May 2023 / INVESTMENT INSIGHTS

China Investing: What Comes Next?

A three-stage recovery is underway

On December 31, 2022, T. Rowe Price’s China Evolution Equity Strategy celebrated its third anniversary. In this recent Q&A session, Wenli responds to questions that were foremost on the minds of our clients in 2023.

Q1: Is it too late to join the China rally?

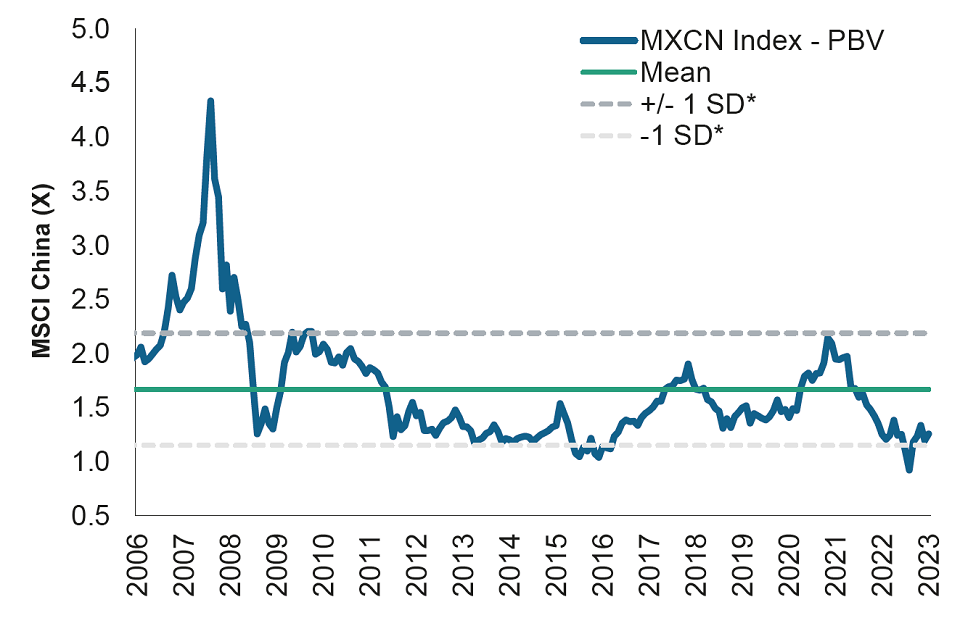

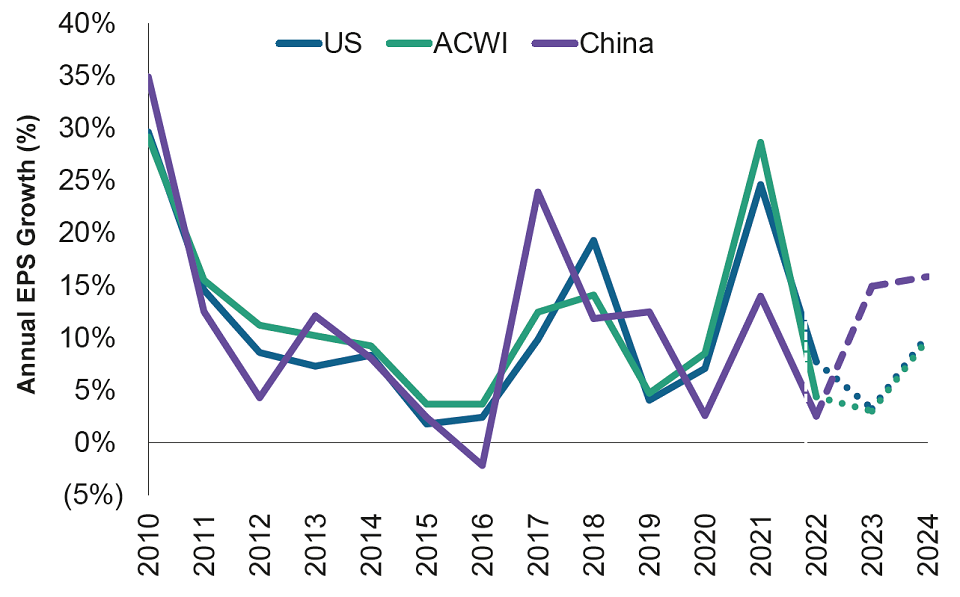

Following the end of zero‑COVID, China equities bounced 40% to 50% from last November’s lows, leading some investors to ask whether it was too late to participate. However, the Q4 rebound was from very depressed levels (Figure 1). In terms of valuation metrics, such as price‑to‑book value (PBV) or price‑to‑earnings (PER) ratios, China equities are still far below their historic averages. They also appear cheap relative to other markets. According to the latest consensus analyst forecasts, growth in earnings per share (EPS) in China this year is projected to be one of the highest among the world's major stock markets. The risk‑off episode in February followed by a global banking scare in March did not leave China equities unscathed. The MSCI China Index is 10% off its January peak (as of April 11, 2023), potentially providing an opportunity for investors. So no, it is not too late to join the rally in China stocks, in our view.

This favorable forecast earnings differential stems primarily from China’s unique position within the business cycle compared to other countries. Other economies are grappling with the emergence of high inflation, forcing central banks to tighten monetary policy significantly. That is not the case with China. Thanks to post‑COVID reopening, the Chinese economy is starting to rebound. While economic activity is picking up pace, inflation in China is low. In fact, inflation has remained benign in China since the pandemic.

FIGURE 1: China Is Still Trading at Attractive Valuations

MSCI China (MXCN) Index 12‑month forward price‑to‑book value (PBV) ratio

As of March 31, 2023.

Past performance is not a reliable indicator of future performance.

Actual outcomes may differ materially from estimates.

*SD = Standard deviation.

Source: Bloomberg Finance L.P. and MSCI

China is in a very different stage of the business cycle compared to other major economies thanks to the rapid COVID reopening. As a result, I believe economic growth is likely to accelerate this year and possibly next year also. Because the economy is accelerating, we do not expect Beijing to add strong economic stimulus at this point in time. Much better for the government to wait and see how strongly the reopening rebound unfolds.

Q2: What do you expect from China’s economy in 2023?

