April 2022 / ASSET ALLOCATION VIEWPOINT

Economic Risks Are Rising

High inflation and economic weakness could stifle global economy.

Key Insights

- Investors have become concerned about stagflation, an environment characterized by high inflation and economic weakness.

- Given heightened economic risks, we believe investors should consider adding exposure to assets that may benefit from higher inflation or potentially hedge against recession.

Following a very volatile first quarter, investors have become increasingly concerned about a potential “stagflationary” environment, which is typically characterized by very high inflation and economic weakness.

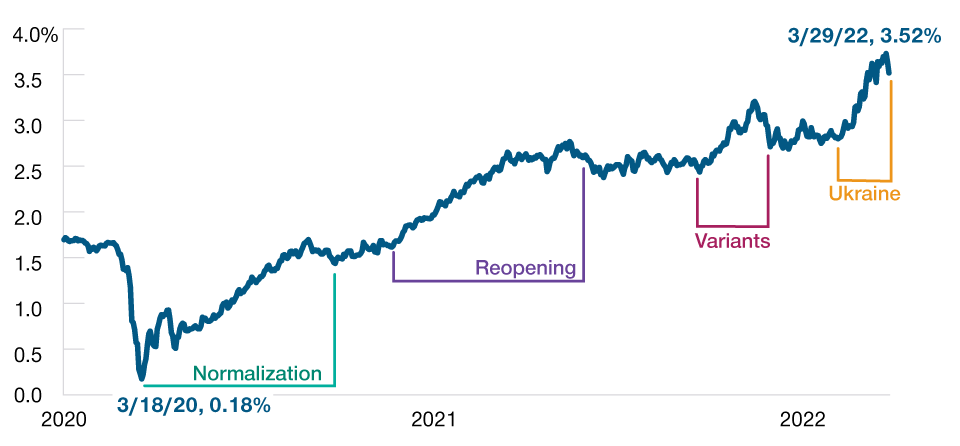

For most of the past 15 years, inflation has been a nonissue, but this is no longer the case. At the height of the pandemic in March 2020, the five‑year forward inflation expectation—derived from the five‑year Treasury inflation protected securities’ break‑even yield—was close to zero (Fig. 1) amid fears that the coronavirus would cause a severe global recession. However, by the end of August 2020, inflation expectations had rebounded to pre‑pandemic levels.

Rising Inflation Has Defied Expectations

(Fig. 1) The inflation outlook, from afterthought to major concern

January 1, 2020, to March 29, 2022.

Source: Bloomberg Finance L.P.

Five‑year forward inflation expectation derived from the five‑year Treasury inflation protected securities’ break‑even yield.

Since then, the inflation outlook has progressively worsened. As economies reopened in 2021, labor shortages and a mismatch in timing between the sharp recovery in demand and a more gradual ramp‑up in supply caused shortages and drove up prices. The emergence of COVID variants and Russia’s recent invasion of Ukraine have further exacerbated supply chain disruptions and accelerated inflationary pressures.

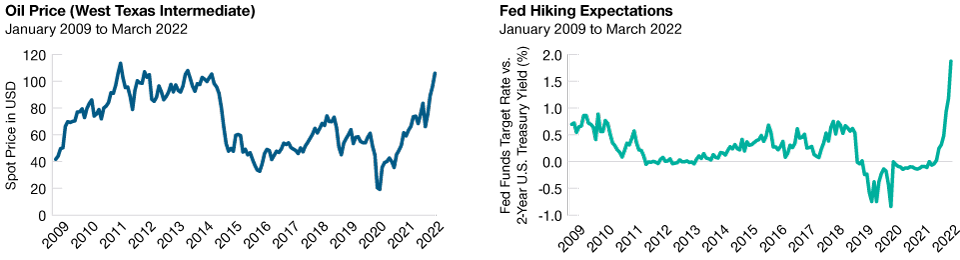

Meanwhile, the global economy faces near‑term headwinds from rising interest rates and higher oil prices (Fig. 2). Determined to curb inflation, many central banks have communicated their intentions to raise interest rates over the coming two years. Rate hikes typically increase borrowing costs and dampen economic growth. Moreover, oil prices have surged more than 450% from April 30, 2020, to March 29, 2022, imposing a significant tax on consumers and economic activity.

Higher Oil Prices and Rising Rates Present Economic Headwinds

(Fig. 2) Oil prices at multiyear highs and a hawkish Fed may stifle growth

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

We believe that economic activity is likely to slow down considerably in the near term due to elevated inflation and economic weakness. Given this expected shift, investors should, in our view, consider increasing their exposure to asset classes that could benefit from higher inflation—including “real assets” like energy, materials, and real estate equities—and to longer-duration1 fixed income assets, such as U.S. Treasury bonds, that could potentially provide a hedge against recession.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

April 2022 / MULTI-ASSET OUTLOOK