utilize in different ways.

We Seek Out Companies at the Forefront of Change

The technology sector and the global economy in general would be noticeably different in the absence of a few select companies. Taiwan Semiconductor Manufacturing Corporation (TSMC) is one such firm, in our opinion, and long a top holding in the portfolio. In 2017, TSMC seized the lead in manufacturing leading‑edge semiconductors from Intel and began producing chips at the 7‑nanometer (nm) process node—a measure of how finely transistors can be etched onto silicon and thus how many transistors can fit on a chip of a given size. In the years since, TSMC has led the way down to the 5‑nm and 4‑nm processes, and it expects to unveil 3‑nm chips this year. Today’s most powerful processors, including Apple’s celebrated “Bionic” and M1 chips used in its iPhones and laptops, would be impossible in the mass market without TSMC’s manufacturing prowess. We consider TSMC to be one of the few “linchpin” companies behind global technology advancement.

We Look for More Mature Companies Successfully Extending to Their Next Stage of Growth

ServiceNow provides cloud‑based software that helps companies manage digital workflows. ServiceNow has established competitive leadership in its industry. While we expect ServiceNow to continue to take share in its core market, we anticipate it will also have success in expanding into areas beyond IT service management as companies may continue to become more digital in their operations and marketing—a transition that was accelerated during the pandemic. The company now offers an array of products addressing employee, customer, and creator workflows, providing it opportunities in areas such as human resources and customer service.

Modeling Long‑Term Profitability

Wall Street has been less inclined over the past several months to look further down the runway at future earnings potential. Put differently, investors have shortened their duration, focusing more on current profitability. The main cause of the market’s shortened duration has undoubtedly been the Federal Reserve’s hawkish pivot last November, which has resulted in a sharp rise in interest rates and correlates closely with the underperformance of high‑growth stocks in the period since.

We believe that our holdings’ fundamentals, however, have remained largely consistent throughout this volatile period, helping to reinforce our conviction and continued focus on longer‑term prospects. Our price targets and profit models have never been premised on the assumption that the era of low rates would continue in perpetuity. Indeed, we believe that a number of our top positions will see their businesses prosper in the current inflationary environment as many technology firms help lower costs for both firms and consumers. For example, many of the software companies that we invest in develop innovative solutions that are valued by their customers precisely for their ability to create greater efficiencies. These efficiencies should lead to higher productivity and lower costs.

While it’s tempting to look to the tech bubble of 2000 as a harbinger of what’s to come, we believe there are notable distinctions. As it became all too clear, some highly valued technology firms during the bubble were operating with fundamentally flawed business models that offered no way for them to turn a profit. In contrast, proven business models and the discretion to balance profit versus growth are hallmarks of the companies we pursue. Some companies in the tech sector are already highly profitable. Others are not. In some instances executives are actively choosing to forgo booking some current profits in favor of investing in their businesses precisely because they are looking further down the runway and perceiving a high return on the invested capital. In other words, they are operating from a position of strength, in our opinion.

Likewise, rather than focusing solely on interest rates or other macro variables, our investment approach evaluates longer time periods in which earnings growth has historically been the paramount driver of returns. We continue to maintain conviction in the potentially strong fundamental growth profiles that our investments bring to the portfolio, and we are confident that the unique, long‑term prospects of these firms will again be rewarded.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

June 2022 / INVESTMENT INSIGHTS