We believe a consumption recovery and an improvement in private investment are going to drive a better macro‑economic outlook for China this year. We believe that we are in the very early stages of China’s cyclical recovery, which still has a long way to go. The March housing data suggest that the property sector—a major drag on activity last year—has stabilized and is finding its footing, supported by the raft of government policies since November. Beyond the general recovery expected in consumer spending and some cyclical areas this year, over the medium term China’s growth drivers are expected to shift more towards technology, high‑end manufacturing, and consumption upgrading.

In 2022, we saw a sharp decline in corporate earnings which were dragged down by the rolling COVID lockdowns and by the slump in China’s residential property sector. I believe that the earnings picture for China going forward will be very different. The consensus estimate is that China’s earnings growth may accelerate from low single digits to mid double digits in 2023. However, I believe there is potential room for further upside to this number, representing a positive surprise to investors. I think there is a realistic chance of this happening because China’s economic reopening has taken place much faster and more smoothly than anyone expected. Indeed, China’s corporate earnings growth in 2023 could be the highest it has been in over five years (Figure 2).

Currently, a strong herd immunity has developed in China since the end to the zero‑COVID policy in early December. We have very quickly seen a strong recovery in consumption, especially for smaller ticket items, such as apparel, restaurants, cinema entertainment, etc. For larger ticket items, such as home appliances, autos, home property, etc, these are improving as well, but at a more gradual pace. This is also the case for private investment, which is also seeing some gradual improvement. However, I believe consumers as well as business owners are going to need some more time to gain greater confidence in the economic outlook before they spend on large ticket items more aggressively or spend to expand their businesses again.

Provided the economy stays on an improving trend, we may expect that at some point in the second half of the year, small‑ and medium‑sized private companies will start investing in their facilities and operations again.

FIGURE 2: China Is Also at a Different Stage of the Profit Cycle

MSCI China Index earnings growth forecast

As of March 31, 2023.

Past performance is not a reliable indicator of future performance.

Actual outcomes may differ materially from estimates.

EPS = Earnings per Share.

ACWI = MSCI All Country World Index; US = S&P 500 Index; China = MSCI China Index Source: Goldman Sachs Research and MSCI. Please see Additional Disclosures for information about this MSCI information.

Download the full article here: (PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

May 2023 / INVESTMENT INSIGHTS